To confirm a payment, a well-structured receipt of payment letter can be an invaluable tool for both businesses and clients. The letter serves as clear documentation that a transaction has been completed and payment received, preventing future disputes and ensuring all parties are on the same page.

Start by addressing the recipient directly, confirming the payment amount and method used. Be specific about the transaction details: include the invoice number, date, and any other relevant identifiers that link the payment to the original agreement.

Keep the tone clear and polite, confirming the payment was processed and that any remaining steps, if applicable, will be taken care of promptly. Include contact information for follow-up questions, ensuring the recipient feels confident in the accuracy of the transaction record.

By using this template, businesses can establish a professional and organized approach to handling payments and documentation, making it easier for all involved to track financial transactions and maintain transparency.

Here is an improved version with minimized repetitions:

Ensure the receipt of payment letter template is concise and clear, focusing on all relevant details. Begin with a short, direct statement confirming payment has been received. Follow with specifics like the payment method, date, and amount. If applicable, include invoice reference numbers or any transaction identifiers for clarity.

Template Structure

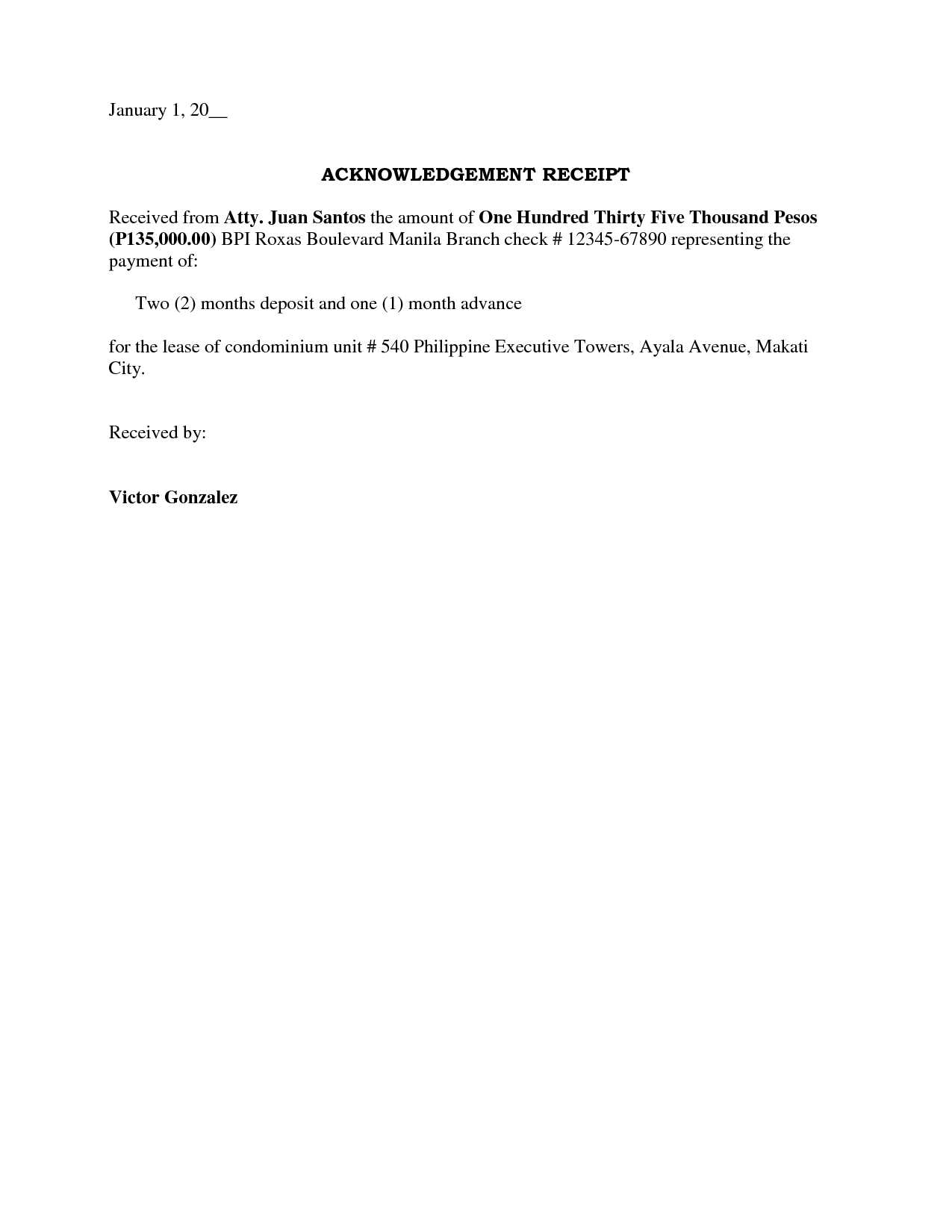

1. Payment Confirmation: Start by stating the payment was received and mention the total amount. Example: “We confirm receipt of your payment of $500 on March 10, 2025.”

2. Payment Method: Specify how the payment was made, e.g., credit card, bank transfer, etc. Example: “The payment was processed via bank transfer to account number 123456789.”

3. Additional Details: If needed, include further information such as the service or product covered by the payment. Example: “This payment covers invoice #4567 for services rendered in February 2025.”

Final Touches

Finish by expressing appreciation for the payment and offering contact information for further queries. Example: “Thank you for your prompt payment. Should you have any questions, feel free to contact us at [email] or [phone number].”

- Template for Payment Receipt Letter

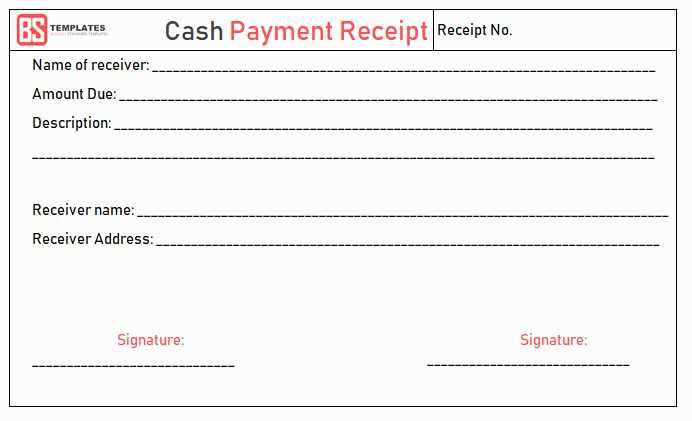

To create a clear and professional payment receipt letter, ensure it includes the following details:

| Field | Description |

|---|---|

| Letter Date | Indicate the date of issuance of the receipt letter. |

| Recipient’s Name | Clearly state the name of the individual or company receiving the payment. |

| Sender’s Name | Include the name of the person or entity issuing the payment receipt. |

| Payment Amount | Specify the exact amount paid and the currency used. |

| Payment Method | Clarify how the payment was made (e.g., bank transfer, cash, check, etc.). |

| Invoice or Reference Number | Include any relevant reference or invoice number to link the payment to a specific transaction. |

| Payment Date | Specify the exact date on which the payment was received. |

| Notes | Provide additional information, such as any remaining balance or conditions related to the payment. |

Ensure that the language is clear and concise, with no ambiguity regarding the transaction. A well-structured payment receipt letter can help maintain transparency and avoid future disputes.

To create a payment receipt letter template, focus on clarity and simplicity. Start by organizing the key information that should appear in the letter, such as payment details, sender and receiver information, and transaction confirmation.

Key Components of the Template

Include the following sections in your template:

| Section | Details |

|---|---|

| Sender Information | Include the name, address, and contact details of the company or individual issuing the receipt. |

| Receiver Information | Provide the name, address, and contact details of the person or organization receiving the payment. |

| Payment Amount | State the exact amount paid, including the currency. Specify if it’s a partial or full payment. |

| Payment Method | Specify whether the payment was made by cash, credit card, bank transfer, or another method. |

| Transaction Date | Include the exact date of the transaction. |

| Receipt Number | Assign a unique receipt number for reference and tracking. |

Formatting Tips

Keep the format clean and easy to read. Use clear headings, bullet points, and tables to structure the letter. Ensure there’s enough space between sections for readability. Consistency in font type and size helps maintain a professional appearance. Use formal language but keep the tone friendly and straightforward.

Make sure to leave a place for signatures or initials, if needed, for verification purposes. Once the template is set, save it in a reusable format, such as PDF or Word, to allow easy updates when required.

Include the following details to ensure clarity and prevent any confusion:

- Date of Payment – Clearly state the date when the payment was made to confirm the transaction’s timeline.

- Amount Paid – Specify the exact sum received. This helps both parties verify the correct payment amount.

- Payment Method – Indicate how the payment was made, such as by check, bank transfer, or credit card.

- Transaction Reference Number – Provide a unique number or code associated with the payment for easy tracking.

- Paid To – Mention the name of the party or business receiving the payment.

- Invoice or Account Number – Link the payment to any specific invoice or account for clear reference.

- Balance Due (if any) – State any remaining balance or indicate that the payment has cleared the full amount due.

- Payment Purpose – Briefly describe what the payment is for, such as services rendered or product purchased.

Structure the payment receipt document clearly to ensure that all details are easy to read and find. The layout should prioritize readability and include essential components.

- Header Section: Include the business name, address, and contact information at the top. This helps recipients identify the document source immediately.

- Receipt Number: Assign a unique receipt number to each document for tracking and future reference.

- Date of Payment: The date when the payment was made should be placed near the receipt number, making it easy to reference.

- Buyer Information: List the name, address, and contact details of the buyer to confirm the transaction details.

- Payment Details: Include a breakdown of the payment made, such as the product or service purchased, the amount paid, and any applicable taxes.

- Payment Method: Specify the payment method used (e.g., cash, credit card, bank transfer), which provides a clear record of how the transaction was completed.

- Total Amount: Clearly indicate the total amount paid, ensuring that all charges are included.

- Footer Section: Add any necessary disclaimers, return policies, or contact information for follow-up questions.

Keep margins consistent, and use a readable font to enhance clarity. The document should be formatted with clear sections and plenty of white space to reduce clutter.

When designing a payment receipt template, make sure the payment amount is clearly visible. A common mistake is hiding it in small text or formatting it poorly. This leads to confusion and can cause issues when referencing payments in the future. Always highlight the payment amount in a bold or larger font for easy identification.

1. Missing or Incorrect Payment Details

Always include the correct details such as the date of payment, payment method, and transaction reference number. Leaving these out or providing incorrect information can create unnecessary complications when verifying payments. Ensure accuracy and check each field before finalizing the template.

2. Unclear Payee and Payer Information

Clearly state both the payee’s and payer’s names. If this is not specified or is written unclearly, it may cause confusion or disputes later on. Be sure the names are placed prominently, and if needed, include additional details such as company names or contact information.

Inconsistent formatting is another issue to avoid. The receipt should maintain the same font and style throughout. Mixing different fonts or sizes can make the document look unprofessional and harder to read. Stick to a consistent layout that improves readability and maintains clarity.

Finally, avoid using vague or ambiguous language. Terms like “payment received” or “amount due” should be specific. Replace them with more direct statements that leave no room for interpretation, such as “full payment received” or “balance paid.” This ensures that both parties understand the transaction without any confusion.

To make your payment receipts truly useful, tailor them to match specific situations. Customization improves clarity and ensures that the necessary details are captured in every transaction.

- Partial Payments: If a customer makes a partial payment, adjust the receipt to clearly show the outstanding balance. Include a note specifying that the remaining amount is due, along with the due date.

- Refunds and Adjustments: For refunds or adjustments, modify the receipt to reflect the change in the amount paid. Highlight the refund amount and mention the reason, ensuring transparency in the transaction.

- Multiple Payment Methods: If a customer uses different payment methods (credit card, cash, check, etc.), break down the receipt to show how each method was used. List the individual amounts and methods clearly.

- Deposit Receipts: When receiving a deposit, note the amount paid as a deposit and specify what it applies to (e.g., a service or product). Include the remaining balance and any payment schedule if applicable.

- Subscription Payments: For recurring payments, include details about the subscription plan, payment frequency, and next payment due date. Indicate if there are any changes in the amount or service being provided.

- Gift or Promotional Payments: Customize the receipt to mention if the payment was made using a gift card or promotional offer. Clearly state the discount applied and the adjusted total payment amount.

Each scenario calls for specific details. Customize accordingly to provide transparency and improve customer experience. Make sure the receipt is clear, accurate, and reflects the exact payment context to avoid any confusion later.

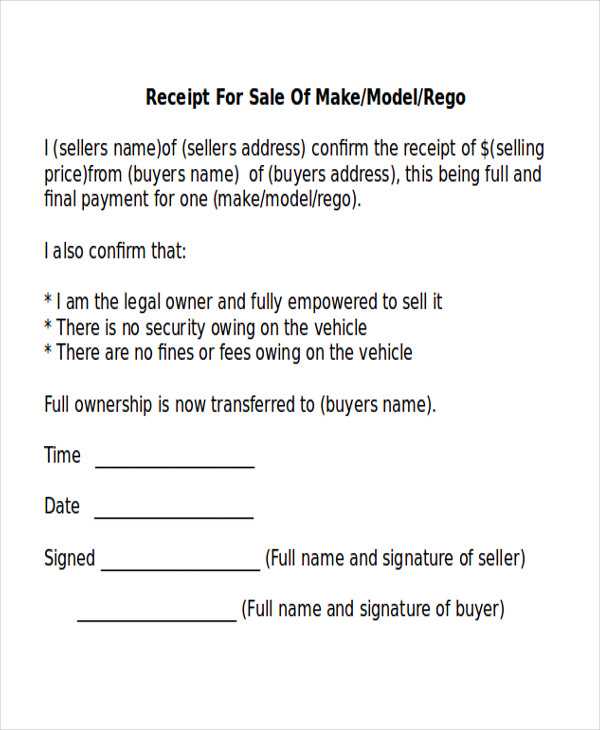

Payment receipt letters serve as written confirmation of a transaction and are crucial in any legal dispute involving payments. They can protect both the payer and payee by documenting the exchange, preventing misunderstandings. It is important that these letters include key details such as the amount paid, date, method of payment, and the purpose of the transaction. Without clear and accurate records, it can be difficult to prove the terms of the payment if questioned later.

When creating a payment receipt letter, ensure it aligns with any applicable local or international regulations governing financial transactions. The letter should also state the full name and address of both parties involved. These details make the letter legally binding and ensure its validity should the need for evidence arise in a legal setting. Be sure to sign the letter to confirm the transaction, as this adds weight to its legal status.

In some jurisdictions, payment receipts may need to be stored for a certain period. Check the local laws to confirm how long these documents must be retained. If your business operates across borders, consider any specific requirements that could apply depending on the region or country involved. Proper record-keeping prevents potential legal issues related to tax audits, refunds, or other disputes.

It’s also crucial that both parties keep copies of the payment receipt letter. A copy should be given to the payer, and one should remain with the payee. This ensures both sides have equal proof of the transaction, minimizing confusion or fraud risks. Without this step, one party may be left with insufficient proof if legal action is necessary.

To create a clear and professional receipt of payment letter template, focus on the following structure. Start with a concise header, clearly stating the document type, such as “Receipt of Payment.” This sets the tone for the recipient and ensures no confusion about the letter’s purpose.

Key Components

Include the following sections in your template:

- Recipient Information: Specify the name and contact details of the person or entity receiving the payment.

- Payment Details: Clearly outline the amount paid, the method of payment (e.g., credit card, bank transfer), and the date of the transaction.

- Invoice Reference Number: Mention the invoice number related to the payment, helping the recipient identify the transaction easily.

- Payment Confirmation: A brief statement confirming that the payment has been received and processed.

Additional Tips

Make sure the language used in the letter is straightforward and free of ambiguity. A receipt should act as proof of payment, so ensure that all the details are accurate and verifiable. Keep your letter format consistent for a professional appearance.