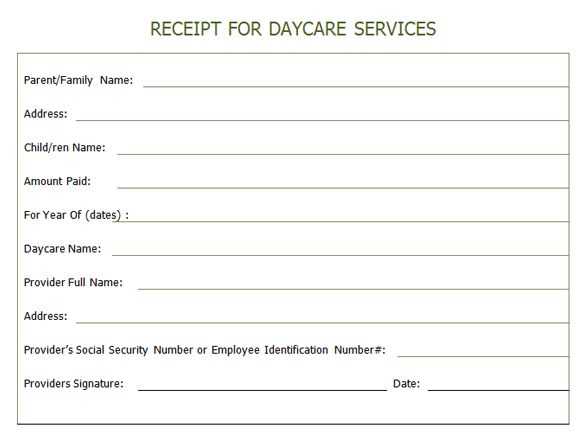

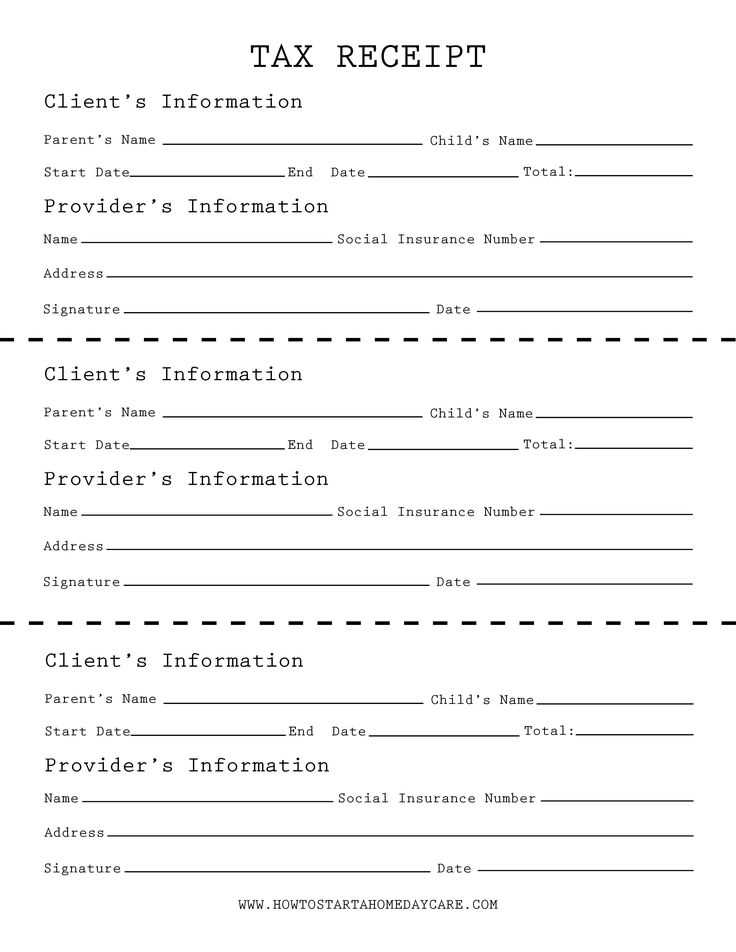

Keep your records organized by creating a precise year-end daycare receipt. This document is vital for both personal tax filings and verifying the childcare expenses paid throughout the year. A well-structured template should include the daycare provider’s name, address, and tax identification number, along with the total amount paid during the year.

Ensure the receipt reflects all the necessary details for tax purposes: the child’s name, the period of service, and a breakdown of payments made. Avoid any ambiguity by listing the total number of days or hours the child was in care and include any additional services or fees that might apply. This transparency helps maintain clear financial records.

Using a template saves time and ensures consistency across receipts. You can easily customize it for each client or year, ensuring the template stays accurate with changing information. To streamline the process, choose a format that allows quick modifications, and always double-check the data for any discrepancies before sending out the receipt.

Here’s the revised version with minimized repetition:

Use a straightforward format for your year-end daycare receipt template to avoid clutter. Start with basic information such as the child’s name, the provider’s details, and the dates of service. Each entry should reflect the specific days or months covered, alongside the total amount charged for each period.

Make sure the breakdown is clear–include both the weekly or monthly rate and any additional charges. Summarize the total amount paid for the year without unnecessary elaboration. This makes it easier for tax purposes and ensures the recipient gets all the information they need without confusion.

Lastly, double-check the accuracy of the details before issuing the receipt. A simple layout, free from excess text or repetitive data, helps prevent mistakes and improves readability.

Year-End Daycare Receipt Template Guide

Creating a Template for Year-End Receipts

Including Required Information for Tax Filing

Customizing Your Receipt Template for Various Providers

Automating the Year-End Receipt Process

Ensuring Accuracy in Daycare Receipts

Best Practices for Sending Receipts to Parents

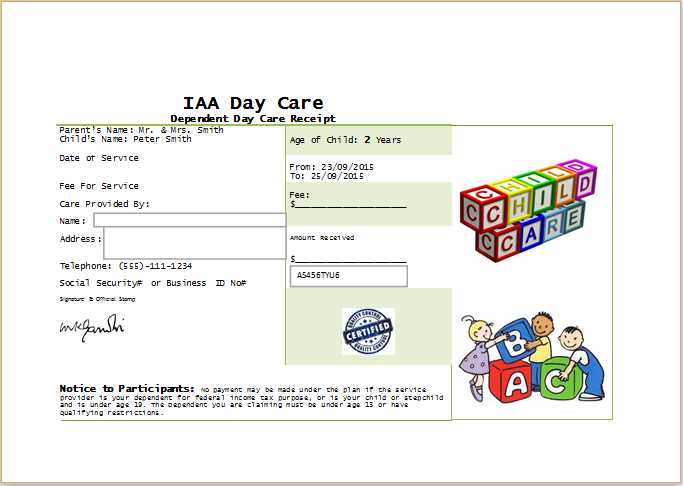

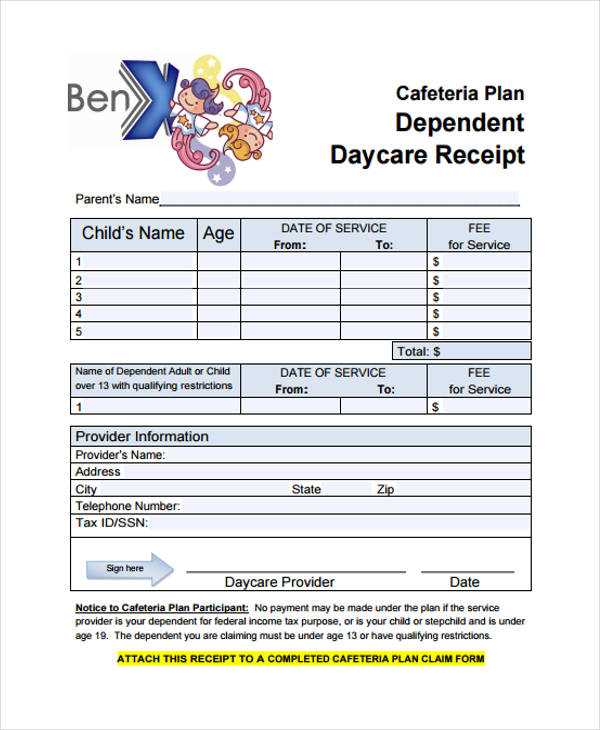

Create a Template for Year-End Receipts: Start by designing a simple, clear template that captures all the necessary details. Include fields for the daycare provider’s name, address, and contact information. Add a section for the parent’s name, child’s name, and the tax year being covered. Ensure space for the total amount paid for the year and any relevant breakdowns (e.g., monthly payments, late fees). Consider including a space for the daycare’s tax ID number, which is necessary for filing.

Include Required Information for Tax Filing: For the receipt to be tax-compliant, it must list the total payments made by the parent, the dates of service, and the provider’s tax identification number. These details are critical when claiming daycare expenses for tax deductions. Make sure the format is straightforward and readable, avoiding unnecessary jargon that could confuse parents.

Customize Your Receipt Template for Various Providers: Customize the template for different types of daycare services. For instance, if the provider offers both part-time and full-time care, create separate templates or sections in the receipt to account for the different rates. If the service includes additional activities like after-school programs or meals, ensure these are reflected clearly in the totals and descriptions.

Automate the Year-End Receipt Process: Use software that can track payments throughout the year. Automating the process will help eliminate manual errors and save time. Many daycare management systems allow you to generate receipts in bulk at year-end, reducing the effort involved in creating individual receipts for each family. Additionally, ensure the system can update for tax year changes.

Ensure Accuracy in Daycare Receipts: Double-check all numbers before sending out receipts. Parents depend on accuracy when filing taxes, and errors can cause confusion or delay. Cross-reference payment history with the receipt details to verify the totals align with what was paid. Keep a backup system for records in case parents request corrections or updates.

Best Practices for Sending Receipts to Parents: Send the receipts in a secure format, such as a PDF, to ensure that the information remains unaltered. Avoid sending receipts through unsecured email or messaging platforms. Offer to mail physical copies if parents prefer. Set a deadline for when all year-end receipts will be available to avoid last-minute requests.