To keep accurate records of monthly rent transactions, a rent payment receipt template is invaluable. It simplifies documentation, ensures transparency, and reduces misunderstandings between tenants and landlords. Providing clear details on each payment can protect both parties in case of disputes or future reference.

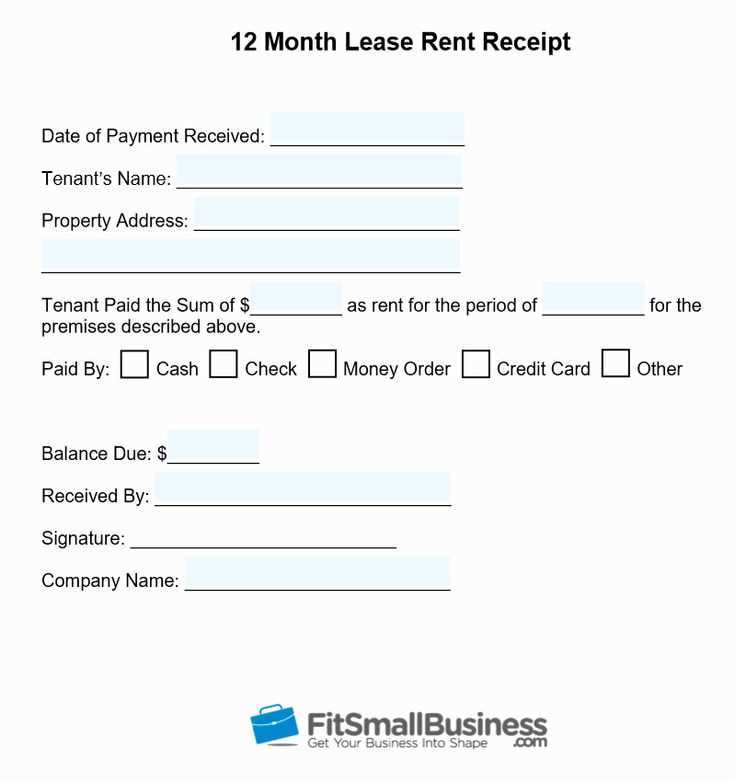

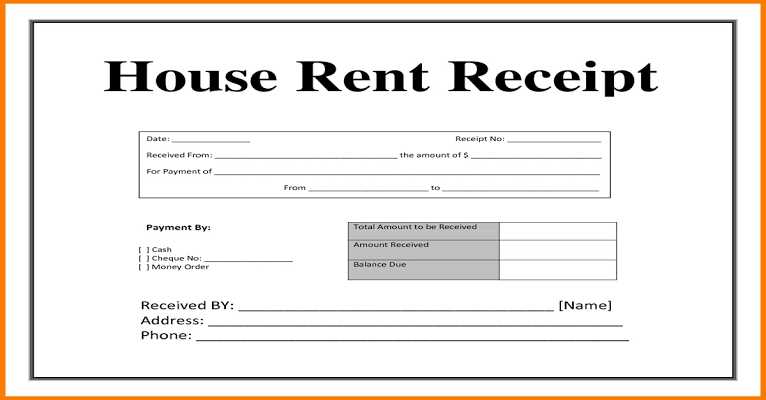

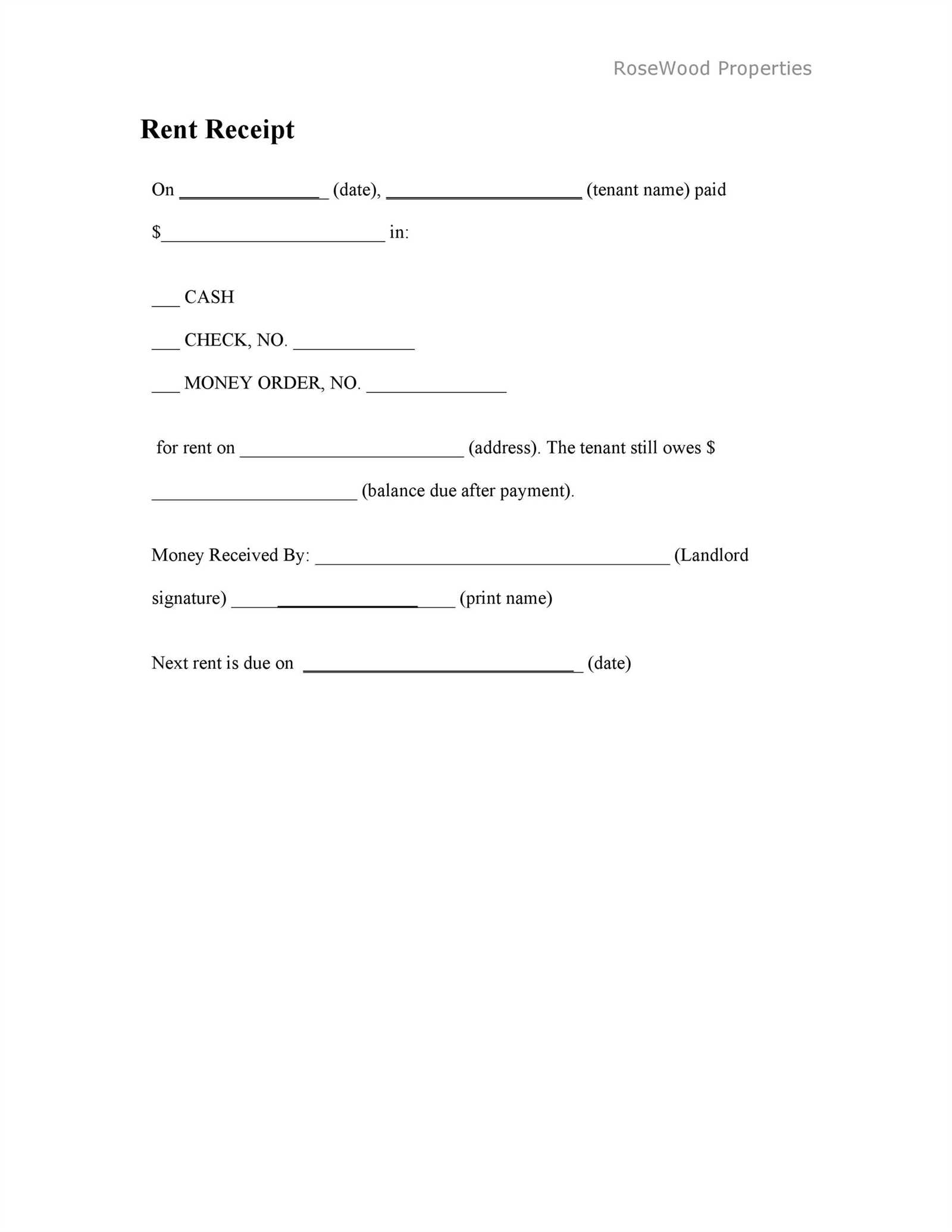

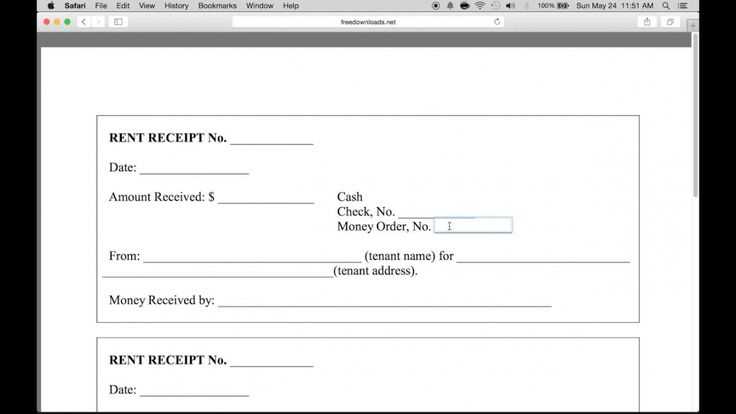

Ensure your template includes the tenant’s name, the property address, the amount paid, and the payment date. It should also have space for any additional notes, such as late fees or adjustments. This transparency builds trust and avoids confusion in the long run.

By customizing the template with a unique reference number for each receipt, you can easily track payments over time. A clean layout with clear sections helps tenants quickly verify the accuracy of their payments. Additionally, consider including the payment method (cash, check, or bank transfer) for more detailed records.

Here’s the revised version where each word repeats no more than 2-3 times:

Begin by clearly stating the payment amount in the receipt header. Ensure that the date of payment is visible to confirm when the transaction occurred. Use a consistent format for the month and year to avoid confusion. Specify the property address or unit number to identify the rental space associated with the payment.

Next, include a section for both the landlord’s and tenant’s names. This helps to identify both parties involved in the agreement. Provide a breakdown of the rent, such as base rent and any additional charges (e.g., utilities, maintenance fees). This transparency ensures clarity for both parties.

For accuracy, detail the method of payment (e.g., bank transfer, cash, check) and any reference numbers if applicable. Including a payment reference number can be helpful for future inquiries or disputes. Finally, add a section for both parties to sign and date the receipt, indicating acknowledgment of the transaction.

| Description | Amount |

|---|---|

| Base Rent | $1,200 |

| Utilities | $100 |

| Total Payment | $1,300 |

Keep the layout simple and organized to enhance readability. Adjust fonts and spacing to ensure the receipt is easy to understand at a glance.

- Monthly Rent Payment Receipt Template

For landlords and tenants, having a well-structured receipt for monthly rent payments is important for record-keeping. A simple template can streamline the process. Here’s what should be included in a rent payment receipt:

- Date of Payment: Always mention the exact date when the payment was made.

- Tenant Information: Include the tenant’s full name and address. This identifies the party making the payment.

- Landlord Information: Provide the landlord’s name or company name, along with their address for clear reference.

- Amount Paid: State the exact amount paid for that month’s rent. Specify the currency if necessary.

- Payment Method: Indicate whether the payment was made by check, cash, or bank transfer.

- Rental Period: Clearly specify the period for which the rent is paid (e.g., February 2025).

- Property Address: Include the address of the rented property being paid for to avoid any confusion.

- Receipt Number: Assign a unique receipt number for easy tracking of payments.

- Signature: If applicable, provide a signature section for both the landlord and tenant to verify the transaction.

Having all of this in one place ensures clarity for both parties. It’s a good practice to provide the tenant with a copy immediately after payment is received and keep a copy for your own records.

Include the tenant’s name, address, and the property being rented. Specify the payment amount, payment date, and the rental period it covers. Add the payment method used (e.g., cash, check, bank transfer) for clarity. Make sure to note whether the payment is for a specific month or a different period. If applicable, include any late fees or discounts that apply to the payment. Always include a receipt number or reference to keep track of the transaction.

Clearly state that the payment has been received, using a straightforward phrase such as “Payment received in full.” Provide a space for the signature of both the landlord and the tenant, as well as the date of signing. Double-check all details for accuracy to avoid any future confusion.

Clearly state the payment date. This confirms the exact moment when the transaction took place, helping both parties reference the specific payment if needed.

List the amount paid, specifying the currency. This eliminates any confusion about the sum involved and avoids disputes later.

Details of the Renter and Property

Include the name of the payer, their contact information, and the rental property address. This ensures both parties are identified correctly in case of any issues or future communication.

Payment Method

Indicate how the payment was made, whether through bank transfer, cash, check, or any other method. This adds clarity about the transaction process and can help track the payment method in case of errors.

Provide a receipt or reference number for easy tracking and record-keeping. This helps in identifying the payment if there’s a need to revisit the transaction later.

1. Missing Key Information: Always include the tenant’s name, the property address, the payment date, and the amount paid. Leaving out any of this information can lead to confusion and disputes later. Ensure that the payment method (cash, check, online transfer) is also specified.

2. Incorrect Payment Amount: Double-check the payment amount before finalizing the receipt. Mistakes with the rent figure could lead to misunderstandings or complications in the future. Ensure that any late fees or discounts are accurately reflected.

3. Vague Descriptions: Avoid being unclear about the rent period. Specify the month or range of dates for which the payment is made. A vague “payment for rent” does not give enough context for future reference.

4. Lack of Signatures: Both the landlord’s and tenant’s signatures (or initials, if applicable) provide validation to the receipt. Missing signatures could invalidate the document or cause issues in case of legal disputes.

5. Unclear Payment Terms: Ensure the rent receipt clearly reflects any adjustments, like partial payments or prepayments. If the rent was paid in advance for several months, specify how many months the payment covers.

6. No Receipt Number: Including a unique receipt number can help both parties track payments and reference them in case of issues. Failing to number receipts can make it difficult to match payments with specific documents later.

7. Failure to Keep Copies: Both the landlord and tenant should retain a copy of each receipt. Failing to provide or keep a record of payments can complicate things if disputes arise about paid amounts or timing.

Customizing your receipt template allows you to tailor the document to your business’s specific requirements. By adjusting the layout and information fields, you can highlight what matters most, such as your logo, business name, or special payment terms. This level of personalization improves brand visibility and creates a more professional impression.

Consider adding custom fields for specific product details, such as serial numbers or service descriptions. This makes tracking payments more straightforward and ensures that customers receive all relevant information in a clear format.

Custom receipts also help streamline accounting and tax filing processes. By including your tax identification number, payment method, and transaction ID, you simplify bookkeeping tasks, saving time and reducing the chance of errors.

Additionally, customizing your receipt allows you to include legal disclaimers or refund policies, which can provide transparency and avoid potential disputes. Clear, concise receipts contribute to better customer experiences and create a trustworthy business environment.

How to Format Your Payment Receipt for Clarity

Organize your receipt in a way that anyone can quickly understand the transaction details. Start with clear headings for each section, such as “Payment Details,” “Amount Paid,” and “Payment Method.” This ensures the key information stands out immediately.

Use a Logical Order

List the payment date, followed by the name or ID of the tenant or payer, and the amount paid. Then include the payment method, like bank transfer, credit card, or check, for further transparency. This format ensures nothing is overlooked, and each detail can be easily found.

Include Reference Numbers or Codes

Each receipt should include a unique receipt number or reference code. This number helps both parties track the payment easily and eliminates confusion in case of disputes. Ensure this code is prominently displayed at the top of the document.

By following these steps, you make your receipt easy to read, helping to avoid misunderstandings and creating a reliable record of the transaction.

Store receipts in a cloud-based storage service with strong encryption. Popular options include Google Drive, Dropbox, or OneDrive. These platforms provide secure access and backup options, ensuring your receipts are protected from physical damage and unauthorized access.

If you prefer offline storage, use an encrypted external hard drive or USB drive. Always enable encryption on these devices to protect sensitive data from theft or unauthorized access. Keep these drives in a secure location, like a locked drawer or safe, to prevent unauthorized access.

For distribution, use email with secure, password-protected attachments. PDFs are a good format as they can easily be encrypted with a password before sending. If you’re sharing receipts with multiple parties, consider using secure file-sharing services that offer built-in encryption, such as Tresorit or Sync.com.

Never share receipts over unencrypted communication channels like regular text messages or unsecured email. Always verify the identity of the recipient before sending any sensitive documents.

Finally, periodically review your storage practices and update passwords to maintain security. Ensure you have a backup plan in place in case of device failure or data corruption.

Creating an Effective Monthly Rent Payment Receipt Template

Ensure your receipt template is simple, clear, and legally sound by including the following key components:

- Date: Add the date of the payment to confirm the transaction took place on that specific day.

- Tenant’s Information: Include the tenant’s full name and contact details to verify who made the payment.

- Landlord’s Information: Provide the landlord’s name and contact details for reference.

- Amount Paid: Clearly state the exact amount received. Include the currency for clarity.

- Payment Method: Specify how the payment was made (e.g., bank transfer, cash, check).

- Rental Period: List the start and end dates of the rental period that the payment covers.

- Payment Description: Include a brief description of the payment, such as “monthly rent” or “late fee payment.”

- Receipt Number: Assign a unique receipt number for record-keeping and tracking purposes.

Designing the Layout

Keep the design minimalistic to avoid confusion. Use clear sections for each piece of information, and make sure the layout is easy to read. Use large fonts for critical data, such as the payment amount and date, to highlight them.

Consider Legal Requirements

In some regions, specific details may be required for rental receipts. Familiarize yourself with local rental laws to ensure your template meets legal standards. A professional template will help prevent disputes by providing accurate and formal records of each transaction.