For any organization or individual receiving donated equipment, it’s important to provide a clear, detailed donation receipt along with an estimate letter. This document should outline the donated items, their estimated value, and the condition in which they were received. A well-structured receipt serves as both an acknowledgment and a tool for tax purposes. An estimate letter, paired with the receipt, provides transparency and helps in valuing the donated equipment accurately.

Start by listing the equipment with detailed descriptions and quantities. Then, provide an estimate of their current value, taking into account their age, condition, and market trends. This estimate should be reasonable and align with industry standards for similar equipment. It’s also useful to specify any relevant details, such as whether the equipment is operational or needs repairs, to avoid misunderstandings in the future.

By including these elements in the donation receipt and estimate letter, both parties ensure clarity and avoid potential complications. The donor can claim tax deductions, while the recipient has a clear record for their inventory and budgeting. Ensure to use professional language and double-check the figures for accuracy before issuing the final documents.

Here is the revised version:

Start by clearly indicating the donation’s details in the header, including the donor’s name, contact information, and the recipient organization’s name and address. Include the donation date and the estimated value of the donated equipment. The donor’s signature and a brief description of the items are essential. Make sure to specify the condition of the items and any relevant maintenance or repair requirements to avoid confusion later on.

Detailed Description

In the body of the letter, provide a list of the donated equipment, detailing the condition, model numbers, and quantities. If applicable, mention any specific features that add value or require attention. For example, “This equipment has been maintained regularly and is in good working condition.” A clear and concise description ensures transparency and helps in tax documentation processes.

Estimate of Value

Include an estimate of the total value of the donation. Use market value for similar items or provide a professional estimate if possible. This helps both parties establish the worth of the donation for tax purposes. The letter should end with a statement of appreciation for the donation and any next steps, such as a request for confirmation of receipt or further arrangements.

- Equipment Donation Receipt with Estimate Letter Template

An equipment donation receipt with an estimate letter serves as a formal acknowledgment of a donation, providing both a receipt for the donor and an estimated value of the donated item. It is important to keep this document clear and professional, ensuring that it serves as both a tax record and a reference for valuation purposes.

Key Information to Include

Start by listing the name of the donor and the recipient organization. The receipt should detail the type of equipment donated, the condition it is in, and any identifying serial numbers or model numbers. Including a brief description of the equipment helps ensure clarity in case of future inquiries. If the donor is eligible for tax deductions, mention the IRS guidelines that apply, ensuring compliance with legal requirements.

Valuation of Donated Equipment

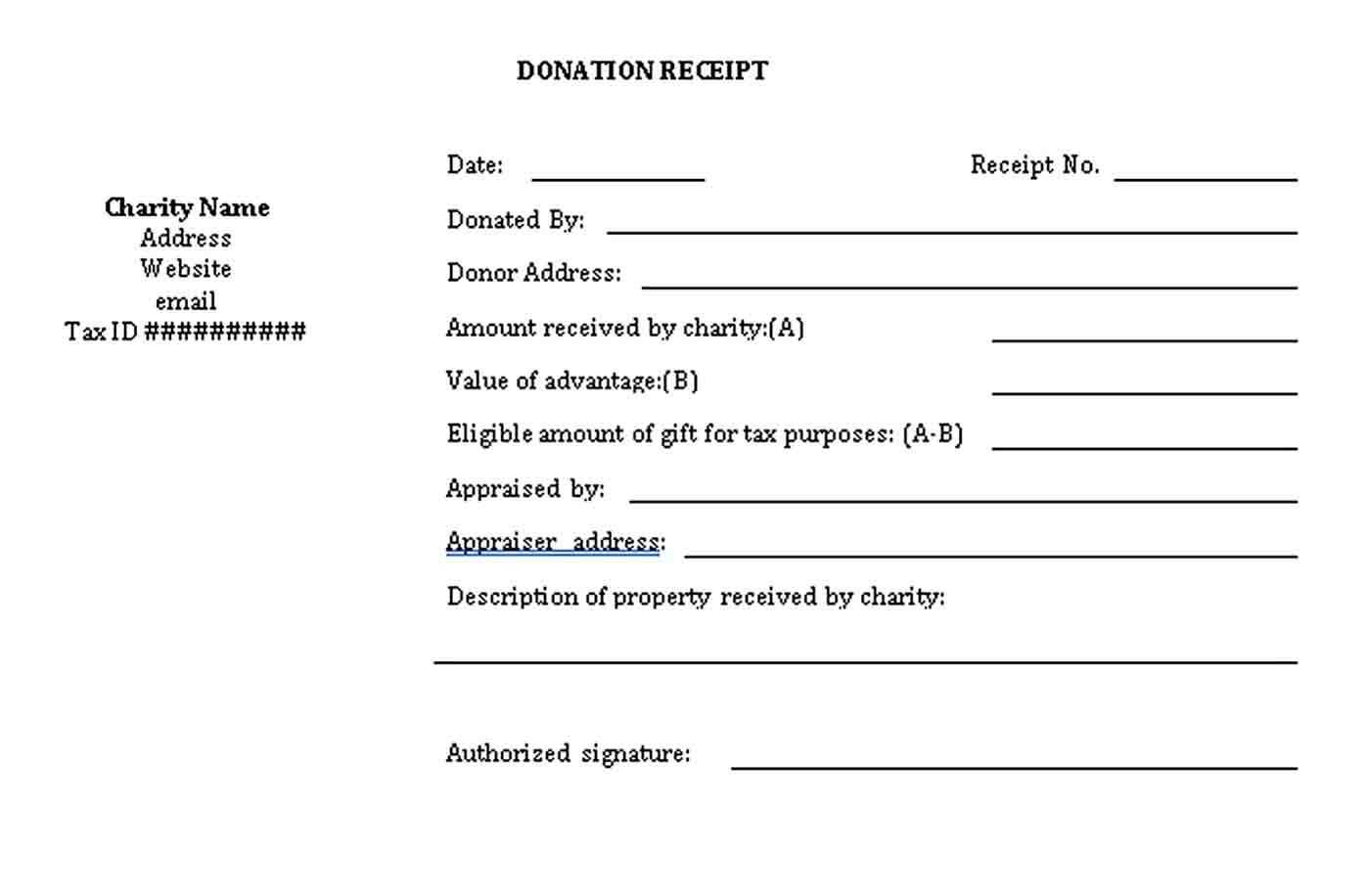

Provide an estimate of the fair market value of the equipment at the time of donation. This estimate should be based on comparable items’ values, considering factors such as condition, age, and functionality. If applicable, mention any appraisals that have been made. Transparency in valuation can avoid future discrepancies and ensure that the donor receives an accurate and reasonable tax deduction.

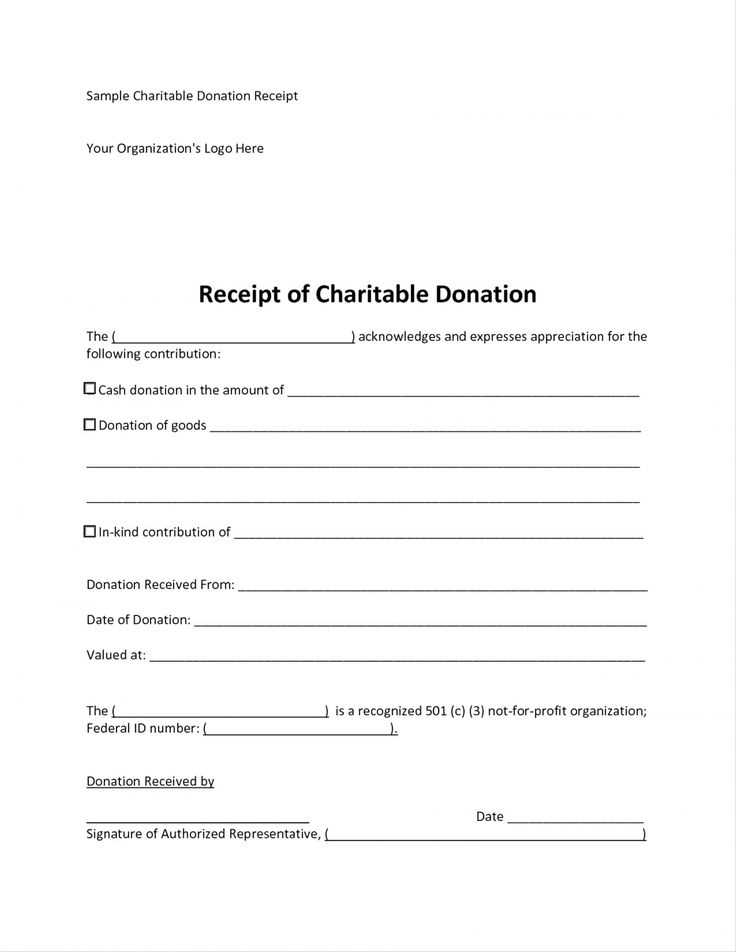

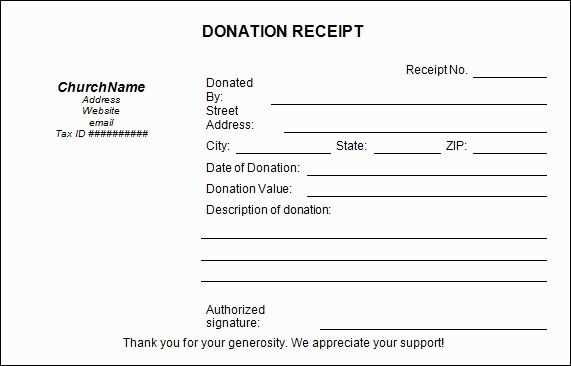

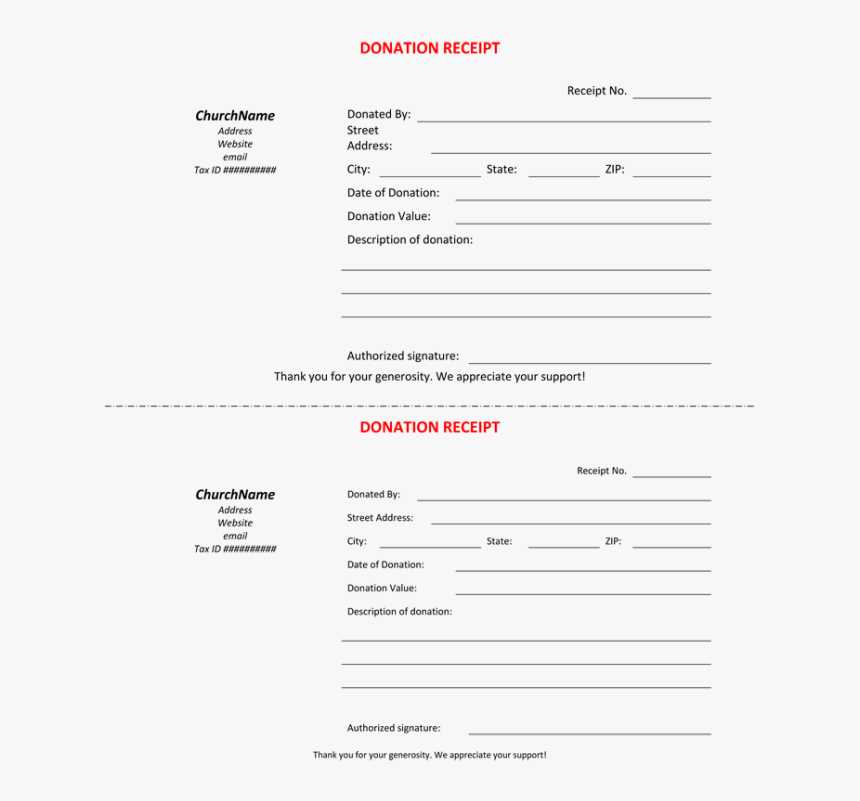

Begin with a clear header stating “Donation Receipt” or “Equipment Donation Receipt.” This should be prominently placed at the top of the document. Below the header, include the name of the donor and their contact details (address, phone number, email). This identifies the person or organization making the donation.

Next, list the donated equipment in detail. Provide a description of each item, including its model, make, serial number (if applicable), and condition. For example, “Used Desktop Computer, Dell OptiPlex 7000, Serial #123456, Good condition.” This ensures transparency regarding what was donated.

State the date of the donation. This helps both parties keep track of the timing of the transaction. Include any terms or conditions tied to the donation, such as restrictions on use or a time frame for collection.

Indicate the fair market value of each donated item. If the donation involves items that do not have an easily determined value, an estimated value can be provided. Ensure this is an objective, reasonable estimate, often guided by similar equipment values. You may also add that no goods or services were exchanged in return for the donation, reinforcing its charitable nature.

Include a statement confirming the donor’s intent. For example, “This equipment is being donated to [Organization Name] without any form of compensation.” This solidifies that the transaction is indeed a donation and not a sale.

Finish the receipt with the signature of the authorized recipient from your organization, along with the recipient’s title and contact information. This acts as verification of the donation.

Lastly, provide a closing thank-you message. A simple “Thank you for your generous donation” expresses gratitude and reinforces the value of the donor’s contribution.

Clearly outline the scope of work. Specify what is included in the estimate and any potential exclusions. This helps set expectations for both parties and avoids misunderstandings later.

Provide a breakdown of costs. Include detailed pricing for each task, material, and service involved. Avoid vague terms like “miscellaneous fees” – list everything so the recipient can clearly see what they are paying for.

Timeline and Project Duration

Give a timeline for the completion of the work. This should include both start and finish dates, and if relevant, key milestones. If the timeline depends on factors outside your control, such as weather, note that as well.

Terms of Payment

Specify payment terms and conditions, including deposit requirements, payment schedules, and any late fees. This helps avoid confusion over financial matters as the project progresses.

Consider adding a disclaimer about the possibility of changes to the estimate. If unexpected issues arise, let the recipient know how changes will be handled and documented.

Donation receipts for equipment must clearly identify the donor, the recipient organization, and the donated items. Ensure that the receipt specifies the date of the donation and provides a description of the equipment, including any relevant details such as model or condition, if applicable.

The IRS mandates that non-cash donations valued over $500 require the donor to complete IRS Form 8283. The organization must sign the form acknowledging the donation, which serves as confirmation for the donor to claim the tax deduction. For donations exceeding $5,000, a qualified appraisal may be necessary to establish the fair market value of the equipment.

Receipts should not include an estimate of the donation’s value. Only the donor can determine the value of the donated items. However, organizations should provide a clear description of the equipment, noting its condition, to ensure transparency in the donation process.

Ensure the receipt includes a statement confirming the donor did not receive any goods or services in exchange for the donation. If any goods or services were provided, their value must be disclosed separately.

Finally, it’s essential to retain records of all donations, including receipts and related forms, for at least three years. This helps both the donor and the organization comply with tax regulations and provides a clear record of donations made.

Begin by evaluating the condition of each donated item. Determine if the item is new, gently used, or in need of repairs. This will significantly impact its estimated value.

Assess Market Value

Check online platforms or local stores to identify the current market value for similar items. If the item is no longer in production, research the resale value through second-hand markets or specialty dealers.

Consider Depreciation

Account for the age of the item and its wear and tear. Older items or those that have been heavily used will naturally have a lower value than newer or better-maintained goods. Apply a depreciation rate based on these factors to estimate a fair value.

Be transparent about the estimated value. If the item has any defects, clearly note them in the estimate to avoid misunderstandings. If repairs are required, include the estimated cost of those repairs to provide a complete picture of the item’s current worth.

Finally, be consistent in your approach. Use the same valuation methods across all donated items to ensure that the estimate is as accurate and fair as possible.

Start by clearly separating the receipt and the estimate sections. Each part should be distinct to avoid confusion. Begin with a header that includes the donation details, followed by a breakdown of the equipment being donated. This allows for easy identification of the donation and serves as a record for both parties.

- Receipt Section: List the donor’s name, date of donation, and a detailed description of the equipment or item received. Include the estimated value of the equipment (if applicable) and ensure the wording is clear and precise. Acknowledging the donor’s contribution should be clear, as this serves as their proof of donation for tax purposes.

- Estimate Section: The estimate should present the expected cost of repairs, services, or other work related to the donated equipment. Include a detailed list of services, associated costs, labor charges, and any other expenses anticipated. Be transparent about the scope of work and timelines.

Ensure both sections include contact information for follow-up or questions. This builds trust and allows the donor or recipient to address any concerns. Finally, consider adding a disclaimer that the estimate is subject to change depending on further assessments or findings.

Accurate documentation is key to ensuring your equipment donation process runs smoothly. Below are common mistakes to avoid when handling donation receipts and estimates:

1. Failing to Include Detailed Descriptions of Donated Equipment

Donors often overlook providing a clear description of the equipment. It’s important to list the item’s brand, model, condition, and serial number. Without these details, the receipt may lack the necessary information for tax purposes or future audits.

2. Ignoring the Donor’s Information

Donor details, including their full name, address, and contact information, must be accurately recorded. Missing or incorrect information can delay the processing of the donation or make it difficult for the donor to claim tax benefits.

3. Incorrect Valuation of Donated Equipment

Donors should provide an accurate estimate of the equipment’s value. Avoid generic or inflated valuations. A well-supported valuation should reflect the current market price and condition of the equipment.

4. Omitting the Date of Donation

The date of donation is crucial for recordkeeping and tax purposes. Without it, there could be confusion about the time frame in which the donation was made, which could impact the donor’s eligibility for deductions.

5. Forgetting to Acknowledge Any Conditions or Restrictions

If there are any special conditions or restrictions tied to the donation (e.g., the equipment must be used for a specific purpose), these must be explicitly stated in the documentation. Failing to do so can lead to misunderstandings between the donor and recipient.

6. Not Providing the Donor with a Copy of the Receipt

Always provide the donor with a copy of the donation receipt. This serves as confirmation and allows them to retain the necessary paperwork for tax reporting or personal records.

7. Overlooking Legal Requirements

Some jurisdictions have specific legal requirements for donation receipts, such as certain wording or language in the document. Familiarize yourself with these to avoid non-compliance.

8. Relying on Generic Templates Without Customizing

Using a standard template without customizing it for your specific donation can lead to missing key information or improperly addressing unique circumstances. Make sure to adapt each document as needed to accurately reflect the donation.

Avoiding these mistakes will ensure a smoother process for both donors and recipients while maintaining proper documentation for tax purposes and legal compliance.

Equipment Donation Receipt with Estimate Letter Template

Include a clear statement of the donation’s value and the recipient’s acknowledgment in your donation receipt. The document should detail the equipment being donated and offer a reasonable estimate of its market value. This ensures both parties are on the same page regarding the donation, and it may also be used for tax purposes.

Key Elements of the Receipt and Estimate

Provide the following details in your donation receipt and estimate:

- Donor Information: Name, address, and contact details.

- Recipient Information: Name and address of the organization receiving the donation.

- Item Description: A detailed list of the donated items, including make, model, and condition.

- Estimated Value: An accurate market estimate of the equipment’s value, ideally based on current market prices.

- Date of Donation: The exact date when the donation was made.

- Donor’s Signature: A line for the donor’s signature to validate the document.

Sample Estimate Table

This table serves as an example for how to structure the donation details and valuation.

| Item Description | Quantity | Condition | Estimated Value |

|---|---|---|---|

| Industrial Drill Press | 1 | Good | $450 |

| Woodworking Lathe | 1 | Used | $350 |

| Table Saw | 1 | New | $800 |

Make sure the estimate reflects the true market value of the equipment based on condition, age, and comparable items. This transparency ensures that the donor is satisfied with the valuation and that the recipient organization can handle the donation appropriately.