Creating a clear and professional receipt is straightforward when you use a well-designed template. Australian businesses often need receipts that comply with local tax regulations and capture necessary details such as the business name, ABN, and the transaction specifics. Make sure to include a unique receipt number for easy tracking.

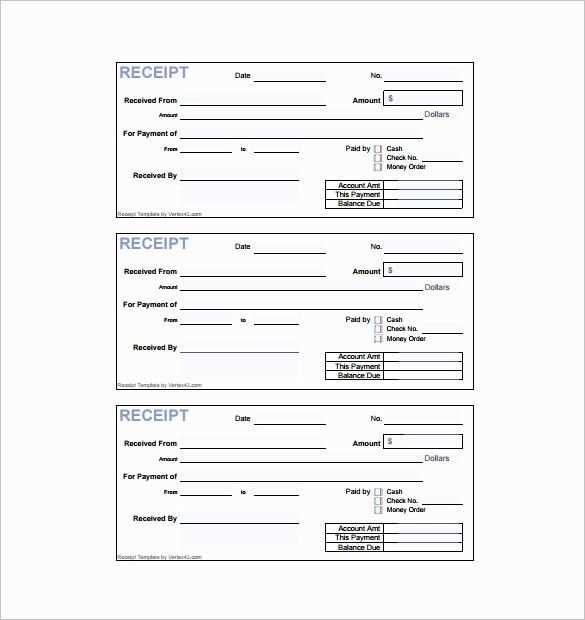

Customization of your receipt template is key. Many templates come with fields that allow you to adjust for specific items, services, or even taxes. You can tailor the layout and colors to match your brand, ensuring the receipt reflects your business’s image while staying professional and easy to read.

If you need a template, a quick search online will offer many options. Look for templates that offer flexibility and ease of use. Many free resources are available, but premium options often come with additional features, such as tax calculations and automated number sequencing, which can save time and avoid manual errors.

Here’s the adjusted version with minimized repetition of words:

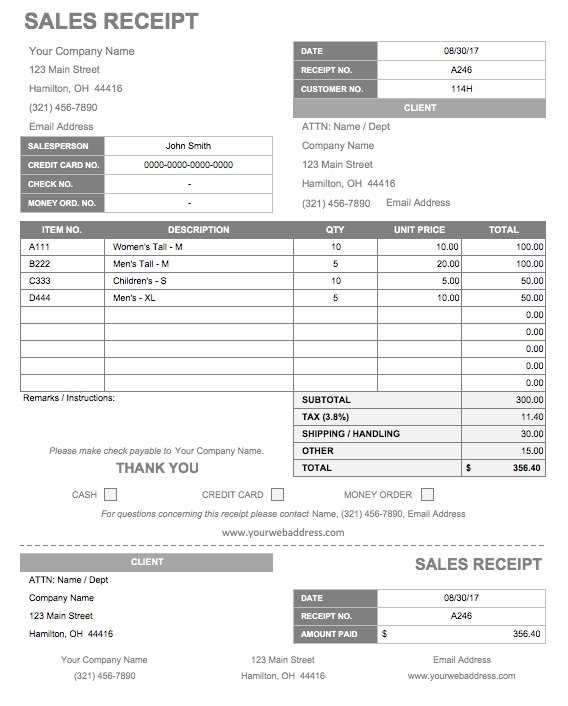

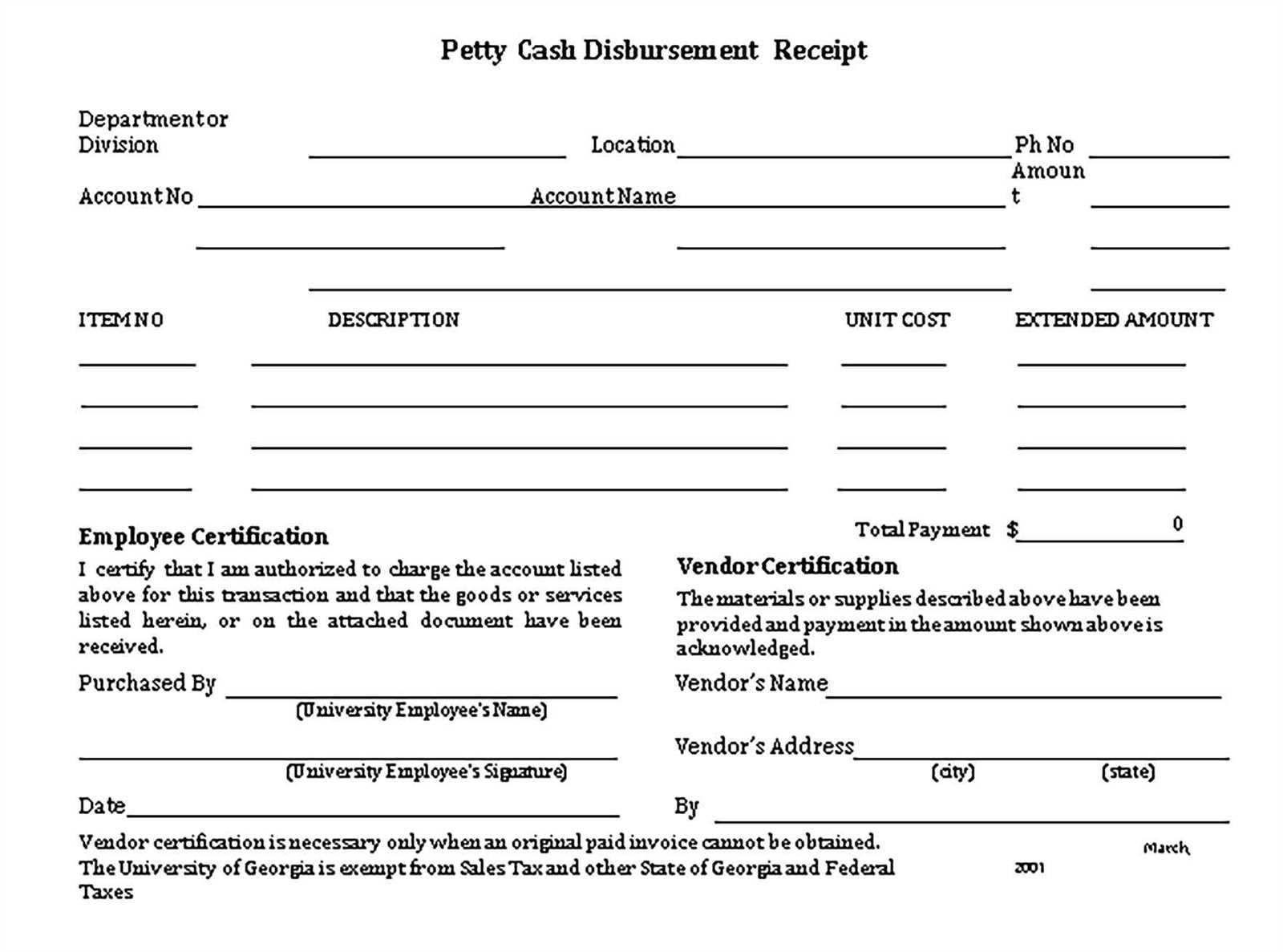

For creating receipt templates in Australia, focus on simplicity and accuracy. Ensure the template includes key details such as the business name, address, contact information, and ABN (Australian Business Number). Include a section for itemized charges, showing product descriptions, quantities, and unit prices clearly. Taxes should be calculated and displayed separately. Consider providing space for payment methods, such as cash, credit card, or EFTPOS. Customizing these elements will help streamline the process and meet Australian requirements.

Make sure the design is easy to read. Use clear fonts and proper alignment. Keep the layout clean by leaving enough white space. A user-friendly receipt increases customer trust and improves record-keeping. Avoid cluttering the template with unnecessary information. Stick to what’s legally required and beneficial for the transaction. Updating the template regularly to stay compliant with changing regulations is advisable.

- Receipt Templates Australia

When creating a receipt in Australia, ensure it contains specific details for clarity and compliance. Use a straightforward template to streamline the process and guarantee that all necessary information is included. Below is a list of key elements to include in your receipt template:

- Business Information: The business name, address, and contact details should be clearly displayed.

- Receipt Number: This should be a unique identifier to easily track transactions.

- Date of Transaction: The exact date when the transaction occurred.

- Itemized List: Clearly list all items purchased or services provided along with the prices.

- GST (Goods and Services Tax): If applicable, include the GST amount or note if the item is GST exempt.

- Total Amount: Clearly state the total cost, including taxes or fees.

- Payment Method: Specify how the transaction was completed (e.g., cash, credit card, EFT).

Design Tips

Keep the layout simple and easy to read. Use standard fonts and ensure the receipt is visually balanced. Provide clear spacing between sections to avoid confusion. Ensure that the template works across different devices or printing formats for easy access and usage.

Where to Find Templates

There are various platforms offering free or paid receipt templates for Australian businesses. Many accounting software programs also include built-in receipt templates, saving time while ensuring all legal requirements are met.

Design your template with a clear layout that reflects the specific needs of your business and complies with Australian standards. Incorporate fields for tax details, such as the Australian Business Number (ABN), Goods and Services Tax (GST), and itemized descriptions, which are required by Australian law. Make sure the design is user-friendly and includes space for your business name, contact information, and payment terms.

Include Legal Information

Ensure that your template includes the necessary legal disclaimers. For example, include information about GST, stating whether your prices include tax. Clearly define payment terms and deadlines, ensuring transparency for both your customers and your business. If you operate as a sole trader or company, include your ABN and other regulatory details to stay compliant with local regulations.

Keep It Simple and Consistent

Consistency in design helps maintain your business’s branding while ensuring that clients quickly understand the necessary details. Use clear fonts, consistent color schemes, and logical placements for information. Customize your template to suit your business’s unique products or services while ensuring that all required details are visible and easy to read.

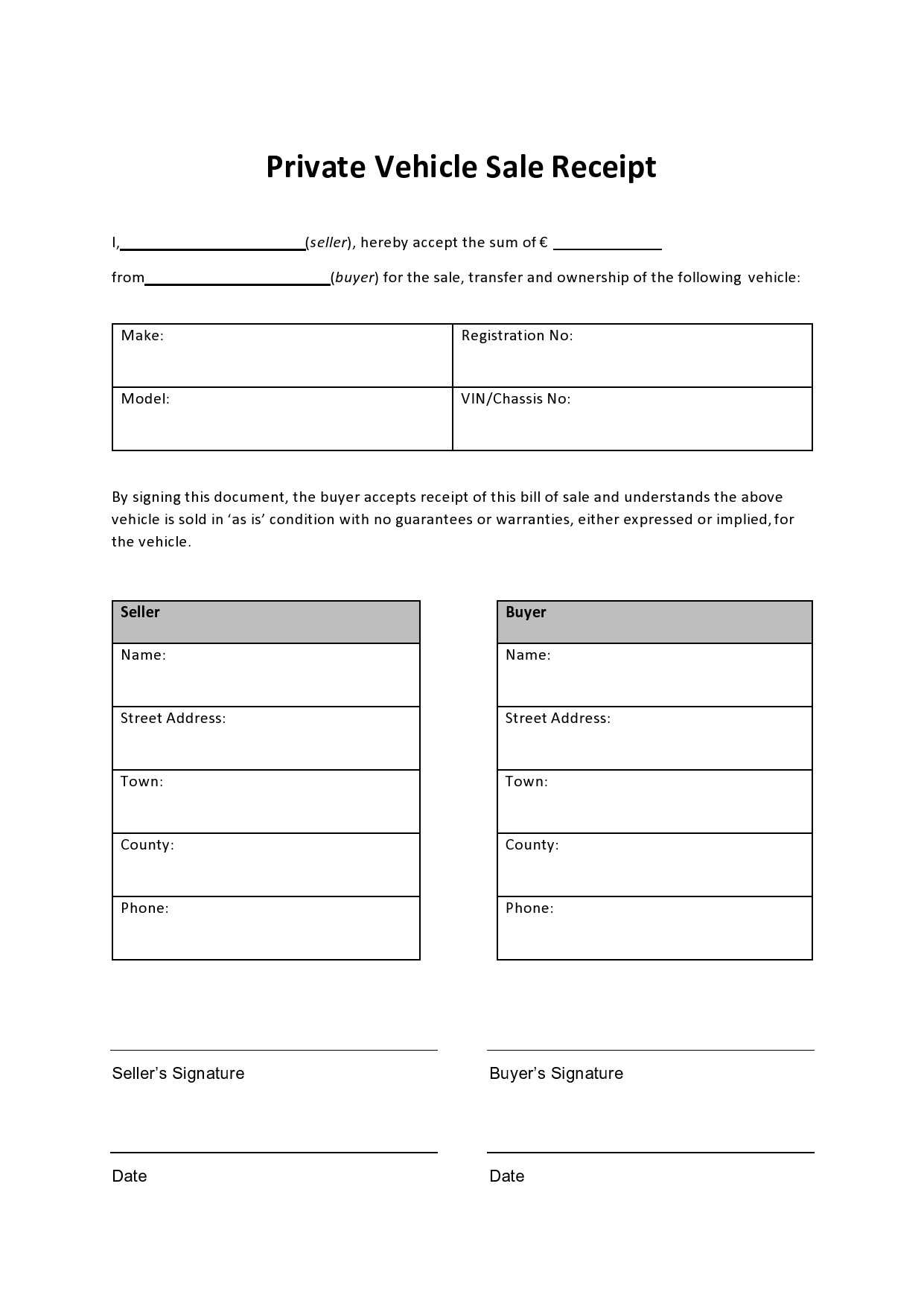

In Australia, receipts must meet specific legal requirements to ensure transparency and accuracy in financial transactions. All receipts must clearly display the following information: the name and address of the business, the date of the transaction, the items or services purchased, the total amount, and the method of payment. If applicable, the receipt should also include the ABN (Australian Business Number) and GST details for businesses registered for GST.

For businesses that issue receipts electronically, the same standards apply. It is important that the receipt includes clear and legible information that the customer can easily verify. Additionally, businesses must ensure they retain copies of all receipts for a minimum of five years, in accordance with the Australian Taxation Office (ATO) regulations.

Failure to comply with these legal requirements can result in penalties. It is advisable for businesses to maintain clear records and ensure that their receipt templates are fully aligned with the Australian legal framework.

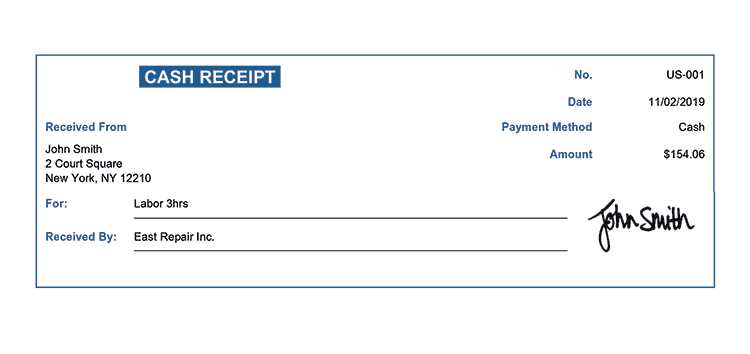

For seamless integration and usability, select formats that suit both digital and printable needs. PDF is a widely accepted option for its reliability and compatibility across devices. It preserves the original formatting, ensuring it looks the same whether viewed on-screen or printed. For simplicity and flexibility, you can also consider using HTML format for receipts, particularly if you need them to be customizable or easily accessible on websites and apps.

When choosing between these formats, assess the convenience of your customers. PDFs are perfect for email receipts or downloadable invoices. HTML, on the other hand, is ideal for interactive forms and offers dynamic elements, like clickable links or embedded payment details, making it useful for online transactions.

| Format | Advantages | Best Use Case |

|---|---|---|

| Preserves layout, universally accessible, suitable for archiving | Online purchases, email receipts, downloadable invoices | |

| HTML | Customizable, interactive, easy to integrate into websites | Online stores, interactive receipt options, dynamic content |

For printable receipts, ensure the format is optimized for A4 or standard receipt paper size. Use a layout that makes it easy for customers to read and store the receipt without unnecessary clutter. Balance visual appeal with functionality to meet both digital and physical transaction needs efficiently.

To comply with Australian tax regulations, always list the Goods and Services Tax (GST) on receipts. This applies to businesses registered for GST, as they are required to display the tax component clearly. If your business is GST-registered, you must include a GST amount next to the price of taxable goods and services.

Include GST Details

Start by indicating the GST-exclusive price and then show the GST separately. For example, if the total cost is $110 (including GST), the receipt should list the amount before tax ($100) and the GST ($10). This transparency helps customers understand the tax breakdown.

Tax Invoice Requirements

Receipts that total over $82.50 (including GST) must be classified as tax invoices. Include the following information: your Australian Business Number (ABN), the date of the transaction, a description of goods or services, the GST-inclusive total, and the amount of GST.

By including accurate tax details, you help ensure your receipts meet legal requirements and facilitate better business practices.

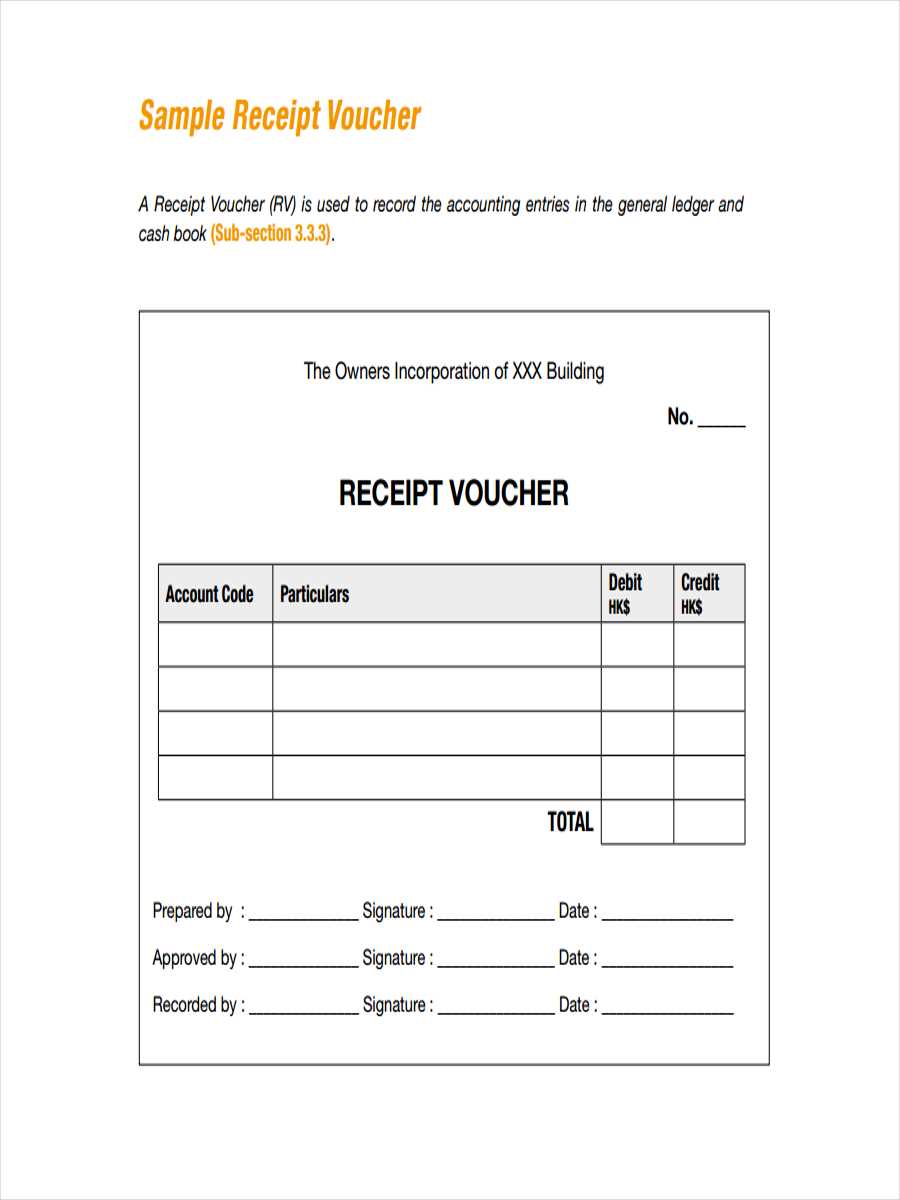

Using templates for expense tracking simplifies financial management. With ready-to-use forms, you can quickly document each transaction and categorize expenses, saving time and effort. This method helps prevent missing details or forgetting important expenses. Templates also offer clear structures, making it easier to track multiple types of costs–whether personal or business-related.

Streamlined Organization

Templates allow for easy organization of receipts and invoices, which is key for maintaining a clean financial record. Categories like transportation, meals, or office supplies make it simple to separate different expenses. With Australian tax regulations in mind, having a template that includes sections for GST or tax-deductible expenses makes it even more efficient.

Customized to Your Needs

Templates can be tailored to suit specific requirements. For example, you can create one that tracks recurring monthly expenses or one designed for travel costs. Many platforms offer customizable fields that let you input specific details, such as payment methods or project names. This personalization adds value by aligning the template with your unique needs.

For creating receipt templates in Australia, these tools and software offer user-friendly features, saving time while ensuring professionalism:

- Canva: A popular design platform with customizable receipt templates. The free version allows you to design and download receipts easily, offering a variety of fonts, colors, and layouts suitable for Australian businesses.

- Microsoft Word: While not specifically for receipts, Word provides a variety of templates that can be customized for receipt creation. It’s easy to modify, and it’s readily available to most users.

- Zoho Invoice: While designed for invoicing, Zoho allows users to create detailed receipt templates. The free version includes essential features like automatic calculation and PDF export, ideal for small businesses.

- Google Docs: Another excellent free tool. With the ability to access templates or create custom receipts, Google Docs offers ease of use and cloud-based access for Australian users working remotely.

- Invoice Generator: This web-based tool provides a straightforward interface for creating receipts without needing to sign up. It’s quick, free, and perfect for basic receipt creation with options to add company logos and personalized details.

Each of these tools offers unique advantages depending on your needs, whether you’re looking for complete customization, simplicity, or additional features like automated calculations.

Use a clear structure when creating a receipt template for Australian businesses. A standard receipt should include specific information such as the business name, ABN (Australian Business Number), transaction date, items purchased, quantities, and total amount. Make sure the template accommodates these fields in a readable format.

Key Elements

- Business Details: Include your business name, address, and ABN. This ensures the receipt meets Australian tax compliance regulations.

- Itemized List: Clearly display the description, quantity, and price for each item purchased.

- Total Amount: Show the total amount due, including taxes (GST, if applicable), and any discounts or additional charges.

- Payment Method: Specify how the payment was made (cash, card, etc.).

Formatting Tips

Ensure the text is legible by using a clean font and organizing information into sections. Avoid clutter, and use bold text for key elements such as totals and business information. Make sure the layout adapts well to both digital and printed formats.