If your organization is a registered 501(c)(3) non-profit, it’s crucial to provide donors with accurate donation receipts for tax purposes. A well-structured receipt not only meets IRS requirements but also reinforces transparency and trust with your supporters. Below is a template for crafting a donation receipt that includes all necessary details while remaining clear and concise.

The receipt should include the donor’s name, the amount of the donation, and the date of the contribution. If the donation involves property, provide a description of the item without assigning a value, as the donor is responsible for that valuation. Additionally, include a statement confirming that the donor received no goods or services in exchange for the donation, unless they did, in which case, the fair market value of the items must be disclosed.

Ensure that your receipt also includes the organization’s legal name, tax-exempt status (501(c)(3)), and your Employer Identification Number (EIN). This is critical for the donor’s ability to claim the deduction on their taxes. Finally, make it easy for donors to get in touch with you if they need further documentation or clarification regarding their donations.

Here are the corrected lines, minimizing repetition while keeping the meaning intact:

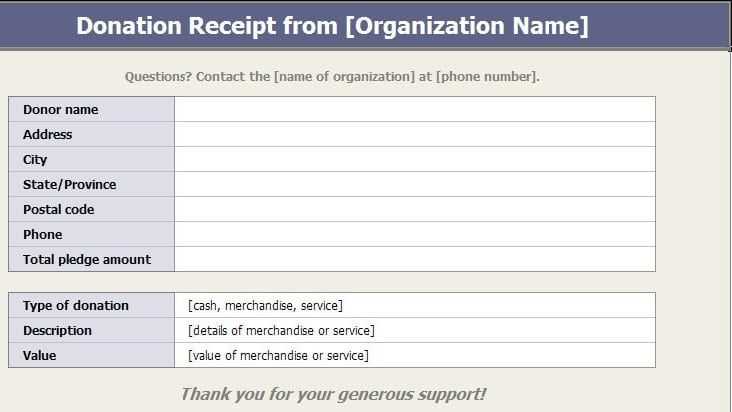

Ensure the donor’s name, address, and donation details are clearly stated. Include the organization’s name, tax-exempt status, and the date of the donation. Indicate whether the donation was monetary, goods, or services. For non-monetary donations, describe the items given and their approximate value.

Specify if the donor received anything in exchange for the donation. If no goods or services were provided, include a statement confirming this. Make sure the receipt is signed by an authorized person within the organization.

For larger donations, provide any additional details such as the method of donation (check, online, etc.). It’s helpful to add a brief thank you note to show appreciation for the contribution.

Double-check that all fields are correctly filled out and reflect the correct tax year to avoid discrepancies during tax filing.

- 501(c)(3) Non-Profit Donation Receipt Template

A well-structured 501(c)(3) non-profit donation receipt template serves as a key document for both the donor and the organization. It provides necessary tax documentation and ensures that both parties meet IRS requirements. Here’s how to structure it effectively:

1. Basic Information

- Organization’s Name and Address: Include the full name of the non-profit along with its physical address.

- Donor’s Name and Address: Clearly list the name and address of the donor for tax purposes.

- Date of Donation: The date when the donation was received must be specified.

2. Donation Details

- Description of the Donation: For non-monetary gifts, provide a detailed description. If the donation is in the form of cash or check, mention the amount.

- Value of Non-Cash Donations: If the donor provides goods or services, indicate the fair market value (FMV). Do not assign a value to the donation unless it is a good or service with an established FMV.

- Statement of Goods or Services Received: If the donor received something in exchange for their donation, briefly describe the item or service and its value. This reduces the deductible amount.

3. IRS Compliance Statement

- Tax-Exempt Status: Include a statement confirming that the organization is recognized as a 501(c)(3) entity by the IRS. This assures donors that their contributions are tax-deductible.

- No Goods or Services Provided (if applicable): If the donor received no goods or services in exchange, include a statement that confirms this fact. This allows the donor to claim the full amount as a charitable deduction.

4. Signature and Acknowledgment

- Authorized Signature: Have a representative from the non-profit sign the receipt, acknowledging the donation.

- Donor’s Acknowledgment: Optionally, allow space for the donor to acknowledge their donation with a simple “Thank you” or “Donation receipt acknowledged” if they prefer.

5. Additional Information for Large Donations

- Donations Over $250: For donations over $250, include a statement that the donor did not receive any goods or services in exchange for their contribution, or specify the details of the goods/services provided. This helps the donor comply with IRS filing requirements.

- Donations of $500 or More: Include information that may be required for Form 8283, which the donor might need for tax filing.

To create a legally compliant donation receipt, ensure it includes specific information required by the IRS for 501(c)(3) organizations. The receipt should contain the following details:

- Name of the Organization: Include the legal name of the nonprofit as registered with the IRS.

- Tax-Exempt Status: State that the organization is a 501(c)(3) and provide the IRS tax-exempt number.

- Date of the Donation: The exact date on which the donation was made should be clearly stated.

- Donation Amount or Description: If the donation is monetary, include the dollar amount. If it is non-monetary (like goods), provide a detailed description of the items donated. Do not assign a value to the non-monetary donations–leave that to the donor.

- Statement of No Goods or Services Provided: If the donor did not receive any goods or services in return for the donation, include a statement such as: “No goods or services were provided in exchange for this donation.” If goods or services were provided, disclose the fair market value of those items.

- Donor’s Information: Include the donor’s name and address for tax record purposes. For larger donations, it is advisable to also request the donor’s signature.

For donations of $250 or more, you must provide a written acknowledgment stating the amount of the donation and whether any goods or services were provided. Failure to meet these requirements could result in the donor being unable to claim the deduction on their taxes.

Lastly, remember to maintain records of all donations and receipts for at least three years in case of an IRS audit.

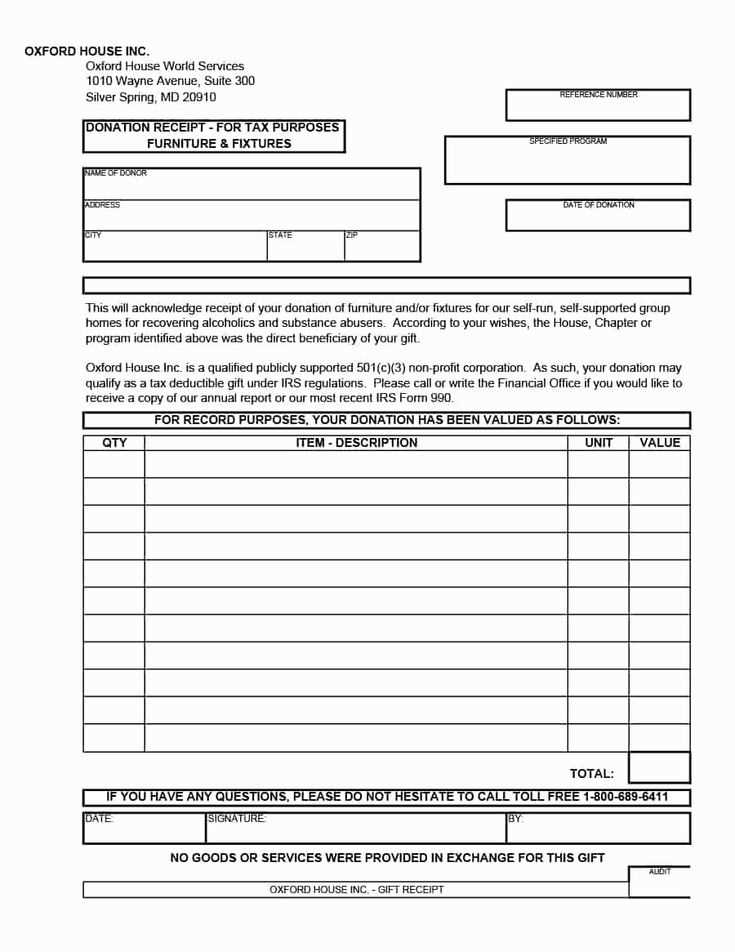

Each donation receipt issued by a 501(c)(3) organization must meet specific IRS requirements. Here are the key elements to include:

| Element | Description |

|---|---|

| Organization’s Name and Address | Clearly display the full name and physical address of the nonprofit organization. |

| Date of Donation | Record the exact date the donation was received. This is crucial for tax reporting. |

| Donor’s Name | Include the name of the individual or entity making the donation. |

| Donation Amount | Specify the monetary value of the donation or describe the non-cash item(s) donated, including estimated value when applicable. |

| Description of Non-Cash Donations | If the donation is non-cash (e.g., goods or services), provide a brief description. Do not assign a dollar value unless appraised by the donor. |

| Statement of No Goods or Services | If the donation was entirely charitable (no goods or services received in return), include a statement such as: “No goods or services were provided in exchange for your donation.” |

| Organization’s Tax-Exempt Status | State that the organization is recognized by the IRS as a 501(c)(3) tax-exempt entity. This lets the donor know that their contribution is tax-deductible. |

| Signature of Authorized Representative | The receipt must be signed by an authorized person from the organization to validate the transaction. |

Ensure all these elements are included to maintain compliance and provide donors with the documentation they need for their tax records.

Make sure to clearly specify the donation amount and type of donation on the receipt. Failure to list the correct value of both cash and non-cash donations can lead to confusion or even legal issues. For non-cash donations, such as goods or services, always provide a description of the items, but do not assign a value unless the donor has done so themselves. If you’re unsure of the value, it’s best to leave it blank or state “fair market value is to be determined by the donor.”

Include the Required Legal Information

Omitting key legal information is a common mistake. The IRS requires that your receipts include your organization’s name, address, and tax-exempt status (501(c)(3)). Additionally, be sure to include the date of the donation and a statement confirming no goods or services were provided in exchange for the gift, if applicable. Failing to include these details could lead to penalties or a rejection of the donation deduction on the donor’s tax return.

Keep Accurate Records of Donations

Inadequate recordkeeping of donations and receipts can be problematic for both your organization and the donor. Ensure you track all donations and issue receipts promptly. If donors need receipts for tax purposes, delays or lost receipts can result in frustration and mistrust. Also, when issuing a receipt, include a reference number or a system for organizing receipts to maintain a clear record of all donations.

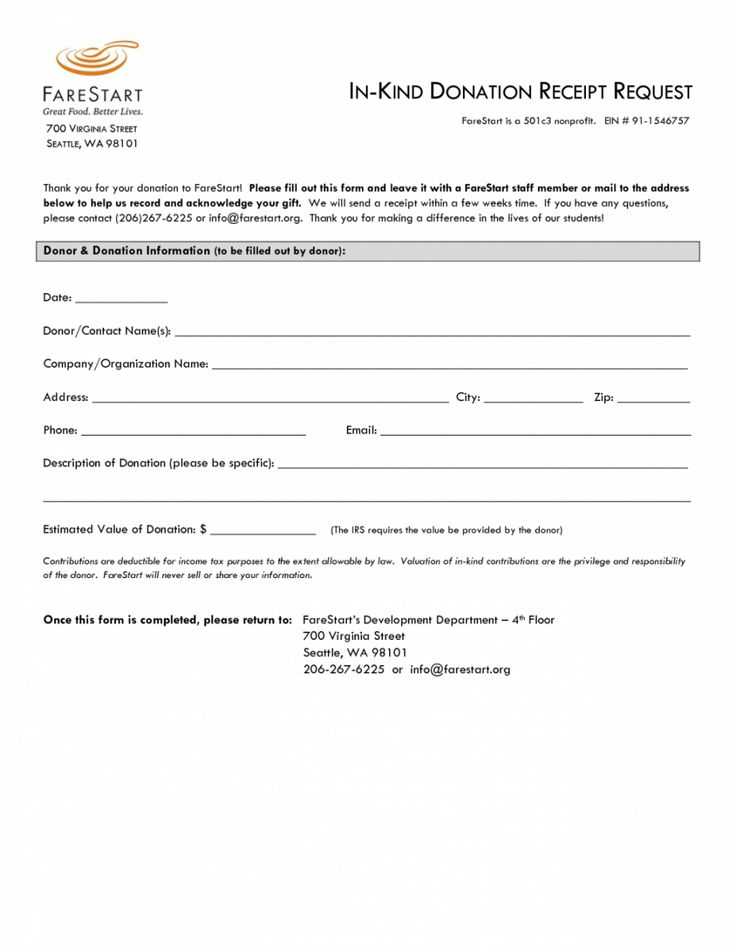

When a donor contributes goods or services instead of cash, it’s important to handle the receipt properly to maintain transparency and ensure compliance with IRS regulations. The IRS requires that donations of goods and services be acknowledged, but with specific guidelines for each type of contribution.

Goods Donations

For donations of physical items, the receipt should clearly describe the items donated, including their quantity and condition. Avoid placing a monetary value on the donated goods, as the IRS prohibits nonprofits from assigning value to them. It’s the donor’s responsibility to determine the value of the donated items. The receipt should include the date of donation, the name of the donor, and a statement confirming that no goods or services were exchanged for the donation, if that is the case.

Service Donations

For donated services, it’s important to note the nature of the service provided, along with the hours donated. While the IRS allows nonprofits to acknowledge donated services, they cannot assign a monetary value to those services on the receipt. Instead, list the time spent and the type of service performed. A statement should be included noting that no goods or services were exchanged for the donation. However, donors can claim deductions for out-of-pocket expenses related to their services, such as materials or supplies used during the donation.

Customizing your donation receipt template ensures that it reflects your non-profit’s identity and meets legal requirements. Follow these steps to create a professional and compliant receipt.

1. Include Required Information

Start by adding the necessary details. These typically include:

| Information | Description |

|---|---|

| Non-profit Name | Ensure your full legal non-profit name is at the top. |

| Tax Identification Number (TIN) | Include your organization’s EIN (Employer Identification Number) for tax purposes. |

| Donor’s Name | List the full name of the donor to personalize the receipt. |

| Donation Date | Record the exact date the donation was made. |

| Donation Amount | Clearly state the donation amount, either in cash or the value of in-kind contributions. |

| Statement of No Goods or Services | Include a statement confirming whether any goods or services were exchanged for the donation. |

2. Add Branding and Design Elements

Customize the layout to align with your non-profit’s branding. Use your organization’s logo, colors, and fonts to create a consistent, professional appearance. Make sure the receipt is clear and easy to read, using sufficient spacing and hierarchy in the design.

3. Make It User-Friendly

Ensure that your receipt is simple to understand. Avoid jargon or complex language. Each section should be clearly labeled, and the donation details should be easy to find. Including a thank-you message adds a personal touch that strengthens donor relationships.

4. Comply with Legal and Tax Requirements

Check local tax regulations to ensure compliance. If applicable, include a disclaimer regarding the non-deductibility of contributions, especially if the donation involves goods or services. This will help avoid future issues with tax authorities and give donors the correct documentation for tax deductions.

5. Save and Automate for Future Use

Once your template is set, save it in a format that allows for easy customization. If you expect frequent donations, consider automating the generation of receipts using a donor management software to streamline the process and save time.

Send receipts as soon as possible after receiving a donation. Aim for distribution within 24-48 hours to ensure prompt acknowledgment of the donor’s contribution. The quicker the receipt is sent, the more likely the donor is to feel valued and appreciated.

Ensure that each receipt contains all the required elements, including the donor’s name, the donation amount, the date, and a statement of whether the donation was tax-deductible. If applicable, mention if goods or services were provided in exchange for the donation.

Use both physical and electronic methods to send receipts. Offering a digital copy via email provides convenience and immediate access. However, sending a hard copy can be a more personal touch, especially for larger donations. Always offer the donor a choice of how they’d like to receive their receipt.

Be consistent in your receipt format. Using a standard template for all donations ensures professionalism and reduces the likelihood of errors. The template should be clear, easy to read, and include your organization’s logo for brand recognition.

Consider customizing the message in the receipt. Adding a short note of gratitude or highlighting how the donation will be used helps create a personal connection. It shows the donor the impact of their contribution.

Ensure compliance with IRS requirements by including a disclaimer on the receipt for donations of $250 or more. This statement should clarify that no goods or services were provided in exchange for the donation, if that is the case.

Provide an annual summary for frequent donors. This can be a helpful reference for their tax filing. Sending this summary at the end of the year shows thoroughness and care in managing donor information.

Finally, keep a record of all receipts issued. Implementing a robust system to track sent receipts ensures you can provide copies if requested and helps with future donor engagement and reporting.

Changes Made:

Make sure the donation receipt template includes the organization’s official name and address. This should be clearly visible to ensure the donor knows where the contribution is going. Ensure that the document includes the organization’s IRS status as a 501(c)(3) nonprofit. This clarifies the tax-exempt status of the donation, which is important for both legal and tax reporting purposes.

Specify the donation amount or a description of the donated property. If it’s a monetary donation, include the exact amount given. For property donations, provide a detailed description. This helps prevent any confusion for both parties when it comes to tax filing. Be clear about whether the donor received anything in return for the donation. If no goods or services were given, include a statement confirming this. If there was an exchange, outline the fair market value of what was received by the donor.

Don’t forget to add the date of the donation. This ensures the timing of the contribution is recorded for tax purposes. Keep the receipt signed and dated by an authorized person in your organization, typically someone responsible for processing donations. This adds legitimacy and accountability to the receipt.

Update any templates to reflect the most recent IRS guidelines for nonprofit donations. These guidelines may change periodically, and it’s crucial to stay compliant with tax laws to avoid any issues for both your organization and donors.

- Remove Redundant Phrases (e.g., “Donation Receipt” and “501(c)(3)”)

Focus on keeping your template clean and concise. Avoid repeating phrases like “Donation Receipt” or “501(c)(3)” multiple times. For example, once you mention the donation receipt at the top of the document, there’s no need to repeat it in every section. Similarly, stating that the organization is a 501(c)(3) only once is sufficient, as it applies to the entire document. This improves readability and ensures that the information is direct and to the point.

Structure your receipt with clear headings that highlight different sections without unnecessary repetition. By minimizing redundant terms, you create a smoother experience for both the donor and the organization managing the receipt.

Focus on eliminating redundant phrases by choosing concise language. Instead of repeating ideas with different words, aim to convey the same meaning in a more straightforward way. For instance, instead of writing “It is important to note that the donation receipt is required by law,” simply state, “The donation receipt is legally required.” This approach removes unnecessary words while keeping the message clear.

Clarify Language

Rephrase overly complex sentences. Avoid adding unnecessary qualifiers such as “absolutely” or “highly” unless they directly impact the meaning. A sentence like “The donor must absolutely receive a donation receipt” can be simplified to “The donor must receive a receipt.” The direct approach improves comprehension.

Avoid Repetition

When you mention a concept multiple times, ensure each mention adds value. For example, if you already state that a receipt is required for tax purposes, there’s no need to reiterate that it is necessary for donors to receive one for this reason. Instead, you can emphasize the action, such as: “A receipt is provided for tax filing purposes.”

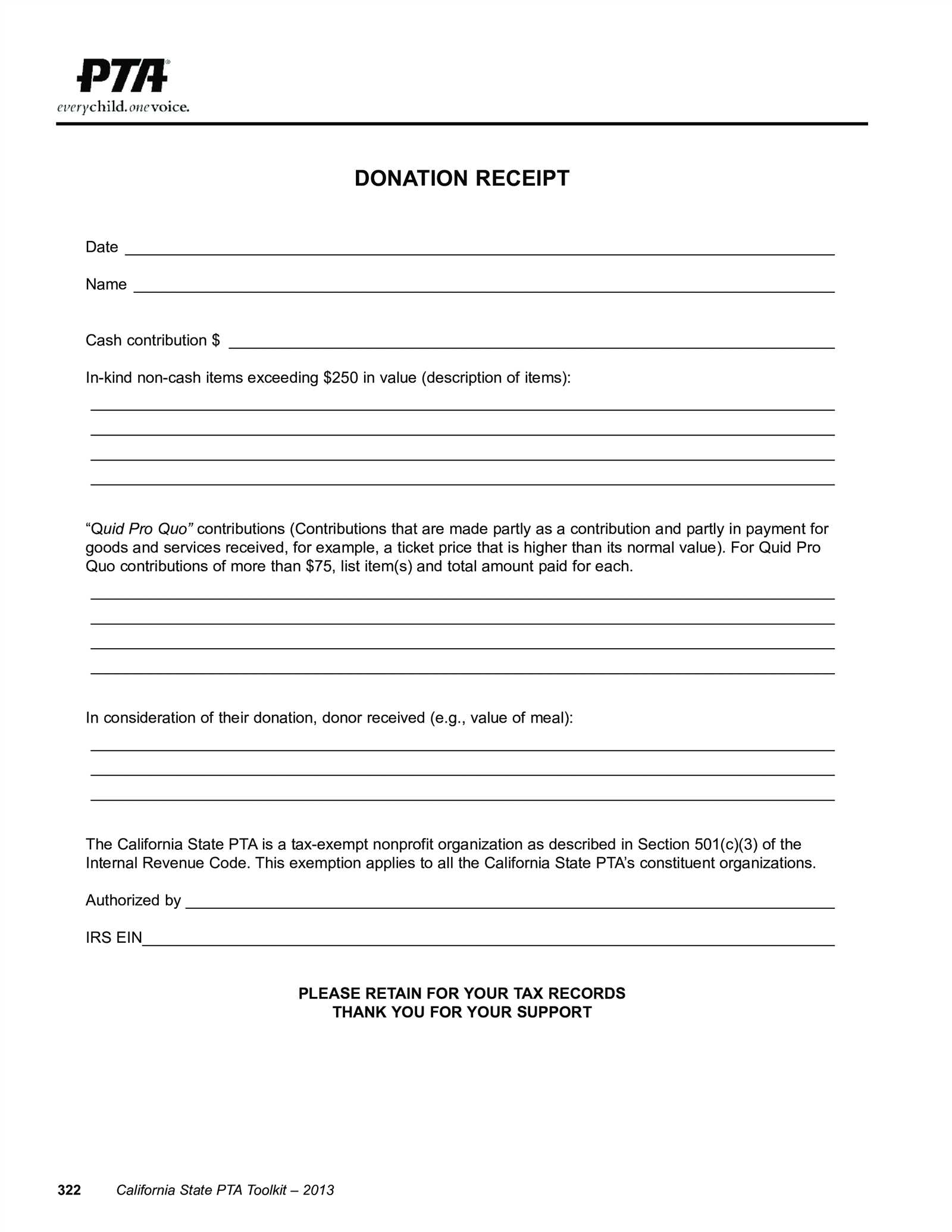

Each section of a donation receipt template for a 501(c)(3) nonprofit must remain consistent to meet IRS requirements and maintain transparency with donors. Here’s a breakdown of the core elements that should stay the same:

- Organization’s name and address: Include the full legal name of the nonprofit and its address to verify the source of the donation.

- Donor’s name: Correctly spell the donor’s name, ensuring it matches the records for accurate tax purposes.

- Amount of the donation: Clearly state the exact amount donated, whether it’s in cash or in-kind contributions.

- Date of the donation: Specify the date the donation was made to verify its tax-year eligibility.

- Description of the donation: Provide a brief description of the donation, especially for non-cash items like goods or services.

- Nonprofit’s tax-exempt status statement: The receipt must include a statement confirming the organization’s 501(c)(3) status and that no goods or services were provided in exchange for the donation, if applicable.

- Signature of an authorized representative: Include a signature from someone authorized by the nonprofit, confirming the donation.

Consistency in these key points ensures the document holds up to scrutiny and protects both the donor and the nonprofit. Be sure to maintain accuracy and clarity in all details for effective recordkeeping and tax purposes.

Donation Receipt Template for 501(c)(3) Nonprofits

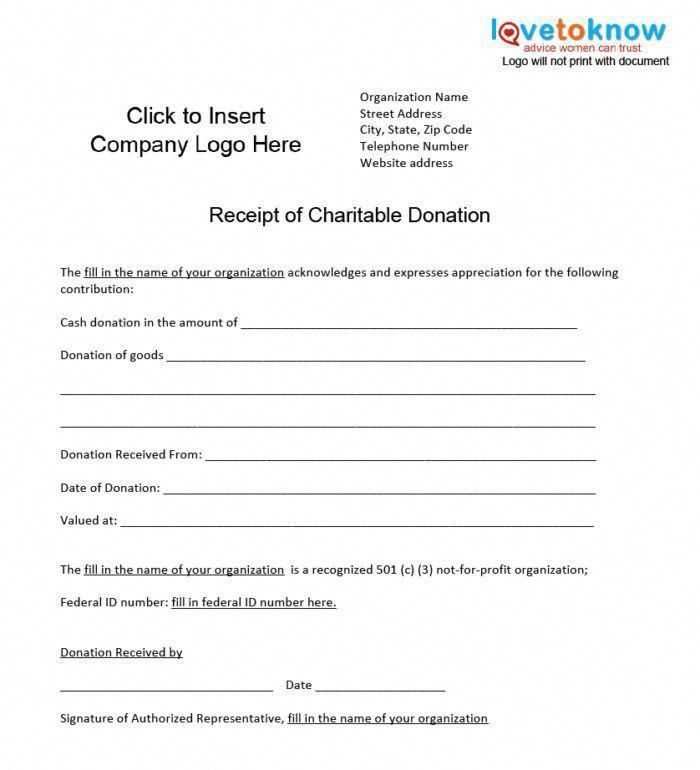

Creating a precise donation receipt is critical for both nonprofits and donors. Below is a template structure for a 501(c)(3) organization’s donation receipt that meets IRS requirements. Customize this template to reflect your nonprofit’s branding and operational details.

- Organization Name and Address: List your nonprofit’s full name, address, and contact details at the top of the receipt.

- Donor’s Name and Address: Include the donor’s full name and address, ensuring accuracy for tax purposes.

- Date of Donation: Mention the date when the donation was made to provide clarity for both parties.

- Donation Amount: For monetary gifts, specify the exact amount donated. For non-cash gifts, provide a brief description.

- Description of the Gift: Detail any items or services donated, including a general description of their value.

- Statement of No Goods or Services Provided: If applicable, include a statement confirming that no goods or services were exchanged for the donation (e.g., for cash donations).

- Signature of Authorized Representative: Ensure an authorized nonprofit representative signs the receipt to validate it.

- Tax-Exempt Status Statement: Include a statement that the organization is recognized as tax-exempt under IRS Section 501(c)(3).

- Language for Non-Cash Donations: If the donation is non-cash, indicate that the donor is responsible for determining the fair market value of the donation.

Adhering to these steps helps your nonprofit issue proper receipts while ensuring that your donors have the necessary documentation for tax deductions.