A clear and concise receipt is a key part of documenting a personal loan agreement. It ensures both parties have a written acknowledgment of the terms and conditions, as well as proof of the transaction. Without this document, misunderstandings and disputes may arise, making it harder to track repayments or enforce the agreement. A properly drafted receipt serves as a reliable reference in case of any disagreements down the line.

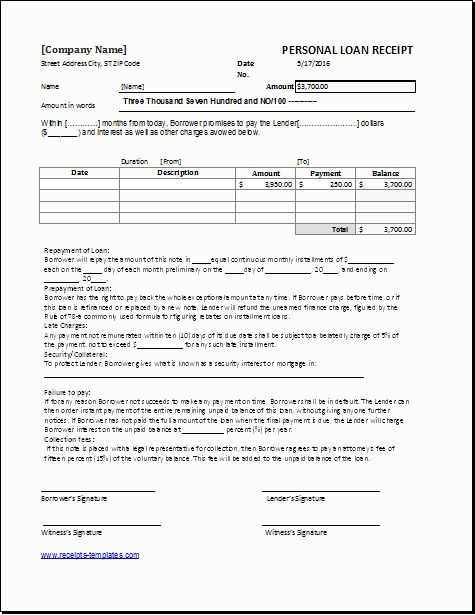

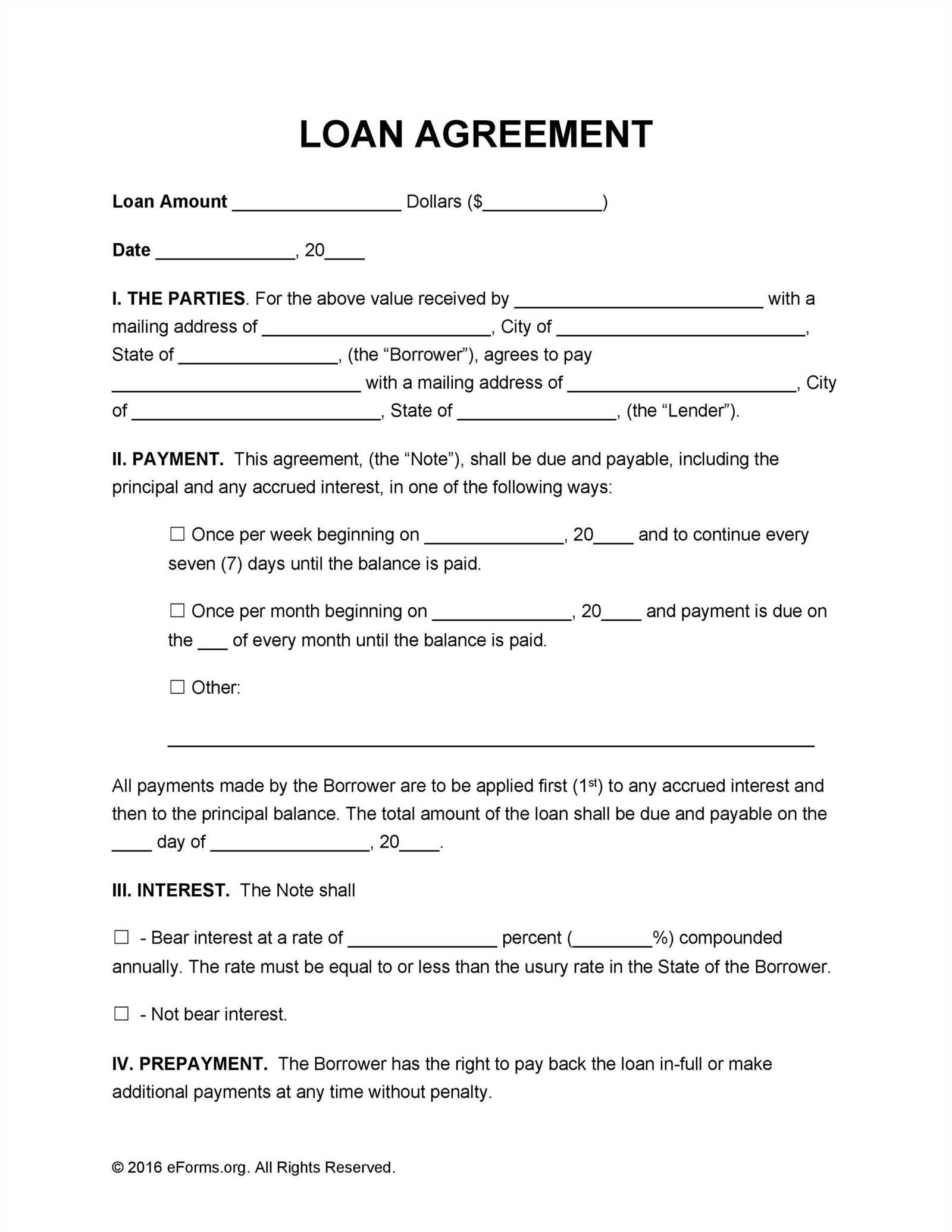

The template should include the names of both the lender and borrower, the loan amount, the interest rate (if applicable), and the repayment schedule. Additionally, it must specify any collateral involved, as well as the exact date the loan was issued. This level of detail will prevent confusion and ensure both parties are on the same page throughout the loan’s duration.

Use a straightforward structure when drafting your receipt. Start with the basic loan details, followed by a summary of payment terms, and then end with a clear acknowledgment from both parties. This approach makes the document both easy to understand and legally binding. Keeping a copy of this receipt is also a good idea, as it can be referenced at any time during the course of the loan agreement.

Here’s the revised version:

When drafting a personal loan agreement receipt, ensure the following elements are clear and correctly formatted:

Basic Information

- Loan Amount: Clearly state the loan sum in both numbers and words.

- Interest Rate: Mention the interest rate applied to the loan, if any.

- Loan Term: Specify the repayment period, including start and end dates.

Payment Details

- Installment Information: List the payment schedule with due dates and amounts.

- Mode of Payment: Indicate how payments will be made (e.g., bank transfer, check).

- Late Fees: If applicable, include any penalties for delayed payments.

By organizing these elements clearly, you create a document that both parties can reference easily throughout the loan term.

- Personal Loan Agreement Receipt Template

To create a clear and professional personal loan agreement receipt, include the following key details:

- Borrower and Lender Information: Full names, contact details, and addresses of both parties.

- Loan Amount: Specify the exact sum of money being loaned, including the currency type.

- Repayment Terms: Outline the schedule, including start date, repayment amount, and frequency (e.g., monthly, weekly).

- Interest Rate: If applicable, clearly state the interest rate or confirm if the loan is interest-free.

- Security/Collateral: If any, include the details of collateral offered for the loan.

- Signature Section: Include spaces for both parties to sign and date the document, confirming agreement to the terms.

Additional Information

If the loan agreement includes specific clauses, such as late fees, penalties, or loan forgiveness conditions, be sure to include these in the receipt for transparency. It is also beneficial to note any amendments or changes to the original loan agreement that may have occurred during the loan process.

A loan document serves as a clear record of the agreement between the lender and the borrower. It outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any penalties for late payments. This document holds both parties accountable, providing a legal framework for resolving disputes if they arise.

For the borrower, the loan document defines the commitment made, offering protection by detailing what is expected in terms of payments and timelines. For the lender, it ensures that the loan terms are enforced, securing their financial interests. Having a written document also simplifies the loan process, eliminating potential misunderstandings down the line.

By reviewing the loan document thoroughly, both parties can be confident about the terms and expectations set from the start. It ensures transparency and a shared understanding of what’s involved, contributing to a smoother transaction.

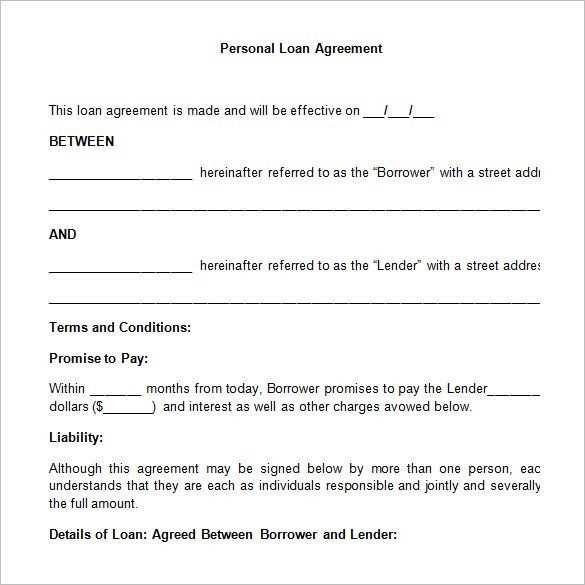

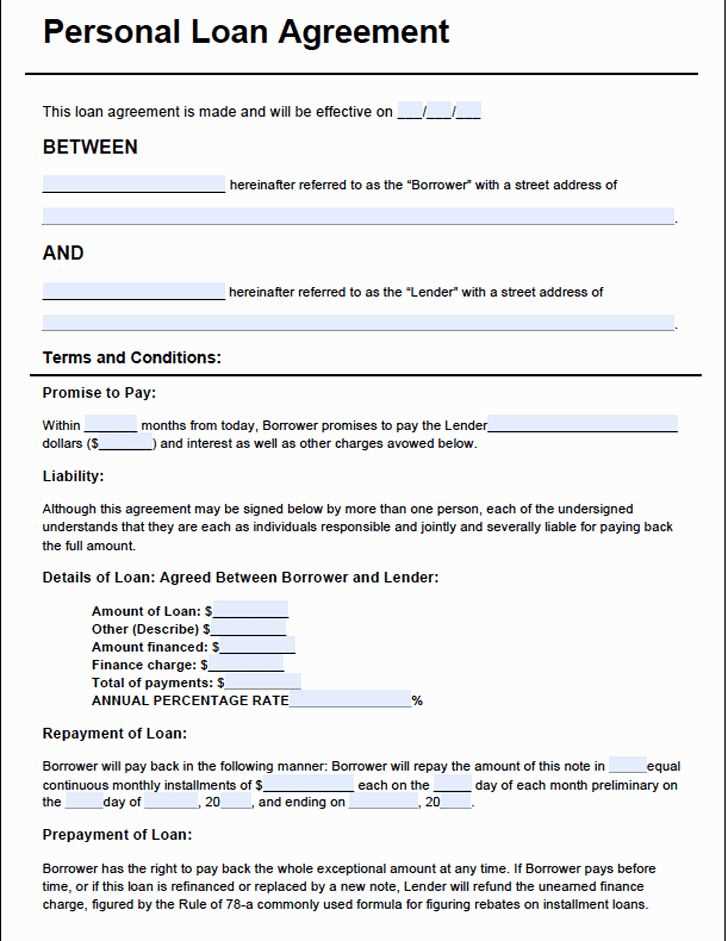

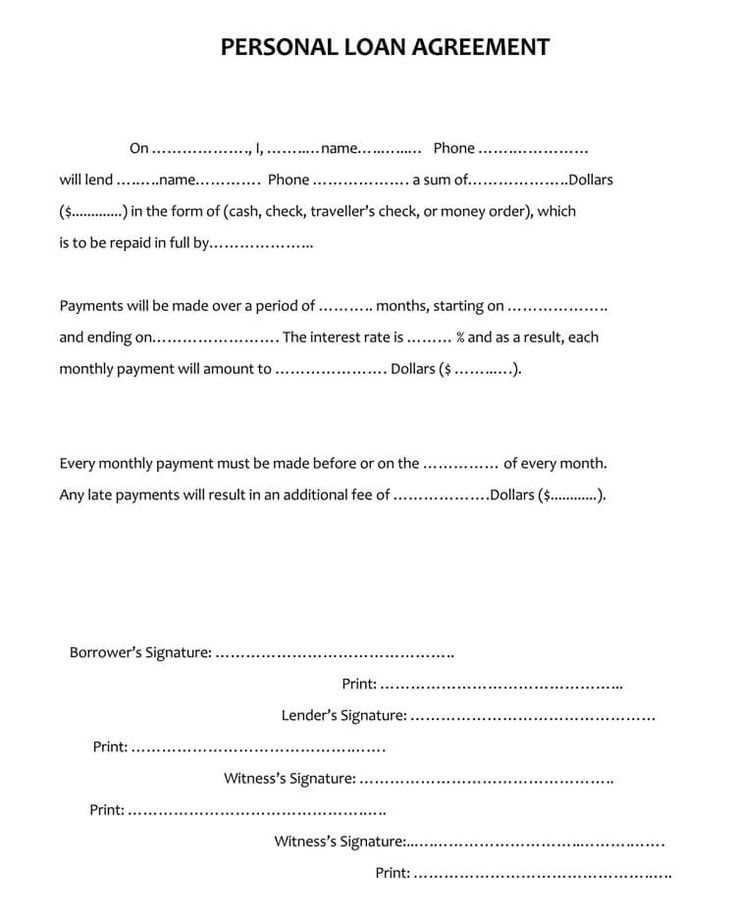

The form should clearly identify the parties involved in the loan agreement. Include the full legal names and addresses of both the borrower and the lender. This information ensures that both sides are properly identified in the contract.

The loan amount must be specified, including the principal sum agreed upon. Also, state the interest rate and whether it’s fixed or variable, along with the payment terms (e.g., monthly, quarterly) and the total repayment amount.

Include the loan term, specifying the start and end dates. Mention any grace periods or repayment holidays if applicable. The form should also define the due dates for payments and consequences of late payments.

List any collateral or security for the loan, if applicable. Provide details of the item(s) used as security, including their description and value, to ensure that both parties are clear about the terms in case of default.

Specify the conditions under which the loan can be modified or terminated, such as prepayment terms or early repayment fees. This section ensures that both the borrower and lender are clear about the options available during the loan period.

Lastly, ensure the form includes a section for signatures. Both parties must sign and date the document to confirm that they understand and agree to the terms of the loan agreement.

| Element | Description |

|---|---|

| Borrower and Lender Details | Full names and addresses of both parties involved |

| Loan Amount | Principal sum and any agreed-upon interest rate |

| Loan Term | Start and end dates, payment schedule |

| Collateral | Details of any collateral securing the loan |

| Modification and Termination Conditions | Terms for prepayment or early repayment fees |

| Signatures | Both parties’ signatures to confirm agreement |

Ensure that the document is clear and easy to read. Begin with the title centered at the top, indicating the nature of the agreement, such as “Personal Loan Agreement.” Use a standard font, such as Arial or Times New Roman, with a font size of 12 points for the body text.

The agreement should be divided into sections with clear headings, such as “Loan Terms,” “Borrower’s Responsibilities,” and “Repayment Schedule.” Use bold or underlined text for these headings to distinguish them from the rest of the content.

Keep the margin consistent on all sides, generally 1 inch. Double-space the text to allow for easy reading and make the document look organized. Use numbered or bulleted lists when outlining specific terms or conditions to make the information easy to follow.

Each paragraph should be aligned to the left, with no indentations at the beginning of lines. Instead, leave a space between paragraphs to clearly separate different sections. Make sure that all dates, amounts, and terms are clearly visible, formatted consistently throughout the document.

Finally, always leave room for signatures at the bottom, including the names of both parties and a date line. Consider adding a space for witnesses, if applicable.

Ensure that the loan agreement record includes clear identification of both parties involved, with full legal names and contact details. This ensures there are no ambiguities about who the lender and borrower are. Specify the exact loan amount, interest rate, repayment terms, and any penalties for missed payments. These details ensure the document is legally enforceable in the event of a dispute.

Include a section outlining the loan’s purpose, whether it’s for personal, business, or other reasons. This ensures clarity on the loan’s intended use, which could impact its tax or legal implications.

The agreement must be signed by both parties. In some jurisdictions, a witness or notary public may also be required for additional legal validation. The signatures act as proof of agreement and ensure both parties accept the terms presented.

| Key Requirement | Explanation |

|---|---|

| Identification of Parties | Full names and contact details of the lender and borrower. |

| Loan Amount | Clear indication of the amount being loaned. |

| Repayment Terms | Specifics on how and when the loan will be repaid. |

| Interest Rate | Clearly stated rate of interest applied to the loan. |

| Signatures | Both parties must sign the agreement, with a witness if necessary. |

Loan payment statements should clearly show the amount paid, payment dates, and any remaining balance. For instance, a typical statement might display: “Payment of $500 received on January 15, 2025. Remaining balance: $2,000.” If payments are irregular, ensure each payment is detailed with date and amount paid. It’s also helpful to list any fees or penalties for missed payments, such as, “Late fee of $25 applied on February 1, 2025, for payment delay.” Include all relevant details to keep both parties informed about the loan status. This transparency helps prevent confusion and ensures the borrower and lender are on the same page.

Double-check the borrower’s and lender’s information for accuracy. Any typo or incorrect detail could lead to confusion or disputes later. Ensure the full name, addresses, and contact details are correctly entered.

Don’t skip the date fields. Recording the correct date when the loan is made and when repayments are due is crucial for clear documentation. This avoids any potential confusion or legal issues regarding the loan terms.

Clearly outline the loan terms, including the amount, interest rate, and repayment schedule. Ambiguous language can lead to misunderstandings. Be specific about all conditions to avoid future disputes.

Include a clear payment method and frequency. If the repayment plan isn’t specified, it might lead to confusion about how and when payments should be made. Clearly state whether payments will be made monthly, weekly, or in lump sums.

Avoid vague or general language. Legal documents need precise language to be enforceable. Using terms like “may” or “could” in critical areas like repayment can lead to problems down the line.

Don’t forget to include any fees or penalties for missed payments. Clearly state the consequences of defaulting, including late fees or changes to the interest rate. This ensures both parties are aware of the full agreement.

Finally, make sure both parties sign and date the agreement. Without signatures, the record isn’t legally binding. Be sure both the lender and borrower acknowledge and agree to the terms by signing the document.

All words in each line repeat no more than two or three times, and the meaning remains the same.

To create a clear, understandable receipt template for a personal loan agreement, avoid redundant word usage. Each statement should maintain its clarity and directness.

- Ensure the loan amount and payment terms are clearly stated, using concise language to avoid repetition.

- Indicate the borrower’s and lender’s names only once in the relevant sections.

- Describe the repayment schedule without unnecessary rephrasing or excessive detail.

- Summarize key dates, like the loan start and end, without reiterating the same information.

- Use straightforward terms for payment methods and amounts to keep the document efficient.

By following these guidelines, the document remains clear and professional, while ensuring important details are easy to find without redundant phrases.