Using a donation receipt template can simplify the process of acknowledging contributions and ensuring proper documentation for both donors and organizations. A well-structured receipt includes key details such as donor information, donation amount, and the organization’s acknowledgment. This minimizes the risk of errors and streamlines record-keeping.

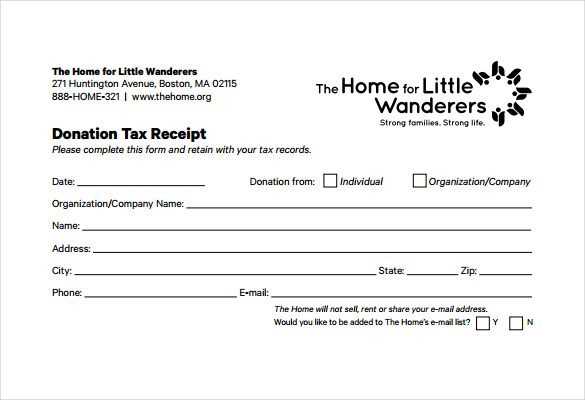

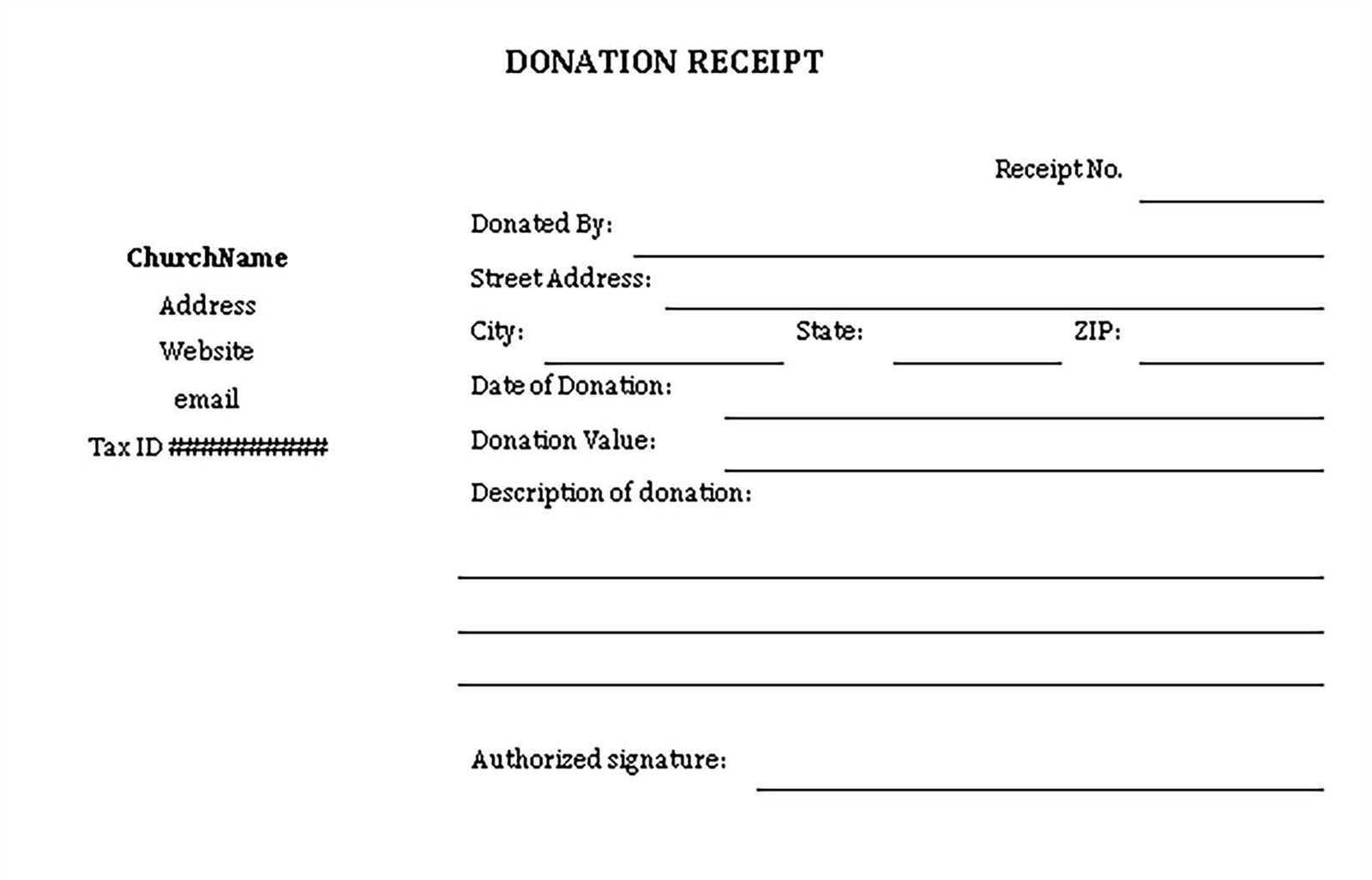

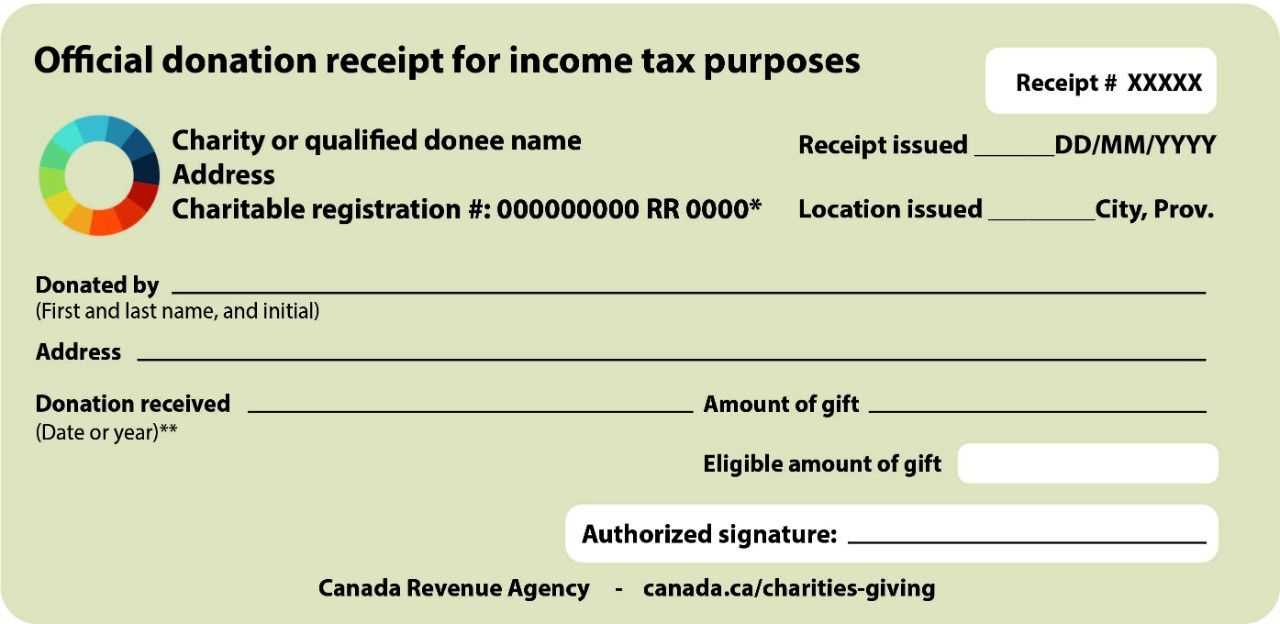

Ensure your donation receipt template includes donor details like their full name, address, and the date of the donation. The donation amount and the purpose of the contribution should also be clearly listed, whether it’s a monetary gift or an in-kind donation like goods or services. Donors often need these details for tax purposes, so accuracy is essential.

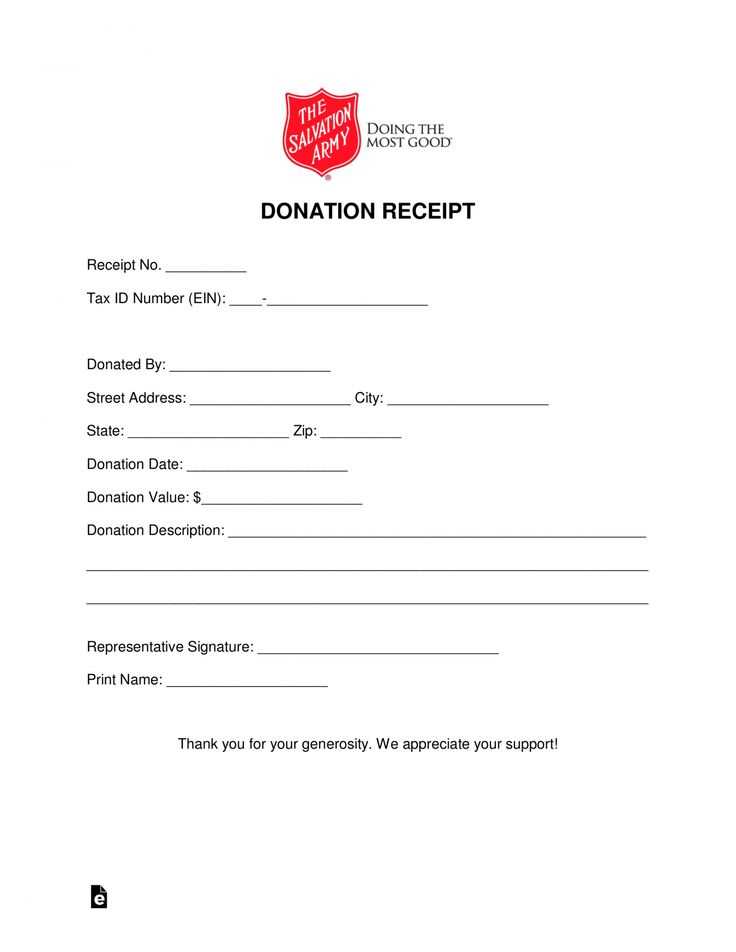

Additionally, it’s wise to include the organization’s tax ID number and a statement confirming the non-receipt of any goods or services in exchange for the donation, if applicable. This helps clarify that the donation was a charitable contribution and qualifies for potential tax deductions.

Finally, customizing your receipt template to match your organization’s branding can enhance its professionalism. Keep it simple, clear, and easy for both the donor and your team to process quickly. A well-organized donation receipt template builds trust and strengthens donor relationships.

Here’s the revised version:

When preparing a sample donation receipt, make sure the template includes clear, concise, and accurate information to ensure transparency for both the donor and the recipient organization. Use the following format to create a professional and easy-to-understand document.

Key Details to Include

Each donation receipt should feature the following elements:

- Organization’s name and contact details

- Donor’s name and contact information

- Donation date

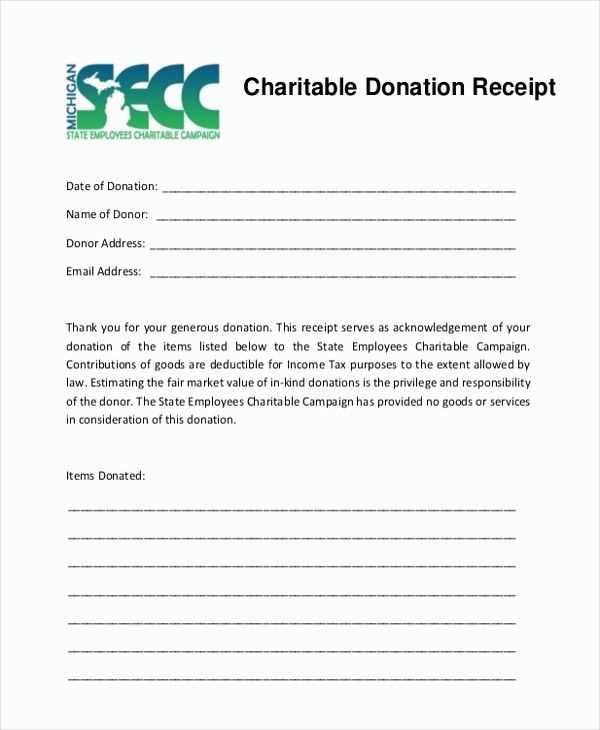

- Itemized list of donated items or services (if applicable)

- Value of the donation (estimated, if needed)

- Statement of non-compensation (if applicable)

- Signature of an authorized person

Example Template

| Field | Information |

|---|---|

| Organization Name | ABC Charity |

| Organization Address | 1234 Charity St., City, Country |

| Donor Name | John Doe |

| Donation Date | February 1, 2025 |

| Items Donated | Clothes, 10 books, Furniture |

| Estimated Value | $500 |

| Signature | Jane Smith |

Ensure that all information is accurate, as it helps the donor with tax deductions and provides your organization with clear documentation for internal records.

- Donation Receipt Template

To create a donation receipt template, include key details that ensure the donor’s contribution is properly acknowledged and documented. The template should be clear and professional, making it easy for both the donor and the recipient organization to retain important information for tax or record-keeping purposes.

Key Elements of the Template

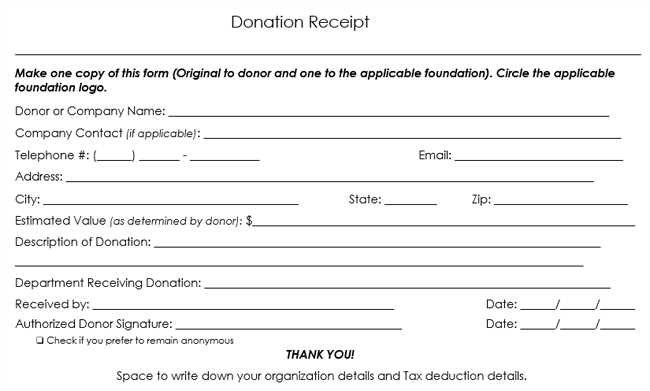

Start with the organization’s name, address, and contact information. Include the donor’s name and address to personalize the receipt. Specify the donation amount, whether monetary or in-kind, and include the date the donation was received. If the donation is in the form of goods or services, provide a description of the items donated.

Tax-Exempt Status and Thank-You Note

If applicable, mention the organization’s tax-exempt status (e.g., 501(c)(3)) and include a statement such as: “No goods or services were provided in exchange for this contribution” if that’s the case. Finish the receipt with a thank-you note to express appreciation for the donor’s generosity.

Ensure your donation receipt includes the donor’s full name and address. This helps both the donor and the charity maintain accurate records for tax filings. Clearly state the amount donated and the date of the donation. If the donation was in-kind (non-cash), describe the items donated and provide an estimated value, noting whether the donor received any goods or services in return for the donation.

Provide a Statement on Goods or Services

If the donor received goods or services in exchange for their donation, include a statement with an estimated value of those items or services. This is necessary for the donor to deduct only the portion of the donation that exceeds the value of the benefits received.

Ensure the Organization’s Details Are Clear

Include the name of the organization, its tax identification number (TIN), and its status as a registered nonprofit. These details verify the organization’s legitimacy and make the receipt valid for tax purposes. Keep the language clear and concise, avoiding vague or non-specific terms.

To ensure clarity and proper documentation, include the following key elements in your donation receipt:

1. Donor’s Information

Include the donor’s full name and contact details. This ensures both parties have a record for tax purposes and future reference.

2. Donation Details

Clearly state the date of the donation, the amount or value of the donation, and whether it was cash or non-cash (e.g., goods, services). If applicable, specify the type of goods or services donated.

3. Non-Profit Information

The name and address of the organization receiving the donation must be present, along with its tax identification number (TIN) to confirm its non-profit status.

4. Acknowledgement Statement

Include a statement confirming that the organization did not provide goods or services in exchange for the donation, or if they did, describe those goods/services and their value.

5. Signature

Ensure the receipt includes the signature of an authorized representative of the organization. This helps validate the document for both legal and tax purposes.

Selecting the right receipt template depends on your organization’s specific needs. Consider these key factors:

- Branding – Ensure the template reflects your organization’s branding. Use your logo, colors, and fonts to create a professional and consistent image.

- Donation Information – The template must clearly display donor details, donation amount, date, and the purpose of the donation. These are the most important pieces of information for both you and your donor.

- Tax Compliance – Choose a template that includes the necessary legal language required for tax-deductible donations. This may vary based on your location and type of nonprofit.

- Customization Options – Select a template that allows for easy customization. This will ensure you can adjust details as needed without formatting challenges.

- Format – Opt for a template that is compatible with your preferred tools, whether that’s Word, Excel, or a specific online platform. You may also need a version that works for digital or physical receipts.

- Ease of Use – Make sure the template is easy to fill out. This will save time for both your team and your donors.

- Donor Recognition – If donor recognition is part of your process, choose a template that offers space to include personal messages or a thank-you note.

By keeping these factors in mind, you can select a template that serves both your organizational needs and offers clarity to your donors. Prioritize usability and compliance to ensure smooth processing and satisfaction on both ends.

Each state has its own legal requirements for donation receipts, which can vary depending on the size of the donation and the status of the organization receiving the gift. It’s crucial to comply with these rules to ensure donors receive the proper acknowledgment for tax purposes. Below are some key state-specific guidelines to keep in mind.

California

In California, donations of $250 or more require a written acknowledgment from the organization, which includes the amount donated and a statement whether any goods or services were provided in exchange for the donation. The receipt must be provided no later than the earlier of the date of filing the organization’s return or the date of the donor’s request for a copy.

New York

New York requires a written receipt for any donation over $75. The receipt should clearly outline the amount of the donation, any goods or services given in return, and a description of any non-cash donations. If a donor contributes more than $250, a written acknowledgment must be sent detailing the amount and value of any goods or services exchanged.

Texas

Texas requires organizations to provide a written receipt for all donations of $25 or more. For non-cash donations over $500, a description of the donated items and their fair market value must be included in the receipt. If the donation exceeds $250, an acknowledgment letter is necessary with similar details as those required in California.

| State | Minimum Donation for Receipt | Additional Requirements |

|---|---|---|

| California | $250 | Must include a statement of goods/services received |

| New York | $75 | Include a description of non-cash donations if applicable |

| Texas | $25 | Non-cash donations over $500 require a fair market value description |

Adjust your donation receipt template to match the specific needs of your organization. Start by adding your organization’s name, logo, and contact details at the top. Make sure the receipt clearly states the donor’s name and the amount donated. If you accept various types of donations, include separate fields for monetary gifts, goods, or services.

Incorporate a unique receipt number for tracking purposes. This will help both you and the donor stay organized. If your organization offers tax deductions, include a statement confirming that no goods or services were exchanged for the donation, if applicable.

Personalize the message with a thank-you note. Adding a brief acknowledgment shows gratitude and reinforces the importance of the donor’s contribution. You can also add any specific instructions or next steps for the donor, such as tax filing guidelines or additional ways to get involved.

Ensure the template is easy to read. Keep the layout clean and avoid overcrowding the receipt with unnecessary details. You can use bold text to highlight key sections like the donation amount and donor information, but keep it balanced with whitespace for a professional look.

Lastly, save the template in a format that’s easy to share electronically or print. Ensure your system can auto-fill fields like the donor’s information and donation amount for convenience. Customize and adjust as needed to fit your specific reporting or legal requirements.

Send receipts promptly after receiving a donation to ensure timely acknowledgment and tax purposes. Use a clear and easy-to-read format, detailing the amount, date, and any other relevant information. Ensure your contact details and the recipient’s information are included. If possible, send receipts digitally to reduce overhead and expedite delivery.

For archiving, create a systematic approach that allows you to quickly retrieve receipts if necessary. Store digital copies in a secure, organized folder structure by year or donor name. For physical receipts, use a filing system with clear labels, storing them in a fireproof and waterproof container. Regularly back up your digital records to avoid losing them due to technical issues.

Adopt a consistent practice for categorizing donations based on their type (monetary, in-kind, etc.), which will simplify the process for both sending receipts and managing archived documents. Consider using accounting software to automate the tracking, issuing, and archiving of receipts to save time and reduce the risk of error.

Now, word repetition is minimized, meaning is preserved, and the structure remains intact.

Start by using clear and straightforward language. Avoid over-explaining or using redundant phrases. Each sentence should convey its purpose without unnecessary elaboration. A good practice is to replace repetitive words with synonyms or restructure the sentence entirely. For example:

- Original: “The company provides great service and exceptional service quality.”

- Revised: “The company provides excellent service quality.”

Additionally, focus on keeping the message concise. When revisiting ideas, opt for linking phrases instead of reiterating the same concept. This will maintain flow while eliminating repetition.

Finally, ensure the tone remains friendly and clear. Avoid making sentences overly complex while keeping the intent intact. By following these strategies, you’ll have content that’s both clear and engaging without redundant wording.