Using a well-structured earnest money receipt template ensures clarity in any real estate transaction. This document verifies the receipt of funds, offering a straightforward record of the transaction between a buyer and a seller. It outlines the amount, date, and purpose of the payment, helping both parties stay on the same page and avoid misunderstandings.

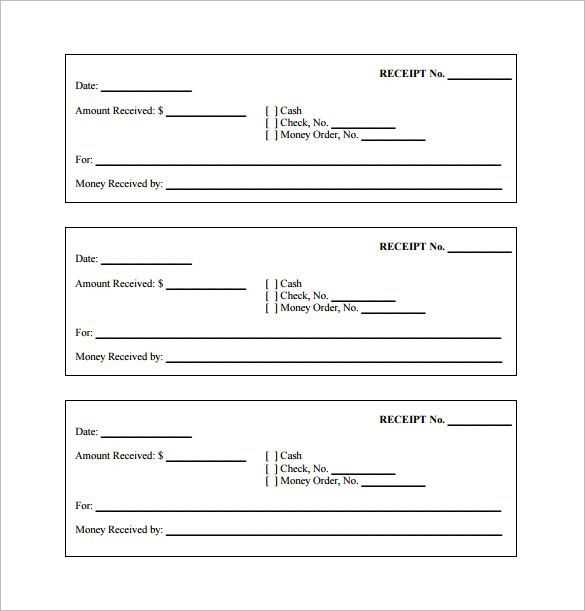

When drafting an earnest money receipt, include the date of the payment, the amount paid, the name of the buyer, and the name of the seller. Specify the property involved, as well as the terms under which the money is held. It’s essential to state whether the earnest money is refundable or non-refundable, depending on the agreement. This will prevent confusion down the road.

To keep things professional, make sure the receipt is signed by both parties. You can also include space for additional details like the agent’s name if applicable, or any conditions tied to the earnest money. Having a clear, concise, and legally sound template saves time and ensures both parties are protected.

Here’s the corrected version:

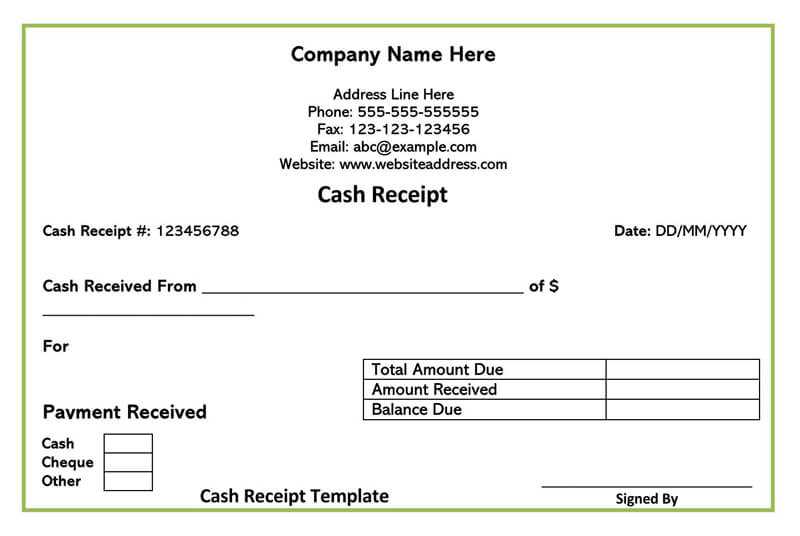

Ensure that the receipt includes all required details to avoid confusion. Begin by clearly stating the names of both the buyer and the seller, as well as the transaction date. Specify the amount of earnest money paid, along with the payment method used. It is crucial to outline any conditions under which the deposit may be refunded or forfeited.

Key Elements to Include:

Include a statement acknowledging that the earnest money has been received, and clarify the purpose of the deposit in relation to the agreement. If applicable, list any relevant dates, such as the deadline for completing the agreement or any contingencies tied to the payment.

Legal Language and Clarity:

Make sure the language is straightforward but legally binding. Avoid ambiguous terms and ensure that both parties have a mutual understanding of the terms. It’s helpful to include a section outlining the consequences in case either party defaults.

Earnest Money Receipt Template Overview

How to Structure the Earnest Money Receipt Form

Essential Details to Include in the Receipt

When to Issue the Earnest Money Document

Legal Consequences of Earnest Money Receipts

Common Errors to Avoid in Earnest Money Receipts

Tailoring Earnest Money Receipts for Various Transactions

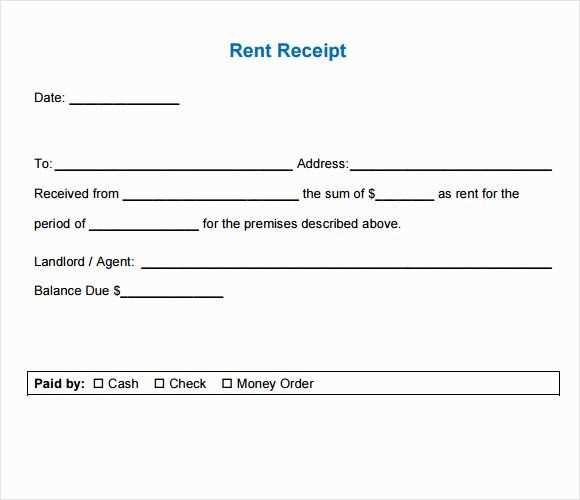

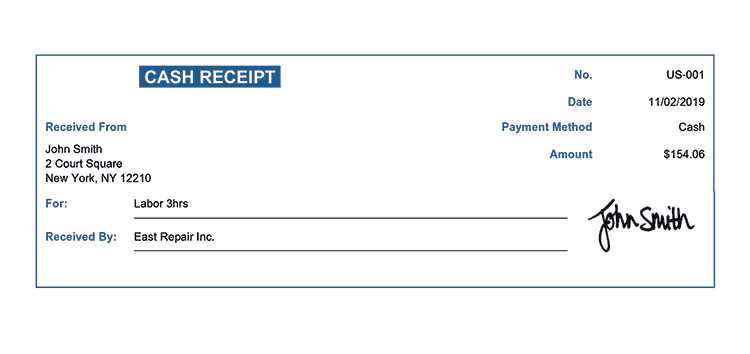

Start by clearly identifying the parties involved, including the buyer and seller, as well as the property or transaction. Include the exact amount of earnest money paid, and specify the payment method (e.g., check, cash, or electronic transfer). The date of the transaction should also be included for record-keeping.

Structure the receipt with a section for both the buyer and seller’s signatures to validate the agreement. This adds legal weight to the document, confirming that both parties acknowledge the payment. Clearly state the terms under which the earnest money will be applied or refunded in case of cancellation.

Include the full address of the property or item being purchased, and specify whether the earnest money will be credited toward the purchase price or refunded if certain conditions are met. Mention the specific conditions that will allow the buyer to withdraw and claim the earnest money back, such as failing to meet contractual terms.

Issue the earnest money receipt immediately after the deposit is made. This ensures both parties have documentation of the transaction, protecting the interests of the buyer and seller. It’s best practice to provide a copy to both sides, with the original kept for legal purposes.

Legally, earnest money receipts bind both parties to the agreement’s terms, such as deadlines and contingencies. If either party defaults on the contract, the earnest money may be forfeited or refunded, depending on the specific conditions outlined in the agreement. Be clear about these details in the receipt to avoid misunderstandings.

Watch for common mistakes such as unclear terms or leaving out payment details. Missing signatures or dates can also cause disputes down the line. Double-check the receipt for accuracy before signing and issuing it.

When adapting the template for different transactions, ensure that any specific terms relevant to the transaction are included, whether for real estate, vehicle purchases, or other agreements. Each type of deal may require unique clauses regarding how the earnest money is handled.