If you are a landlord, creating a professional receipt for your tenants doesn’t have to be a complicated task. A free receipt template can simplify this process, helping you stay organized and maintain clear records of all transactions. This template will save you time and ensure that each payment is documented correctly for both parties.

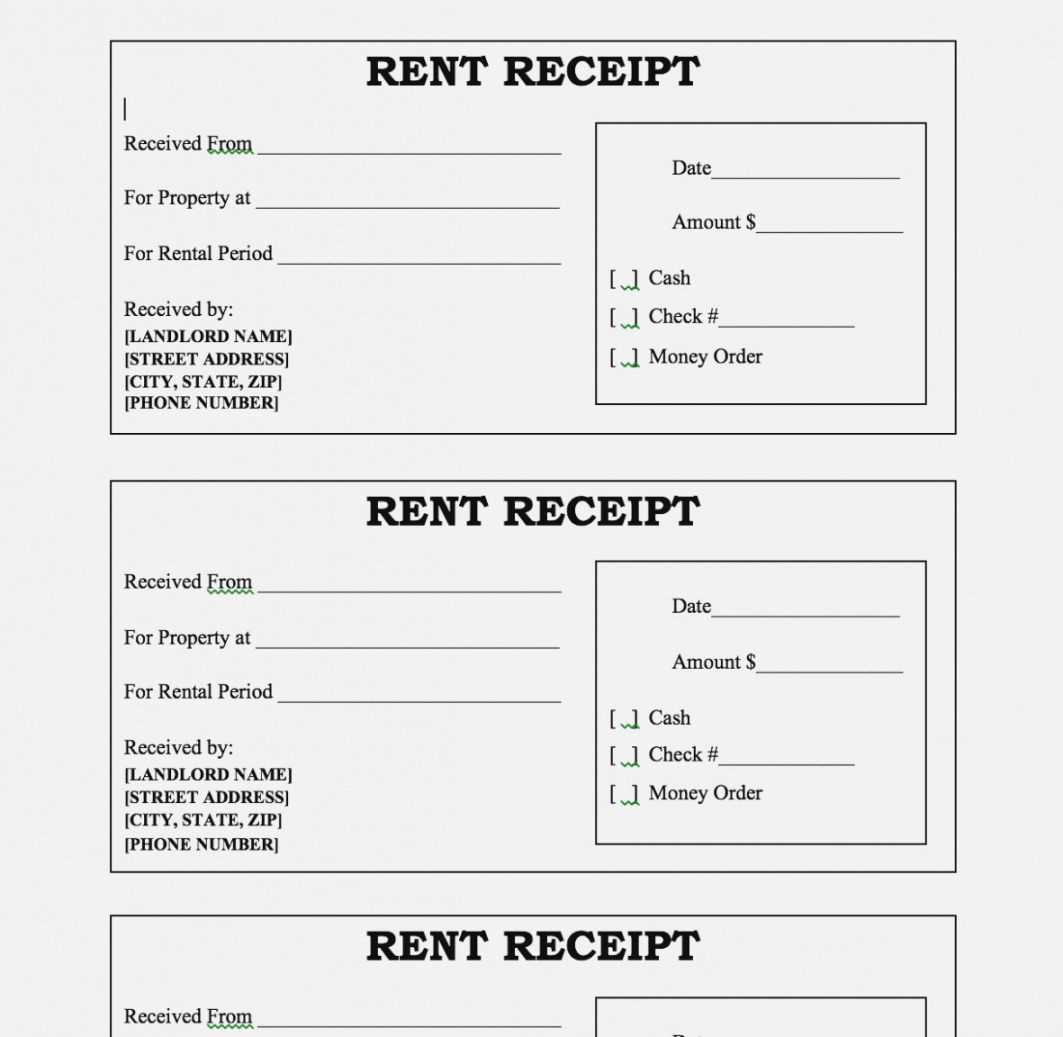

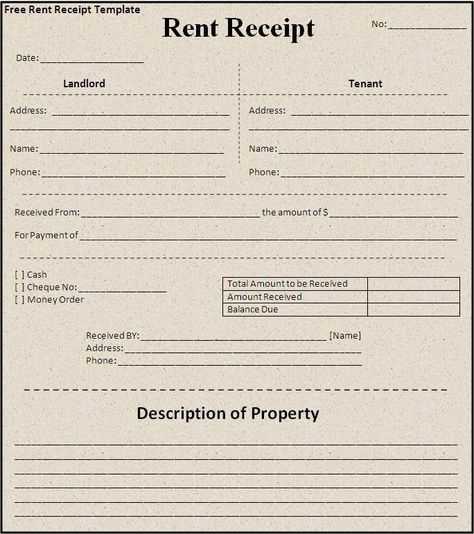

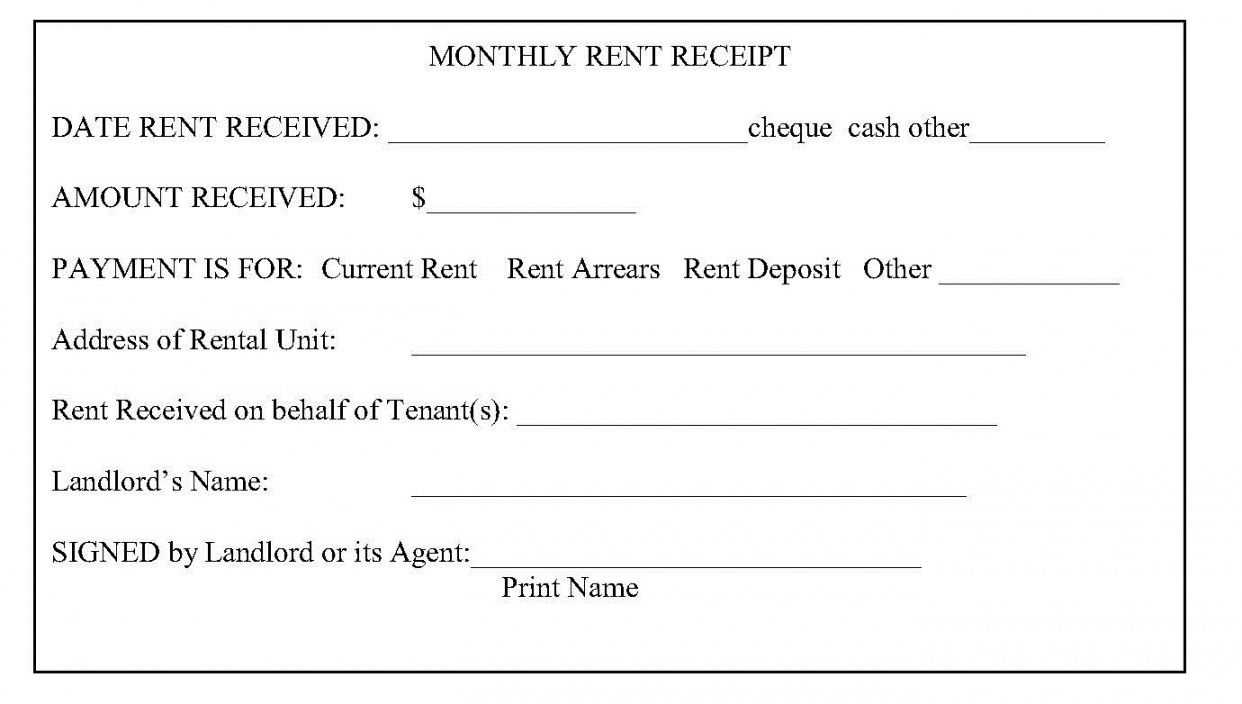

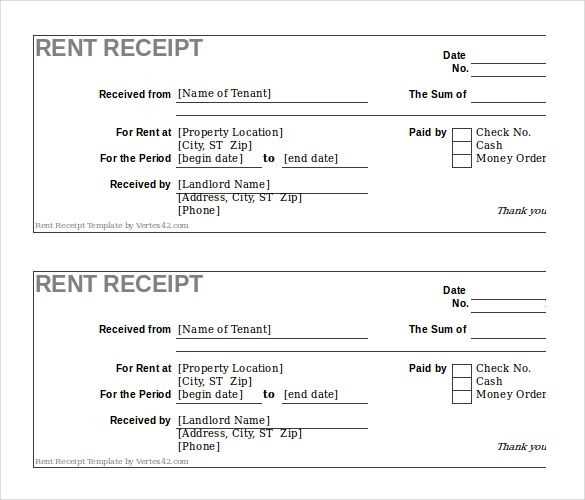

Customize the receipt template with basic details such as the tenant’s name, address, rental period, and the amount paid. It’s also useful to include the payment method, whether it’s cash, check, or electronic transfer. Having these details on hand provides clarity in case of disputes or for tax purposes.

By using a free receipt template, you ensure consistency and accuracy with each payment. This helps create trust with your tenants and provides both parties with a straightforward reference for future correspondence.

Here are the corrected lines with minimized repetition:

For landlords looking to create a simple, clear receipt for rental payments, it’s important to focus on essential details only. Start by specifying the tenant’s name, property address, and payment date.

Receipt Layout and Format

Clearly list the rental amount and any additional charges separately. Avoid repeating payment amounts or due dates unnecessarily. Ensure there is space for the tenant’s signature, confirming receipt of payment.

Specific Terms to Include

Highlight the payment method used (cash, bank transfer, etc.), and if applicable, any balance carried forward. Keep the language direct and straightforward, avoiding extra verbiage or redundant clauses.

- Free Receipt Template for Landlords

For landlords looking for a simple way to manage rental payments, a free receipt template can save time and provide clarity. The template should include specific details to ensure both parties have accurate records of transactions. Here’s what a good receipt should contain:

- Tenant’s Name – Identify who made the payment.

- Amount Paid – Clearly state the amount received.

- Payment Date – Mention the exact date of the payment.

- Payment Method – Specify whether it was cash, check, or online transfer.

- Rental Period – Indicate which months the payment covers.

- Landlord’s Information – Include the landlord’s name and contact details for transparency.

- Signature – Either the tenant or the landlord should sign for confirmation.

Having this information will protect both the landlord and tenant, helping avoid any future disputes. You can easily find customizable templates online, allowing you to fill in the details quickly each time a payment is made. These templates are especially useful for landlords managing multiple tenants or handling payments manually. Using a template makes your financial records organized and easily accessible.

Customize your rental payment template by adding essential details that match your rental agreement. Begin with the tenant’s name and the property address, making sure the details are clear and accurate. Add a field for the payment amount due, the due date, and the payment method (bank transfer, check, or online platform). Including a section for any late fees or penalties will ensure that tenants are informed about potential charges for delayed payments.

Payment History and Rent Breakdown

Include a table that outlines the rent breakdown, such as the base rent, utilities, and any additional charges (maintenance, parking, etc.). This transparency helps tenants understand what they are paying for. Add a column for the date of payment and the status (paid, pending, overdue) to track payments effectively. This allows you to spot any missed payments or disputes quickly.

Tenant Acknowledgment and Signature

Always provide space for the tenant’s acknowledgment and signature. This ensures that both parties agree on the payment terms and conditions. It also adds a layer of professionalism and accountability to the rental agreement process.

Start with the date of the transaction. It’s crucial to provide an accurate record for both you and the tenant. Include the payment amount, the method used (cash, bank transfer, etc.), and any additional fees, such as late charges or cleaning fees, if applicable.

Tenant Details

Include the tenant’s full name and address, which helps in identifying the tenant and linking the payment to the correct individual. This prevents any confusion for future reference.

Property Information

Clearly state the address of the rental property. This will ensure there’s no ambiguity about which property the payment is related to, especially if you manage multiple units.

Finally, don’t forget to include your contact details as the landlord. This provides a clear communication line in case of any follow-up or disputes. Keep it simple and accurate to avoid complications later on.

Several free online platforms offer quick and easy rental receipt creation. These tools help you avoid mistakes and save time. Here are some of the best options available:

- Receipt Generator – This tool allows landlords to create rental receipts with customizable fields such as tenant information, payment date, and amount. It also lets you download receipts in PDF format for easy distribution.

- Zoho Invoice – A free version of Zoho Invoice lets you create professional receipts. You can adjust the template to match your preferences and include specific rental details. The platform offers export options for PDF or email delivery.

- Rentec Direct – Rentec Direct offers free receipt creation tools for landlords managing multiple properties. The platform allows automatic rental receipt generation, including detailed payment breakdowns.

- Wave – Wave’s free invoicing tool is perfect for creating rental receipts with all necessary fields, like payment amounts, due dates, and tenant details. It offers a simple interface and integrates with accounting systems for smooth management.

- Invoice Simple – This straightforward tool helps create rental receipts without complexity. You can easily input necessary data and customize templates with the free version.

These tools streamline the process, making it easy to generate clear and accurate receipts for your tenants.

Always issue receipts for any rent payment. Record the date, the amount paid, and the payment method. This guarantees transparency for both you and your tenant. Use a secure, easy-to-access format, such as a PDF or digital receipt that includes your contact information, the tenant’s name, and the rental property address.

Protect personal data: Avoid including sensitive information, like your bank account details, in the receipt. Stick to necessary payment details to prevent unauthorized access. If you’re using an online payment platform, rely on their built-in receipt system to ensure security.

Store receipts carefully: Keep both digital and physical copies in a secure place. Consider using encrypted cloud storage for digital receipts, and file paper copies in a locked cabinet. This ensures you have proof of transactions available when needed.

Set clear guidelines: Inform tenants about how you will issue receipts and when they can expect them. This builds trust and encourages timely payments.

Landlords must comply with specific receipt regulations depending on their jurisdiction. In some regions, receipts must include particular details such as tenant information, rent amount, date, and property address. Make sure to include all mandatory elements to avoid legal complications.

For instance, in the UK, landlords are required to provide a receipt upon request, particularly for rent payments. The receipt must detail the amount paid, the payment method, and the date of transaction. Failure to provide a receipt when requested could result in penalties or disputes.

In the United States, requirements vary by state. Some states mandate that landlords provide a written receipt for cash payments, while others may not require receipts for electronic or check payments. Be sure to research your state’s regulations and adapt your receipt format accordingly.

In Australia, landlords must issue receipts for all rent payments if requested by the tenant. The receipt should include the payment date, amount, and the period covered. Additionally, receipts must be signed or otherwise authenticated to ensure their validity.

It is crucial to check local laws in your area to ensure that your receipt practices meet legal standards and protect both you and your tenants.

To track payments efficiently, include key details in your template such as the tenant’s name, payment amount, date of payment, and payment method. This allows you to quickly verify if the payment matches the agreed terms. Use a simple table format to organize this data, with columns dedicated to each piece of information. Each entry should include a unique identifier, like a receipt number, for easy reference. Include a section for notes, which can be useful for documenting any late fees or partial payments.

Update the template regularly to ensure it reflects the most recent transactions. It’s helpful to set reminders to check payments monthly, matching your records against the bank account statements. This keeps your payment tracking system accurate and minimizes the chances of overlooking any payments.

Using color-coding for different payment statuses (e.g., paid, pending, overdue) can simplify identifying issues at a glance. By staying consistent in recording payments and using this template, you’ll maintain a clear, organized overview of your rental transactions.

When creating a receipt template for landlords, clarity is key. The document should be clear, concise, and provide all necessary details about the transaction.

Here’s an example template layout:

| Field | Description |

|---|---|

| Tenant’s Name | Include the full name of the tenant who made the payment. |

| Amount Paid | State the exact amount of rent or any other payment made by the tenant. |

| Payment Method | Specify whether the payment was made by cash, check, or bank transfer. |

| Payment Date | Record the date the payment was received. |

| Landlord’s Name | Include the name of the landlord or property manager. |

| Property Address | Clearly list the address of the rental property. |

| Receipt Number | Assign a unique receipt number for better tracking and reference. |

Ensure the template is easy to edit and adjust based on payment types or other special circumstances. This format helps both the landlord and tenant stay organized.