Creating a payment receipt for services rendered is a straightforward process, but it must be clear, accurate, and professionally formatted. To streamline this, use a template that covers all the necessary information, from the service description to the payment method. This ensures transparency for both parties and helps maintain proper financial records.

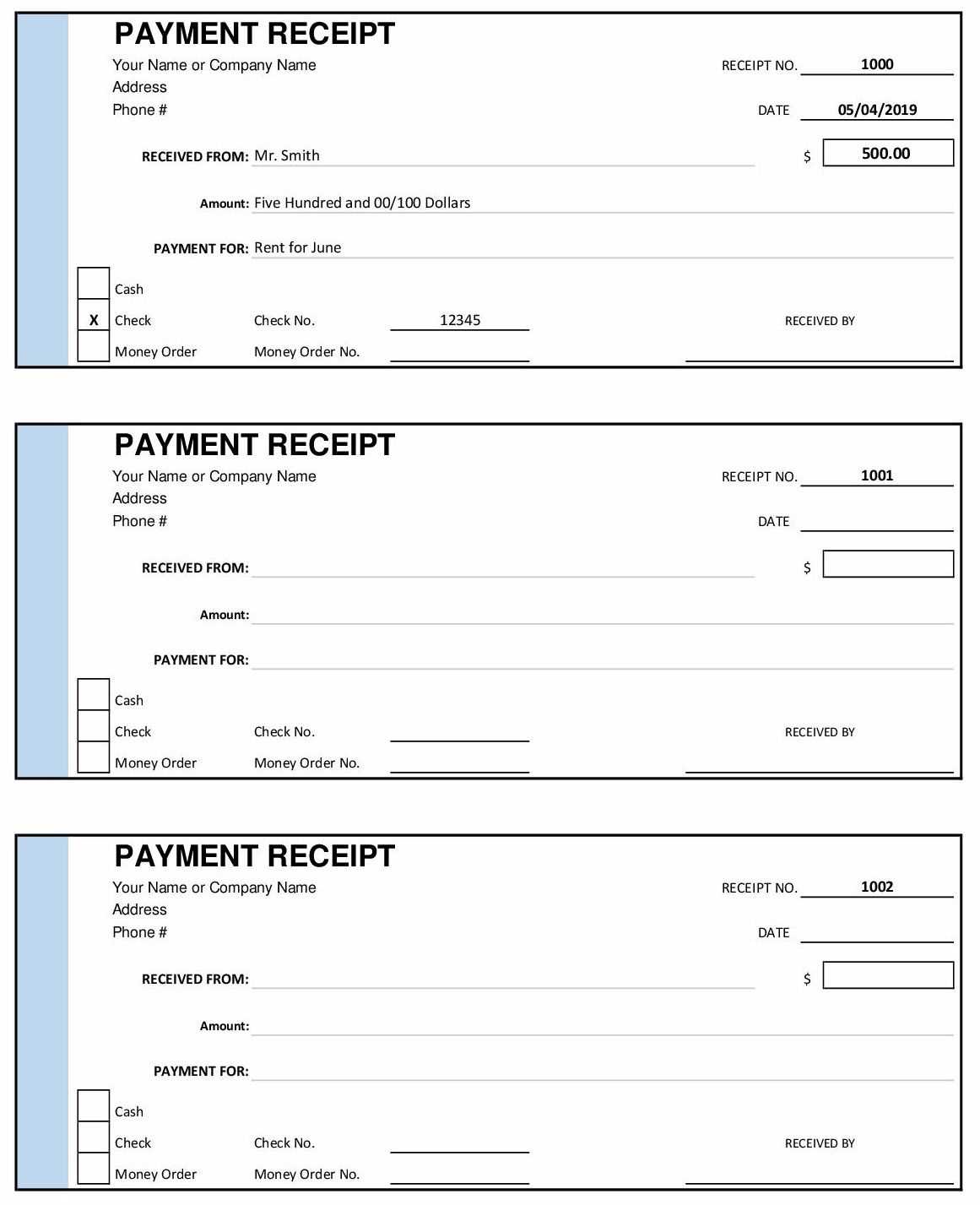

A good template should include key details like the service provider’s contact information, the client’s name, a breakdown of services provided, the payment amount, and the date of payment. Additionally, always include a unique receipt number for easy reference. Customizing your template with these essentials will make invoicing simpler and more efficient.

It’s also important to specify payment terms–whether it’s a full payment, a deposit, or an installment. If taxes apply, include those as well. Make sure the document is formatted in a way that’s easy to read and understand. A receipt that’s organized and well-structured gives both you and your client a record that can be referred back to without confusion.

Here’s the revised version without repetition:

To create a clear and professional payment receipt for services rendered, use the following structure:

1. Receipt Header

Include your business name, address, and contact information at the top. This ensures the receipt is linked directly to your services.

2. Customer Information

Provide the client’s name, address, and contact details to avoid confusion and confirm the transaction’s legitimacy.

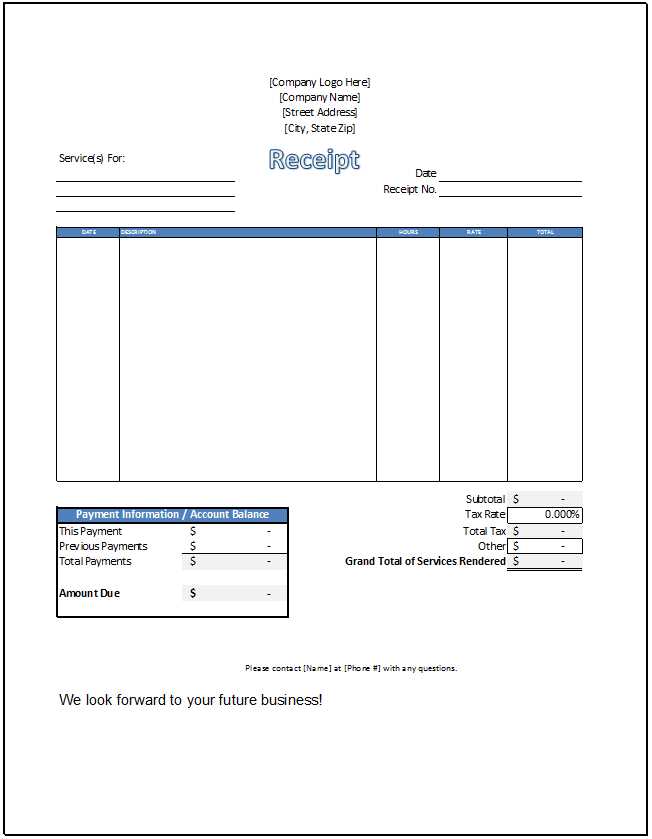

3. Description of Services

List each service provided, detailing the scope, duration, and any agreed-upon conditions. This helps prevent misunderstandings about the work completed.

4. Payment Breakdown

Clearly state the amount for each service and any taxes or additional fees applied. Include the total amount due and the payment method used.

5. Payment Date and Due Date

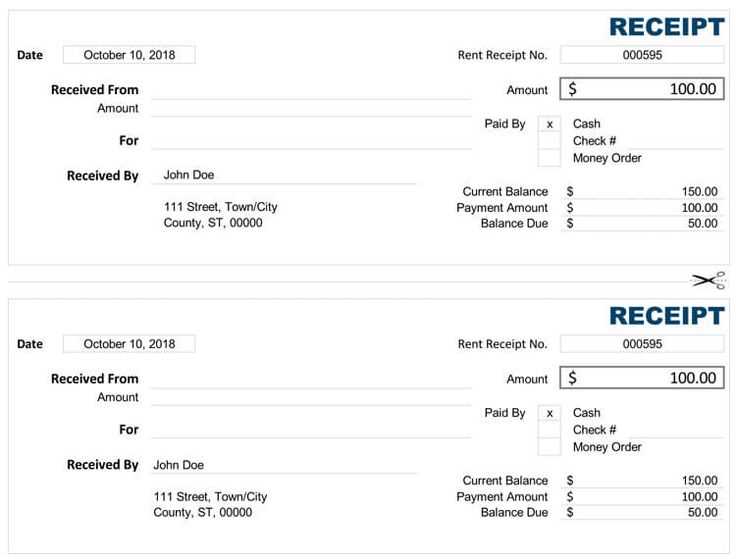

Always include the date the payment was made, along with any due date for pending payments. This helps keep track of financial timelines.

6. Signature Line

A space for both the client’s and provider’s signatures can be added to formalize the transaction, ensuring both parties agree to the terms.

By following this template, you avoid confusion and maintain transparency in every transaction.

- Payment Receipts for Services Rendered Template

When creating a payment receipt for services rendered, ensure that it contains the key elements to confirm the transaction. A well-structured receipt reduces misunderstandings and provides clarity to both the service provider and the client.

Key Information to Include

Start with the receipt header. Include your company name, address, and contact details, followed by the date of payment. Include both the client’s name and their contact information. Specify the services provided and the agreed price for each service. Clear itemization helps avoid disputes.

Sample Template

| Field | Details |

|---|---|

| Receipt Number | Unique reference number for the receipt |

| Company Name | Your business or company name |

| Client’s Name | Client’s full name or business name |

| Service Description | Detailed description of the services provided |

| Amount Paid | The total payment amount |

| Payment Method | How the payment was made (e.g., credit card, bank transfer, cash) |

| Payment Date | Date when the payment was received |

| Receipt Issuer’s Signature | Your signature or company representative’s signature |

Using a clear and simple format like this will ensure both parties are aligned on the details of the payment transaction. Customize the template as needed, adding extra details or payment terms specific to your business needs.

Begin by including key details like your business name, address, and contact information at the top. This helps the client easily identify your company. Next, list the client’s details, including their name, address, and contact info, if necessary.

Details of the Service

Clearly describe the service provided. Include specifics such as the type of service, the date it was rendered, and any additional terms agreed upon. This section is crucial for both parties to understand exactly what was provided.

Financial Information

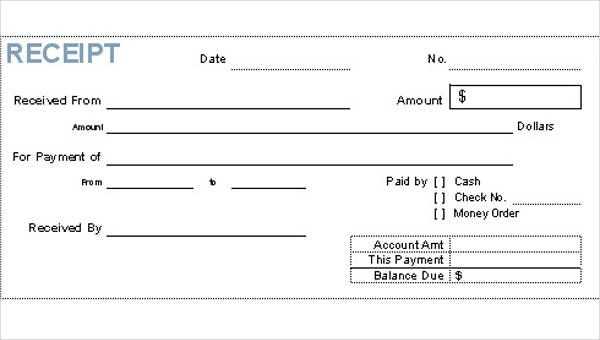

Include the amount charged for the service, any applicable taxes, and the total amount due. If partial payments were made, note the amount paid and the balance remaining. Be sure to include the payment method, whether it was cash, check, or card.

Receipt Number and Date

Assign a unique receipt number for easy tracking and reference. Include the date the receipt is issued, which may differ from the service date.

- Business Name and Contact Information

- Client’s Name and Contact Information

- Description of Services Rendered

- Cost Breakdown (Service Fee, Taxes, Total)

- Payment Method

- Receipt Number

- Date of Issue

Make sure to include these key details in every service payment receipt for clarity and legal compliance:

1. Service Provider Information

Include your name, business name, and contact details (address, phone number, and email). This ensures the recipient knows exactly who provided the service.

2. Client Information

Clearly list the client’s name, address, and contact information. This prevents confusion if the receipt needs to be referenced later.

3. Description of Services

Provide a concise description of the services provided, including quantities, rates, and any special terms or conditions that apply.

4. Date of Service and Payment

Clearly state the date when the service was rendered and the date payment was received. This helps with tracking payments and avoiding misunderstandings.

5. Amount Paid

Indicate the exact amount received for the service, including any applicable taxes, fees, or discounts. Be transparent about how the total was calculated.

6. Payment Method

Specify how the payment was made–whether by cash, credit card, bank transfer, or another method. This serves as proof of payment.

7. Receipt Number

Assign a unique receipt number for reference. This simplifies record-keeping and helps both parties track the transaction.

8. Signature (Optional)

Although not always necessary, including a signature from the service provider adds an extra layer of authenticity to the receipt.

Pick a receipt format that suits your business and your customers’ needs. A clear, well-structured format ensures both parties have all the necessary details. Choose between paper receipts or digital ones based on your workflow and customer preferences. Digital receipts are convenient and eco-friendly, while paper receipts can be more suitable for in-person transactions.

Paper Receipts

Paper receipts should include key details such as the business name, contact information, date of service, list of items or services, total amount, and a unique receipt number. A simple, readable design prevents confusion and helps in keeping records organized. Choose a size and layout that fits well within your business environment, such as A4 or small thermal paper rolls for quick printing.

Digital Receipts

For digital receipts, a PDF or email format is common. Ensure the receipt is easy to read on various devices. Include the same details as a paper receipt and consider adding links to customer support or return policies for a smoother experience. You can automate the process using invoicing software, which ensures consistency and saves time.

Ensure the layout is simple and easy to read. Use a clear, organized structure with distinct sections for transaction details, such as the date, service description, amount, and payment method.

Prioritize Key Information

Highlight the most important details like the service name, date, and total amount paid. Use bold text for key items to draw attention and ensure clarity.

Incorporate Your Brand

Add your company’s logo, colors, and contact details to make the receipt align with your brand identity. This gives a professional touch while ensuring the receipt is easily recognizable by customers.

Use consistent font styles and sizes to maintain a uniform and polished appearance. Avoid cluttering the receipt with unnecessary graphics or excessive information.

Always include a unique reference or invoice number. This helps both you and your customer easily track the transaction in the future.

Ensure the receipt is adaptable to various devices, especially if it’s being sent digitally. It should be clear and legible whether printed or viewed on a mobile device.

Provide a clear call-to-action for customer feedback, if applicable. This invites engagement without overwhelming the document.

Double-check the date, service description, and payment details before finalizing the receipt. Make sure the service provided matches the description on the receipt, and that the amount charged is correct. Cross-reference the payment method, whether it’s cash, card, or another form, with the recorded transaction. Pay attention to any discounts or taxes applied and ensure they are calculated accurately. Double-check your business name, contact information, and tax identification number to avoid any mistakes in official documents.

Consistency is key–use a clear, standardized template that you fill in each time. This minimizes human error and helps keep information uniform across all receipts. If a mistake is made, correct it promptly and clearly, issuing a revised receipt if necessary.

Ensure that all receipts include clear and accurate details. This includes the service provided, the total amount paid, the date of the transaction, and the name and contact information of both parties involved. Any discrepancies in these details can lead to misunderstandings or legal disputes down the line.

Keep in mind that a receipt may serve as proof of transaction for tax and financial purposes. Depending on the jurisdiction, you may be legally required to retain records of transactions for a specific number of years. Failing to comply with these requirements can result in penalties.

Be aware of the local laws regarding electronic versus paper receipts. Some regions may require specific formats or conditions for receipts issued electronically. Always check if your method of issuing receipts aligns with local regulatory requirements.

Clarify refund or cancellation policies directly on the receipt. This will help both parties understand their rights and obligations in case of a service dispute.

Finally, avoid issuing receipts for services that were not performed or that did not involve an actual exchange of goods or services. This could be considered fraudulent activity and lead to significant legal consequences.

Key Elements for Payment Receipts Template

Focus on these key components when designing a payment receipt template:

- Receipt Header: Include the company name, address, and contact information. Make sure it’s clear that this is a payment receipt.

- Payment Details: List the payment amount, the date it was received, and the payment method. Specify if it’s cash, credit card, or another method.

- Service Description: Provide a brief description of the services rendered. Include the date of service and any relevant identifiers like invoice numbers.

- Recipient Information: Add the name and contact details of the person or company receiving the service. This makes the receipt personalized.

- Authorized Signatures: Include a space for signatures to validate the transaction and confirm payment acknowledgment.

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference in future interactions.

Ensure the template is clear and professional, making it easy for both the service provider and the client to review the transaction details quickly.