Using a proper in-kind receipt template is crucial for both businesses and individuals involved in charitable donations or transactions. It helps ensure that the transaction is documented accurately for legal purposes, providing both parties with clear evidence of the items or services exchanged. The template serves as proof for tax purposes and can be used in case of audits or disputes.

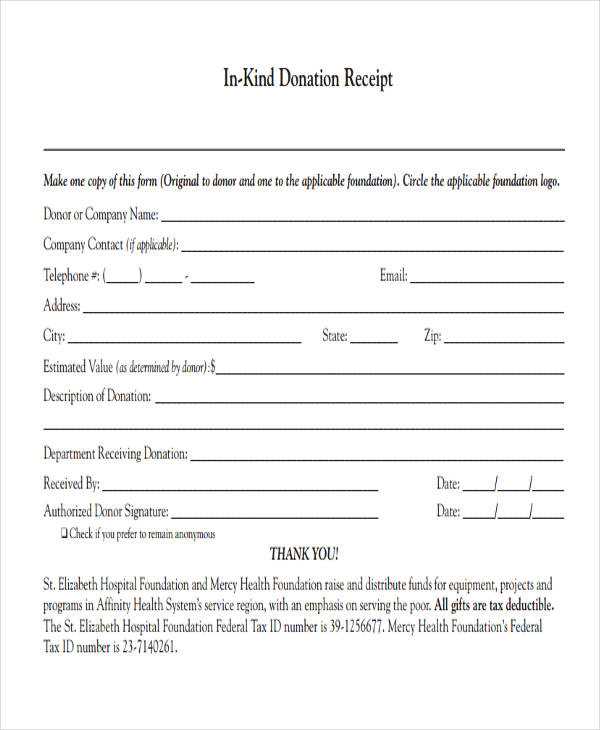

To create an effective in-kind receipt, include specific details such as the description of the donated goods or services, their fair market value, and the date of the transaction. The receipt should clearly state that no goods or services were exchanged for the donation to comply with tax laws. Make sure that both the donor and the recipient sign the document, as this will validate the transaction.

When preparing the in-kind receipt template, make sure it complies with local tax regulations. Some jurisdictions may require additional information, such as the tax-exempt status of the recipient organization or a statement indicating whether any goods or services were provided in exchange for the donation. This will help prevent any issues during tax filing or legal reviews.

Here’s the revised version without repetition, maintaining the meaning:

Ensure that the document clearly identifies the goods or services received in exchange for the transfer. Specify the quantity, description, and value of items, if applicable. Mention the date of receipt and the method by which the goods or services were delivered. Include a statement confirming that no payment was made, or if it was, explain the amount and nature of the transaction. Be precise with the terms of agreement, especially regarding any legal obligations tied to the transaction. The signature section should include space for both parties to sign and date the document for verification.

Additionally, the template should allow for flexibility in case of disputes. It should clarify the procedure for resolving disagreements, specifying whether mediation or arbitration is required. Avoid unnecessary legal jargon to ensure that both parties can easily understand the terms. The document should also state that the receipt serves as a legally binding confirmation of the transaction, preventing any misunderstandings about the nature of the exchange.

- In-Kind Receipt Template Legal

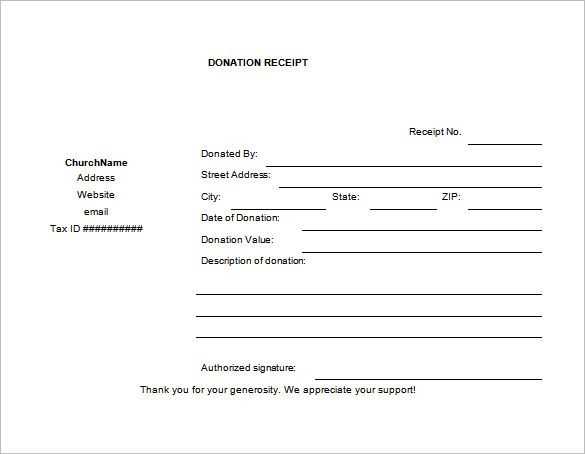

To create a legally sound in-kind receipt template, ensure it includes all necessary components to meet legal and tax reporting requirements. The template should clearly identify the donor, the nonprofit organization receiving the donation, and describe the donated items or services accurately.

Key Elements of an In-Kind Receipt

Each in-kind receipt must specify the following details:

- Donor’s full name or business name

- Donor’s contact information

- Description of the donated goods or services (with sufficient detail for tax purposes)

- Fair market value (FMV) of the donation, if applicable (note: the organization cannot appraise the donation’s value, but can provide a description)

- Date of donation

- Signature of a representative of the nonprofit or receiving organization

Guidelines for Legal Compliance

Ensure that the in-kind receipt does not include language that implies any guarantee or assurance of the fair market value. The IRS requires the donor to independently determine the FMV for tax deductions. The receipt must not be used to influence or determine the amount of the donor’s deduction. Be sure that the language is clear and neutral.

If the donation is valued at over $500, additional reporting may be necessary, and the donor should file IRS Form 8283, which also requires signatures from both the donor and the organization. For donations over $5,000, an independent appraisal may be required for tax purposes.

In-kind contributions refer to non-monetary donations provided to a campaign, organization, or cause. These can include goods or services that hold a value equivalent to a cash donation. It’s important to recognize that these contributions must meet specific legal standards, as defined by the Federal Election Commission (FEC) in the United States and other regulatory bodies worldwide.

What Qualifies as an In-Kind Contribution?

In-kind contributions may consist of tangible items, such as office supplies, or intangible services, like consulting or marketing. For a contribution to be classified as “in-kind,” it must have a measurable value and be directly beneficial to the recipient. For instance, donating office space or professional services, such as graphic design, counts as an in-kind donation.

Legal Requirements and Reporting

The recipient of an in-kind contribution must report its value accurately, similar to monetary donations. The FEC requires that campaigns disclose these contributions to maintain transparency. It’s essential to document both the fair market value of the donation and the details of the service or goods provided. Failing to report or misrepresenting the value of in-kind donations can lead to legal penalties.

To create a legally binding in-kind receipt, clearly outline the item being donated or exchanged, along with its fair market value. Begin with a heading that specifies it is an “In-Kind Receipt” to avoid confusion with other types of documentation.

1. Identify the Parties Involved

Start by including the names, addresses, and contact details of both the donor and the recipient. Specify the date the donation was made. This ensures that both parties can be easily identified and that the document has a clear time frame.

2. Describe the Donated Item

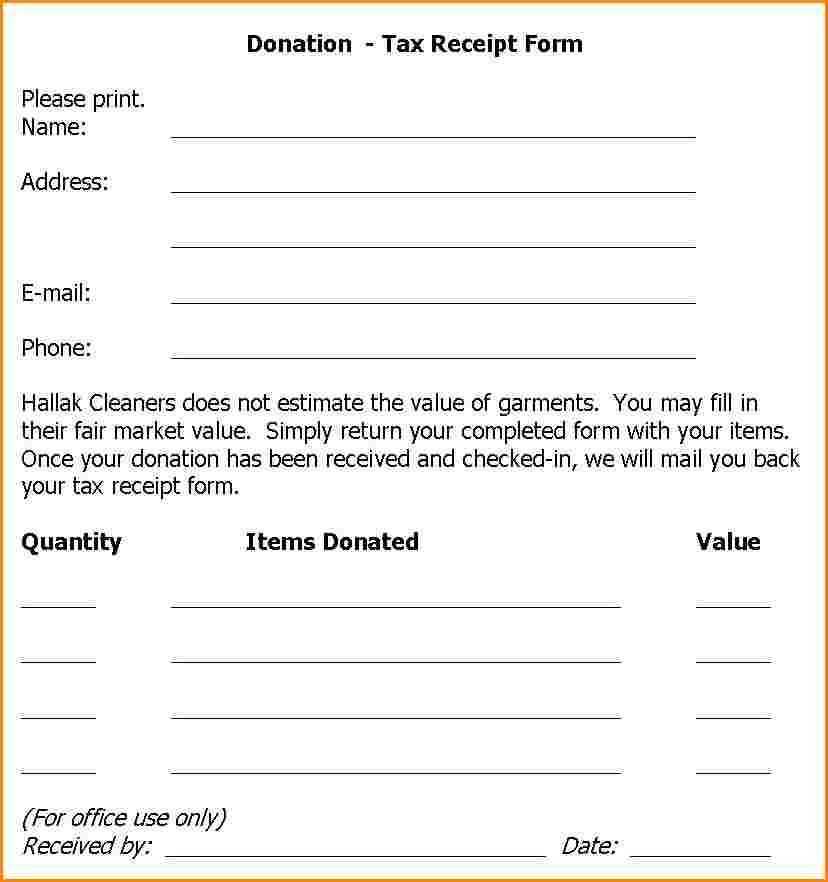

Provide a detailed description of the item or service being donated, including quantities, brand names, models, or serial numbers. Be as specific as possible to avoid future disputes about what was provided.

3. Include the Fair Market Value

Indicate the fair market value of the donation. This can be determined by checking current market prices or using industry standards. It’s important to note that this is for tax purposes, so it should be accurate. If the value is difficult to assess, both parties can agree on a reasonable estimate.

4. State the Purpose of the Donation

Clarify the purpose or intended use of the donation, especially if it is for charitable purposes or in exchange for services. This helps set expectations for both parties and ensures there is no misunderstanding about the nature of the transaction.

5. Confirm No Goods or Services Were Provided in Exchange

Make it clear that the donation is made voluntarily and without expectation of anything in return, unless there is a formal arrangement for goods or services to be exchanged. This protects the legal standing of the receipt as a donation rather than a business transaction.

6. Signatures of Both Parties

Both the donor and recipient should sign the receipt to acknowledge the terms and agreement. The donor’s signature confirms that they have given the item, and the recipient’s signature affirms their acceptance. Include the printed names and the dates of signing.

7. Retain Copies

Both parties should retain a copy of the receipt for their records. This helps in case of future audits or legal inquiries, providing proof of the transaction.

Make sure the in-kind receipt contains accurate and clear details for both the donor and the recipient. Key elements to include are:

1. Donor’s Information

The name and contact details of the donor should be clearly listed. This allows both parties to confirm the transaction. Include the donor’s full name, address, and phone number or email address.

2. Description of Donated Items

Clearly describe the donated goods or services. Mention the quantity, type, and condition of the items to avoid confusion. For example, “Five boxes of office supplies, including pens, paper, and folders,” is more precise than “office supplies.” Be specific to ensure accurate documentation for tax purposes.

3. Date of Donation

Include the exact date when the donation was made. This helps keep track of donations for both tax reporting and record-keeping purposes.

4. Valuation of Donated Goods

If applicable, provide an estimate of the fair market value of the items. This can be helpful for the donor in claiming deductions. If the recipient does not assign a value, make it clear that the donor is responsible for determining the value.

5. Statement of Non-Receipt of Goods

If the items are donated in kind and not in cash, include a statement confirming that no goods or services were received in return for the donation. This is important for tax exemption purposes.

6. Signature of Recipient

The recipient must sign and date the receipt, confirming that they received the goods. The signature serves as proof of the transaction for both parties.

Ensure all information is accurate and complete to avoid confusion or issues with tax filings. The more detailed the receipt, the easier it will be for both the donor and the recipient to reference or use it for legal or tax purposes.

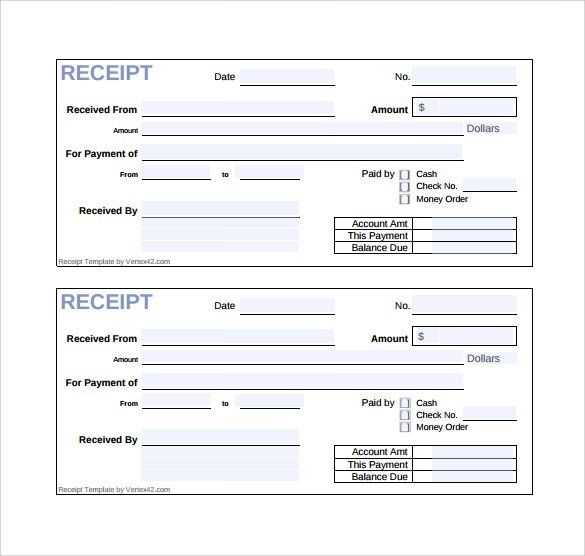

One of the most common errors is failing to include a unique receipt number. Every receipt should have a distinct identifier for record-keeping and to avoid confusion. Without it, tracking payments or resolving disputes becomes difficult.

Another mistake is omitting the date of the transaction. A receipt must clearly show when the exchange took place to ensure accuracy in documentation and avoid potential legal complications.

Incorrectly listing the amount paid is a serious mistake. Double-check that the amount matches the agreed-upon figure and specify whether it is inclusive or exclusive of taxes. Discrepancies can create trust issues and potential legal problems.

Be sure to specify the exact nature of the goods or services provided. Ambiguity in descriptions can lead to misunderstandings. Include clear, detailed descriptions to avoid confusion in case of future disputes.

It’s also important to note the payment method. Whether the payment was made in cash, by credit card, or another method, this should be clearly indicated. Omitting this detail can lead to complications if there are any questions about how the payment was made.

Avoid the mistake of not including contact information. The receipt should list the seller’s business name, address, phone number, or email address. This information makes it easier for the buyer to reach out if there are any questions or issues regarding the transaction.

Finally, check for any spelling or numerical errors. Typos in the name, amount, or other critical details can invalidate a receipt. Always proofread your document to ensure accuracy and professionalism.

| Error | Recommendation |

|---|---|

| Missing receipt number | Include a unique identifier for each receipt |

| Omitting transaction date | Always list the exact date of the transaction |

| Incorrect payment amount | Double-check and specify amounts clearly |

| Unclear item description | Provide detailed and specific descriptions of goods/services |

| Missing payment method | Specify the payment method used |

| Lack of contact information | Include your business contact details |

| Spelling/number errors | Proofread the receipt for accuracy |

When donating in-kind goods, donors and recipients must consider tax implications. Both parties should be aware of specific rules for these types of donations to avoid potential issues during tax filings.

- For Donors:

- Donors can claim a charitable deduction for in-kind donations made to qualified organizations. However, the deduction is typically limited to the fair market value (FMV) of the donated goods at the time of the donation.

- If the value of the in-kind donation exceeds $500, donors must complete IRS Form 8283. Donations above $5,000 require a qualified appraisal to determine FMV.

- Donors must ensure that the donated items are in good condition. The IRS may reject deductions for items that do not meet this standard.

- For Recipients:

- Recipients do not face immediate tax consequences for accepting in-kind donations, but they may need to report the fair market value of the goods on their tax returns if the donation is considered income (for example, if the goods are sold or used in business activities).

- Charitable organizations receiving in-kind donations should provide a receipt detailing the donated items, including a description and, where applicable, the FMV. This is necessary for the donor’s tax deduction.

Both donors and recipients should ensure accurate record-keeping to support the value of donations during tax filing. Failure to follow proper procedures may lead to the loss of deductions or penalties for misreporting. It’s advisable to consult a tax professional to navigate specific circumstances surrounding in-kind donations.

Organizations must carefully navigate the legal aspects of accepting contributions to ensure compliance with applicable laws and regulations. Here are key factors to consider:

- Gift Acceptance Policies: Establish clear policies for accepting contributions, specifying the types of donations your organization will accept and any restrictions on their use. Ensure these policies align with your organization’s mission and legal requirements.

- Documentation and Acknowledgment: Maintain proper records of all donations, including in-kind gifts. Acknowledge contributions in writing to provide transparency and to comply with IRS requirements for tax purposes.

- Valuation of In-Kind Donations: Accurately assess the value of non-cash donations. For tax reporting purposes, donors may need to provide documentation supporting the value of in-kind gifts. Your organization should not provide valuation but should document the details of the donation and inform donors of their responsibility for accurate reporting.

- Tax Implications: Understand the tax consequences for both the organization and the donor. Nonprofit organizations must ensure that contributions qualify for tax-exempt status and comply with any reporting requirements, including filing Form 990 if necessary.

- State and Local Regulations: Check for specific state or local regulations that may govern the acceptance of donations. Some states have additional laws regarding registration, reporting, or receipts that may apply to in-kind gifts.

- Unsolicited Donations: Address how your organization will handle unsolicited donations. Some donations may not align with your organization’s goals or legal obligations, and policies should be in place to manage such instances appropriately.

- Conflict of Interest: Ensure that contributions do not create conflicts of interest. In some cases, donations from individuals or entities with conflicting business interests may raise ethical or legal concerns that need to be addressed.

- Nonprofit Status and Reporting: Maintain transparency in all donation-related processes, particularly if your organization holds tax-exempt status. Ensure that in-kind contributions are appropriately recorded and reported in compliance with both federal and state requirements.

By implementing these measures, organizations can protect themselves legally while maintaining their reputation and supporting their mission effectively.

Ensure the document reflects accurate details of the transaction. Clearly list the item or service received in exchange for the value specified. Include the date of receipt and the party who provided the goods or services. Specify any relevant terms or conditions for the exchange, such as timelines or quality standards that apply.

Use precise language to avoid ambiguity, and avoid generic descriptions. Be clear about the valuation of the goods or services to prevent future disputes. Include a space for signatures of both parties to validate the document. This adds an extra layer of accountability and confirms that both parties agree to the terms outlined.

Keep the format simple and organized. Include headers for key sections like “Description of Items,” “Value,” and “Signatures.” A well-structured template makes it easier for everyone involved to follow the details and reduce the likelihood of mistakes.

Lastly, store this receipt in a secure location. Both parties should retain copies for reference and potential legal purposes. The receipt serves as proof of the transaction and can be used for auditing or resolving future issues.