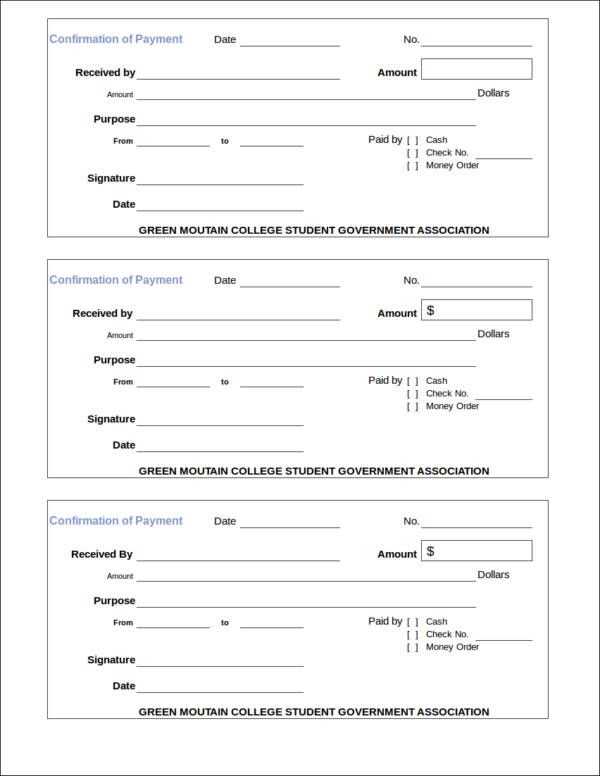

Use a receipts and disbursements template to track both incoming and outgoing funds accurately. This straightforward tool helps organize financial activities, whether for personal or business purposes. By recording each transaction with clear details, you avoid confusion and ensure better financial oversight.

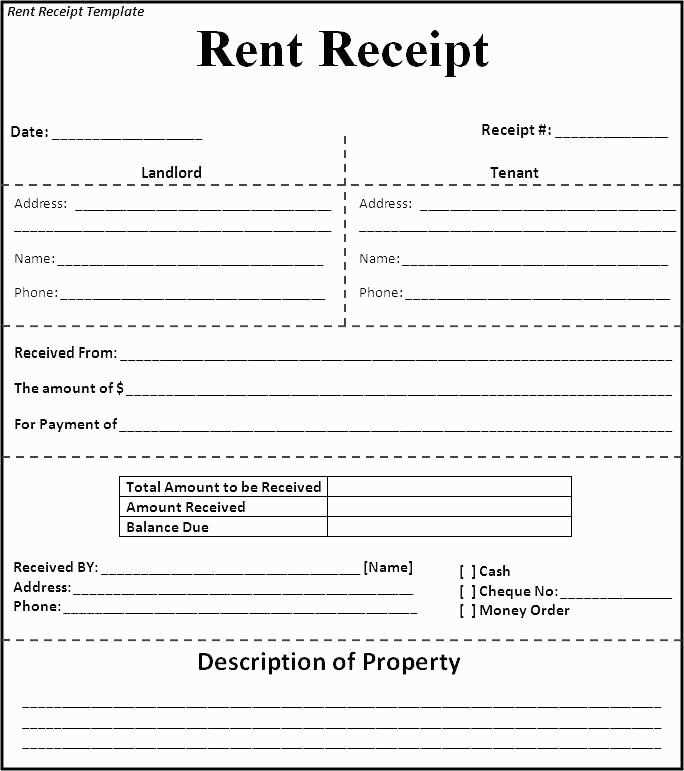

Ensure each entry includes essential components such as the date, description, amount, and category of the transaction. Break down receipts and disbursements into distinct sections to keep track of money inflows and outflows. Consider adding columns for payment method and related notes for further clarity.

For better control, prioritize categorizing transactions based on their nature. Group them into income sources, operating expenses, or one-time payments. This will give you a clearer understanding of where your finances stand and how money moves in and out. Keeping these records updated will provide transparency and support financial planning.

Here are the corrected lines with minimal word repetition:

To improve clarity and reduce redundancy, it’s important to revise phrases that repeat words unnecessarily. Consider simplifying your statements to make them more concise while preserving the message.

For Receipts:

Instead of repeating “Receipt received,” you can shorten it to “Receipt issued” or simply “Issued receipt.” This change removes the redundancy and still communicates the same message efficiently.

For Disbursements:

Avoid saying “Disbursement made for payment” when “Payment disbursement” is clearer and to the point. Using fewer words without losing meaning ensures better readability.

Receipts and Disbursements Template

How to Structure a Template for Small Business Transactions

Tracking Various Categories of Receipts in Your Template

Incorporating Dates and Payment Methods into Your Record

Ensuring Accurate Expense Reporting in Disbursements

Customizing Your Template for Different Transaction Types

Automating Data Entry for Receipts and Payments

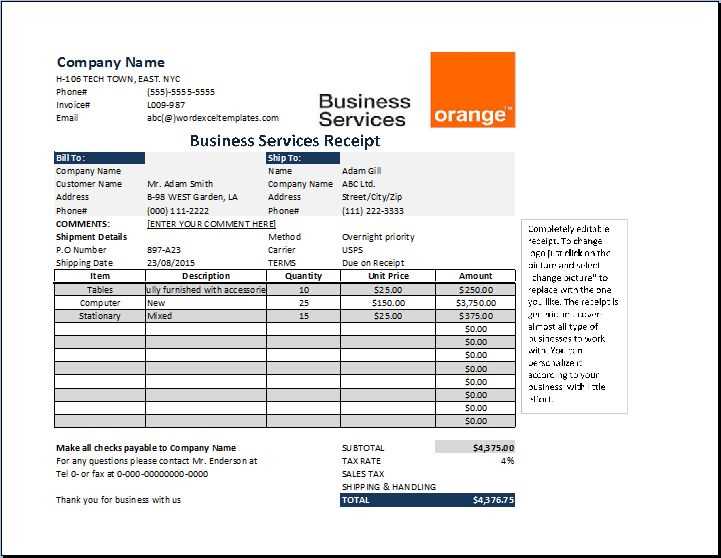

Start by setting up clear categories for both receipts and disbursements in your template. This helps avoid confusion and allows for quick analysis. Use columns or rows for different types of income and expenses, such as sales, refunds, wages, utilities, and equipment purchases. By separating these into defined sections, you’ll have a detailed financial overview at a glance.

Tracking Various Categories of Receipts: Include distinct fields for each category of receipt, such as product sales, service fees, or other income. This way, you can easily sort and analyze specific streams of revenue. Make sure each entry has a clear description, the amount, and any applicable tax information. This level of detail supports transparency in your financial reporting.

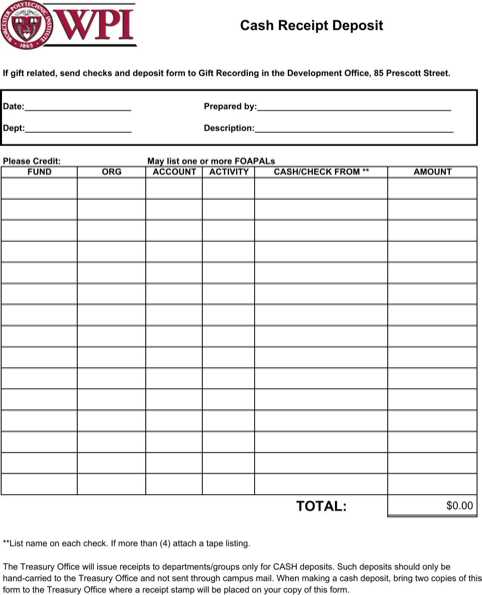

Incorporating Dates and Payment Methods: Dates are crucial for keeping accurate financial records. Add a field for the date of the transaction, and include payment methods like cash, credit, or bank transfer. This helps with tracking cash flow and ensures that transactions are recorded in the correct accounting period. Additionally, noting the payment method provides insights into your cash handling and customer preferences.

Ensuring Accurate Expense Reporting in Disbursements: When tracking disbursements, it’s essential to categorize expenses like payroll, rent, utilities, or vendor payments. Include a column for the payment date, amount, and vendor name. Accurate tracking will enable you to spot trends in your expenses, manage cash flow better, and ensure you’re staying within your budget.

Customizing Your Template for Different Transaction Types: Depending on the nature of your business, you may need to adapt the template for specific transactions. For instance, if you deal with inventory, create columns for product purchases and sales quantities. Similarly, if your business involves multiple departments, tailor the template to track expenses by department. Customization helps make the template more relevant and useful for your specific needs.

Automating Data Entry for Receipts and Payments: Consider automating the process of entering receipts and payments using accounting software or spreadsheet formulas. Set up automated entries for recurring transactions like rent or subscriptions to save time. Automation ensures data consistency and reduces the risk of manual errors, improving the accuracy of your records over time.