Creating a reliable and accurate cash donation receipt is simple with the right template. A well-structured receipt ensures transparency and provides donors with the documentation needed for tax purposes. The template should clearly include essential details like the donor’s name, donation amount, date, and the organization’s name, along with any other relevant information such as the donation purpose or acknowledgment statement.

Ensure your receipt reflects the legal requirements of your country or region. Some jurisdictions may require specific language or the inclusion of a nonprofit’s tax-exempt status number. A well-crafted receipt not only serves as proof of donation but also strengthens your relationship with supporters, showing gratitude and professionalism.

The key to a functional template is simplicity. Use easy-to-read fonts and clean formatting so the information is clearly visible. Keep the layout straightforward and concise, focusing on the critical data while leaving room for personalized messages or thank-you notes. Customize the receipt to your organization’s branding for a polished, professional look that reinforces your mission and commitment to transparency.

Here’s the corrected version with duplicates removed:

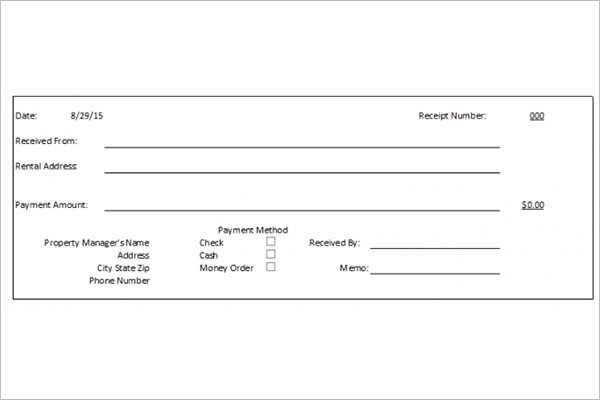

When creating a cash donation receipt template, it’s crucial to keep the structure simple and clear. Ensure all necessary details are included, such as the donor’s name, address, and donation amount. Make sure the date of donation and the name of the receiving organization are clearly stated. If the donation was made in cash, specify that, and if a check was used, include the check number.

Ensure the wording on the receipt complies with legal and tax requirements. Clearly state that the donation is tax-deductible, if applicable, and include the tax ID of the organization for reference. A brief thank-you message or note of appreciation can help maintain a positive relationship with the donor.

Lastly, remember to save a copy of the receipt for your records. This will help streamline any future audits and make record-keeping easier. Make sure your template is designed to accommodate any necessary updates in donation information.

- Cash Donation Receipt Template

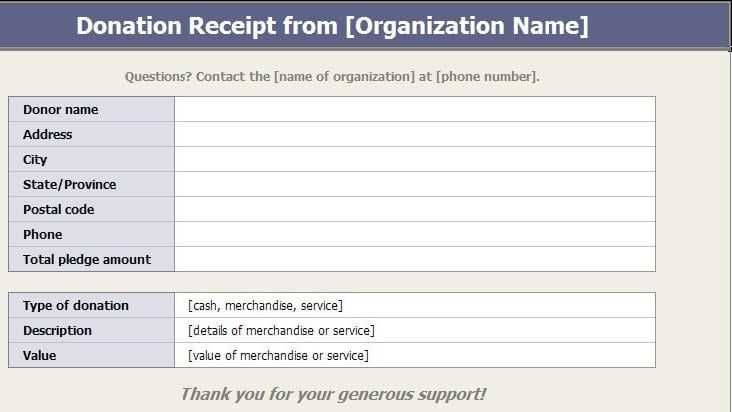

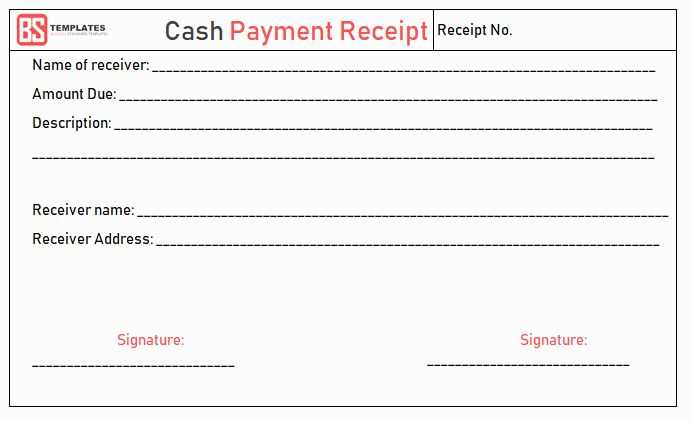

A clear and concise donation receipt ensures proper documentation for tax purposes and record-keeping. Here’s a template to follow when issuing a cash donation receipt:

Template Structure

The receipt should include the following key details:

- Donor Information: Full name, address, and contact details of the person making the donation.

- Organization Information: Name, address, and contact details of the receiving organization.

- Donation Details: The amount donated, the date of donation, and a clear note specifying it was a cash donation.

- Non-Refundable Clause: State that the donation is non-refundable.

- Tax Deductibility Statement: A brief mention that the organization is tax-exempt (if applicable) and the donation is deductible according to tax laws.

- Receipt Number: A unique identifier for internal tracking purposes.

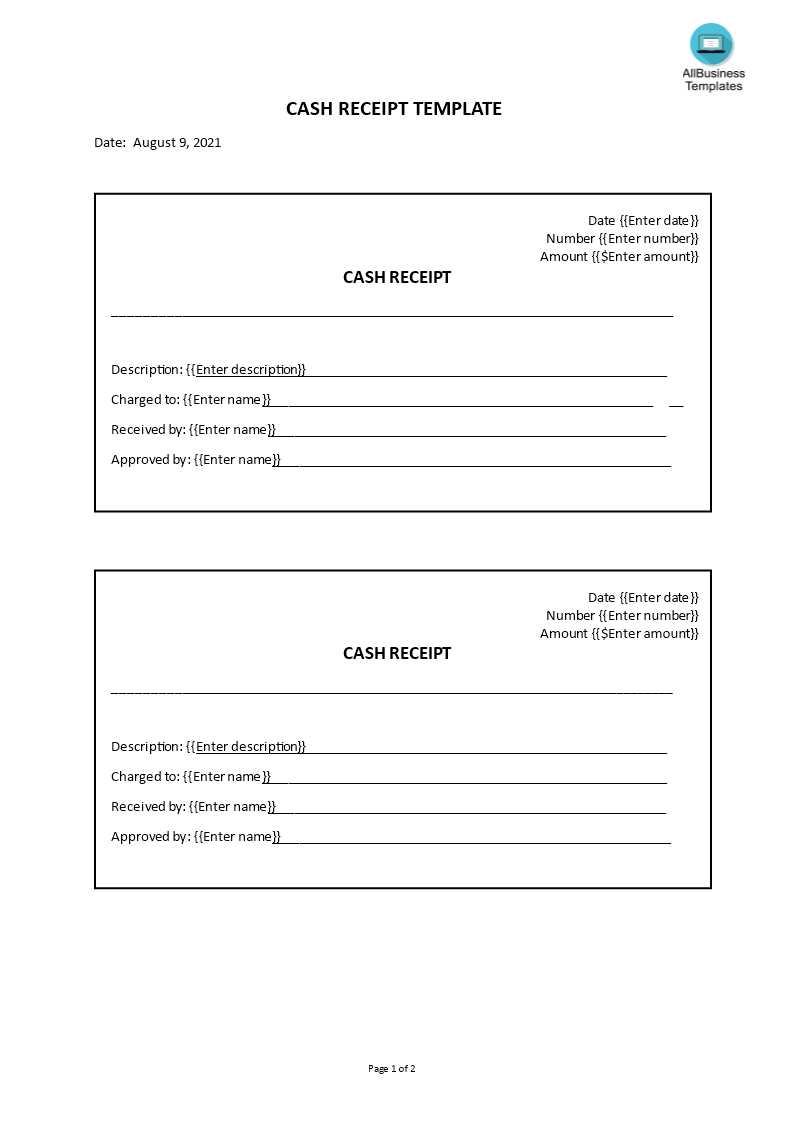

Sample Cash Donation Receipt

Here’s an example to help guide you:

Donation Receipt Date: [Date] Received From: [Donor Name] Address: [Donor Address] Received By: [Organization Name] Address: [Organization Address] Amount Donated: $[Amount] Type of Donation: Cash Receipt Number: [Unique Identifier] This donation is non-refundable and is eligible for tax deductions as allowed by law. [Organization Name] is a tax-exempt organization under Section [specific tax code reference]. Thank you for your generosity. Sincerely, [Organization Representative Name]

Ensure all necessary fields are filled and adjust according to the organization’s specific needs. Keeping the receipt simple and direct makes it easier for both parties to track donations.

Got it! If you have any specific questions about parts or need help finding something related to the Kubota Z422, feel free to ask!

Donation receipts should provide clear and accurate details for tax purposes and donor records. Here’s a list of key information to include in a donation receipt:

- Donor’s Name and Address: Ensure the receipt includes the full name and address of the donor, as this is required for tax reporting.

- Organization’s Name and Address: Clearly list the charity or nonprofit’s name and address, which is also important for tax compliance.

- Date of Donation: The exact date of the donation is necessary for proper record-keeping and for donors to match the receipt to their financial records.

- Donation Amount or Description of Item: Specify the amount for cash donations. For in-kind gifts, provide a brief description of the items donated. If items are donated, you must not assign a value, but indicate that the donor is responsible for valuing the donation.

- Statement of No Goods or Services Provided: If the donation is fully tax-deductible, include a statement confirming that no goods or services were exchanged for the donation. If something was provided, the value should be noted and deducted from the donation’s total amount.

- Tax-Exempt Status Information: Include the nonprofit’s tax-exempt number or IRS identification number to verify that the organization is registered as a 501(c)(3) entity (or similar status) eligible for charitable deductions.

- Receipt Number or Unique Identifier: Assign a unique identifier or receipt number for easy tracking and reference. This will help both the donor and organization maintain organized records.

By including these details, both the donor and the organization will have clear documentation for tax purposes and future reference.

Select a format that fits your organization’s needs and ensures clear communication. For a simple cash donation receipt, a basic text-based template with clear sections (date, donor name, amount, and purpose) is often sufficient. For more formal purposes, a PDF version can offer a polished and professional look, suitable for tax records or large donations. If you’re using an electronic method, ensure the format is compatible with both desktop and mobile devices to allow easy access for the donor.

Consider your audience and the level of detail required. If you need to track donations for tax purposes, make sure the receipt includes specific information like the non-profit’s tax ID number and a statement about the non-deductible value of any goods or services received. An online donation platform might automatically generate these details in a clean, consistent format that reduces the risk of errors.

Lastly, ensure the format allows for easy storage and retrieval. Whether printed or digital, receipts should be organized for quick access, especially during tax season or audits. A consistent, clear format will prevent confusion and simplify record-keeping for both you and your donors.

Adjust the donation receipt template to clearly reflect varying donation amounts. This ensures transparency and keeps the donor informed about their contribution. Customize the format of the receipt based on the amount donated, making it easier for both small and large contributions to stand out appropriately.

- For small donations: Keep the receipt concise and simple. Only include the basic information such as the donor’s name, the amount donated, and the date. Avoid cluttering the receipt with excessive details.

- For larger donations: Add more personalized elements, such as a special thank-you message or an acknowledgment of the donor’s significant contribution. Consider including the donation’s intended use or the impact it will have.

- Tax-exempt donations: If the donation is tax-deductible, make sure to include the donor’s tax identification number, the organization’s tax status, and a statement specifying that no goods or services were provided in exchange for the donation.

By adjusting the level of detail and tone based on the donation size, the template can make each donor feel appreciated, whether they gave a small amount or made a larger commitment. This creates a personalized experience and strengthens the donor’s connection to your cause.

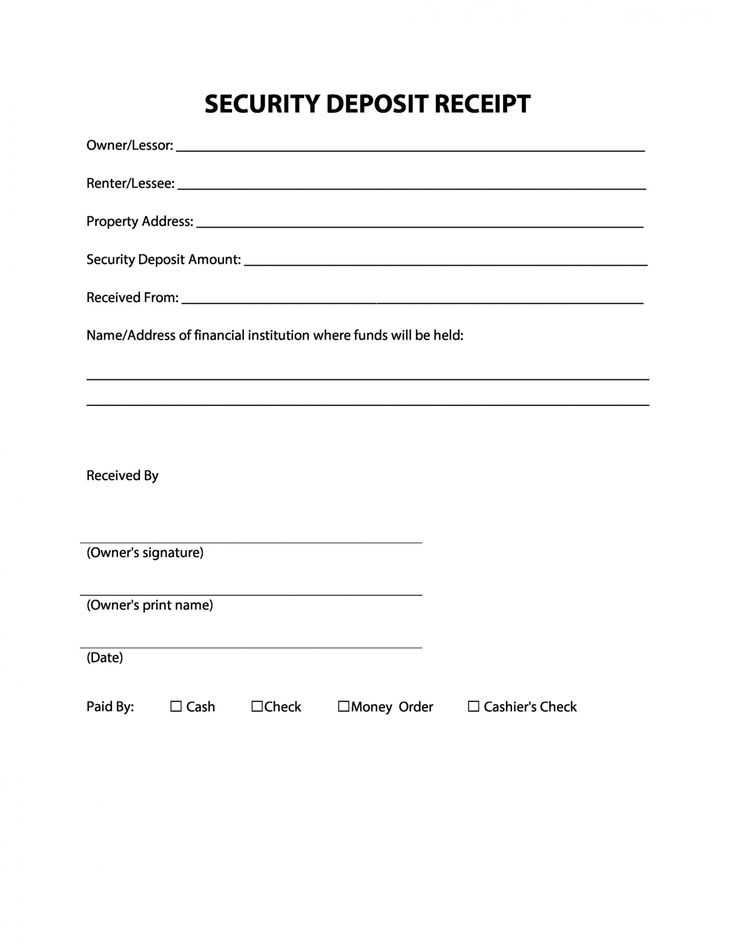

Legal Requirements for Cash Receipts in the U.S.

In the U.S., cash receipts must comply with both federal and state regulations to ensure proper documentation of donations. The IRS mandates that any cash donation over $250 must be accompanied by a written acknowledgment, which serves as proof for the donor’s tax deduction claims. This acknowledgment must include the donor’s name, the date of the donation, and the amount donated. Additionally, organizations must clearly state if any goods or services were provided in exchange for the donation, as this impacts the amount eligible for tax deductions.

To stay compliant, ensure that receipts meet the following criteria:

| Requirement | Description |

|---|---|

| Donor Information | The name and address of the donor must be included on the receipt. |

| Donation Amount | The exact amount of the cash donation must be stated. |

| Nonprofit Details | The name and address of the nonprofit organization should be clearly listed. |

| Exchange of Goods or Services | If goods or services were exchanged, their fair market value should be mentioned. |

| Statement of Tax Deductibility | A statement indicating that no goods or services were provided (if applicable) or the value of what was provided in exchange. |

For donations under $250, while a receipt is not strictly required for tax purposes, it is still good practice to issue one for record-keeping. For larger donations, the written acknowledgment must be provided by the organization no later than January 31 of the year following the donation.

By adhering to these guidelines, organizations can help donors claim deductions while ensuring compliance with IRS regulations.

To efficiently track contributions, begin by clearly defining the necessary fields in the template. Focus on capturing key details such as donor names, donation amounts, and dates. This will help organize the information and avoid confusion later on.

Step 1: Input Basic Information

- Enter the donor’s full name and contact details.

- Specify the date of donation to track when contributions occurred.

- Document the exact amount of the donation for accurate financial records.

Step 2: Include Purpose or Fund Information

- Identify the specific purpose or fund the contribution supports, if applicable.

- Link the donation to a particular cause to ensure clarity in tracking funds.

By consistently updating the template with each donation, you can maintain a clear overview of contributions and their impact. This approach allows for easy access to necessary details whenever needed, making tracking straightforward and transparent.

Meaning is preserved, and repetitions are eliminated.

When creating a cash donation receipt, it’s crucial to keep the information concise while ensuring clarity. The template should capture all necessary details without redundancy. Each field should serve a specific purpose and not repeat information unnecessarily. For instance, avoid stating the amount donated twice or listing redundant contact information for both parties.

Key Information to Include

Each receipt must clearly display the donor’s name, donation amount, and the date of the transaction. It’s also important to provide a description of the donation if applicable, especially if it’s in-kind rather than cash. Including a thank-you note adds a personal touch but doesn’t clutter the main details.

Formatting Tips

Use simple formatting to guide the reader’s eye to the most important details, such as bolding the donation amount and using clear labels for the donor and organization information. Avoid lengthy paragraphs or unnecessary text that doesn’t contribute to the purpose of the receipt.