To streamline your sales process, a well-designed receipt template is key. It ensures all necessary details are captured and easily understood by customers, boosting trust and clarity in every transaction.

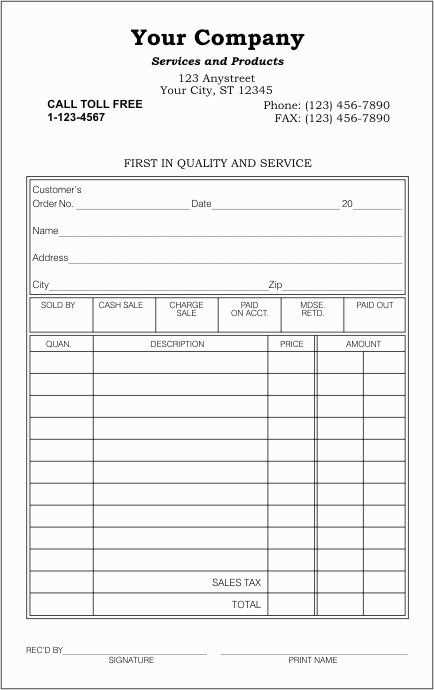

A good template should include the date of purchase, itemized list of products or services, and the total amount. Ensure the customer’s name and contact details are visible, along with payment methods used. This keeps transactions transparent and traceable.

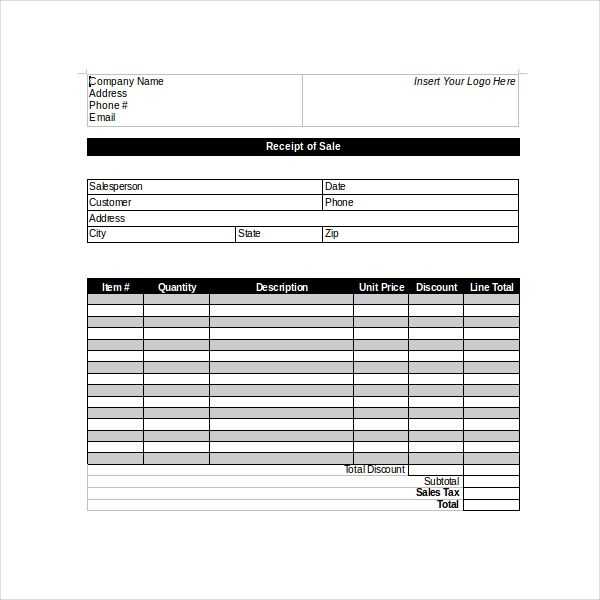

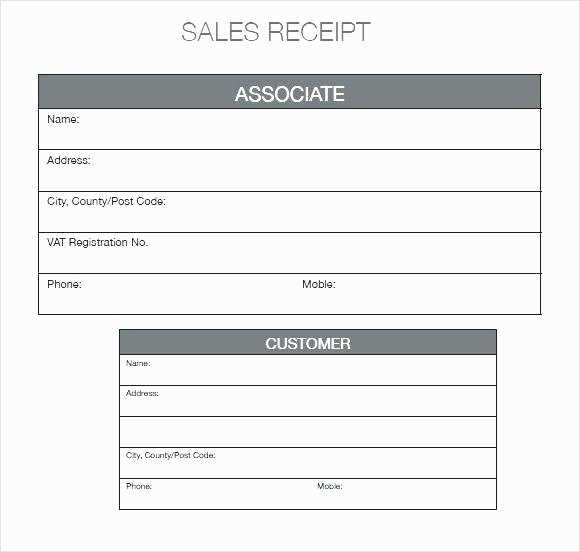

Don’t forget to add your business details–such as name, address, and contact info–at the top. This makes it easy for customers to contact you if needed and reinforces your brand identity.

For convenience, make sure the template is easy to fill out digitally or on paper. Clear section breaks and a clean design will make it user-friendly for both you and your customers.

Here’s the revised version with minimal word repetition:

Optimize your sales receipt template by ensuring that each section is clear and concise. Start with the necessary transaction details like the date, receipt number, and total amount. Avoid including excessive descriptions or redundant information that could clutter the document. Keep the language direct, focusing on the core data of the sale.

Transaction Details

Clearly list items purchased, including their quantities and prices. This will allow customers to review their purchases without confusion. Using bullet points or tables helps present this information in an organized way. Keep the item names brief, using simple terms that customers can easily recognize.

Payment Information

Include the method of payment (e.g., credit card, cash, mobile payment) and the amount paid. This section should be straightforward to avoid ambiguity. Avoid adding irrelevant fields like customer feedback or loyalty points unless they are crucial to the transaction.

- How to Create a Professional Receipt Template

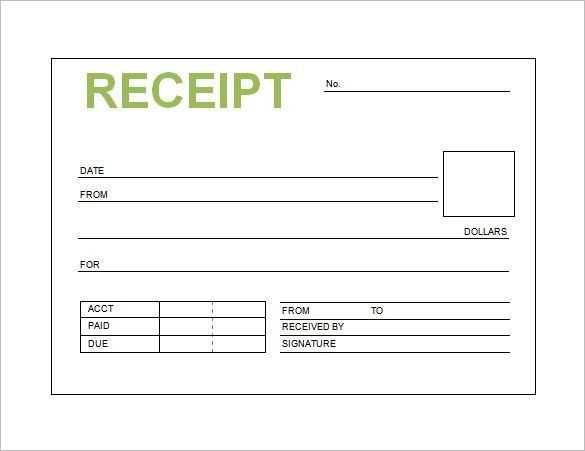

To create a professional receipt template, focus on clarity and simplicity. Begin by ensuring that all relevant details are easily readable. Include the following key sections:

- Business Information: Include the name, address, and contact details of the business issuing the receipt.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Date and Time: Clearly state the date and time of the transaction.

- Items Purchased: List each item or service with its price, quantity, and any applicable taxes or discounts.

- Total Amount: Clearly show the total amount paid, breaking it down by item and tax.

- Payment Method: Indicate whether the payment was made by cash, credit card, or other methods.

- Terms and Conditions: If applicable, include a brief section on return policies or warranties.

Ensure that the font is legible and that spacing between sections is consistent. Avoid clutter by using simple borders and lines to separate different areas of the receipt. Keep the design minimal, focusing on functionality.

Lastly, save your template in a format that is easy to update and distribute, such as PDF or Word. This allows for quick adjustments if necessary while maintaining a professional appearance.

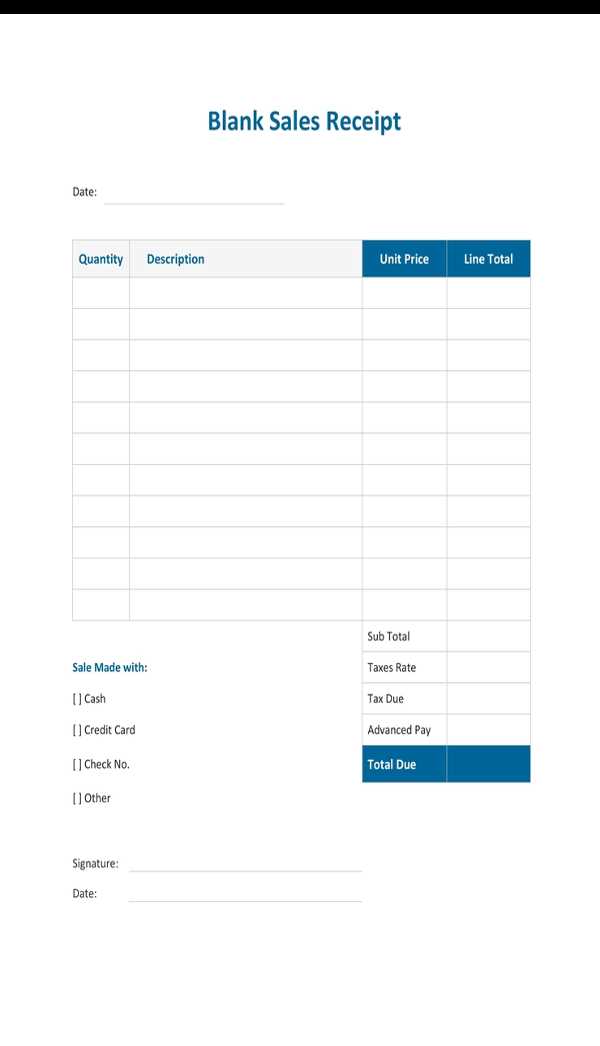

A sales receipt should be clear and easy to read, containing specific details to protect both the buyer and seller. Below are the key elements every sales receipt must include:

- Receipt Number: A unique identifier that helps track the transaction for record-keeping and customer inquiries.

- Date of Sale: The exact date when the transaction took place. This helps with warranties, returns, and financial records.

- Itemized List of Products or Services: Each item sold, including its description, quantity, price, and any applicable discounts or promotions.

- Total Amount: The sum total of the sale, including taxes and fees. This ensures clarity on how much was paid.

- Tax Information: A breakdown of the tax rate and amount charged. This is especially important for legal and business compliance.

- Payment Method: Details about how the payment was made (e.g., credit card, cash, mobile payment). This verifies the transaction method for both parties.

- Business Information: The name, address, and contact details of the business. This provides the customer with the information needed to reach out in case of returns or inquiries.

- Return/Exchange Policy: A short summary or reference to the company’s policy on returns or exchanges. This sets clear expectations for the buyer.

Additional Considerations

- Warranty Information: If applicable, a brief mention of product warranties or guarantees helps the customer understand their rights post-purchase.

- Customer Information (Optional): Some businesses ask for customer information like name or email, especially for loyalty programs or future communication.

To tailor a receipt template to your business, include key details like company name, logo, and contact information. For retail stores, ensure space for itemized purchases, quantities, prices, and taxes. Service-based businesses should prioritize fields for service descriptions, hours, and rates. Restaurants need sections for menu items, special orders, and gratuity details. Adjust the layout and font to maintain clarity and professionalism, while ensuring it’s easy for customers to read.

Incorporate customizable fields like discounts, loyalty program points, or order numbers based on your business’s needs. If you offer refunds, include clear instructions for return policies. For online stores, ensure the receipt includes tracking information or digital download links. Each template should reflect your brand’s style while keeping customer needs in mind. Use a clean, simple design to ensure all information is presented clearly and neatly.

Ensure your receipts include all necessary legal information by consulting local regulations. Some countries require specific details like tax identification numbers, business address, and VAT registration number. Make sure the receipt includes the correct wording for refund policies, guarantees, and any mandatory consumer protection disclaimers. Double-check that the receipt includes clear and accurate dates of purchase, and always include a breakdown of goods or services purchased. This helps not only in legal compliance but also in providing transparency to the customer.

Incorporating a clear and readable font is another simple yet effective way to avoid any legal disputes regarding the receipt’s content. Make sure the text is legible and all figures are easy to read, with no ambiguity in pricing. Also, ensure that the receipt is formatted to prevent manipulation or errors. Some jurisdictions may require that the receipt is printed in a specific way, whether digitally or on paper, to meet local standards.

Integrate payment options seamlessly by offering a simple, intuitive interface. Prioritize widely used methods such as credit cards, PayPal, and digital wallets to reach a broad audience. Keep the payment section clean and free from unnecessary distractions, focusing only on the essential fields and buttons.

Streamline the Checkout Process

Place payment method options clearly visible and easy to select, ideally after customers confirm their order details. Use recognizable icons for each payment method to enhance user confidence and reduce friction during the checkout process.

Security and Trust

Clearly indicate secure payment processing with trusted payment gateways. Use SSL encryption badges and other security symbols to build trust with customers. Show transparency in payment procedures and fees to avoid confusion.

Ensure the receipt template includes accurate details. Misleading or incorrect information, such as wrong amounts or missing data, can cause confusion for both customers and businesses.

Incorrect Formatting

Inconsistent fonts or spacing can make a receipt hard to read. Stick to a uniform layout to avoid errors and improve the overall presentation. Ensure that the most important information, like the total amount, is clear and stands out.

Missing Essential Information

Omitting key elements, such as the business name, date, or tax information, can lead to complications. Always check that the receipt includes everything necessary for both legal compliance and clarity.

| Error | Solution |

|---|---|

| Missing business details | Include business name, address, and contact info. |

| Incorrect tax calculations | Double-check tax rates and amounts. |

| Unclear payment methods | Clearly indicate the method used (cash, card, etc.). |

| Unreadable layout | Maintain consistent font size and clear spacing. |

By avoiding these common mistakes, you can create a reliable and professional receipt template that serves both your business and customers effectively.

To create a receipt sales template, focus on clarity and structure. Begin with a clear header that includes your business name, logo, and contact details. This helps customers identify your brand immediately. Ensure the receipt includes a unique receipt number, which makes tracking transactions easier. For itemized sales, list products or services with clear descriptions, quantities, prices, and total amounts. Add taxes or additional fees in separate lines to avoid confusion.

Next, ensure the total is prominently displayed, including any discounts or refunds applied. It’s crucial to make payment details clear, such as the payment method used, transaction ID, and whether it was paid in full or partially. Also, offer space for the return policy or terms and conditions if applicable. Finish with a polite thank-you message or an invitation for feedback to enhance customer relationships.