If you are submitting childcare expenses through your Flexible Spending Account (FSA), using a clear and accurate nanny receipt template is crucial. A properly structured receipt will ensure quick approval and help avoid unnecessary delays in reimbursement. Keep your receipts organized and ensure all required information is included to meet FSA guidelines.

The receipt should clearly state the caregiver’s name, address, and tax identification number (TIN), as well as the dates and hours worked. Include the total amount paid for services and a brief description of the work performed. Always provide clear, itemized receipts to avoid any confusion during the claims process. The IRS requires documentation that shows the specific service provided, and generic descriptions may lead to rejection of the claim.

Make sure to provide both your contact information and the nanny’s. This transparency will help streamline the process and ensure there are no issues when your submission is reviewed. Using an accurate and complete nanny receipt template is the most efficient way to submit your childcare expenses for reimbursement.

Here is the corrected version:

Include the date of payment and the total amount paid. Clearly specify the hours worked and the rate per hour. Make sure to list both the employee’s name and the employer’s name. Also, ensure that the description includes a brief note on the services provided, such as child care, tutoring, or household assistance. If applicable, mention the payment method and any deductions. Keep the format simple and readable for easy submission to FSA. Lastly, verify the accuracy of all details before submission to avoid delays in reimbursement.

- Nanny Receipt Template for FSA

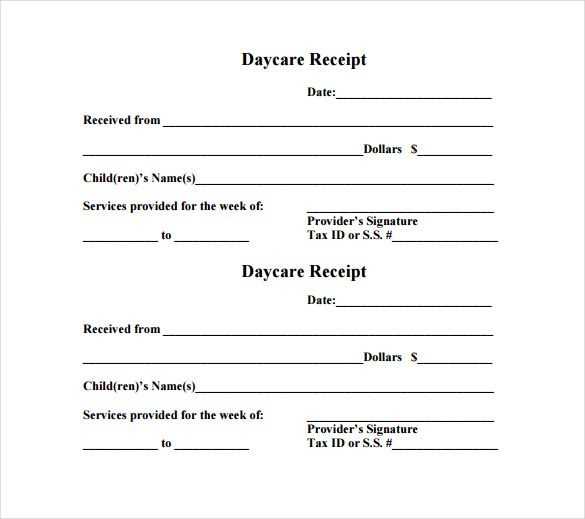

To create a proper nanny receipt for FSA purposes, you must include the following details:

- Provider’s Name: Include the nanny’s full name.

- Provider’s Address: Specify the nanny’s complete address for verification purposes.

- Tax Identification Number (TIN): Mention the nanny’s Social Security Number (SSN) or Employer Identification Number (EIN) for reporting purposes.

- Date of Service: Clearly state the dates the services were provided.

- Service Description: Outline the specific care provided, such as hours worked and any other relevant services.

- Total Amount Paid: Include the exact amount paid for the service during the specified period.

- Signature: Both the nanny and the parent should sign the receipt to confirm the information.

Ensure that the receipt is dated correctly and includes accurate financial details. This template will help you track FSA-eligible expenses and comply with the requirements for reimbursement.

To create a valid nanny receipt for FSA reimbursement, include the following key details:

- Date of Service: The specific dates the nanny provided care.

- Parent or Guardian’s Name: The name of the person paying for the services.

- Caregiver’s Name: The nanny’s full name.

- Description of Services: A brief description of the care provided (e.g., babysitting, nanny services).

- Amount Charged: The total amount the nanny was paid for the service provided. Be clear if it’s for one day or a set of days.

- Signature: A signature from the nanny, confirming the accuracy of the details.

Formatting Tips

- Keep the receipt simple and professional.

- Ensure all the details are clearly legible.

- Use a receipt template or create one manually, making sure to include all required information.

Additional Considerations

- If you are submitting receipts electronically, make sure the file is clear and legible.

- Include your FSA plan’s specific instructions, as some require a detailed breakdown of services.

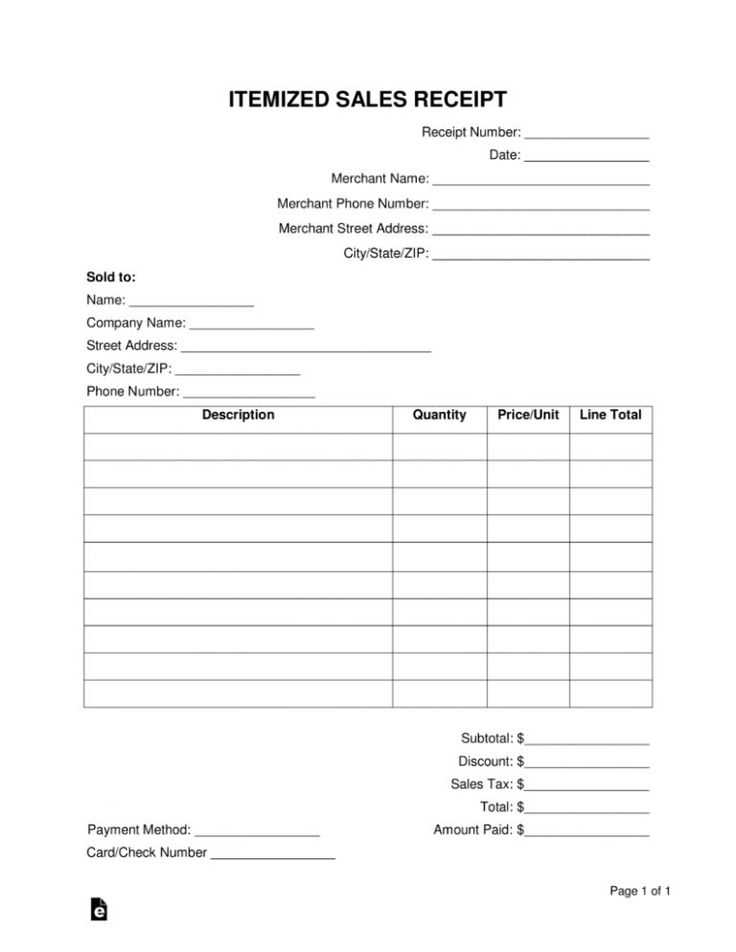

Include the date of service to confirm the specific time period for which reimbursement is being requested.

Clearly state the hourly rate or the flat fee charged by the nanny. This ensures transparency and accuracy when processing reimbursements.

List the total number of hours worked, ensuring it aligns with the agreed schedule. This will help avoid confusion regarding the total amount requested for reimbursement.

Provide a detailed description of the services rendered. This could include specifics such as the child’s name, any special duties, or the location where the childcare was provided.

Include the nanny’s full name and contact information to verify the legitimacy of the service provider.

Make sure to add any applicable taxes or deductions, if necessary, to match the required reimbursement format.

Lastly, have both parties sign the receipt. This provides legal confirmation that both the nanny and the employer agree on the details provided.

Ensure the receipt clearly identifies the service or item, including the name of the caregiver and the date of service. Missing or unclear details can delay processing.

- Do not submit receipts that lack a description of the service provided. Specify the care type and hours worked.

- Make sure the total amount on the receipt matches the amount being claimed. Any discrepancies may cause rejection.

- Avoid submitting receipts without the caregiver’s full name and address. These are required for validation of the service.

- Ensure the receipt is dated. Receipts without a date can lead to confusion and delays in reimbursement.

- Don’t forget to include your dependent’s name if applicable, as it’s necessary to confirm eligibility for the FSA claim.

- Double-check for correct formatting. Some FSAs may require specific information to be included, such as service type or hours.

- Do not submit receipts for non-qualified expenses. Make sure the services you are claiming are eligible under your FSA plan.

Submitting a receipt with all the required information ensures faster approval and avoids unnecessary back-and-forth with your FSA administrator.

The IRS requires specific information to be included in nanny receipts to qualify for tax deductions. Ensure your receipts contain the following details:

| Required Information | Description |

|---|---|

| Date of Service | List the exact date when the service was provided, not just a general timeframe. |

| Amount Paid | Clearly state the total amount paid for each service provided. |

| Service Description | Detail the services rendered, such as hours worked or tasks completed. |

| Employer and Nanny Information | Include both employer’s and nanny’s names, addresses, and contact details for verification. |

| Signature | Both parties should sign the receipt to confirm the transaction. |

Additional Requirements

For the receipt to be valid, it must reflect accurate records of payments made directly to the nanny, not through a third-party service unless it’s clearly stated. Keep copies of all receipts for at least three years in case of an audit.

Filing with the IRS

When submitting nanny-related expenses, be prepared to provide these receipts along with the necessary forms such as the Schedule H. Always consult a tax professional to ensure your records meet IRS guidelines for household employees.

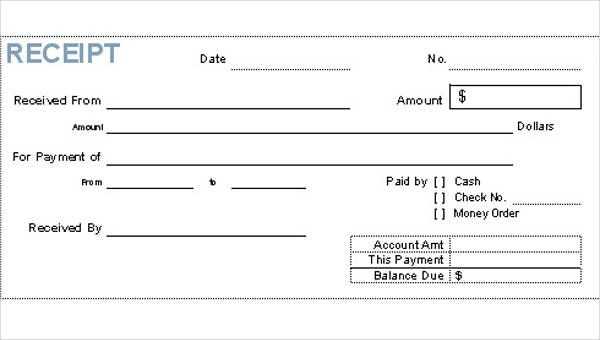

Clearly listing payment methods on a nanny receipt helps avoid confusion and ensures transparency. If multiple payment methods are used, document each method separately, noting the amount paid via each one.

If a payment is made by check, include the check number and the bank it was issued from. For credit card payments, note the last four digits of the card number and the date of payment. If the payment was through an app like Venmo or PayPal, record the transaction ID and the app used.

In cases where a portion of the payment is made in cash, specify the cash amount and balance paid via other methods. When documenting payments, ensure that each transaction is reflected clearly in the total amount section of the receipt, showing both the individual payment amounts and the overall total.

Below is an example of how to structure the information in your nanny receipt:

| Date | Payment Method | Amount Paid | Transaction Details |

|---|---|---|---|

| 02/01/2025 | Check | $200 | Check #12345, Bank of XYZ |

| 02/01/2025 | Venmo | $100 | Transaction ID 987654321 |

| 02/01/2025 | Cash | $50 |

By clearly marking all payment methods and amounts, the receipt remains accurate and complete, which is helpful for both the nanny and the employer, particularly for reimbursement or tax purposes.

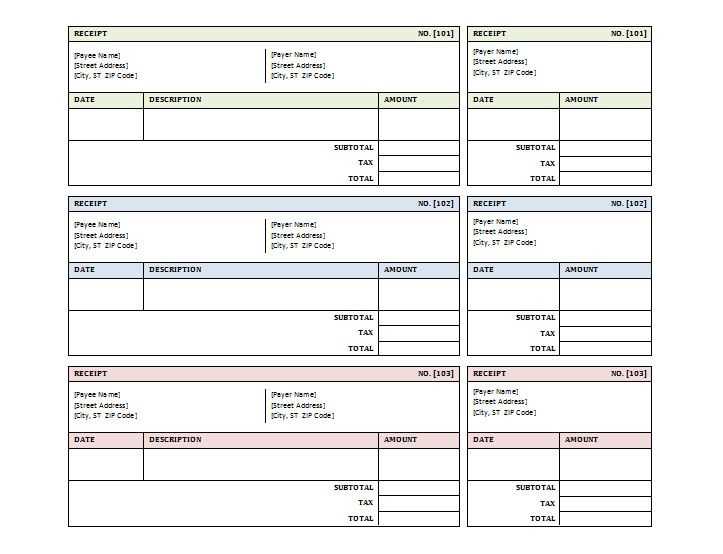

To find or customize an FSA nanny receipt template, start by checking FSA provider websites. Many offer downloadable templates that meet the necessary criteria for reimbursement. These templates are often designed to include the required details such as the provider’s name, services rendered, dates, and amounts paid.

If you prefer to create your own, several online platforms, such as Microsoft Office, Google Docs, and Canva, provide customizable templates. These can be easily adjusted to fit specific needs, ensuring all required information is included for FSA submission. Be sure to follow the FSA guidelines for what should be on the receipt, including clear payment details and a breakdown of services.

Another option is to use specialized accounting software or apps that include receipt templates for child care services, including nannies. These tools often automate the process, making it easier to create accurate receipts each month. Look for one that integrates with your FSA provider to ensure seamless submission.

So the structure remains intact while minimizing repetitions.

To create a nanny receipt template for FSA, ensure you list key details in a clear, concise format. Begin with the nanny’s name, address, and tax identification number, followed by the services provided and their corresponding costs. Include the date(s) services were rendered and payment method. This structure keeps your receipt organized and meets the FSA requirements without overloading it with unnecessary information. Avoid repeating data unless it’s directly relevant to each separate payment.

By adhering to this simple structure, you streamline the process, reducing the chances of submitting redundant or incomplete information. This approach ensures the FSA accepts your receipt without confusion, making it easy to track and reimburse childcare expenses.