A charity receipt book template simplifies the process of issuing donation receipts to contributors. It ensures accurate record-keeping and provides a clear, organized way to acknowledge donations. By using a standardized format, charities can create professional receipts that help maintain transparency and trust with donors.

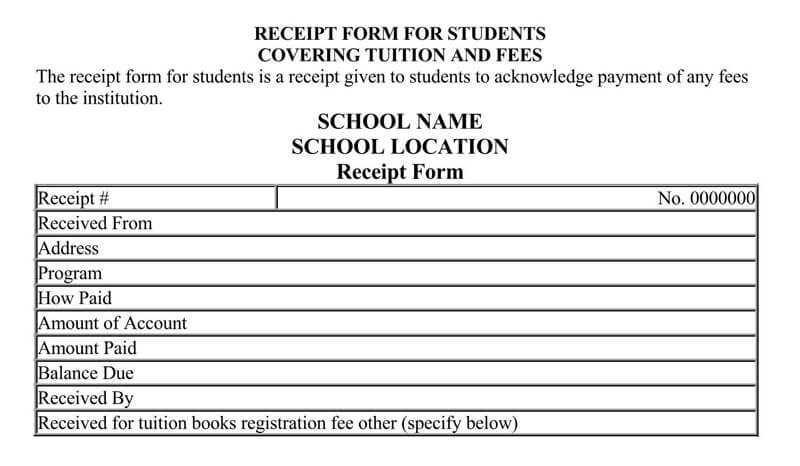

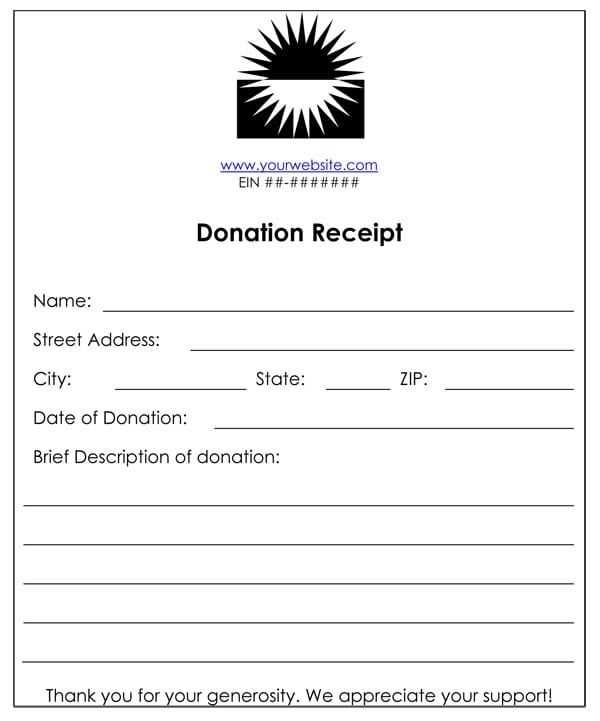

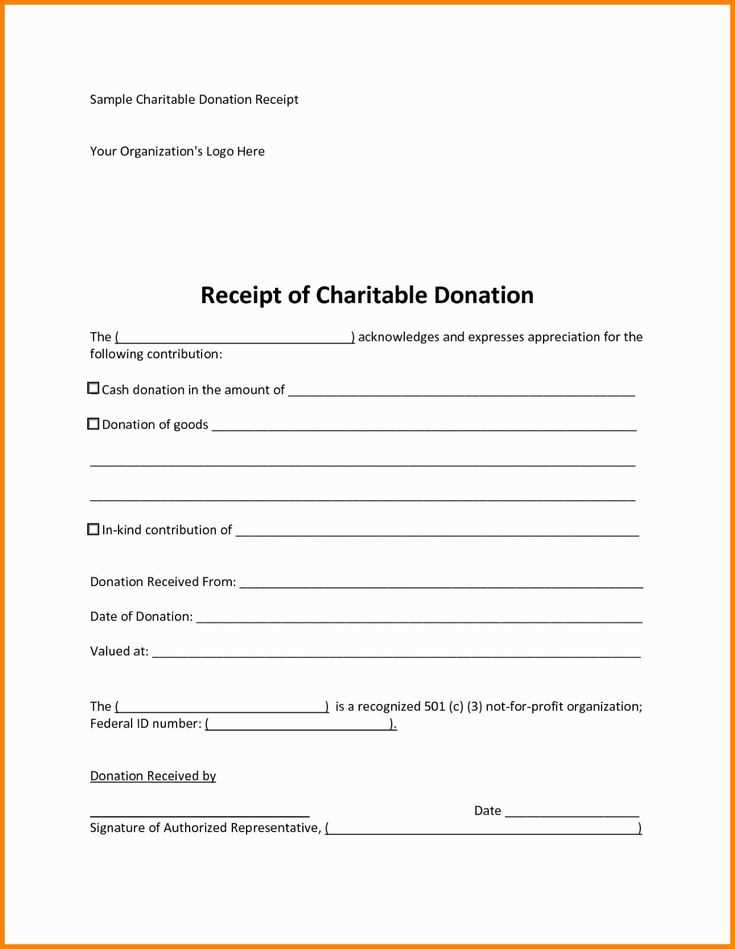

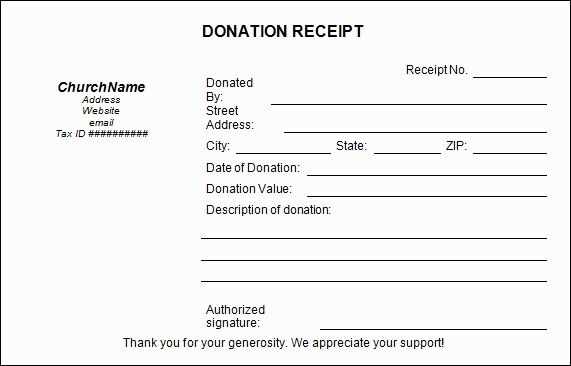

Each receipt should include specific details such as the donor’s name, donation amount, date of donation, and the charity’s official contact information. A well-structured template also allows space for the charity’s registration number and tax-exempt status, which are important for tax-deduction purposes.

To streamline your charity’s administration, consider customizing the template with your organization’s branding. This will help ensure consistency across all communications with your supporters. Additionally, using an electronic version can speed up the process and reduce errors in manual record-keeping.

Here is the revised version with minimal repetition:

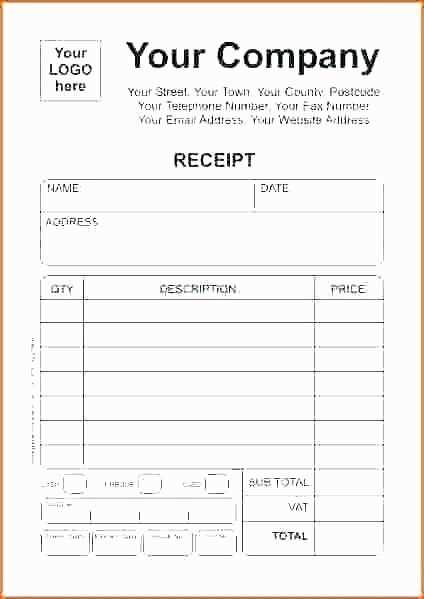

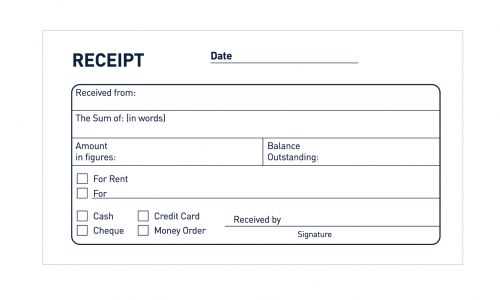

For a streamlined charity receipt book template, focus on clarity and ease of use. Ensure each entry includes essential donor information, such as name, address, and donation amount. Include space for both cash and non-cash donations, with clear fields for descriptions of items or services donated. A signature line for the authorized person, along with a date section, ensures proper documentation.

Customize Your Template

Adapt the template for specific fundraising events or campaigns. Include checkboxes for different donation categories, like one-time or recurring donations. This allows quick tracking and simplifies the process for both donors and staff. A footer with your charity’s contact information and tax ID number can also be included to help maintain legal compliance.

- Charity Receipt Book Template

A charity receipt book should clearly document each donation received, ensuring donors have proper records for tax purposes. Start by creating a template that includes a sequential receipt number for easy tracking. Each receipt should have fields for the donor’s name, address, the donation amount, and date of contribution. Specify whether the donation is monetary or in-kind, and ensure there’s a space for the signature of the authorized charity representative.

Ensure that the template has a space for the charity’s details, such as name, address, contact number, and tax-exempt status number. This allows for easy verification if the receipt is ever questioned. Additionally, you can include a small note clarifying that donations are tax-deductible, if applicable.

To avoid any confusion, maintain consistency in the layout and design of each receipt. Keep it simple, with clearly labeled fields and enough space for each detail. This ensures that both the charity and the donor can easily read and use the receipts when necessary. Keep a copy for the charity’s records, and provide the original receipt to the donor promptly.

Tailor your donation receipt templates to reflect the specific details of each donation type. For one-time contributions, include the donor’s name, the donation amount, and the date. For recurring donations, add information about the payment schedule, such as monthly or quarterly, along with the total amount donated over time.

Incorporating In-Kind Donations

For in-kind donations, specify the item or service donated. A description of the donation, along with an estimated value, should be provided. Unlike monetary gifts, in-kind donations require an acknowledgment of their nature, along with a statement noting that the value of the gift has not been appraised by the charity.

Handling Pledges and Campaign Donations

When dealing with pledges or donations collected through campaigns, track the commitment and fulfillment details. Include the donor’s pledge amount, the due date for payments, and a reminder if the donor has yet to meet their pledge. For campaign donations, note the specific campaign or cause to which the donor contributed, ensuring clarity for future reporting and acknowledgments.

Make sure your charity receipt template includes the donor’s name, donation amount, and date, along with specific language to qualify for tax deductions. Include a statement confirming that the donation was made without receiving any goods or services in return. This is necessary for donors to claim their contributions as tax-deductible.

Additionally, include your charity’s tax-exempt status number, which must be registered with the IRS or local tax authorities. This number assures donors that your organization is eligible for tax-exempt status and can issue receipts that are valid for tax purposes.

Ensure that your receipts provide the following details:

| Item | Description |

|---|---|

| Organization’s name | Full legal name of the charity or nonprofit organization |

| Tax-exempt number | Charity’s IRS or relevant local tax authority registration number |

| Donor’s name | Full name of the donor for tax documentation purposes |

| Donation amount | Exact amount donated, including monetary and non-monetary donations |

| Date of donation | Date the donation was received by the charity |

| Statement of no goods or services provided | A statement confirming no goods or services were given in exchange for the donation |

These steps will ensure your receipts meet tax requirements and help donors properly file for deductions. Regularly consult with a tax advisor or legal professional to ensure compliance with local tax laws and regulations.

Assign a unique identifier to each receipt to ensure consistency and clarity. Use a simple numeric system, starting from 1, with no gaps between numbers. This method allows easy tracking of each entry without confusion. Group the receipts by type or purpose, such as “donations” or “event tickets,” to create logical divisions in the records. Consider adding a prefix or suffix, like “D” for donations or “E” for events, to make identification easier. Keep the numbering sequential for easy referencing, avoiding any random number assignment. This practice minimizes errors and ensures all records are traceable and organized for future use.

Store the receipts in a safe, accessible location where they can be quickly retrieved. A spreadsheet or database can be a useful tool to track the receipt numbers, dates, and amounts, making data entry more accurate. Keep the numbering consistent across all formats, including printed and electronic versions, to maintain a clear audit trail. Regularly review the numbering system to ensure it is functioning smoothly and making the record-keeping process simpler.

Designing a Template for Seamless Integration with Accounting Software

To create a receipt book template that integrates smoothly with accounting software, ensure it captures all necessary details in a format that can be easily imported. Design fields for key data points, such as donor name, donation amount, date, and payment method, in a consistent layout. This structure makes the data extraction process straightforward for software integration.

Key Fields to Include

- Donor Name

- Donation Amount

- Date of Donation

- Payment Method (e.g., cash, check, online)

- Donation Reference Number (optional, for easier tracking)

Software-Compatible Design Tips

- Use standard date formats (e.g., MM/DD/YYYY) to avoid software mismatches.

- Ensure each field is clearly labeled with consistent font sizes and spacing to improve readability and export accuracy.

- Consider including a unique receipt number for each transaction to avoid duplication during imports.

- Structure the template in a table format for better data parsing and organization.

Test the template with the software to identify any potential formatting or compatibility issues, and adjust as needed to ensure smooth data transfer.

Accurate donor details on receipts guarantee transparency and trust. To make sure information is clear and well-organized, include the following key elements:

- Donor Name: Always list the full name as provided. If applicable, also include the organization name for corporate donations.

- Donation Amount: State the exact amount given, including currency. If the donation is non-monetary, specify the item and its value.

- Date of Donation: Clearly state the date when the donation was made to avoid any confusion later.

- Purpose of Donation: If applicable, indicate the specific project or cause the donation supports.

- Receipt Number: Assign a unique receipt number to each donation for easy reference and tracking in your records.

Ensure all details are legible and free from typos. Donors should easily recognize their information on the receipt. Additionally, double-check that the donation’s tax-exempt status is clearly stated if relevant for tax purposes.

Additional Tips for Clear Receipts

- Contact Information: Include your charity’s address, phone number, and email for any inquiries.

- Thank-You Message: A short thank-you note reinforces goodwill while confirming the importance of the donation.

Design a clear and consistent structure for receipts to make tracking recurring donations and subscriptions easier. Use placeholders like donor name, donation amount, payment frequency, and next payment date to help automate the receipt generation process.

Set up a template that automatically updates after each donation cycle. For example, include a field for total contributions received and a next donation amount field to ensure the donor stays informed on their giving pattern. A dynamic template that adapts to the specific amount and timing of each donation keeps the process efficient for both the donor and the organization.

Integrate subscription renewal dates and automatic payment confirmation within the template. Make sure donors are reminded about the upcoming payments and subscription changes. This increases transparency and reduces the chances of confusion.

Provide space for personalized messages or thank-you notes within the template. This can be automated to thank the donor each time they renew their contribution or subscription. Adding a personal touch enhances donor engagement.

To create a simple charity receipt book template, begin by ensuring each receipt includes clear fields for the donor’s name, the donation amount, the date of the contribution, and a brief description of the donation (e.g., cash, goods, etc.). This layout ensures transparency and proper documentation for both the charity and the donor.

Include a unique receipt number for each transaction. This helps with tracking and minimizes errors. Consider numbering receipts sequentially to maintain a proper record-keeping system, making audits easier when necessary.

Incorporate a signature line for authorized personnel of the charity. This acts as confirmation of receipt and prevents disputes about the authenticity of the donation.

Designate a space for the charity’s contact details and tax ID number. This provides donors with necessary information for their tax records and reinforces legitimacy.

For added clarity, include a small note about the charity’s mission or how donations will be used. This encourages repeat donations and shows accountability.