To create a deposit receipt letter, start by clearly identifying the transaction details. Begin with the deposit amount, followed by the date of the deposit and the name of the depositor. Include a reference number if applicable, which helps to track the transaction in your records.

Next, specify the purpose of the deposit and any related details, such as the account or project the deposit applies to. Ensure that the letter includes both the depositor’s and recipient’s contact information to confirm who is involved in the transaction.

Finally, close the letter with a simple acknowledgment of receipt, along with a thank you for the deposit. This provides clarity and a professional tone, helping to confirm the transaction is complete and recorded.

Here’s the corrected text with reduced repetitions:

To create a clean and professional deposit receipt letter, start by providing key details clearly and concisely. Ensure the document includes the date of the deposit, the amount, the name of the depositor, and a reference number if applicable. This helps establish clarity and avoids unnecessary repetition of similar information. Use straightforward language and focus on the most relevant details.

Key Points to Include:

- Deposit date

- Amount deposited

- Depositor’s full name

- Reference or transaction number

By following this structure, you will avoid repeating information and make the letter easy to understand. Keep the wording precise and free of redundant phrases. This will ensure a smooth reading experience for the recipient, minimizing the risk of confusion.

- Deposit Receipt Letter Template

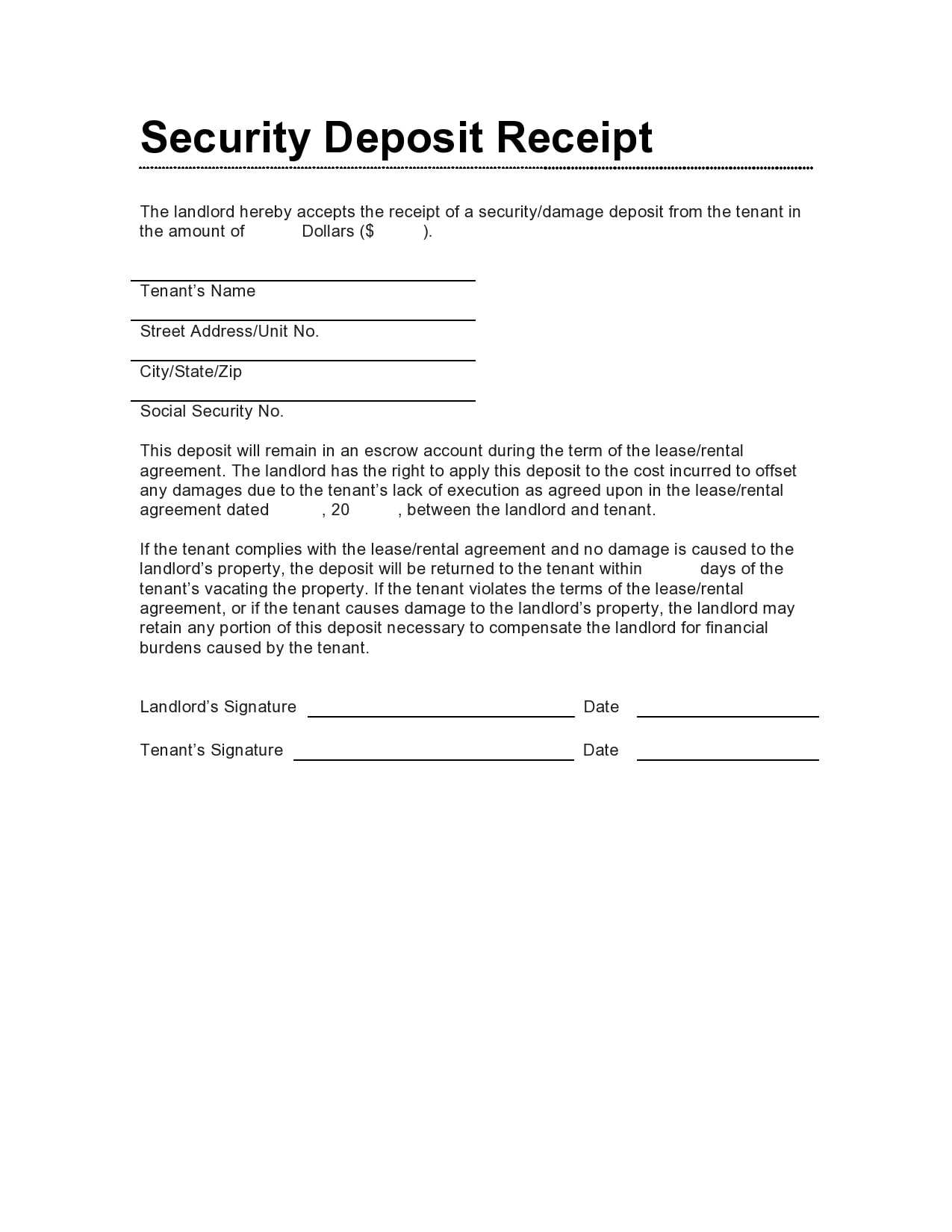

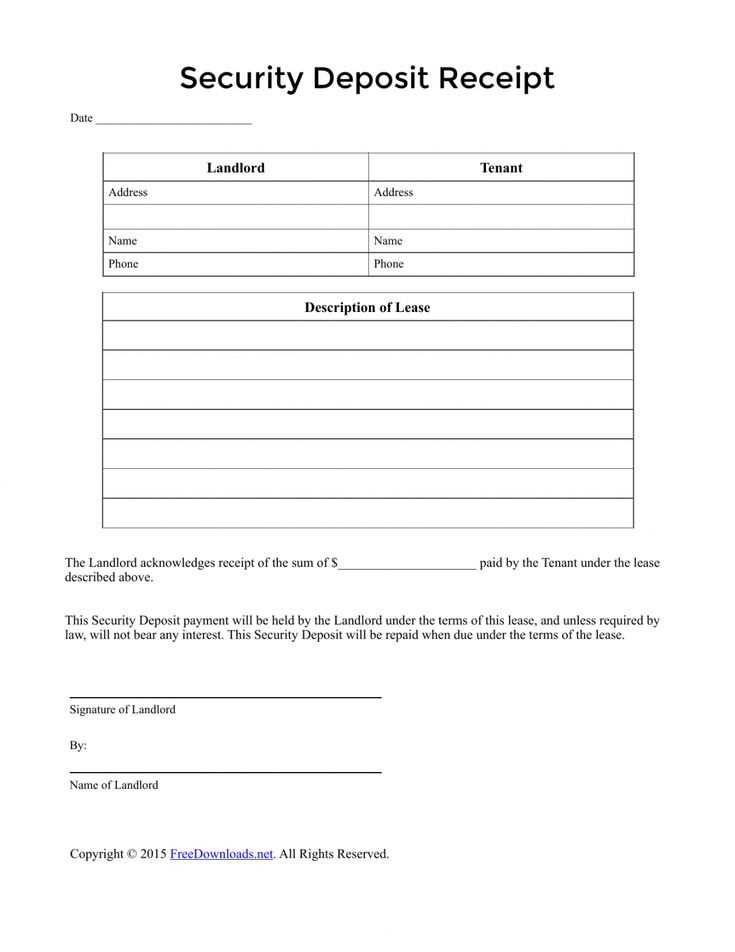

A deposit receipt letter confirms that a deposit has been made by a client or tenant. The letter typically includes the deposit amount, the purpose of the deposit, and any relevant terms or conditions associated with it. Here’s a simple, straightforward template to use for this purpose:

Deposit Receipt Letter Example

This sample outlines the key sections to include in the letter:

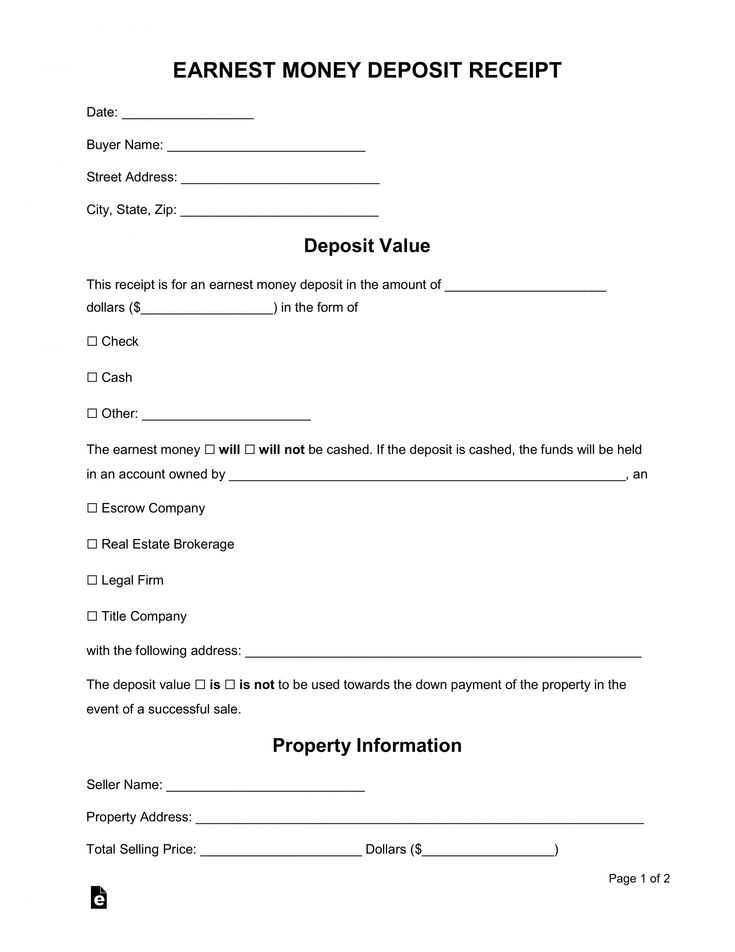

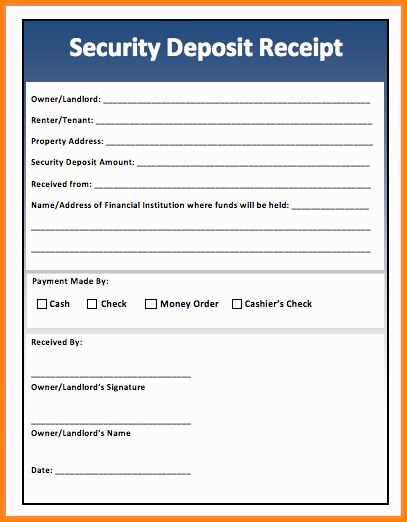

- Recipient Details: Include the full name and contact information of both parties involved in the deposit transaction.

- Deposit Information: Clearly state the deposit amount, the date it was received, and the method of payment (cash, check, etc.).

- Purpose of Deposit: Specify the reason for the deposit, such as a security deposit for a rental property or an advance payment for a service.

- Terms and Conditions: Mention any specific terms that apply to the deposit, such as refund conditions or usage restrictions.

- Signature: Include a space for both parties to sign the document to confirm the transaction.

Deposit Receipt Letter Template

Here’s an example template for creating your own letter:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Recipient’s Name] [Recipient’s Address] [City, State, ZIP Code] Subject: Deposit Receipt Letter Dear [Recipient’s Name], This letter acknowledges the receipt of a deposit of [Amount] made on [Date]. The deposit was received for the purpose of [State the reason, such as security deposit or advance payment]. The deposit was paid via [Method of Payment]. Terms and conditions associated with the deposit: [Outline any terms or conditions] If you have any questions or require further clarification, please feel free to contact me at [Your Contact Information]. Thank you for your prompt payment. Sincerely, [Your Name] [Signature]

This template ensures clarity in the deposit process and helps keep accurate records for both parties. Adjust the details to fit your specific situation and provide all necessary information to avoid misunderstandings.

A deposit serves as a guarantee for both parties in a transaction. It secures the commitment of the payer and ensures the recipient that the transaction is serious. Typically, a deposit reduces the risk of non-payment and helps in the completion of the agreement. For example, when renting property, the deposit assures the landlord that the tenant will honor the terms of the lease.

For businesses, deposits are a way to secure funds before providing goods or services. They protect the business from potential financial loss in case of cancellation or non-fulfillment of the agreement. In some cases, deposits are refundable, but often, they are used to cover initial costs, such as for special orders or reservations.

Deposits also act as a tool for managing risk and commitment. In a contract, they can signal good faith and give both parties assurance that resources will be committed appropriately. The amount required for a deposit can vary depending on the agreement, and it is often negotiable depending on the circumstances.

| Purpose | Examples |

|---|---|

| Guarantee Payment | Rent, hotel bookings, services |

| Secure Commitment | Event reservations, product orders |

| Risk Management | Custom orders, rental agreements |

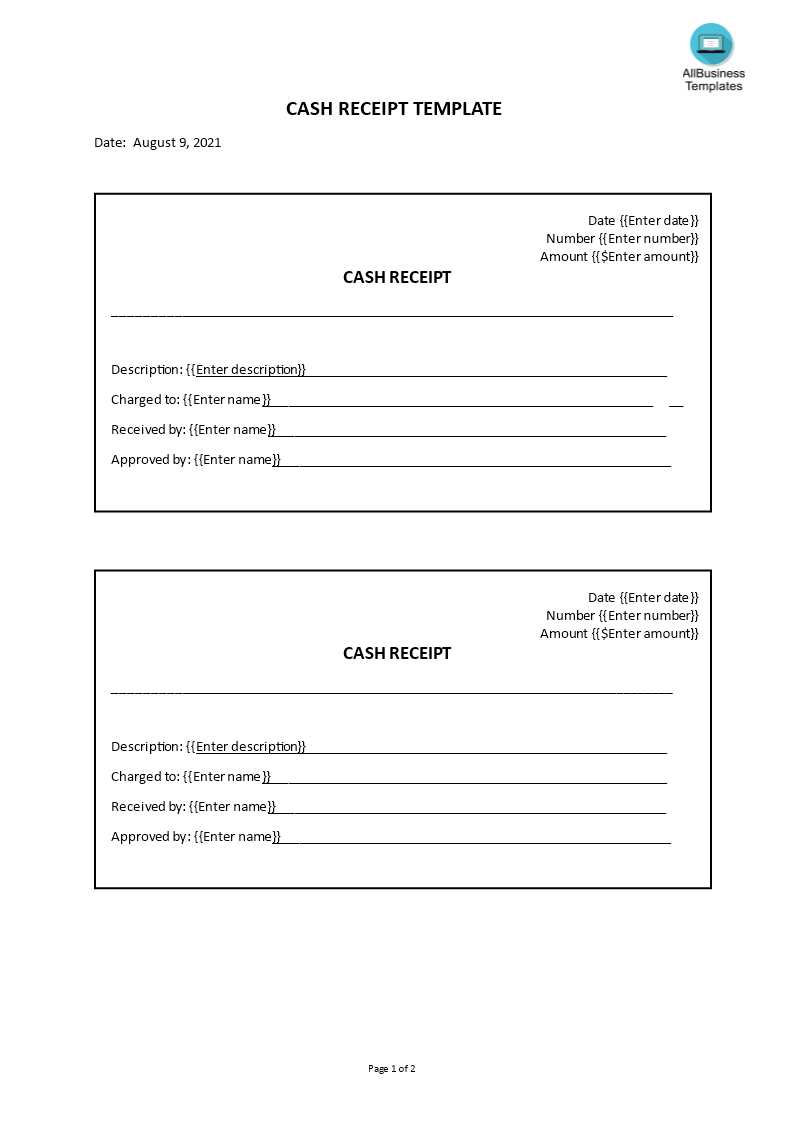

To create a clear and professional receipt, ensure it includes the following details:

- Receipt Title: Clearly label the document as “Receipt” at the top.

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Transaction Date: List the exact date of the transaction to avoid confusion.

- Seller Information: Include the name, address, and contact details of the business.

- Buyer Information: If applicable, add the buyer’s name or company details.

- Description of Items/Services: Provide a breakdown of the products or services purchased, including quantities and prices.

- Total Amount: Specify the total payment amount, including taxes and any additional charges.

- Payment Method: State how the payment was made (cash, credit card, bank transfer, etc.).

- Signature or Authorization: If needed, include a signature or authorization mark to validate the receipt.

Optional Additions

- Discounts or Coupons: Note any applied discounts or promotional codes.

- Refund Policy: Add a brief mention of the return or refund policy, if relevant.

Begin by clearly identifying the parties involved. Specify the issuer (the person or entity providing the receipt) and the recipient (the person or entity receiving the payment). Include their names, addresses, and contact details where relevant. This ensures clarity and accountability for both parties.

Include Transaction Details

List the amount paid, specifying the currency. Be precise about the payment method, such as cash, check, bank transfer, or credit card. If applicable, include transaction numbers or payment references to avoid confusion. This helps track payments efficiently.

Provide a Detailed Description

Describe what the payment was for. Whether it’s a deposit, purchase, or service fee, outline the purpose of the transaction. Mention any relevant dates, such as the date of the service or delivery, to provide context.

Conclude with a clear statement acknowledging the receipt of the payment. Include the date the receipt was issued and a unique receipt number to differentiate it from others. This helps with future references and provides a clear record for both parties.

Begin with the name of the recipient, followed by a formal salutation, such as “Dear [Recipient’s Name].”

Clearly state the purpose of the letter, starting with “This letter confirms the receipt of…” and provide the exact amount, item, or service being acknowledged. Be specific about what has been received.

In the following paragraph, include the date and location where the transaction occurred. This ensures clarity and provides a reference for both parties.

Provide additional details such as the method of payment (if applicable) and any reference number tied to the transaction. If there are any conditions related to the receipt, mention them briefly in this section.

Conclude with a courteous closing, thanking the recipient for their business or cooperation. Sign off with your name and position, if applicable.

Ensure the receipt clearly shows the transaction date. Mistakes in the date can cause confusion, especially for refunds or exchanges. Double-check that all amounts match the total before issuing the receipt.

Do not omit necessary transaction details such as the items or services purchased. Descriptions should be precise, helping the customer identify exactly what they paid for. Avoid vague or generalized terms.

Be careful with the tax information. Incorrect or missing tax rates can lead to legal issues or customer complaints. Always include the exact tax amount and the rate used in the calculation.

Make sure the receipt is legible. Handwritten receipts can lead to errors, so printing receipts is recommended. Also, ensure the font size is readable for both the customer and your records.

Ensure the correct payment method is recorded. If the customer paid by card, include card type and the last four digits. This prevents confusion if the customer disputes the payment later.

Don’t forget to include your business details. A missing business name or contact information makes it harder for customers to reach out in case of problems.

Ensure the receipt includes the full name and contact information of both parties involved in the transaction. This helps confirm the transaction’s legitimacy and provides a point of reference in case of disputes. Clearly state the amount paid, the date, and a brief description of the goods or services exchanged. This documentation may be required for tax purposes or proof of payment in legal settings.

Tax Implications

Some jurisdictions require receipts to be issued for tax compliance. The amount paid, whether it’s inclusive of taxes or not, must be clearly noted. This also helps maintain transparency, should there be a need to substantiate income or expenses during tax filing. Incorrect or missing information could result in penalties or complications during audits.

Data Privacy and Protection

Be cautious when including personal information on receipts. Only share necessary details and avoid over-disclosing sensitive data such as full addresses unless absolutely needed. Follow applicable data protection regulations to safeguard the privacy of all parties involved. This reduces the risk of misuse or unauthorized access to personal information.

Ensure the deposit receipt letter is clear and concise. List the transaction details to avoid confusion, such as the amount, date, and purpose of the deposit. This allows both parties to confirm the terms of the agreement.

Key Components of a Deposit Receipt

Include the following elements in your deposit receipt letter:

| Element | Description |

|---|---|

| Recipient Name | Clearly state who received the deposit. |

| Amount | Specify the exact amount of the deposit. |

| Date | Indicate the date the deposit was made. |

| Deposit Purpose | Briefly describe the reason for the deposit. |

| Signature | Provide a space for both parties to sign, acknowledging the deposit. |

Finalizing the Document

Once the deposit receipt is completed, review the letter for any errors or missing details. Ensure that both parties have a copy for their records. This will help prevent disputes and confirm the terms of the deposit.