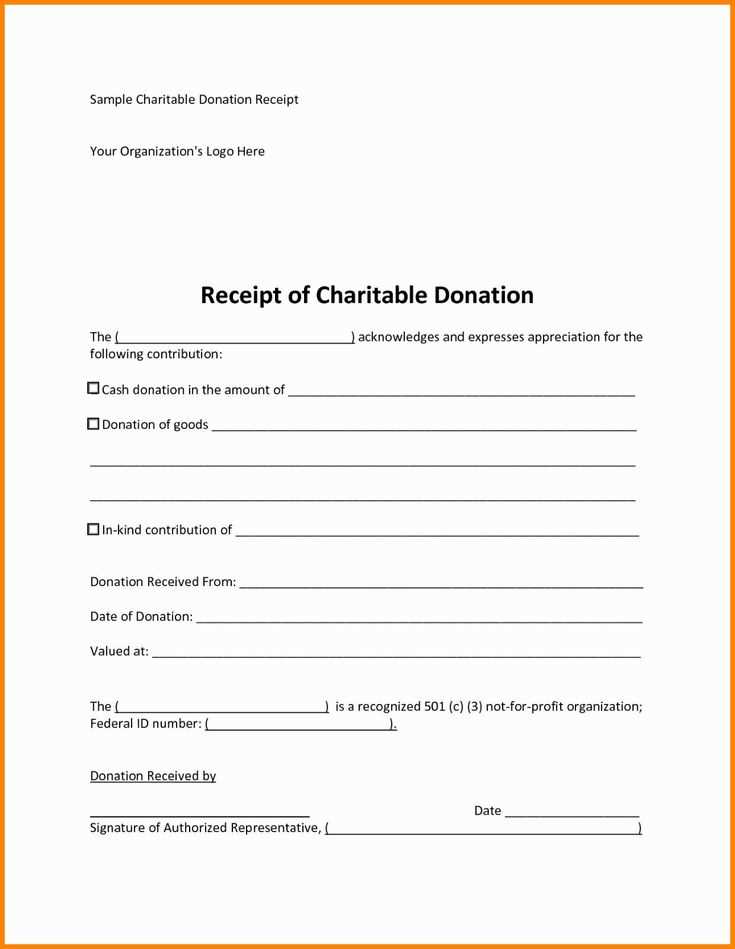

To create a charitable receipt, begin by clearly stating the donor’s name and the organization’s details. Make sure to include the exact amount donated and the date of the contribution. This ensures transparency and accuracy for both parties.

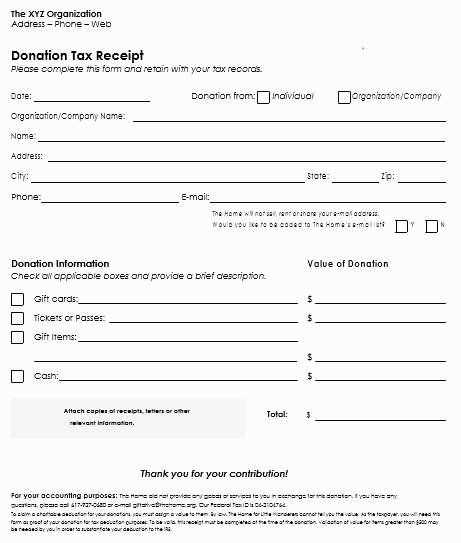

Itemize any goods or services received in exchange for the donation. If the donor receives something in return, such as event tickets or a gift, the receipt should reflect the fair market value of those items. Subtract this value from the total donation amount to ensure compliance with tax regulations.

For tax purposes, provide the donor with a clear statement specifying that no goods or services were exchanged if that is the case. This simple statement will help the donor claim the full donation on their taxes. Be sure to include the organization’s registration number and a brief description of its charitable purpose.

Lastly, make the receipt easily accessible. Offering digital and printed versions can simplify the process for your donors and make it more convenient for them to keep accurate records for tax season.

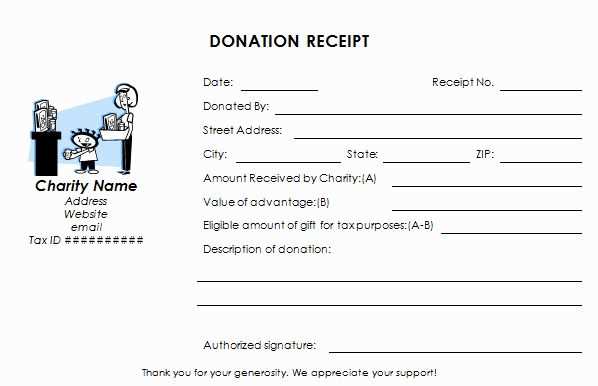

- Charitable Receipt Template

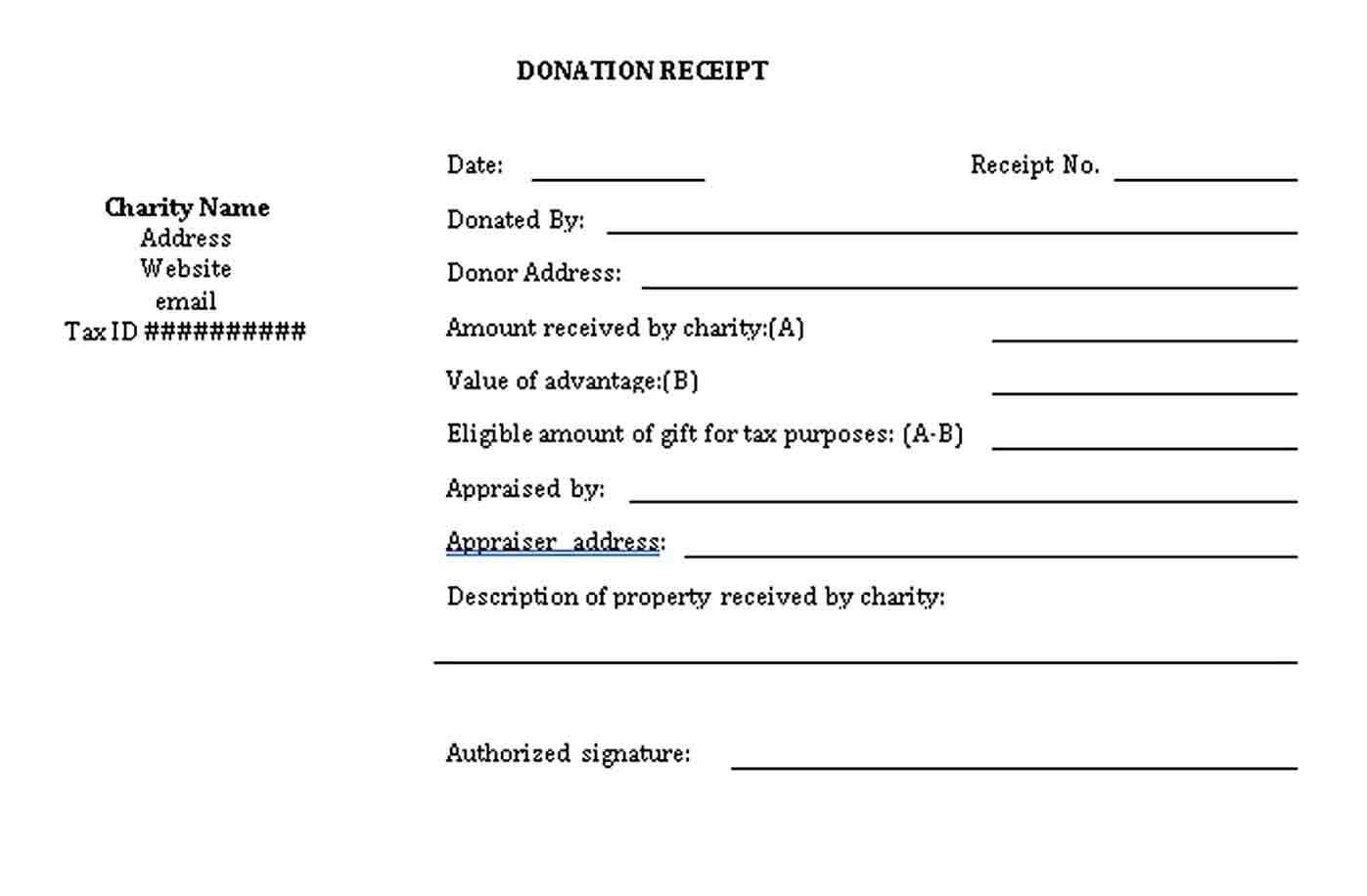

To create a charitable receipt, start by including key details: the donor’s name, address, donation amount, and date of the gift. Ensure that the charity’s name, registration number, and a statement of the donation’s tax-deductible status are clearly visible.

Use the following layout for clarity:

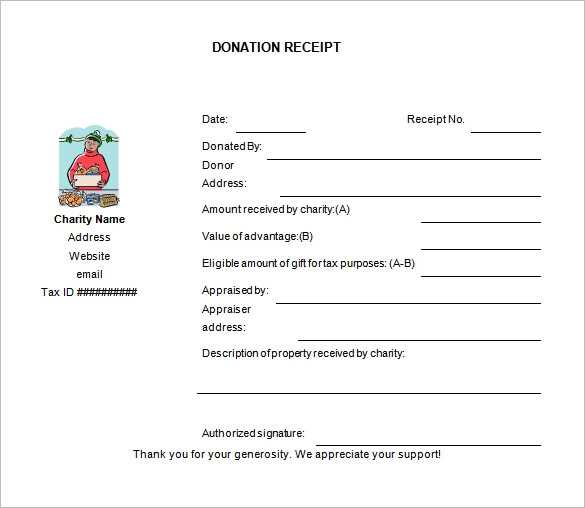

- Charity Name and Logo: Place your charity’s name and logo at the top for identification.

- Donor Information: List the donor’s name, address, and contact details for record-keeping.

- Donation Details: Include the donation amount and specify if it was in cash, goods, or services.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Tax Information: State that the donation is tax-deductible under the applicable local laws.

- Date of Donation: Include the exact date the donation was made to avoid confusion.

- Signature: The signature of an authorized person from the charity confirms the receipt’s legitimacy.

This format ensures both donor and charity comply with tax regulations, offering transparency and accountability in the donation process.

Focus on making the template clear and easy to customize. Start with the donor’s name, the amount donated, and the date. Include a space for the donation method (e.g., credit card, bank transfer) and a unique reference number for tracking purposes. This ensures the template remains professional and organized.

Key Sections to Include

Each donation receipt should contain the following:

- Donor Information: Full name, address, and contact details.

- Donation Details: Amount, donation date, and payment method.

- Charity Information: Organization name, address, and registration number.

- Tax Information: Any applicable tax-exempt status or deduction details.

Customization Tips

Ensure the template includes branding elements such as your charity’s logo and a personal thank-you note. Use a professional, readable font and structure the content for easy scanning. A well-designed receipt can make the donor feel valued and encourage future support.

A charitable receipt must provide specific details to ensure its validity. Here’s what to include:

1. Donor’s Information

Include the full name and address of the donor. This helps verify the donation for tax purposes and keeps records accurate.

2. Date of Donation

The exact date the donation was received should be noted. This ensures the donation is recorded within the correct tax year.

3. Amount or Description of Donation

State the value of the cash donation or a detailed description of the donated goods. If it’s a non-cash donation, an estimate of its fair market value should be provided.

4. Charitable Organization’s Information

Include the name, address, and registration number of the charitable organization. This helps confirm that the recipient is a legitimate charity.

5. Tax Receipt Number

Each receipt should have a unique number for easy tracking. This avoids confusion and ensures proper recordkeeping.

6. Acknowledgment Statement

A statement acknowledging that no goods or services were provided in exchange for the donation must be included. This is important for tax deduction purposes.

7. Signature of Authorized Representative

The signature of someone from the organization who is authorized to issue receipts should be included for legitimacy.

| Information | Details |

|---|---|

| Donor’s Information | Full name and address |

| Date of Donation | Exact date of contribution |

| Amount/Description | Value of cash or description of goods |

| Charitable Organization’s Info | Name, address, and registration number |

| Tax Receipt Number | Unique tracking number |

| Acknowledgment Statement | No goods or services received in return |

| Signature | Authorized representative’s signature |

Adjust your template based on the donation type to provide clear and relevant details for each contributor. For one-time donations, keep it simple: include the donor’s name, the donation amount, and the date. If the donation is recurring, ensure the template specifies the payment frequency (e.g., monthly or quarterly), the start date, and any duration if applicable.

Handling In-Kind Donations

For non-monetary contributions, the template should explicitly mention the item(s) donated, their estimated value, and the date received. It’s also helpful to state that the value of in-kind donations is based on the donor’s estimation unless an official appraisal has been provided.

Customizing for Corporate Donations

When dealing with corporate contributions, include the company name, the donation amount or item, and the contact person’s details. Acknowledge any matching gift programs and ensure the template allows space for specifying these additional details. This makes it easier for both the company and the donor to track the contribution accurately.

In most countries, receipts must contain specific information to be considered legally valid. This typically includes the name of the business, the date of the transaction, a detailed description of the items or services purchased, the total amount, and the tax amount, if applicable. Many jurisdictions require that receipts include the business’s tax identification number, which helps with auditing and compliance purposes.

Required Information on a Receipt

The receipt should list the full address of the business, and in some regions, it must also specify the method of payment, such as cash, credit card, or check. If the receipt is issued for a charitable donation, it must clearly state the amount donated and whether it’s eligible for a tax deduction. The charity’s registration number may also be necessary for validation purposes.

Tax and Compliance Considerations

For tax purposes, receipts serve as proof of expenses or donations. Governments may require businesses to issue receipts for transactions above a certain amount. In cases of charitable donations, donors often need receipts for tax deduction claims, which must meet specific criteria set by the tax authorities. Be sure to check local laws to ensure receipts meet these requirements and are issued in the correct format.

Begin by collecting all necessary donor information. Ensure that each donor’s full name, address, and donation amount are accurately recorded. This will form the basis of the receipt.

Next, generate the receipt using a standard template that includes the following details:

- Organization’s name and contact information

- Donor’s name and address

- Donation amount and date received

- Tax-exempt status (if applicable)

- Signature or official stamp of the organization

Once the receipt is generated, review the information for accuracy before issuing it. Double-check the spelling of names and the amounts donated to avoid mistakes.

Distribute the receipts promptly. For electronic donations, consider sending receipts via email with a PDF attachment for easy access. If a physical receipt is needed, mail it with a thank-you note to show appreciation.

Distribute Receipts Efficiently

- Use an automated system for high-volume distributions, especially for online donations.

- Send reminders for donors who have not yet received their receipts.

Maintain Records for Tax Purposes

Keep copies of all receipts issued for tax reporting purposes. This ensures compliance with regulations and makes it easier to retrieve receipts if a donor requests reprints or corrections.

Double-check all fields for accuracy before finalizing the charitable receipt. Incorrect names, addresses, or amounts can lead to serious issues down the line, especially for tax purposes. Always confirm that the donor’s details are correct before issuing the receipt.

Not Customizing the Template Properly

Many users fail to adjust the template to fit their organization’s specific needs. Make sure to update fields like the organization’s name, logo, and contact information. Leaving default placeholders can create confusion for the donor and make the receipt seem unprofessional.

Missing Legal or Tax Information

Ensure the receipt includes the necessary tax identification number or other relevant legal information required by local regulations. Missing this data can cause delays or complications during the donor’s tax filings, and may lead to fines for your organization.

Finally, avoid using generic templates without verifying their compliance with local rules. A template that worked in one region might not be valid elsewhere, so always confirm that it meets legal requirements in your area.

To properly create a charitable receipt, ensure it includes the donor’s name, donation amount, and date. Specify whether the gift is cash or goods, and if applicable, provide a description of the donated items. Be sure to include your charity’s official name and registration number, as well as contact information for any inquiries. For transparency, add a statement confirming that no goods or services were provided in exchange for the donation, if this is the case. Keep the format clear and easy to read to avoid any confusion for the donor.