Use this template to create a professional sales receipt that complies with Australian business standards. It should include essential details to ensure both the seller and buyer are clear about the transaction.

Required Information for Your Sales Receipt

Ensure you include the following items when creating your receipt:

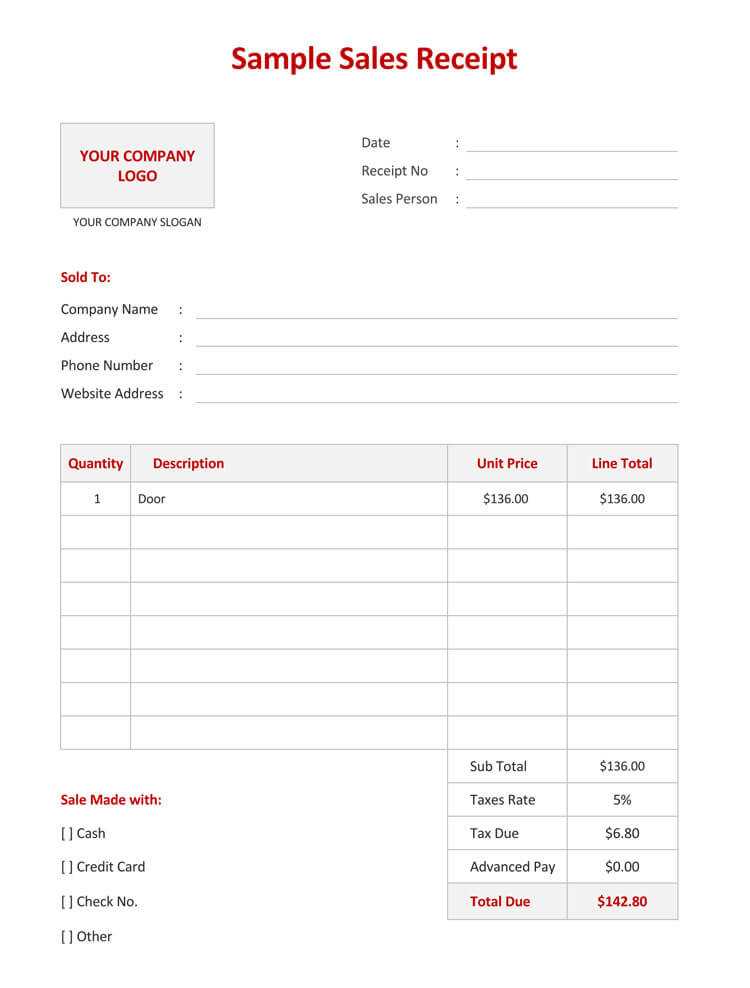

- Business Name and Contact Details: Include your business name, address, phone number, and email address.

- ABN (Australian Business Number): Add your ABN to confirm the legitimacy of your business.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Date of Sale: Clearly state the transaction date.

- Item Description: List the items purchased, including quantity, price, and any applicable discounts.

- Total Amount: The total payment, including taxes, should be clearly visible.

- Payment Method: Specify if the payment was made via cash, credit card, or another method.

- GST (Goods and Services Tax): If your business is GST registered, show the GST amount separately.

Creating the Template

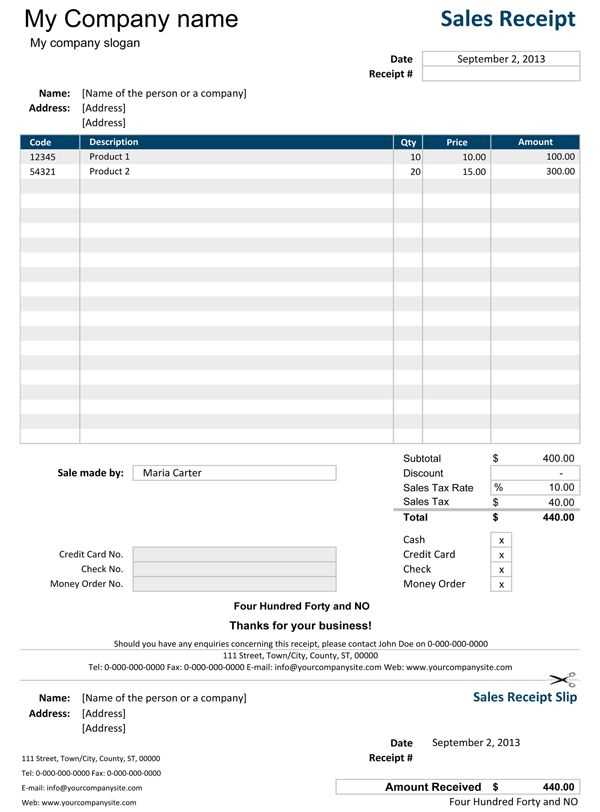

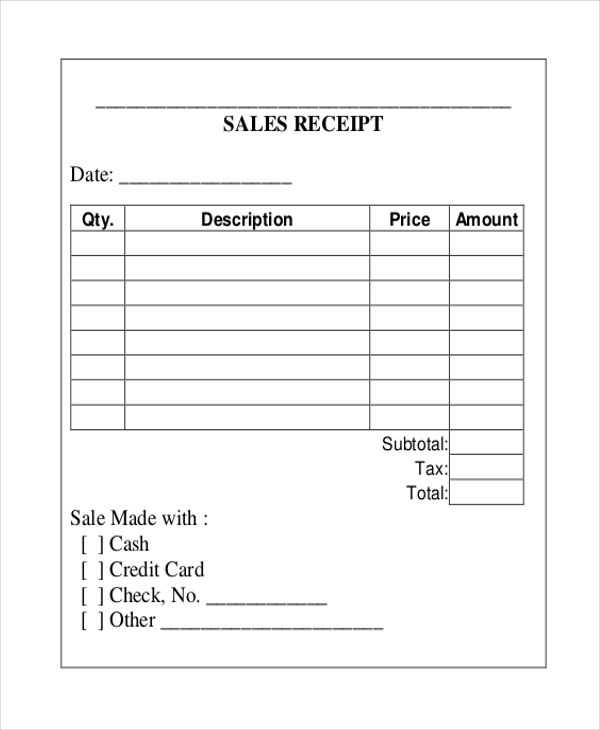

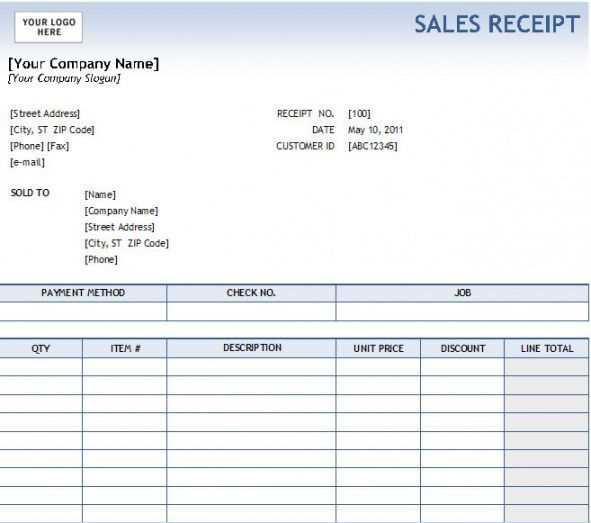

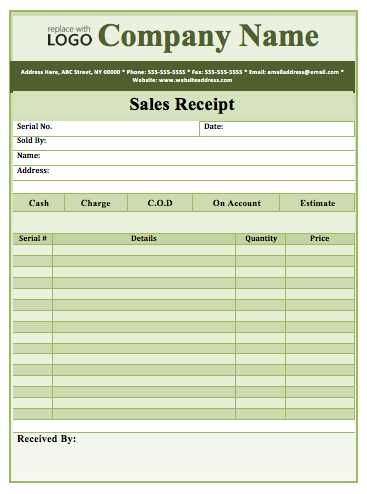

Below is a basic structure for your sales receipt template:

Business Name: [Your Business Name] ABN: [Your ABN] Address: [Your Address] Phone: [Your Contact Number] Email: [Your Email Address] Receipt Number: [Unique Number] Date: [Date of Sale] Item Description: - Item 1: [Quantity] x [Price] = [Total] - Item 2: [Quantity] x [Price] = [Total] Subtotal: [Subtotal Amount] GST (if applicable): [GST Amount] Total Amount: [Total Payment] Payment Method: [Cash/Card/Other]

Customize this template by adding or removing fields based on your specific needs. This ensures clarity and professionalism in every transaction.

Tips for Personalizing Your Receipt

- Use clear fonts: Choose legible fonts to make the receipt easy to read.

- Include a logo: Add your business logo to enhance your branding.

- Keep it simple: Avoid clutter, focusing only on necessary details to prevent confusion.

Sales Receipt Template Australia

Creating a Simple Receipt for Small Businesses

Key Elements to Include in an Australian Receipt

Understanding GST and Tax Details on Receipts

Customizing Your Receipt Template for Various Transactions

Choosing Between Digital and Paper Receipts in Australia

Ensuring Legal Compliance with Receipts in Australia

Begin with your business name, contact details, and ABN. Clearly list the date and unique receipt number. Under the itemized list, mention each product or service with the quantity and price. For tax purposes, show the GST amount separately. The final amount should include tax and be clearly stated. A simple and clean layout makes it easy for customers to read.

Key Elements to Include in an Australian Receipt

Display the following: business name, ABN, transaction date, item descriptions, quantities, prices, GST amount, and total price. Make sure you include a GST-exclusive amount for businesses that are registered for GST. For non-GST registered businesses, only the final price is required. Clear details help prevent any confusion.

Understanding GST and Tax Details on Receipts

When your business is registered for GST, you must show the tax amount on each receipt. Include the GST-exclusive amount, GST amount, and GST-inclusive total. In cases where the transaction is GST-free, specify this to avoid misunderstanding. For businesses not registered for GST, no tax-related details should appear on the receipt.

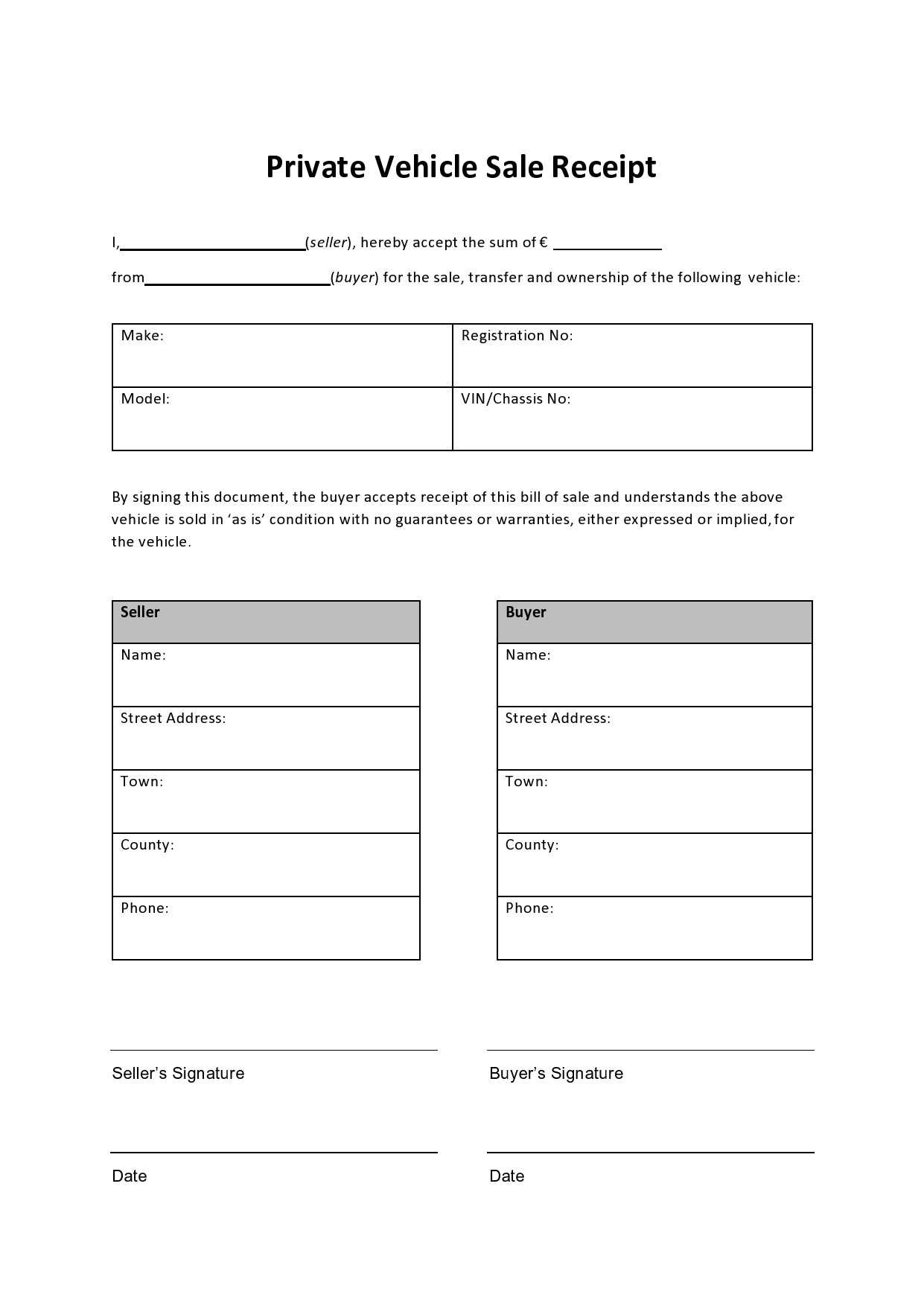

Adjust your receipt template depending on the transaction type. For example, for refunds or exchanges, you might need extra fields such as a reference to the original purchase or reason for the return. This keeps your records organized and clear.

When offering digital receipts, include an option to email or text the receipt to customers. For paper receipts, ensure that they meet legal standards. Whether you choose paper or digital, always ensure the information is legible and meets all compliance requirements.

Legal compliance in Australia is important. Businesses must issue receipts for all transactions over a certain amount, usually AUD 82.50. For each sale, include the necessary details, especially if GST is involved. Keep your receipts accurate, clear, and compliant with Australian laws to avoid penalties.