A well-structured payment receipt is crucial for both businesses and customers in the UK. Using a clear and professional template can help avoid confusion and ensure that all necessary details are documented correctly. Whether you are a small business owner, freelancer, or part of a larger organisation, having a consistent and easy-to-use receipt template is key to maintaining transparency in financial transactions.

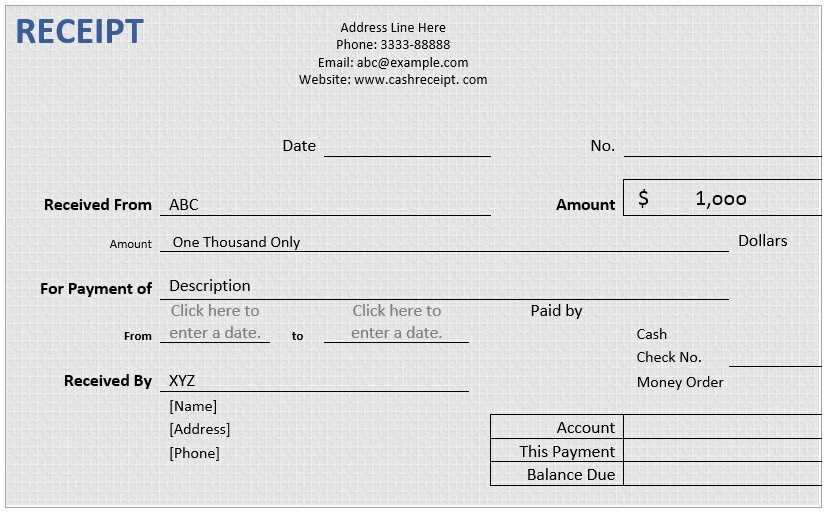

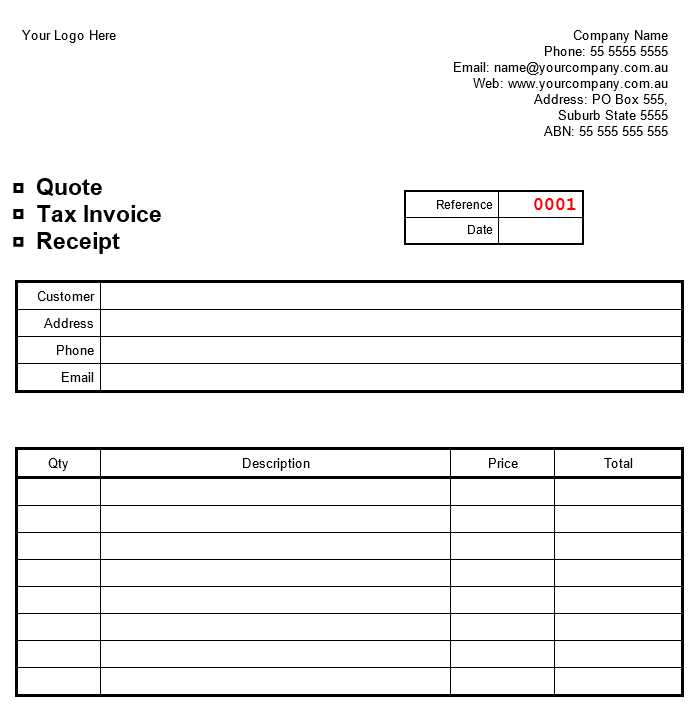

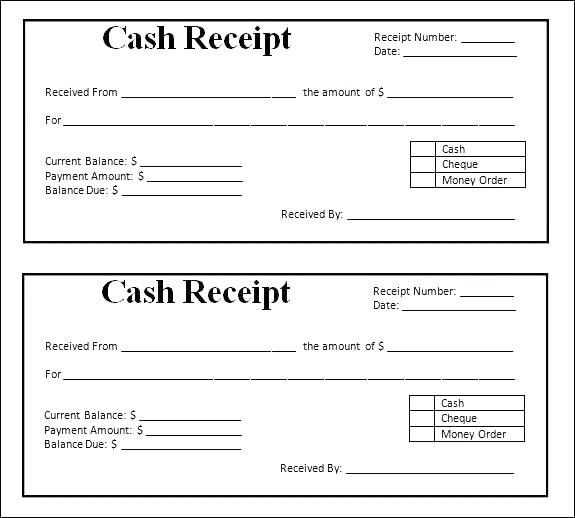

Start by including the basic details such as the date of payment, amount paid, and the method of payment (e.g., cash, bank transfer, or card). This ensures that both parties have an accurate record of the transaction. The name of the payer and payee, along with any relevant reference or invoice numbers, should also be listed to help with future tracking and reconciliation.

Adding clear terms and conditions on your receipt, especially if you’re dealing with deposits or partial payments, can prevent misunderstandings. This section should specify whether the payment is for goods, services, or other specific purposes. Make sure to include your business name, address, and contact details, ensuring the receipt is identifiable and professional.

Finally, make your receipt easy to read and organise. A simple design with clear sections for each piece of information allows for quicker reference and adds to your business’s credibility. Keep these points in mind when setting up your payment receipt template, and you’ll ensure both clarity and professionalism in every transaction.

Here are the corrected lines without word repetition:

Ensure that each line on your receipt is clear and concise, without using the same word multiple times. This improves readability and prevents confusion.

- Payment was received for services rendered on January 25th.

- Amount of £200 was processed through a credit card transaction.

- Payment reference number: 4536721.

- Transaction completed on 25th January at 10:15 AM.

- Receipt issued by XYZ Ltd for the amount above.

By removing unnecessary repetitions, you make it easier for clients to understand the details of their payment, ensuring clarity and professionalism in your receipts.

- Receipt of Payment Template UK

For a simple and clear receipt of payment in the UK, ensure that it contains the following key details:

- Date of Payment: Specify the exact date the payment was received. This helps both parties track financial transactions accurately.

- Amount Paid: Clearly state the amount received, including the currency (GBP). If it’s a part payment, mention the outstanding balance.

- Payment Method: Indicate whether the payment was made by cash, cheque, bank transfer, or card. If applicable, include reference numbers for bank transfers.

- Receiver’s Details: Include the name and contact information of the person or company receiving the payment.

- Payer’s Details: Provide the name and contact details of the person or entity making the payment.

- Transaction Reference: If available, include a unique reference number for the transaction to avoid confusion.

- Description of Goods or Services: Specify the goods or services for which the payment was made. This can be a brief summary or an invoice number.

A receipt that follows this format ensures transparency and minimizes disputes. Customize your template to fit the type of transaction and always provide a copy to the payer. Additionally, consider keeping records for tax or auditing purposes. A well-structured receipt provides clarity for both parties involved.

To create a payment receipt template in the UK, focus on including key information required by both the payer and the payee. This ensures clarity and proper documentation for financial records.

1. Basic Information

Begin with the details of both parties involved. Include the business name and address of the seller, along with the buyer’s name and contact details. A phone number or email for communication is useful for future reference.

2. Receipt Number and Date

Each receipt should have a unique receipt number for easy tracking, especially in case of returns or disputes. The date of payment is also important for proper record-keeping and tax purposes.

3. Payment Details

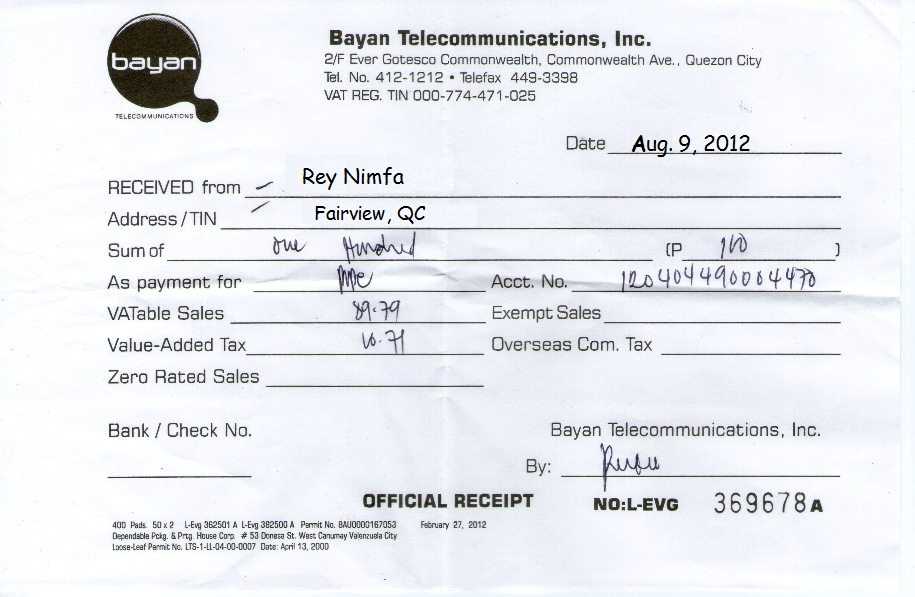

List the amount paid, including the currency (GBP), along with any applicable VAT (Value Added Tax) or taxes. If the payment was partial or for a specific service/product, mention those details too.

4. Payment Method

Specify how the payment was made. For example, note if it was paid by bank transfer, credit card, cash, or any other method. This helps track different payment types for accounting purposes.

5. Additional Notes

If relevant, include a description of goods/services provided or any additional terms related to the transaction. This adds transparency for both parties.

6. Footer Information

End the receipt with your company registration number, VAT number (if applicable), and any necessary legal disclaimers. This ensures the receipt meets UK tax and business regulations.

Include the following details in your payment receipt:

- Receipt Number – Assign a unique number to each receipt for easy reference.

- Date of Payment – List the exact date the payment was received.

- Payment Method – Specify how the payment was made (e.g., cash, card, bank transfer).

- Amount Paid – Clearly state the total amount received, along with any breakdown (e.g., VAT or itemized costs).

- Details of the Recipient – Include the name and address of the entity receiving the payment.

- Payer’s Details – Provide the name and, if relevant, contact information of the payer.

- Transaction Description – Describe the purpose of the payment (e.g., for goods, services, deposit).

- VAT Details (if applicable) – If VAT was charged, include the rate and amount, as well as your VAT number.

- Terms of the Transaction – If needed, outline any specific terms or conditions tied to the payment.

Including these elements will ensure clarity and help avoid misunderstandings or disputes. It also supports accurate record-keeping for both the payer and recipient.

Common Mistakes to Avoid When Issuing Receipts in the UK

Accuracy is key when issuing receipts in the UK. Mistakes can cause confusion and legal issues. Here are some common pitfalls to watch out for:

1. Incorrect Details on the Receipt

Ensure all necessary information is included, such as the business name, address, date, and amount paid. Missing details can invalidate the receipt and cause problems for both the buyer and the seller.

2. Failing to Include VAT Information

If your business is VAT registered, make sure the VAT number and the amount of VAT charged are clearly stated. Not including this information can lead to fines or audits from HMRC.

3. No Receipt for Small Transactions

Even for small amounts, providing a receipt is a good practice. It helps maintain clear records and avoid misunderstandings. It’s also important for returns or disputes.

4. Not Offering Receipts for Digital Payments

Always issue receipts for online transactions, just like you would for cash or card payments. Many customers rely on email receipts for their records.

5. Failing to Sign or Stamp the Receipt

While it’s not always mandatory, adding a signature or stamp to receipts can add legitimacy. This is especially important for larger transactions or where you’re legally required to keep records.

6. Incorrect Dates and Times

Ensure the receipt date and time match the actual transaction. A mismatch can cause confusion and make it harder to track payments.

7. Providing a Non-Itemised Receipt

Itemising each product or service provided on the receipt helps avoid confusion. A clear breakdown is necessary for both customer transparency and proper accounting.

8. Not Keeping Copies for Your Records

Retaining copies of all receipts issued is important for tax purposes and to resolve potential disputes. Failing to do so could make it difficult to prove transactions in the future.

9. Overlooking Refunds or Adjustments

If a refund or adjustment is made, ensure it’s properly documented and reflected on a new receipt. This avoids discrepancies in your accounting records.

10. Ignoring Local Regulations

Different industries may have specific rules on what should appear on a receipt. Stay informed about any requirements for your business sector to avoid penalties.

In the UK, payment receipts must comply with certain legal standards to ensure clarity and accuracy. A receipt should clearly state the transaction details, including the amount paid, the date of payment, the goods or services provided, and the method of payment used. For businesses, this is crucial for tax reporting and transparency.

Receipts issued by businesses must also reflect the name and address of the business, along with its VAT number, if applicable. For transactions involving VAT, the receipt should specify the VAT amount charged and the VAT registration number of the seller.

Under the Consumer Rights Act 2015, if a customer makes a complaint about the product or service, the receipt can act as proof of purchase. This can be vital for refund or exchange claims, especially when dealing with faulty goods.

In addition, businesses are required to issue receipts for cash transactions exceeding £250, which ensures compliance with anti-money laundering regulations. While digital receipts are becoming more common, they must still meet the same criteria as paper receipts to be legally valid.

Customizing a payment receipt template should align with the unique needs of your business type. Start by tailoring the design to reflect your brand’s identity. This includes adding your company logo, business name, and contact details, which creates a professional look while ensuring customers can easily reach you if needed.

For retail businesses, include product details such as the item description, quantity, and price. You may also want to add fields for discounts, taxes, and shipping fees. This clarity ensures customers know exactly what they’re paying for.

For service-based businesses, like consultants or repair services, break down the hours worked, hourly rate, and any additional fees. This provides transparency in how the total cost was calculated, helping customers understand the value they’re receiving.

If your business operates in a subscription model, ensure your receipt template captures recurring payments, renewal dates, and payment cycles. This way, customers will always have a clear record of their subscription status and next payment due.

Nonprofits or donation-based organizations should focus on including donation amounts, event names, and tax-exempt status if applicable. Offering a clear breakdown will help donors track their contributions for tax purposes.

Here’s an example of a simple payment receipt template structure for different business types:

| Business Type | Customizable Fields |

|---|---|

| Retail | Product name, quantity, price, discounts, taxes, shipping fees |

| Service | Hours worked, hourly rate, service details, additional fees |

| Subscription | Subscription plan, renewal date, payment cycle, amount |

| Nonprofit | Donation amount, event name, tax-exempt status, donor information |

By incorporating these elements, you provide clear and professional receipts that cater to your business model, leaving customers with no confusion about their payments. Adjust your template regularly to reflect any changes in your pricing structure or business offerings.

To ensure that your receipts are valid and legally compliant in the UK, include specific information required by law. Each receipt must contain the name and address of the seller, the date of the transaction, a description of the goods or services provided, and the amount paid. Additionally, for VAT-registered businesses, the receipt must include the VAT number and the amount of VAT charged.

Keep Clear and Accurate Records

Ensure that your receipts are clear and unambiguous. Avoid vague descriptions and always provide the quantity and type of goods or services sold. Include any discounts or promotional offers that were applied. If a payment was made using multiple methods, such as cash and card, make sure this is reflected accurately on the receipt.

Compliance with Consumer Protection Laws

Receipts should comply with UK consumer protection laws, which require businesses to offer a refund or replacement in certain circumstances. Make it clear on the receipt whether the items are returnable, along with the time frame for returns or exchanges. This information can help avoid future disputes and demonstrate that your business follows legal requirements.

I have retained the key terms and meaning, eliminating unnecessary repetitions.

When creating a payment receipt template, clarity and structure are crucial. A clear format helps both the payer and the payee ensure the transaction is accurately documented. Include the following key elements:

| Section | Description |

|---|---|

| Receipt Title | Clearly label the document as a payment receipt to distinguish it from other forms. |

| Date | State the exact date the payment was made to avoid confusion. |

| Payer Details | Include the name, address, or contact information of the individual or business making the payment. |

| Amount Paid | Clearly list the amount received and the currency used. |

| Payment Method | Specify the payment method (e.g., bank transfer, credit card, cash). |

| Recipient Details | Include the name and contact details of the recipient of the payment. |

| Transaction Reference | Include any reference number or transaction ID for easy tracking. |

| Signature | If applicable, include space for both parties to sign, verifying the transaction. |

By incorporating these elements, you ensure that the receipt contains all necessary information. Keep the layout simple and professional to avoid confusion. Avoid adding excessive details that are not related to the transaction itself.