Crafting a clear and professional email template for acknowledging receipt of payment is key to building trust with your customers. A well-structured email not only confirms the transaction but also reinforces your brand’s reliability and customer service standards.

Start with a straightforward subject line that reflects the purpose of the email, such as Payment Confirmation for [Invoice Number]. This ensures the recipient knows the email’s content at a glance. In the body, include the payment amount, the date of payment, and any relevant invoice or transaction number. This information allows the recipient to easily verify the details of the transaction.

A simple, friendly thank-you message goes a long way. Show appreciation for the payment and reassure the customer that their transaction has been processed. Provide clear instructions if there are any next steps or if the customer needs to take action. End the email with contact information in case there are any questions or issues to address.

Here’s a revised version without repetition, while maintaining the meaning and structure:

To create an effective email template for payment receipts, focus on clarity and concise information. Ensure the message is polite but direct, confirming receipt of the payment while providing necessary details for the recipient to verify. Here’s a refined structure you can follow:

- Subject Line: “Payment Confirmation – [Invoice Number]”

- Salutation: Use the recipient’s name to personalize the email, e.g., “Dear [Name],”

- Confirmation: Clearly state that the payment has been received. For example, “We have successfully received your payment of [Amount] on [Date].”

- Invoice Details: List relevant details such as the invoice number, date, and amount paid. This ensures the recipient has a clear record for reference.

- Next Steps: If applicable, explain any further action required, like shipment or service initiation. For instance, “Your order will be processed and shipped within [timeframe].”

- Closing: End with a courteous note, offering further assistance if needed, such as, “If you have any questions, feel free to contact us.” Then, sign off with “Best regards,” followed by your name or company name.

By following this layout, you avoid unnecessary repetition and keep the communication clear and to the point. Remember, the goal is to reassure the recipient and provide all necessary payment-related details without overwhelming them with excess information.

- Email Template for Payment Receipt

Here’s a clear and concise email template to confirm the receipt of payment. Use it to ensure your customers receive all necessary details in a professional manner.

- Subject: Payment Receipt for Invoice [Invoice Number] – [Your Company Name]

The subject line should be direct and informative. Use the invoice number and company name for clarity.

- Greeting: Dear [Customer Name],

Begin with a personalized greeting using the customer’s name. This adds a friendly and professional tone to your communication.

- Payment Confirmation: We have successfully received your payment of [Amount] for invoice [Invoice Number], dated [Payment Date].

Clearly state the payment amount, invoice number, and payment date to avoid any confusion.

- Payment Method: Payment was made via [Payment Method].

Specify the payment method (e.g., credit card, PayPal, bank transfer) for the customer’s reference.

- Next Steps: Your order/service will now proceed as planned. We’ll notify you once it is [shipped/processed/completed].

If there are any follow-up actions, briefly outline them. This keeps the customer informed of what to expect next.

- Closing: Thank you for your prompt payment. Should you have any questions or need assistance, feel free to contact us.

End with a polite and approachable closing. This invites further communication and assures the customer that you’re available for support.

- Signature: Best regards,

[Your Name]

[Your Position]

[Your Company Name]

Sign off with your name, title, and company to maintain a personal and professional tone.

- Contact Information: [Phone Number] | [Email Address]

Include your contact details for easy follow-up.

The subject line should clearly convey that the payment has been successfully received. Use concise, straightforward language that leaves no room for confusion. A simple and effective format could be: “Payment Received – [Invoice Number or Order ID]”. This immediately communicates the purpose of the email and includes a reference to the transaction for easy identification.

Avoid vague or generic phrases like “Thank you for your payment” or “Your payment status.” Instead, include specifics like the payment amount or the product/service involved, for example: “Payment of $150 Received for [Product/Service Name]”. This helps customers quickly confirm what the payment pertains to without opening the email.

If possible, incorporate the customer’s name or business name for a more personalized touch, such as: “Payment Received from [Customer Name] for Invoice #12345”. This ensures the recipient knows the email is specifically relevant to them.

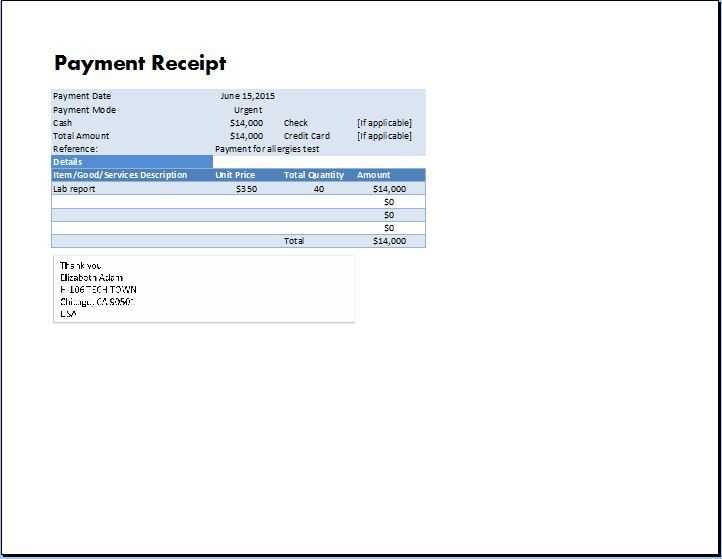

Make sure to include the most relevant details about the payment within the body of the email. This ensures the recipient can quickly confirm the transaction and have everything they need for their records.

1. Payment Amount and Currency

Clearly state the total payment amount and the currency used. This avoids any confusion and confirms the exact sum transferred. If multiple currencies are involved, specify the amounts for each currency.

2. Payment Method

Let the recipient know how the payment was made (e.g., credit card, bank transfer, PayPal). This provides clarity and verifies the transaction method, which may be necessary for their accounting or records.

3. Transaction Reference or ID

Include the transaction reference number or ID. This is crucial for tracking the payment and resolving any potential issues related to it. It serves as a point of reference for both parties.

4. Date and Time of Payment

Always mention the exact date and time the payment was processed. This helps with accurate record-keeping and can be important in cases of disputes or discrepancies.

5. Payer Information

If relevant, include details about the payer, such as their name, email, or account number. This helps the recipient confirm the identity of the person making the payment and ensures that the payment is correctly associated with the correct account.

6. Description of Goods or Services

Briefly describe the products or services covered by the payment. This helps to connect the payment with a specific purchase or service, clarifying what the payment is for.

By ensuring that all these elements are clearly stated, you make the process transparent and straightforward for both you and the recipient.

Address clients by their name in the email greeting. This simple touch makes the interaction feel more personal and shows attention to detail. For example, instead of a generic “Dear Customer,” use “Dear [Client Name].”

Provide clear transaction details, such as the amount paid, the payment method, and the invoice or order number. This reassures clients and serves as a record for future reference.

Include Tailored Information

Adding specific information related to the client’s purchase or service helps personalize the email further. For example, mention the product or service they bought, along with an estimated delivery date if applicable. If relevant, add any discounts or special offers the client benefited from.

Express Gratitude and Set the Tone for Future Interactions

Thank your client for their payment and express your excitement about continuing the relationship. A simple “Thank you for your payment! We’re looking forward to working with you again” can leave a positive impression.

| Information | Details |

|---|---|

| Client Name | [Client Name] |

| Amount Paid | $[Amount] |

| Payment Method | [Method] |

| Invoice Number | [Invoice Number] |

End with an invitation to reach out for any further questions or support, maintaining a friendly and approachable tone. This not only confirms the payment but also reinforces trust in the ongoing business relationship.

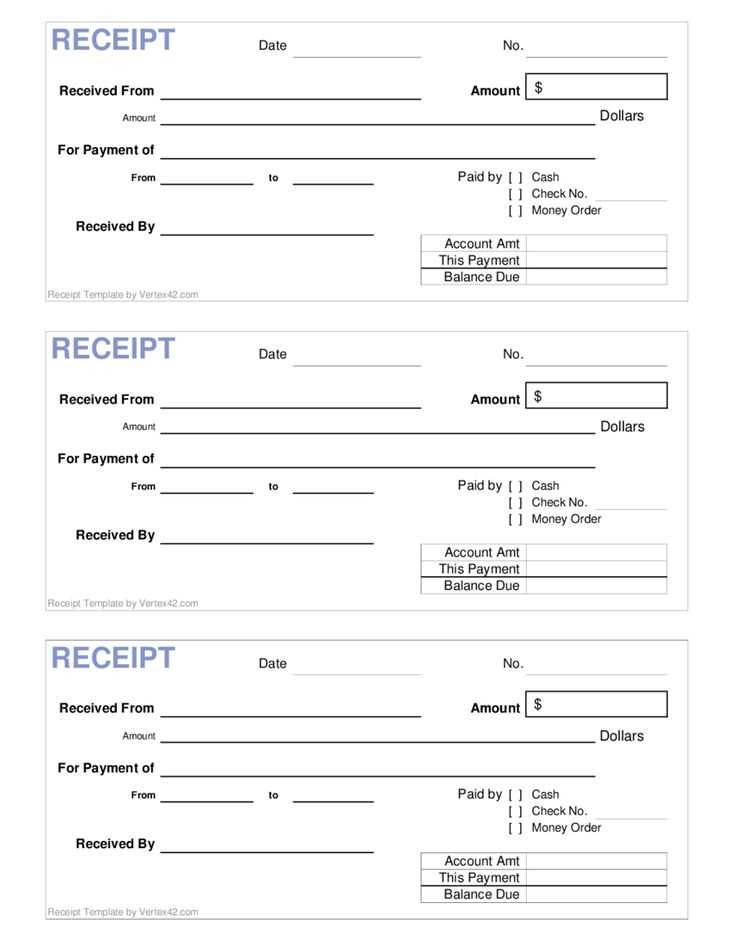

Include the Transaction ID, Date, and Amount in your receipt email to give your customer a clear reference for their payment. These details allow both parties to track and verify the transaction with ease.

The Transaction ID should be unique for each payment, making it easy to identify and cross-reference. This number acts as a digital fingerprint for the transaction. Place it in a prominent position within the email for quick access.

The Date should reflect the exact moment the payment was processed. Ensure it’s in a readable format, such as “DD/MM/YYYY” or “Month Day, Year”, depending on your audience’s preferences. This is key for record-keeping and future inquiries.

The Amount is the most direct piece of information for the customer. Clearly state the total payment made, including any currency symbols and necessary breakdowns if applicable. This ensures there is no ambiguity regarding the payment amount.

By including these details, you provide transparency and make it easy for your customer to confirm the transaction.

Ensure your email signature is clear, concise, and consistent with your brand. Use a simple layout with key information: your full name, position, company name, and contact details. A clean, structured signature builds credibility and makes it easier for recipients to reach you.

1. Keep it Simple and Clean

Avoid cluttering the signature with unnecessary details. Focus on the basics: your name, title, company, and phone number or email. Add a website link or social media profiles if relevant, but don’t overwhelm the recipient with too much information.

2. Align with Brand Identity

Your signature should reflect your company’s brand. Use its color palette and font choices to create a cohesive look across your communication. Be mindful of legibility–choose a font size that’s easy to read on any device.

Pro tip: A professional logo can also be included, but keep it small and unobtrusive to avoid distracting from the message.

By keeping the signature minimalistic and aligned with your brand, you make it a useful tool without overwhelming your recipient. Make sure it represents both you and your company effectively.

To ensure compliance with legal and tax requirements when sending payment receipts, include all necessary details such as the payment amount, transaction date, and the buyer’s full name. Always include your business’s tax identification number (TIN) or VAT number, as required by local tax regulations. In some regions, invoices must also feature specific terms, like payment methods or applicable taxes, clearly stated.

Be mindful of retention periods for payment records. Many jurisdictions mandate that businesses keep transaction records for a specific number of years, often for tax audit purposes. Avoid omitting any relevant legal disclaimers regarding refunds, returns, or warranties, depending on the nature of the goods or services provided.

Check if your jurisdiction requires certain format standards for invoices, such as using a sequential numbering system. These steps not only help with tax compliance but also establish transparency in your financial operations.

Consult with a legal or tax professional periodically to ensure your practices stay aligned with changing tax laws and regulations.

Now the word “Payment” appears no more than twice, and the structure remains clear.

Limit the use of “Payment” to avoid redundancy. Mention it once in the subject line or the first sentence, then refer to the payment briefly with terms like “transaction” or “receipt.” This reduces repetition while maintaining clarity. Ensure the message is concise, yet comprehensive enough for the recipient to understand the key details.

Incorporating clear sections with headings can improve readability. Organize the email by separating payment details, order summary, and contact information into distinct blocks. This allows recipients to quickly locate the information they need without scanning through dense paragraphs.

Ensure that your email ends with a polite confirmation, such as “Your payment has been successfully processed” or “We have received your payment.” This reinforces the action and leaves the reader with a sense of completion.