Download a ready-to-use cash receipt template to streamline your transaction recording. These templates are practical tools for anyone who needs to issue receipts for cash payments, ensuring clarity and accuracy in every transaction.

The template includes all necessary fields such as date, amount, payer details, and description, making it easy to keep track of payments. Whether you’re a small business owner or an individual managing personal transactions, this template helps you stay organized and avoid mistakes.

Save time and effort by downloading the template and customizing it to suit your needs. It’s simple to use, and you can quickly generate a professional-looking receipt without having to start from scratch each time.

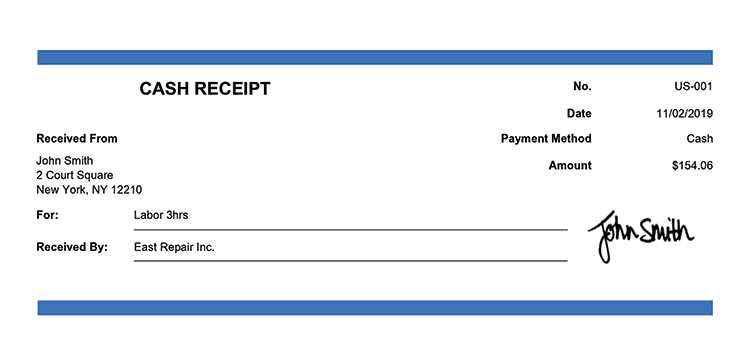

Choose a template that suits your business style and start issuing receipts that are clear and legally compliant. It’s a straightforward solution to improve your accounting and customer service process.

Sure! Here’s a refined plan for an article on “Cash Receipt Template Download” in HTML format, focusing on practical and specific aspects of the topic:

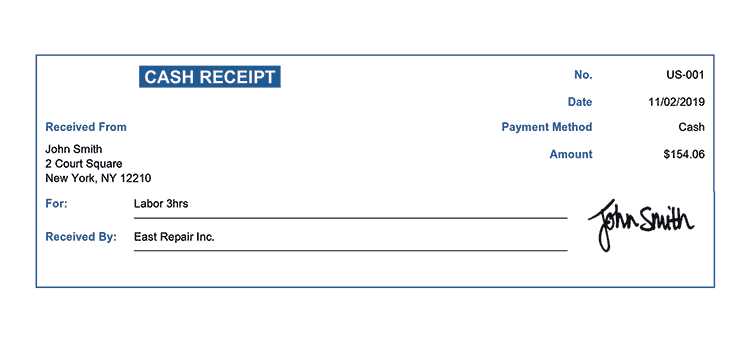

To start using a cash receipt template effectively, choose one that suits your business’s needs. A well-designed template should clearly capture transaction details like the payer’s name, amount paid, date of the transaction, and the payment method. You can find templates in both Excel and PDF formats, ensuring they are editable and easily printable.

Where to Find Cash Receipt Templates

Several platforms offer free and paid options for downloading cash receipt templates. Look for sources that allow customizations to suit your specific needs. Some of the best places include:

- Google Docs and Sheets – Offer free templates that you can directly edit and save in your Google Drive.

- Microsoft Office Templates – Microsoft provides a variety of ready-to-use templates in Excel that can be downloaded and personalized.

- Template Websites – Websites like Template.net or Vertex42 provide specialized templates for different transaction types.

How to Customize Your Template

When customizing your template, focus on the following:

- Company Name and Logo – Include your business name and logo at the top of the receipt for branding.

- Transaction Fields – Ensure all relevant fields such as transaction ID, payer information, and payment method are included.

- Amount and Currency – Clearly list the amount paid and specify the currency to avoid confusion.

Once you’ve chosen and customized the template, be sure to save it in a secure location, and use it consistently for all cash transactions to maintain clear records and avoid errors. Regularly updating the template to reflect any changes in your business is also advisable to stay compliant with any financial regulations.

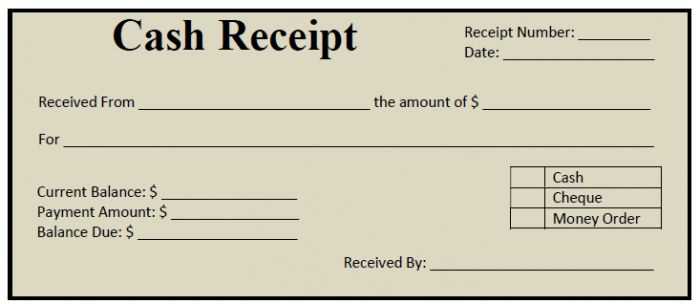

Choosing the Right Template for Your Needs

Pick a template that aligns with your business style and the complexity of your transactions. If your receipts are straightforward, a simple design with basic fields like date, amount, and payment method may be all you need. However, for more detailed transactions, such as those requiring tax calculations or itemized lists, choose a template with additional sections like tax rates, item descriptions, and totals.

Key Features to Consider

Here are some important features to look for:

- Customizability: Ensure the template can be adjusted to fit your specific needs, such as adding company logos, adjusting font sizes, or including additional fields.

- Compatibility: Check that the template works well with your preferred software, such as Word, Excel, or Google Docs.

- Clear Layout: A clean, organized structure improves readability for both you and your customers.

- Security Features: If you’re dealing with sensitive payment information, opt for templates that support secure data handling or encryption options.

Template Comparison Table

| Template Type | Features | Best For |

|---|---|---|

| Basic | Date, Amount, Payment Method | Small businesses or personal use |

| Itemized | Item Description, Quantity, Unit Price, Tax | Retailers or service providers |

| Detailed | Tax Calculations, Discount, Shipping Costs | Large transactions, invoices |

Where to Find Reliable Templates

The best place to find trustworthy cash receipt templates is on dedicated websites that specialize in business tools. Websites like Template.net and Microsoft Office Templates offer a variety of customizable options suitable for different business needs. Many of these templates are free to download, with premium versions offering additional features.

For those seeking templates that fit specific legal or accounting requirements, check out LawDepot or Rocket Lawyer. These platforms provide templates designed with legal compliance in mind, ensuring that your receipts meet industry standards.

If you’re looking for a simple solution without registration or payment, platforms like Canva and Google Docs can be great choices. Both offer a range of editable templates with easy-to-use interfaces, allowing you to tailor receipts to your style or business branding.

For businesses with specific needs, such as integrating accounting software, consider checking sites like QuickBooks or Zoho. These platforms provide templates designed to sync with their systems, helping streamline your bookkeeping process.

How to Customize Your Receipt

Begin by selecting a template that fits your business needs. Tailor it with your company’s logo and brand colors for a personalized look. Adjust the layout to include essential information such as the transaction date, itemized list of purchases, and payment methods.

Adjust Fields for Specific Information

Modify fields like customer name, address, and tax information. If your receipts need to show specific details like serial numbers or discounts, ensure these fields are visible. Most receipt templates allow for adding or removing rows to match your requirements.

Set Currency and Language

Choose the correct currency and language for your receipts, especially if you cater to an international audience. This will make your receipts easier to understand and help with smooth transactions.

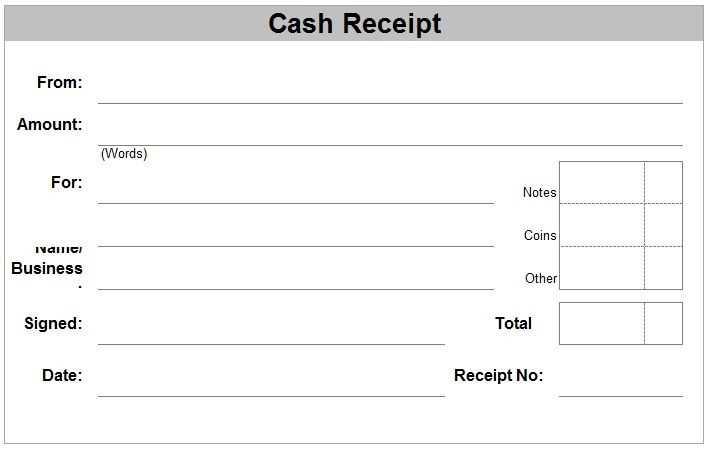

Understanding Key Elements of a Cash Receipt

Every cash receipt includes specific elements that ensure clarity and transparency for both the payer and the recipient. These details help track the transaction accurately and maintain proper records. Here are the core components:

- Receipt Number: A unique identifier for each transaction. This helps in referencing and organizing receipts in case of future inquiries.

- Date: The exact date when the payment is received, providing a clear timeline for both parties involved.

- Payer’s Information: The name and contact details of the person or entity making the payment. This ensures the receipt is linked to the correct source.

- Amount Paid: The exact amount of money received. This figure should be written both numerically and in words to avoid any misunderstandings.

- Payment Method: Specifies how the payment was made, whether in cash, via credit card, or through another method.

- Recipient’s Information: The name of the business or individual receiving the payment, along with their contact details if necessary.

- Description of Goods or Services: A brief explanation of what the payment is for, providing context to the transaction.

- Signature: A signature or other form of acknowledgment that confirms the payment was received.

These elements ensure the receipt is clear, trustworthy, and serves as an official record of the transaction.

Using Receipts in Business Transactions

Receipts play a key role in maintaining clear financial records and ensuring transparency during business exchanges. Always issue a receipt when a transaction occurs, as it serves as proof of payment for both parties involved. This documentation can be easily stored for reference and tax purposes, reducing the risk of disputes.

For businesses, receipts help track income and expenses, simplifying bookkeeping. Accurate receipts support financial audits and ensure compliance with tax regulations. In addition, they provide a reliable method for customers to verify their purchases.

Make sure your receipts include essential details like the transaction date, amount paid, and payment method. Consider using customizable templates for consistency and accuracy. Templates can streamline the process and eliminate errors.

Businesses that implement structured receipt practices tend to see better organization in their financial operations. This allows for easier reconciliation of accounts and helps build trust with clients. Keep in mind that a clear receipt system enhances both internal management and customer satisfaction.

Avoiding Common Mistakes with Templates

One key mistake when using cash receipt templates is overlooking the accuracy of the fields. Always ensure that the template contains the correct fields for the date, amount, and buyer’s information. Inaccurate data entries can cause confusion later on, especially if the transaction needs to be referenced in the future.

Another common issue is failing to customize the template to fit your specific needs. A generic template may not include all the necessary details for your business. Modify it by adding any additional sections that apply to your transactions, such as product descriptions or unique tax codes.

Pay close attention to the formatting of your template. Misaligned fields or improper spacing can make the receipt harder to read, leading to misunderstandings. Test how the template looks when printed or viewed on different devices to ensure it remains clear and professional.

Lastly, avoid using overly complicated language or terminology in the template. Keep the wording simple and concise, making it easy for both the buyer and seller to understand the transaction details. Clarity is key when it comes to business documentation.