If you’re looking for a simple and organized way to manage donation receipts, a donation receipt book template can save you time and effort. This template will help you create accurate, professional-looking receipts that meet all the necessary legal requirements, ensuring transparency for both donors and organizations.

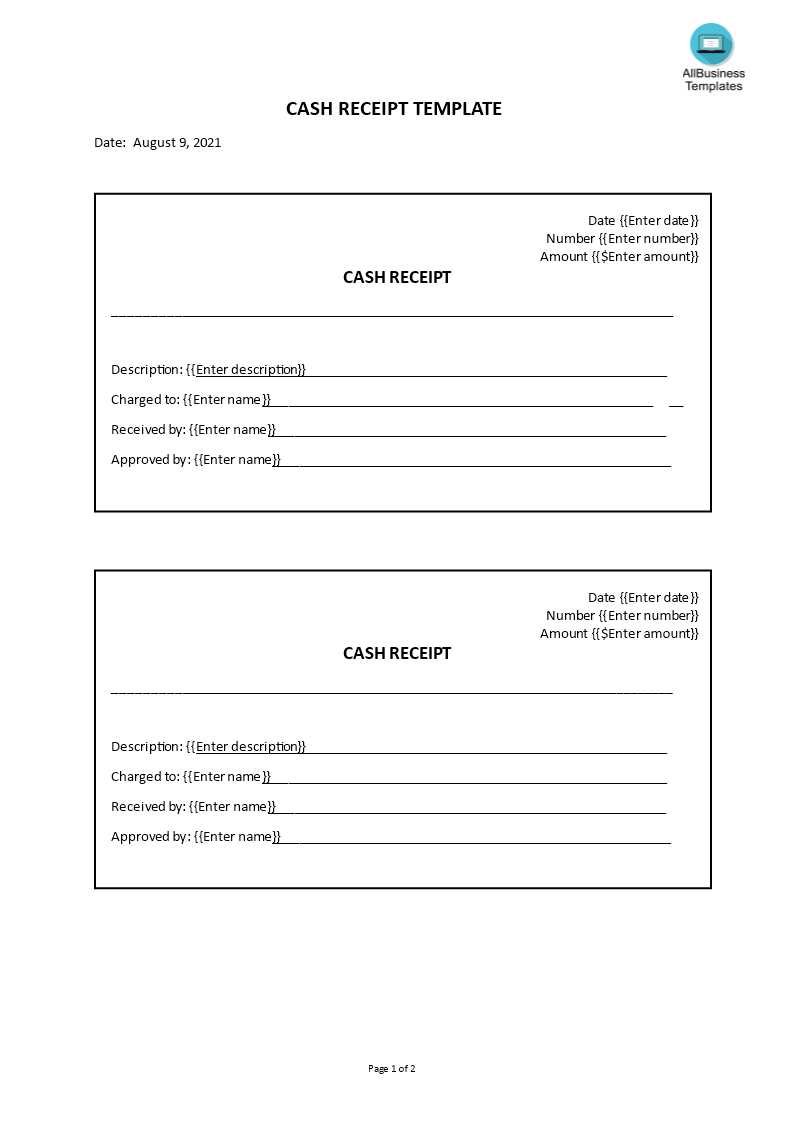

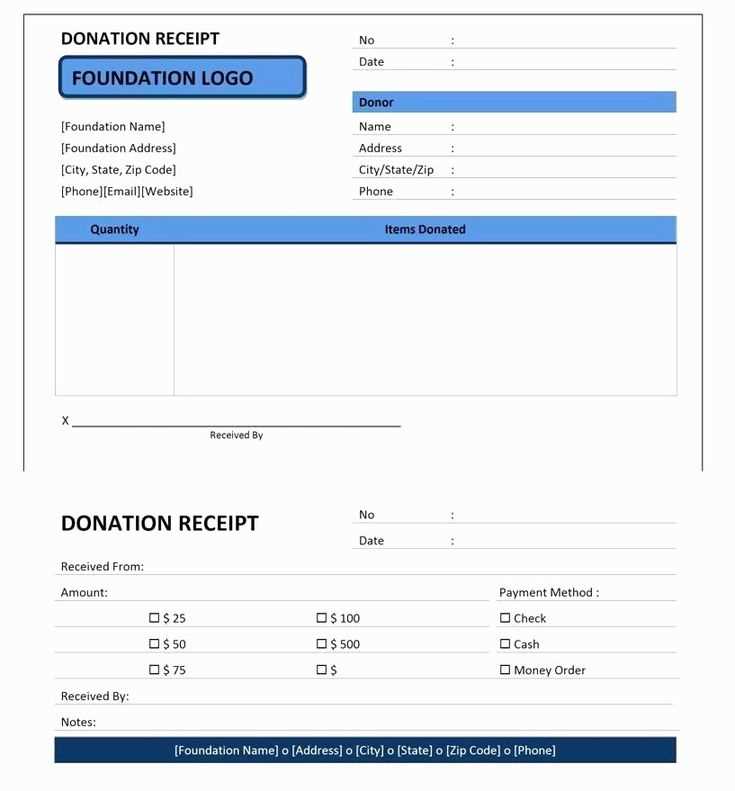

Each receipt should clearly indicate the donor’s name, donation amount, date of donation, and the organization’s details. A well-designed template ensures that this information is structured for easy reference. Use placeholders for essential details and make sure there’s enough space for adding additional notes or specifics about the donation, like in-kind contributions or special instructions.

It’s also a good idea to include a unique receipt number for tracking purposes. This way, donors can easily reference their contributions when needed. Consider integrating a section for the donor’s contact information, especially if you plan on sending future communications or tax-related updates.

By using a template, you can create consistent and reliable records every time a donation is made. Whether it’s a one-time donation or recurring contributions, a well-organized donation receipt book simplifies the process for both sides, enhancing your overall workflow.

Here’s the corrected version:

To create a donation receipt book template, ensure that each receipt includes the donor’s full name, the date of the donation, the donation amount, and a clear statement confirming that no goods or services were provided in exchange. Provide space for the organization’s name and contact information at the top. This ensures transparency and compliance with tax regulations.

Include a unique receipt number for each transaction. This helps keep records organized and prevents duplication. It’s also useful to have a signature line for the organization’s representative to validate the receipt.

Make sure the template is easy to use and print, with a clean layout. Each page should be numbered sequentially, and there should be space for multiple donations on each page if necessary.

- Donation Receipt Book Template

Choose a donation receipt book template that is simple, clear, and customizable to fit your needs. This will help you provide accurate records for donors and ensure proper documentation for tax purposes. Below is a recommended layout for your donation receipt template:

Template Structure

| Section | Details |

|---|---|

| Donor’s Name | Include the full name of the donor. |

| Donation Amount | Specify the amount donated, either in cash or kind. |

| Date of Donation | Include the exact date when the donation was made. |

| Charity/Organization Name | Clearly state the name of the receiving organization. |

| Tax ID or Registration Number | If applicable, include the charity’s tax ID for donation verification. |

| Receipt Number | Each receipt should have a unique number for record-keeping. |

| Donation Type | Specify if the donation is in cash, check, or goods. |

| Donor’s Address (optional) | Include the donor’s address for mailing purposes if necessary. |

Formatting Tips

Use a clean font and clear sections. Ensure that each receipt includes all the relevant details and provides enough space for donors to read the information easily. A well-structured template is crucial for both the organization’s record-keeping and donor transparency.

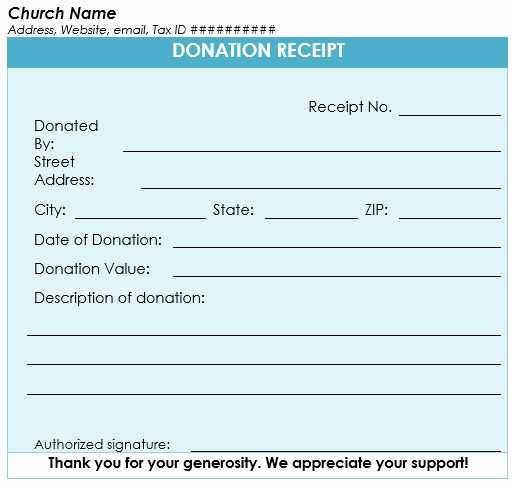

Adjust your donation receipt book to reflect your organization’s identity and meet legal requirements. Begin by adding your logo at the top of the receipt. This simple step makes the document recognizable and professional. Ensure the receipt includes the organization’s name, address, and contact information.

Customize Fields

Include specific donation details like the donor’s name, donation amount, and date. You can also add a unique receipt number for tracking purposes. If you are offering tax receipts, make sure to state that the donation is tax-deductible, and provide any additional information needed for tax reporting.

Design and Layout

Choose a layout that is clear and easy to follow. Keep the font simple and readable. Use borders or shading to separate sections like donor information, donation amount, and any thank-you messages. You can add a thank-you note at the bottom to show appreciation for the donor’s contribution.

Finally, ensure your receipt complies with local regulations. Different regions may have different rules for the format and content of donation receipts, especially concerning tax exemptions. Double-check these rules to avoid mistakes.

Each region has specific legal requirements for issuing donation receipts, and it’s critical for organizations to comply with these rules to ensure donations are tax-deductible for donors. Here’s a breakdown of key requirements in various regions.

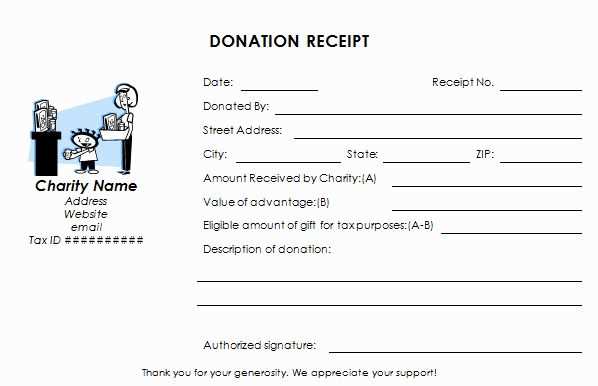

United States

In the U.S., the IRS mandates that donation receipts include the donor’s name, donation amount, and the date of the gift. Nonprofit organizations must provide a written acknowledgment for any donation over $250. For donations of goods, a description and an estimate of the goods’ value must be included. Receipts should also state whether any goods or services were provided in exchange for the donation.

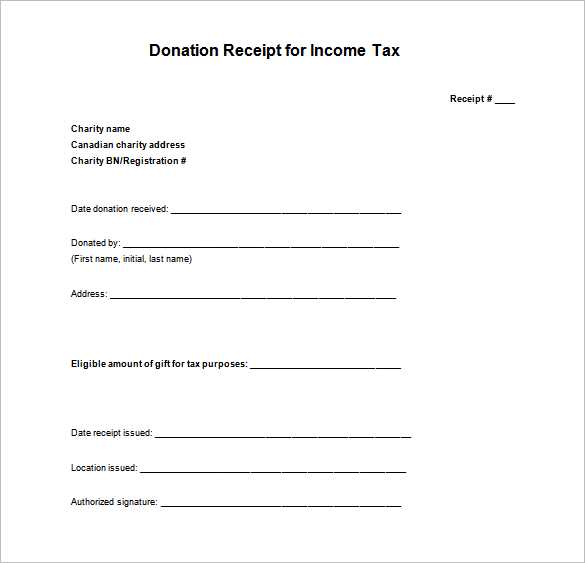

Canada

Canada requires that receipts for charitable donations include the donor’s name, address, amount donated, and the registration number of the charity. Receipts must also specify the date of the donation. For gifts in kind, charities must provide a description of the donated item. For donations over $200, the tax receipt should be issued by the charity for the full value of the donation, with no deductions for the value of any goods or services received in return.

United Kingdom

In the UK, receipts must contain the donor’s details, donation amount, and the charity’s registration number. For donations exceeding £250, charities need to issue a gift aid declaration to ensure the donor can claim tax relief. The receipt should also specify if goods or services were provided in exchange for the donation, and the value of those goods or services must be indicated.

Australia

Australia requires charities to provide receipts for all donations of $2 or more. The receipt must list the donor’s name, the donation amount, and the charity’s ABN (Australian Business Number). For donations of goods, the receipt must describe the items and include their estimated value. The receipt should also mention if the donor received any benefit in return.

Clearly state the name of the organization or individual receiving the donation. This helps donors easily identify where their contribution is going.

Include the donor’s full name and address for proper record-keeping, especially for tax purposes. It also helps in sending acknowledgment letters or tax receipts later on.

Specify the date of the donation to track the timing of the contribution. This ensures that all records are up-to-date and accurate.

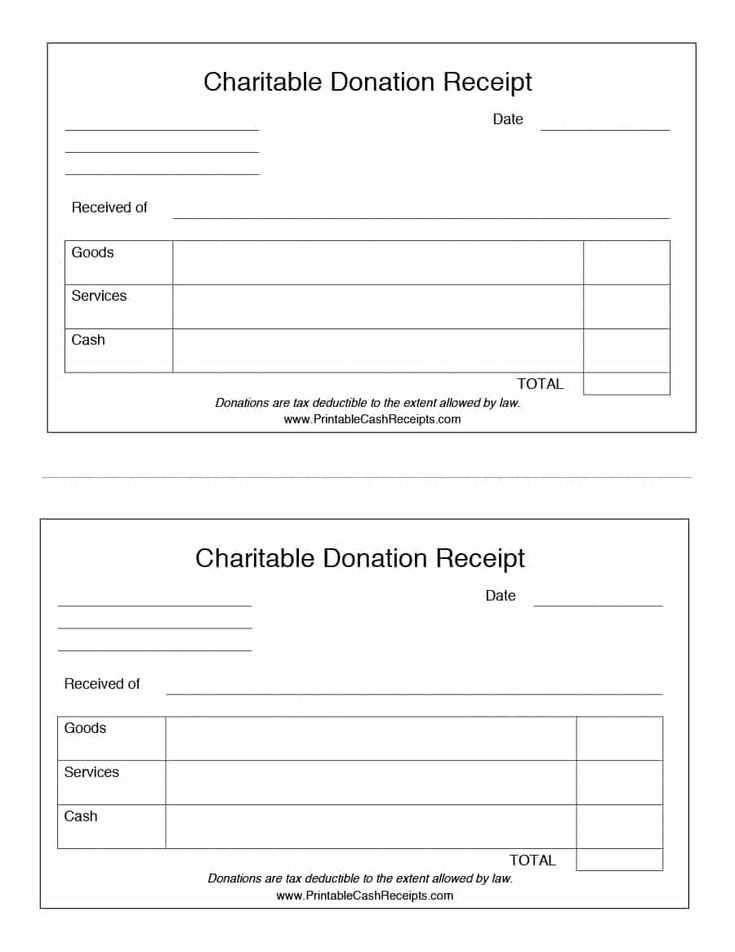

List the donation amount or item description, clearly stating whether it is a monetary donation or a physical gift. If applicable, specify the fair market value of donated goods.

If the donation is monetary, note the payment method (cash, check, or credit card) and any relevant transaction number. This provides an extra layer of verification.

If the donation is tax-deductible, include a statement confirming this status. Provide any necessary tax exemption number or reference to make sure the donor can claim the deduction if eligible.

For in-kind donations, describe the item(s) donated in detail. Include their condition, estimated value, and any other relevant details that will help clarify the donation.

If the donation was part of an event, mention the event name and date. This connects the donation to its source and ensures accurate records.

Pick a format that matches the scale and needs of your organization. If you’re dealing with smaller donations, a simple, manually filled-out template may be sufficient. For larger volumes, consider digital or pre-printed books to save time and reduce errors. Both options have advantages, but it’s important to think about accessibility, efficiency, and ease of use.

Paper vs. Digital

- Paper books: Great for small to medium-sized charities or organizations. They are simple and tangible, with no need for digital skills or devices. However, they can be cumbersome for tracking and storing large volumes of donations.

- Digital records: Offer better organization and quicker access to data. They can be backed up and shared easily, but require consistent internet access and some technical setup.

Design and Layout

- Choose a layout that allows for easy tracking. Include spaces for donor name, amount, date, and purpose of donation.

- Consider adding fields for any relevant tax details or instructions, especially for larger gifts.

- If you opt for a paper format, make sure the book has sufficient space for several donations per page, and that the ink doesn’t bleed or fade.

Keep each donation receipt organized by assigning a unique receipt number for easy reference. Start with a blank template and sequentially number your receipts to avoid confusion. Record the donor’s name, contact information, and donation amount. Be consistent with your entries and use clear handwriting or a reliable printer to ensure readability.

Separate your receipts into categories for better organization. You can group them by donation type (cash, check, in-kind) or by date. Use dividers or tabs in your receipt book to quickly locate specific transactions. Regularly update the records to avoid missing details.

Make a copy or take a photo of each receipt before handing it over to the donor. This serves as a backup and helps with tracking totals over time. Keep a running total of donations in a separate log, which will make reconciling your books simpler at the end of the month or year.

Designate a section in your receipt book for any notes, such as specific donor preferences or special instructions. This allows you to track any follow-up actions or acknowledgments needed.

Finally, review the entries periodically to ensure everything is accounted for. Use the organized receipts to prepare accurate reports, whether for internal use or tax purposes.

Choose high-quality paper for printing receipts to ensure readability and durability. Using thicker paper can also give the receipts a professional feel. Consider using a standard format that includes all the necessary information, such as the donor’s name, the amount donated, the donation date, and a statement confirming whether the donation is tax-deductible.

Set up a system to print receipts in batches, especially if you handle many donations. This saves time and ensures consistency across all receipts. If you’re printing manually, double-check the details on each receipt before distribution to avoid errors.

Offer digital receipts as an option for donors who prefer them. Sending receipts via email or providing them as downloadable PDFs can streamline distribution and reduce paper waste. Ensure the email subject and message are clear to make the process easy for the donor to follow.

If you distribute physical receipts, organize them by donation date or donor name. This method makes it easier to track and retrieve receipts when needed. If receipts are handed out in person, confirm the donor’s details before handing over the receipt to avoid mix-ups.

For tax purposes, include all necessary information, such as your organization’s legal name, address, and tax ID number. This can help donors when they file taxes and will help your organization stay compliant with regulations.

Now words do not repeat, yet the meaning remains intact.

To create a donation receipt book template, include the following key components:

- Donor Information: Name, address, and contact details for accurate record-keeping.

- Donation Details: Date, amount, and type of donation (cash, check, goods, etc.).

- Tax Information: A statement clarifying whether the donation is tax-deductible.

- Organization Details: Include the name, address, and tax identification number of your charity.

- Receipt Number: A unique identifier for each donation receipt, ensuring proper tracking.

Keep the layout clean and straightforward to make the template user-friendly and easy to print. Use standardized fonts and a logical structure, allowing donors to easily read their information and retain it for tax purposes.