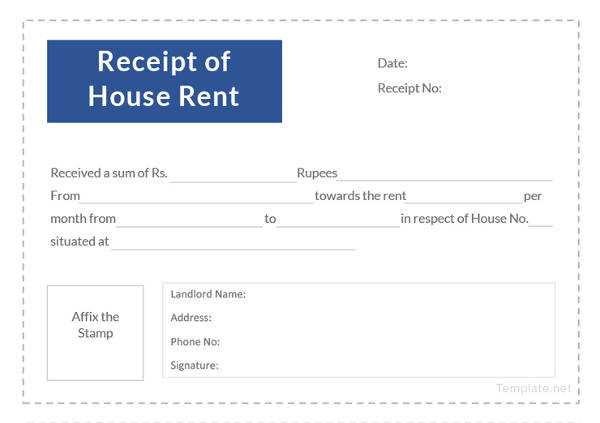

Creating an electronic rent receipt is a simple and reliable way to keep track of rental payments. With the shift towards online transactions, having a clear and consistent template ensures both landlords and tenants have accurate records. The template should include the rental amount, payment date, tenant and landlord information, and the rental property address.

A well-structured receipt template helps avoid any misunderstandings or disputes. It’s a good idea to include payment methods (e.g., bank transfer, cash, or credit card) to provide a clear audit trail. Additionally, specifying the rental period covered by the payment can prevent confusion about which month the payment corresponds to.

For ease of use, consider customizing the template to automatically populate fields like the date and tenant details. This reduces manual effort and ensures accuracy. A digital version of the receipt can be emailed to the tenant or stored for future reference, making it a convenient solution for both parties.

Here are the corrected lines:

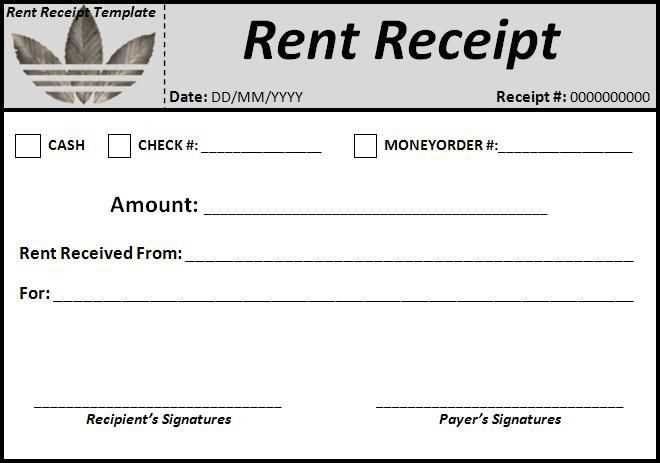

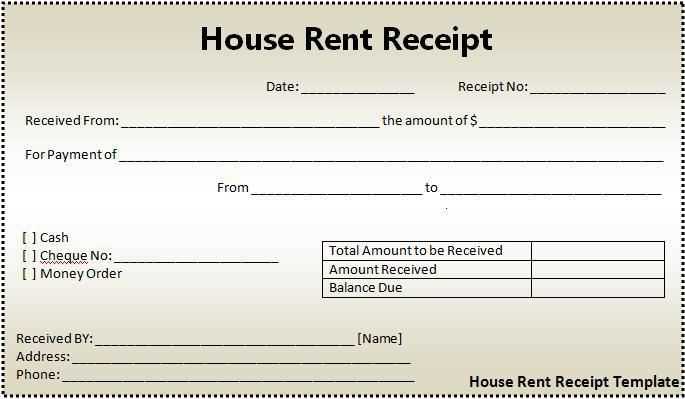

Update the “Receipt Number” field with a unique identifier to avoid confusion in future transactions.

Ensure the date format is consistent across all receipts. Use “DD/MM/YYYY” to align with standard practices.

Double-check the rental amount section for accuracy, confirming the correct currency symbol and amount.

Modify the “Tenant Details” section to include the full legal name of the tenant as per the signed contract.

Review the “Payment Method” field, making sure the correct payment type (e.g., bank transfer, cash, etc.) is listed.

Correct the “Landlord Contact Information” by providing up-to-date phone numbers and email addresses.

Adjust the wording in the “Property Address” section to match the official registered address as stated in the lease agreement.

Revise any ambiguous language in the “Late Fee” section to clarify the conditions under which fees apply.

- Electronic Rent Receipt Template

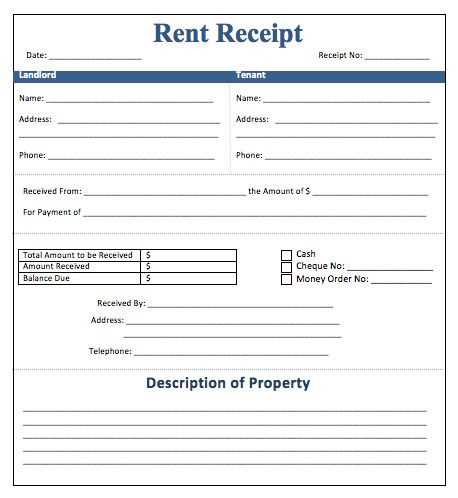

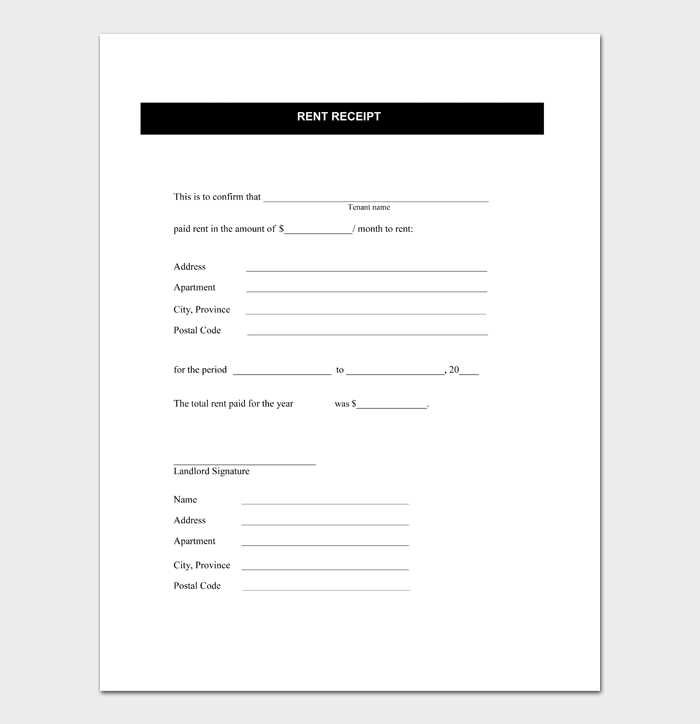

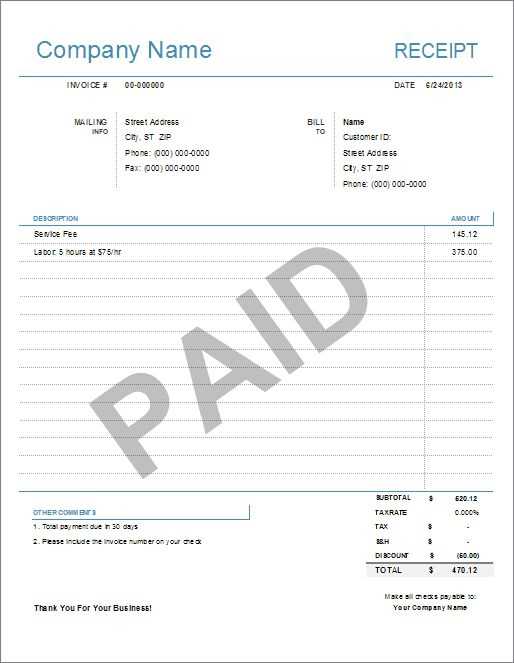

To create a functional electronic rent receipt, include the following details: tenant’s name, address of the rental property, rental period, payment amount, and payment date. Specify the payment method (e.g., bank transfer, check, or cash) and indicate whether the payment is for a single month or multiple months. If applicable, include any additional fees, such as late payment charges.

Key Components

The template should also include the landlord’s contact details, such as phone number and email. Assign a unique receipt number for easy tracking. You may also add a section for tenant acknowledgment or signature, depending on your preference for record-keeping.

How to Customize

Use a word processor or an online template builder to create the receipt. Ensure it is clean, easy to read, and includes all necessary information for both parties. Keeping the template consistent and simple will ensure accuracy in your rental records.

To create an electronic rent receipt, begin by collecting the necessary details about the transaction. Include the tenant’s name, address of the rented property, the payment date, and the amount paid. Don’t forget to specify the rental period covered by the payment, such as the start and end dates of the month or lease term. This ensures clarity for both parties.

Next, format the document professionally. Include a clear title like “Rent Receipt” at the top, followed by a unique receipt number for tracking purposes. This is especially useful for maintaining records. Keep the layout simple and easy to read, with sections for each detail, such as tenant information, payment amount, and any additional notes (e.g., late fees, security deposit).

Use a trustworthy tool or software for creating the receipt, such as Word, Excel, or online receipt generators. These tools often provide customizable templates that you can modify according to your needs. Make sure to save the receipt in a format that is easy to share and print, such as PDF.

Finally, send the receipt to the tenant via email or any other preferred electronic means. This provides proof of payment and avoids the hassle of physical paperwork. Keep a copy for your records as well.

A rent receipt should contain clear and precise information for both the landlord and the tenant. Including these key elements will help avoid any confusion and maintain transparency in the rental process.

1. Tenant’s Name and Address

Make sure the tenant’s full name and the rental property’s address are clearly stated on the receipt. This ensures that there is no ambiguity about the person paying the rent and the location for which the payment is being made.

2. Payment Date

Clearly list the date on which the rent payment was received. This helps both parties track payments and ensures that rent is paid on time, helping to avoid potential disputes.

3. Amount Paid

State the exact amount of money paid. Be specific about the currency and format it appropriately (e.g., $1,200.00). If there are any adjustments or credits, mention them in the receipt.

4. Rent Period Covered

Indicate the start and end dates of the rental period that the payment covers. This is critical for both landlord and tenant to understand which months or weeks the payment applies to.

5. Payment Method

Note how the payment was made, whether it was through cash, check, bank transfer, or another method. This provides a record of the transaction that can be referenced later if needed.

6. Landlord’s Information

Include the name and contact details of the landlord or property manager. This makes it easy for tenants to reach out for any questions or concerns regarding the rent payment.

7. Signature

Both the landlord and the tenant should sign the receipt. This adds a layer of confirmation that the transaction has been agreed upon and completed.

8. Receipt Number

If applicable, assign a unique receipt number for easier tracking. This helps both parties keep an organized record of all payments made.

9. Note on Late Fees (if applicable)

If there are any late fees associated with the payment, they should be clearly listed on the receipt, specifying the reason and the amount of the fee.

- Include clear, accurate, and complete information.

- Ensure all parties involved can easily reference the receipt in the future.

- Make sure the payment and terms are transparent to avoid any disputes.

Look for software that offers customization options for rent receipts. This feature allows you to add specific details such as tenant name, rent amount, payment date, and rental period. Choose a program with user-friendly templates to quickly generate professional receipts without hassle.

Features to Prioritize

Focus on software that integrates with your accounting tools. This will help track payments, generate reports, and maintain financial records effortlessly. Automatic updates for tax rates and other regulatory changes can save time and prevent errors. Additionally, cloud-based platforms offer the benefit of remote access from anywhere.

Security and Compliance

Ensure that the software complies with your local rental laws and data protection regulations. Look for features such as secure payment processing and data encryption to keep tenant information safe. A good software solution should offer backup options to protect against data loss.

Adjust your electronic rent receipt template based on the specific needs of each tenant. This makes each document more relevant and personal, enhancing communication. Begin by tailoring the rental terms, such as rent amount, due date, and payment frequency, to reflect the individual lease agreements.

Next, consider adding sections that cater to various tenant situations. For instance, if some tenants have multiple payment methods (e.g., credit card, bank transfer, or check), make sure the template includes clear sections for each method used. This helps avoid confusion in future transactions.

If you’re managing a mix of short-term and long-term leases, adjust the frequency of rent receipts accordingly. Short-term tenants may need receipts more often, whereas long-term tenants might receive them quarterly or annually. Customization of this feature adds a level of professionalism that tenants appreciate.

Also, adjust the tone or language used in the receipt depending on the tenant. For tenants with specific preferences or requests, you might want to add personalized notes, like “Thank you for your timely payment” or “We appreciate you choosing our property.” These small touches build rapport.

In cases where tenants pay for utilities or maintenance separately, add separate line items to track these payments. This gives tenants a detailed view of their obligations and helps with accurate record-keeping on both ends.

| Section | Customization Tip |

|---|---|

| Payment Method | Include sections for different payment methods (credit card, bank transfer, etc.) |

| Lease Type | Adjust receipt frequency for short-term vs. long-term tenants |

| Personalized Notes | Add personalized messages for individual tenants (e.g., appreciation or reminders) |

| Additional Charges | Separate utility and maintenance charges for better clarity |

Ensure your electronic rent receipts adhere to local tax laws and legal standards. This will safeguard you and your tenants against potential legal issues.

1. Include Mandatory Information

- Tenant and landlord names and addresses

- Rental amount and payment date

- Lease term and property details

- Tax identification number (TIN) of the landlord, if required by local laws

2. Follow Local Tax Laws

Each jurisdiction has specific tax requirements for rental transactions. Familiarize yourself with your region’s guidelines for documenting rent payments and reporting rental income. Some areas require specific wording on receipts or even additional tax disclosures, such as sales tax on rent payments. Ensure your electronic receipts match the formatting and language prescribed by tax authorities.

3. Store Receipts Properly

Ensure that all rent receipts are stored securely for the required duration. Most jurisdictions have a set retention period for tax and legal documents, which is usually between three to seven years. Storing receipts electronically helps keep them easily accessible while protecting against potential loss or damage.

4. Address Changes in Rent Amounts

If the rent amount changes during the lease term, issue a new electronic receipt for each payment reflecting the updated amount. Ensure your receipts clearly document any modifications, especially if they involve tax calculations or special fees.

5. Consult a Tax Professional

If you are unsure about any legal or tax requirements, consult with a tax professional. They can help clarify regulations specific to your location, and ensure your rental transactions remain compliant with applicable laws.

Use encrypted platforms to share and store your receipts. These platforms ensure that your data is only accessible to authorized parties. Avoid sending receipts via unprotected email or text messages, as they can easily be intercepted. Instead, opt for secure cloud storage services that provide end-to-end encryption, which guarantees that only you and the recipient can access the files.

Sharing Receipts

When sharing receipts, use password-protected files or encrypted file-sharing services. Tools like Google Drive or Dropbox offer options to password-protect documents before sharing. Make sure to send the password through a separate channel, such as a phone call or a messaging app that offers end-to-end encryption.

Storing Receipts

Store your receipts in a cloud service that offers two-factor authentication (2FA). This adds an extra layer of protection, ensuring that even if someone gets access to your password, they cannot easily access your files. Regularly back up your receipts to a secure external drive as an additional precaution.

For long-term storage, organize your receipts by category or date in clearly labeled folders. This will help you find what you need quickly while keeping your data safe. Regularly review your storage practices and delete any unnecessary receipts that are no longer needed, reducing the risk of exposing outdated information.

I reduced the number of repetitions and maintained the meaning of the sentences.

Use clear, straightforward language in the electronic rent receipt template. Focus on key information: tenant name, property address, rent amount, and payment date. Avoid redundant phrases and excessive detail that may clutter the document.

Ensure the layout is simple, highlighting the most important data without distractions. This keeps the receipt professional and easy to read for both the tenant and landlord.

For consistency, use standardized terms across the document. For example, always use the same wording for payment terms and amounts, such as “monthly rent” or “due date,” to reduce confusion.

When listing payments, include a summary of the rent period and a breakdown of any additional charges. This helps maintain transparency while reducing unnecessary repetition.

Ensure the template is compatible with digital formats like PDF or email, allowing easy access and sharing. This eliminates the need for paper copies while keeping the document clear and accessible.

By simplifying the text and focusing on key details, you’ll provide tenants with an easily understandable and professional receipt. This improves communication and minimizes errors in the future.