Creating an HSA receipt template requires clear formatting and specific data points that comply with healthcare spending requirements. Start by including the necessary details like the date of service, provider’s name, description of the service, and total amount paid. These elements ensure transparency and help with reimbursement claims.

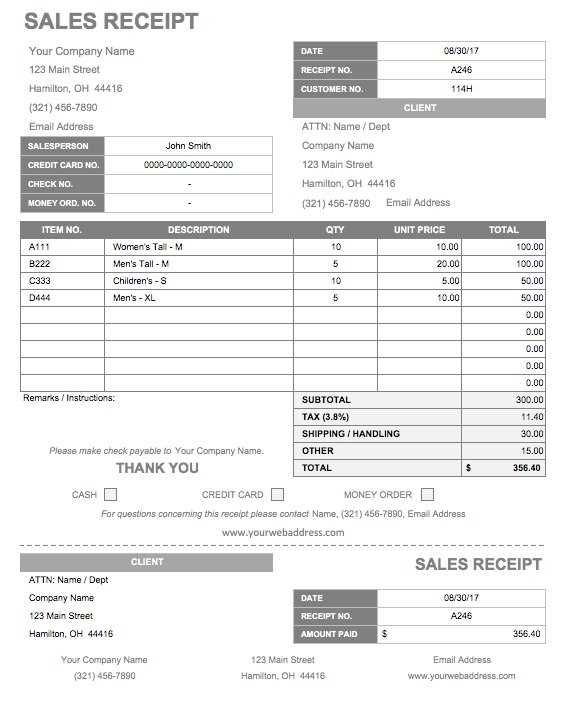

For maximum accuracy, ensure the template includes fields for itemizing each individual service or product purchased. This can prevent issues during reimbursement requests and make tracking healthcare expenses much simpler. If your template is digital, consider including checkboxes or dropdown options to streamline data entry.

Be sure to verify eligibility criteria before submitting any claims. Some services may not be covered by the HSA plan, and detailing this on the receipt can save time when filing for reimbursements. Additionally, providing both itemized and summary views will give users flexibility in presenting the data for their personal or tax records.

By customizing the template based on your specific HSA plan’s requirements, you can ensure the receipt serves its purpose without any confusion during the claims process. It’s a small but effective tool that can save both time and effort when dealing with health savings accounts.

Here’s the revised text, where repetitive words are shortened to 2-3 occurrences while maintaining meaning:

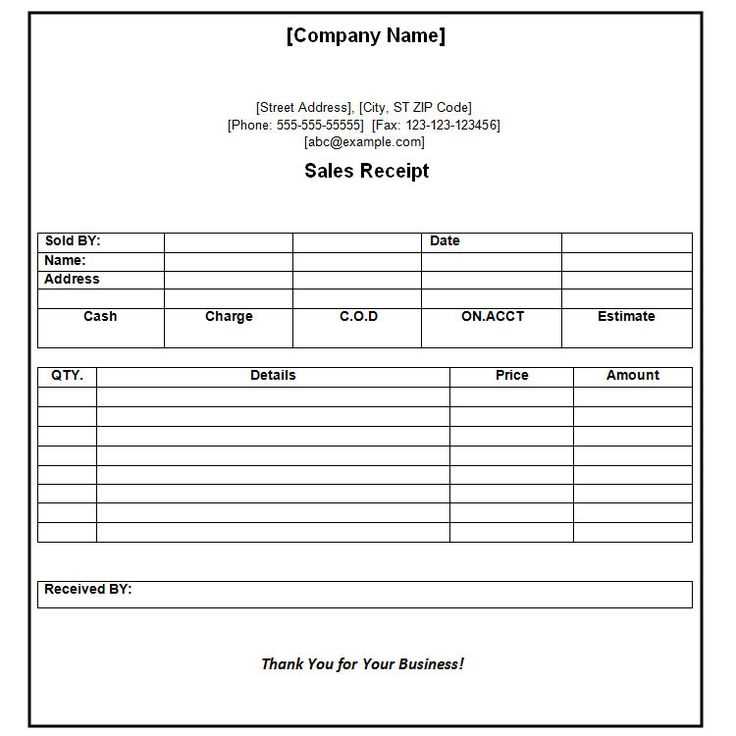

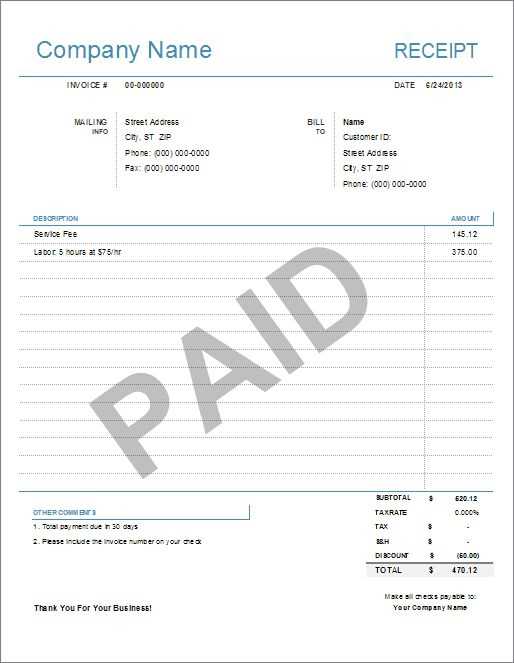

To create a clear and concise HSA receipt template, focus on the key components that ensure both compliance and clarity. Start with the recipient’s details, followed by the service provider’s name and contact information. Clearly list the items or services provided, including dates, amounts, and the total sum. Ensure that the format is easy to follow with well-defined sections for each element.

Streamlining the Design

Eliminate unnecessary descriptions and use bullet points for clarity. Use standardized abbreviations for common terms, such as “Amt” for amount and “Svc” for service, but ensure that they are easily understood by all parties. This minimizes redundancy and keeps the document straightforward while still delivering all required information.

Key Elements to Include

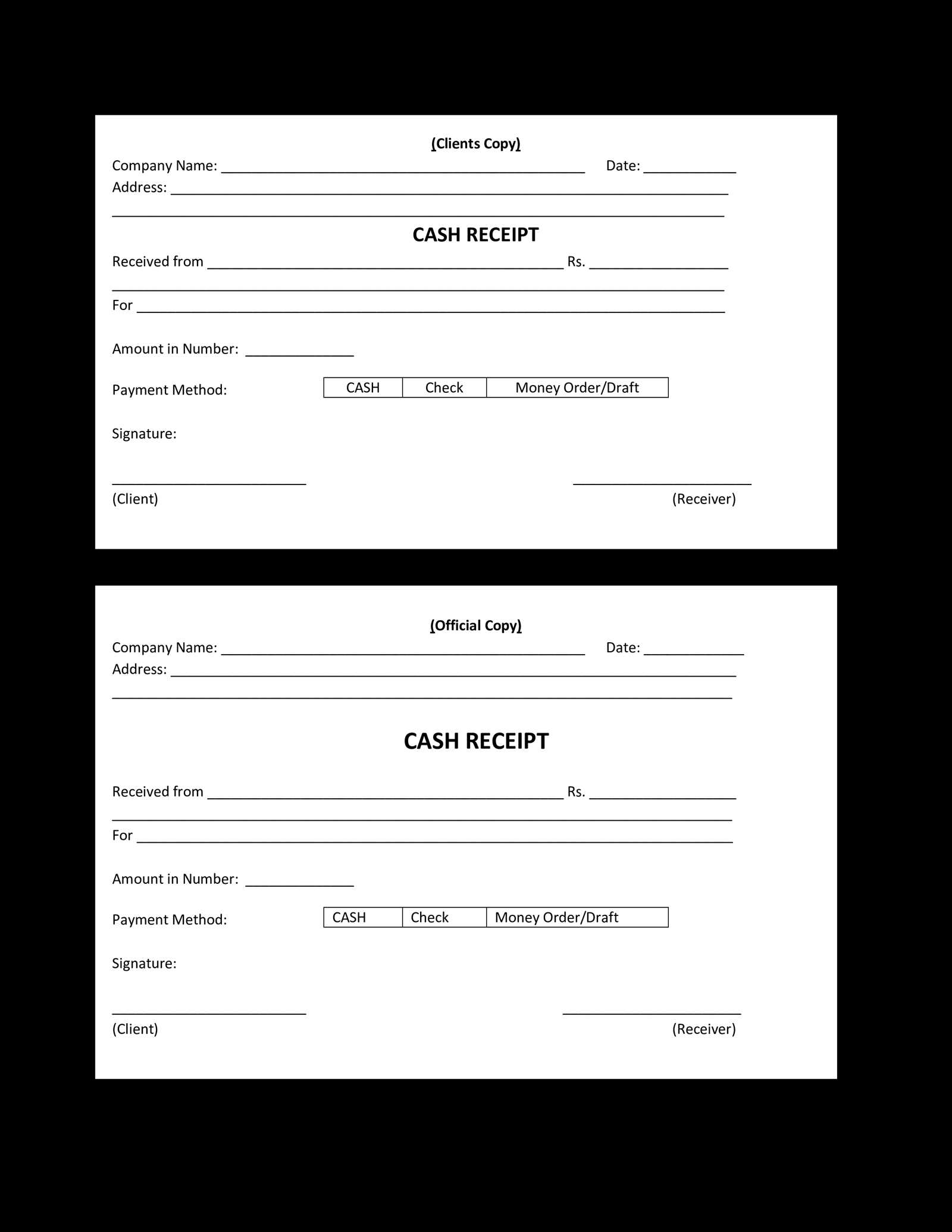

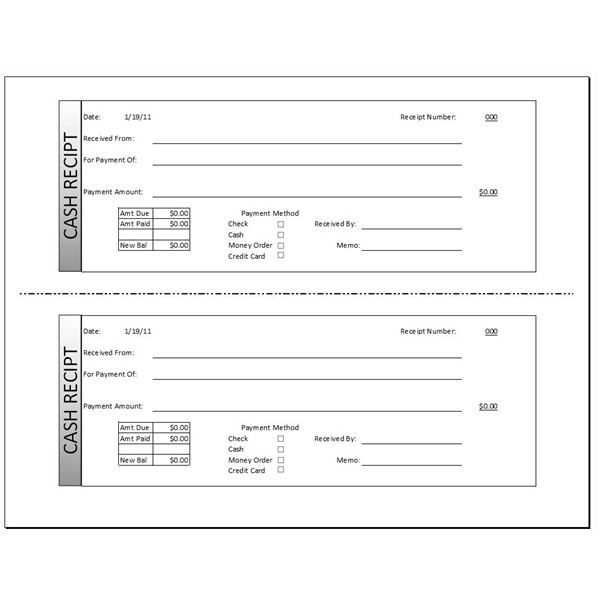

The template should also have a space for the payer’s signature and the date of the transaction. These details are crucial for record-keeping and validation purposes. Ensure there is a clear separation between services rendered and any discounts or adjustments to avoid confusion.

- Detailed Guide on Creating an HSA Receipt Template

Include the provider’s name, address, and contact details at the top. Specify the type of service or product, including any relevant codes or identifiers. Make sure to include the date and description of the expense to clarify the purpose for which the funds were used.

Clearly indicate the amount paid, breaking it down if necessary. List any taxes, fees, or adjustments separately to avoid confusion. If applicable, show any insurance payments or third-party contributions, indicating the amount paid by the HSA specifically.

Include the patient’s name and HSA account number, which links the receipt to the correct individual and account. Adding a reference number or unique receipt ID will help with tracking and documentation.

Make the receipt simple and easy to read. Use a clean layout with clear sections, using bold or underlined text for key information. Ensure the total payment amount is easy to identify at the bottom, and place any disclaimers or notes at the footer, indicating the receipt’s use for tax purposes or HSA claims.

Keeping precise records of HSA transactions is necessary for ensuring smooth reimbursements and maintaining compliance with tax regulations. Without clear documentation, you risk facing complications when claiming reimbursements or during tax filings. Double-check all receipts and ensure that each expense is properly categorized according to IRS guidelines. Incorrect records may lead to unexpected audits or denials of claims, which can delay or reduce benefits.

When you maintain accurate HSA records, you are better prepared for any inquiries from your plan administrator or the IRS. It provides clear proof of eligible expenses and supports your case if any discrepancies arise. Consistent and detailed records allow you to track your spending, helping you maximize your account’s potential and avoid mistakes that can cost you in the long run.

In addition to aiding in reimbursements and tax preparation, accurate records contribute to your overall financial health. By understanding where and how your funds are spent, you can make informed decisions about your healthcare spending and future HSA contributions. This proactive approach ensures that you never miss out on eligible claims or tax benefits that could reduce your financial burden.

To correctly format an HSA template for medical expenses, follow these key steps:

- Include Date and Provider Details: Always start by entering the date of service and the healthcare provider’s name. This ensures clarity for both the recipient and the IRS, should you need documentation for tax purposes.

- List of Expenses: Break down the individual medical expenses. Itemize each expense, including medical procedures, prescriptions, or medical devices. Specify the cost of each item or service to maintain transparency.

- Amount Paid: Document the total amount paid for each service. If the payment was made by you directly, include this detail clearly alongside any reimbursements from your HSA account.

- Payment Method: Specify how each expense was paid–whether it was through your HSA, insurance, or out-of-pocket. This helps to ensure the accuracy of your claim and provides clarity on fund distribution.

- Claim Number (If Applicable): For certain services or claims, include any claim numbers or reference codes provided by the healthcare provider or insurance. This makes tracking the payment easier.

- Health Savings Account Reimbursement Section: Create a section for documenting any reimbursements received from your HSA. Include the date and amount reimbursed, ensuring all HSA fund transfers are noted.

- Tax Deduction Information: If the expense is tax-deductible, add a section that marks it for tax purposes. This simplifies your year-end financial organization and helps ensure you’re claiming everything you are entitled to.

By organizing your expenses clearly and accurately, you can streamline the reimbursement process and maintain well-documented records for both personal and tax purposes.

Include the following key details on your HSA receipt to ensure it meets the necessary requirements for reimbursement and tax purposes:

- Date of Service: The exact date when the service was provided, ensuring it falls within the plan year.

- Provider Name: The name of the healthcare provider or facility where the service was rendered.

- Service Description: A brief but specific description of the service or treatment received.

- Amount Paid: The total amount you paid for the service, excluding any discounts or adjustments.

- Payment Method: How you paid for the service (e.g., credit card, check, or other means).

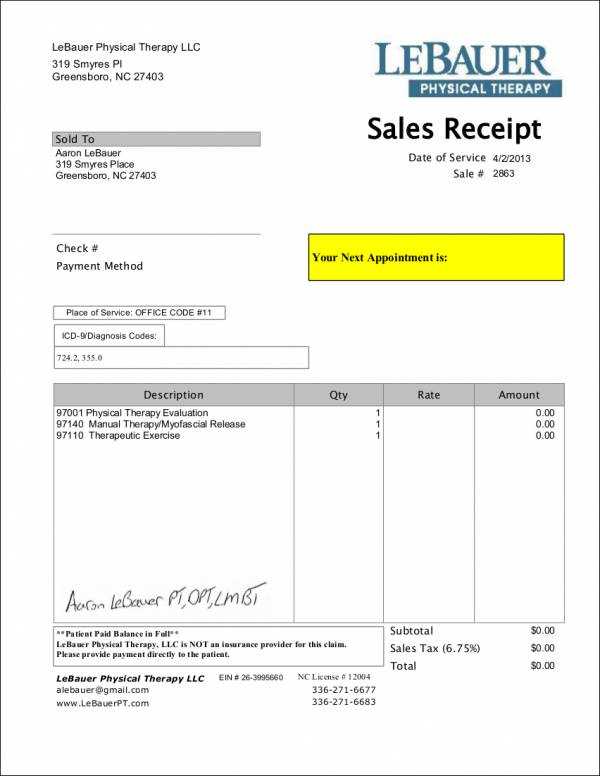

- Diagnosis and Treatment Code: Include ICD-10 (diagnosis) and CPT (treatment) codes if available to validate the medical nature of the expense.

- Provider Tax ID Number: The tax identification number of the healthcare provider, especially for claims processing.

- Prescription Details (if applicable): For prescriptions, provide the name of the medication and dosage details if relevant.

Accurate inclusion of these elements ensures that your receipt meets the guidelines for reimbursement and record-keeping. Keep your receipts organized for smooth processing and tax filing.

Ensure all details are accurate. Double-check transaction amounts and dates before finalizing the receipt. Mistakes in these areas can lead to confusion or disputes. Miscalculations, such as adding extra charges or missing discounts, can create unnecessary issues.

Always include clear descriptions of the purchased items or services. Avoid vague terms like “miscellaneous” or “various goods” without further explanation. Specifics help the recipient understand what was purchased, preventing confusion later on.

Don’t forget to provide the correct tax information. If applicable, make sure the tax rate is listed clearly and correctly. Failing to do so could result in legal complications for both parties involved.

Check that the receipt includes all required fields, such as the business name, address, contact details, and transaction reference number. Missing this information can cause problems if the receipt is needed for returns or warranty claims.

Avoid making the receipt difficult to read. Ensure the text is legible with an appropriate font size and contrast. A cluttered or hard-to-read receipt can lead to frustration and make it harder for the customer to reference later.

Make sure the receipt is dated correctly. A receipt with a wrong or missing date can cause confusion about the timing of the transaction and affect refund or warranty processes.

Adjust your HSA receipt template based on the type of medical service provided to ensure accurate and complete records. For example, different services might require distinct categories such as diagnosis codes, treatment types, or medication details. Customizing each section will help capture all necessary information, making it easier to submit claims or track expenses.

For outpatient visits, add fields for the provider’s details, visit reason, and treatment codes. These details help in identifying and categorizing services under your HSA plan. If medications are prescribed, a separate section for drug name, dosage, and quantity is beneficial.

In case of surgeries or hospital stays, include sections for surgical procedure codes, dates, and facility charges. These often involve multiple billing categories, so creating space for detailed breakdowns can streamline reimbursement processes. Add a specific section for lab work and diagnostic imaging, ensuring each test has a corresponding entry for easy reference.

For chiropractic or physical therapy services, make sure to list treatment session details and the number of visits. These services may have different billing structures, so customizing your receipt template will ensure that each visit is properly recorded and claimed under your HSA account.

To illustrate, here’s a simple example of how a customized table might look for a physical therapy session:

| Date of Service | Treatment Type | Provider Name | Session Duration | Cost |

|---|---|---|---|---|

| 02/06/2025 | Physical Therapy | John Doe, PT | 30 minutes | $100.00 |

By customizing your template with relevant fields, you ensure that all necessary details are captured, making the claims process smoother and reducing the risk of missing deductions or reimbursements.

Organize receipts in a way that makes them simple to locate and comply with regulations. Use clear categories like “business expenses,” “personal purchases,” or “tax-related” for easy retrieval. Store physical receipts in labeled folders or filing cabinets, ensuring they are preserved in a dry, safe place to prevent damage. Digital receipts should be scanned and stored in cloud-based systems that are easily searchable and backed up regularly.

Use a Digital Filing System

A digital filing system can save time and ensure compliance. Create folders by month or category, labeling them clearly to reflect the content. Invest in software that allows you to scan, store, and search receipts easily, such as document management systems with OCR (Optical Character Recognition) capabilities. This ensures that even handwritten details can be extracted and searched.

Track Receipt Expiry Dates

Some receipts may have limited lifespans for warranty or return purposes. Set calendar reminders for important dates to keep track of the validity of these documents. Regularly update your filing system to remove expired receipts and prevent clutter from building up.

Finally, ensure that all stored receipts are backed up and encrypted if sensitive data is involved, maintaining both security and compliance.

I’ve removed redundant repetitions while maintaining the meaning and correctness of the sentences.

When creating a receipt template for HSA, clarity and simplicity should be prioritized. Start by listing all key details: the provider’s information, date of service, description of services rendered, and the amount charged. Include a section for payment details such as the total paid, insurance coverage, and the patient’s contribution. Make sure to break down complex information into clear categories to avoid confusion.

Standard Fields for HSA Receipt Templates

Ensure the receipt contains the following fields for consistency and completeness:

- Provider’s Name and Contact Information

- Service Date

- Itemized List of Services or Products

- Total Amount Charged

- Payment Method and Insurance Information

- Patient’s Responsibility

Additional Considerations

Keep the design clean with readable fonts and logical structure. A receipt should easily be understood at a glance. Avoid unnecessary details that could clutter the template and cause confusion. Ensure all information is correct before finalizing the template for use.