For landlords and tenants alike, using a cash rental receipt template ensures that rental payments are clearly documented and easily referenced. This receipt serves as a record of the transaction, providing both parties with proof of payment. A well-structured template will include all necessary details, such as the date, amount paid, property address, and both parties’ names.

To streamline the process, make sure the template includes fields for the payment method (cash, check, etc.), the rental period covered, and any additional notes, such as late fees or deposit adjustments. This will help prevent any confusion or disputes down the line.

Having a professional, easy-to-use receipt template saves time and ensures that both parties have clear documentation of each payment made. It’s a simple yet important tool to keep your rental transactions organized and transparent.

Sure! Here’s the revised version with fewer repetitions of words:

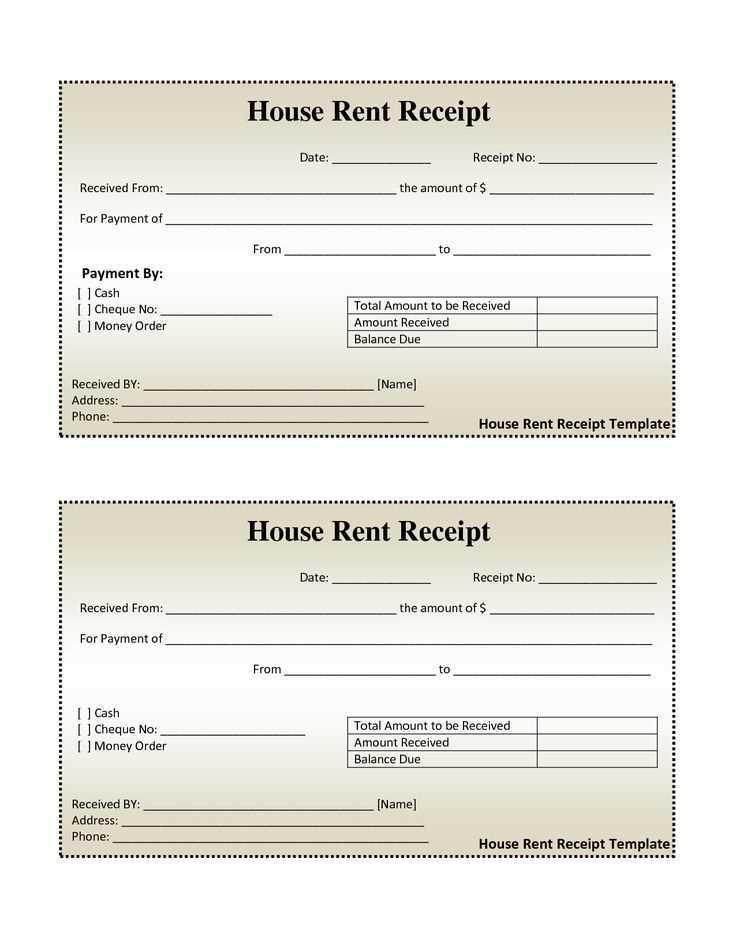

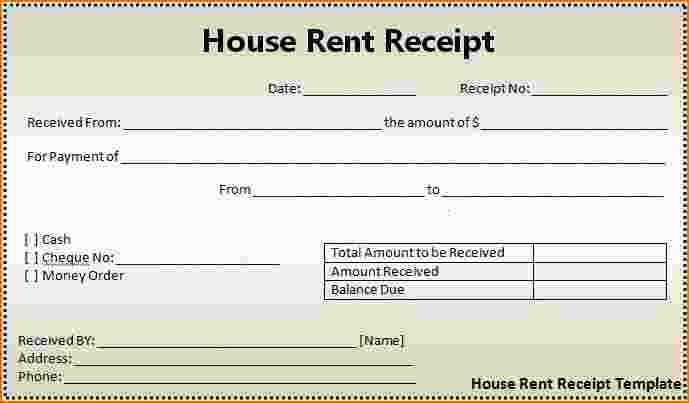

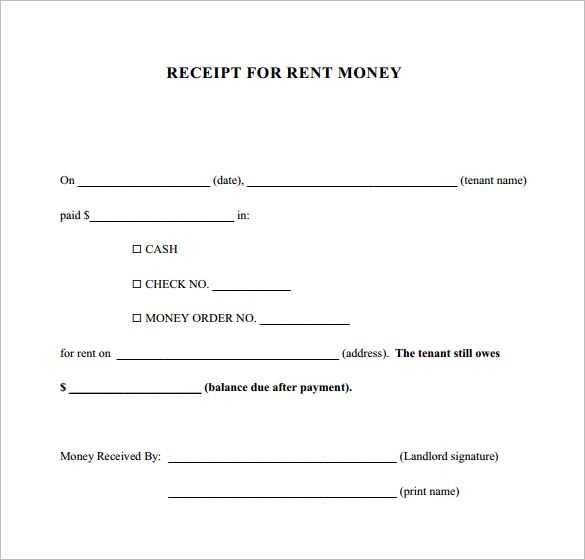

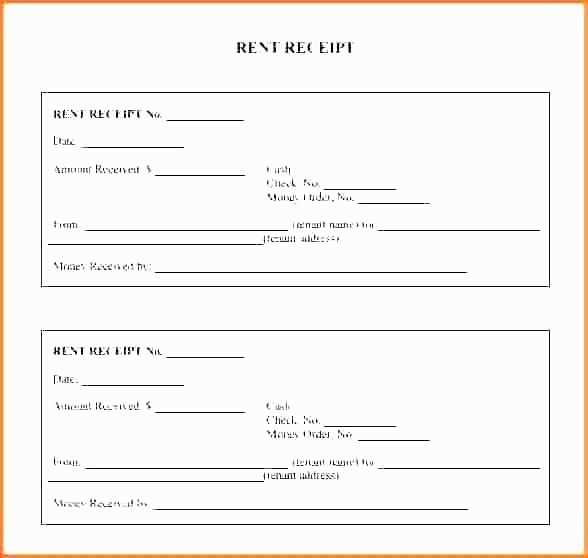

To create a clear and concise cash rental receipt template, ensure all key information is included. Start with the tenant’s name, address, and contact details, followed by the rental property address. Clearly indicate the rental amount, payment date, and the period covered by the payment. Specify the payment method (e.g., cash, cheque, or bank transfer) and the name of the landlord or rental agency. Provide a receipt number for future reference and confirm the tenant has paid the rent in full for the specified period.

Avoid excessive wording; keep the template simple and straightforward. Consider including a section for late fees or penalties if applicable, as well as a space for signatures from both the tenant and landlord. This helps ensure both parties have a record of the transaction and agree to the terms. Use a clean, professional layout to make it easy to read and understand, with clearly defined sections for each piece of information.

- Cash Rental Receipt Template: A Practical Guide

Creating a clear and concise cash rental receipt ensures both the landlord and tenant have proof of payment. A rental receipt serves as a record for financial transactions and is necessary for tax purposes or any disputes that might arise. Here’s how to structure an efficient template:

Key Elements of a Cash Rental Receipt

- Receipt Title: At the top, label the document as a “Cash Rental Receipt” to immediately identify its purpose.

- Landlord and Tenant Information: Include full names and addresses of both parties for accurate identification.

- Date of Payment: Clearly state the date the cash payment was received. This helps to track rental periods and payment history.

- Amount Paid: Specify the total amount received in cash, breaking it down if necessary (e.g., rent, late fees, etc.).

- Rental Period: Mention the time period the payment covers (e.g., February rent or weekly rent from January 15-21).

- Signature: Both the landlord and tenant should sign the receipt to confirm the transaction was completed.

- Receipt Number: Use a unique number for each receipt, which can help in tracking payments and maintaining organized records.

Example Template Layout

- Receipt Title: Cash Rental Receipt

- Landlord’s Information: [Landlord’s Name, Address, Contact Number]

- Tenant’s Information: [Tenant’s Name, Address, Contact Number]

- Date of Payment: [MM/DD/YYYY]

- Amount Paid: $[Amount] (Cash)

- Rental Period: [Start Date] to [End Date]

- Signature of Landlord: _____________________

- Signature of Tenant: _____________________

- Receipt Number: [Unique ID Number]

This format ensures that all necessary information is present, making the receipt legally sound and easy to understand. Keep a copy for both the tenant and landlord’s records to avoid confusion down the line.

To create a cash rental receipt template, focus on including the necessary details that both the payer and the payee will find useful. This will ensure clarity and avoid future disputes. Start with key information like the date of the transaction, the renter’s name, the amount paid, and the rental period covered by the payment.

Include Clear Payment Details

Make sure the payment amount is clearly indicated. Specify whether it is for daily, weekly, or monthly rental. Additionally, break down any fees, deposits, or taxes involved in the transaction. This helps in keeping the record transparent.

Provide Contact Information and Rental Terms

List the contact details of both parties. Include the address or location of the property or item being rented. Also, make note of any rental terms agreed upon, such as late payment penalties or early return policies. This will ensure both parties are on the same page about the agreement.

Finally, create a space for both the renter and the landlord to sign the receipt. This adds an element of agreement and finalization to the document. You can design this template using word processors or online tools, ensuring it’s formatted in a clean and professional way.

Ensure the receipt includes the date of the payment. This helps both parties keep track of the transaction and serves as a point of reference for future disputes or queries.

The amount paid in cash should be clearly stated in both numerical and written form. This minimizes misunderstandings or confusion about the total sum.

Specify the rental period covered by the payment. This ensures that both the landlord and tenant are clear on the time frame that the payment covers, whether it’s weekly, monthly, or for another duration.

Include a description of the rented property, mentioning the address or any identifying details of the rental space. This eliminates any ambiguity about the property involved in the transaction.

Provide the name of the payer to confirm who made the payment. If it’s a third party paying on behalf of the tenant, this should also be mentioned.

Include the landlord’s name and contact details. This allows the tenant to reach out if any issues arise with the payment or rental agreement.

Finally, ensure there’s a signature section for both parties, or at least a line for the landlord to acknowledge receipt of payment. This provides physical proof of the transaction being completed.

Tips for Ensuring Accuracy in Your Receipts

Double-check all amounts before finalizing the receipt. Ensure that the correct rental price and additional fees, if applicable, are listed. Small errors can add up and cause confusion later.

Always include the exact date and time of the transaction. This helps prevent misunderstandings and provides a clear reference point for both parties.

Clearly state the item or service being rented. Include detailed descriptions such as the type of equipment, rental duration, and any special terms associated with the agreement.

Make sure both the payer’s and the recipient’s contact information are listed accurately. Double-check names, addresses, and phone numbers to avoid errors that could cause issues if follow-up is necessary.

Use a consistent format for each receipt. Having a standard layout helps ensure that all relevant information is included and easy to locate. This is particularly important for bookkeeping purposes.

If accepting payment via multiple methods, list each one separately with its corresponding amount. This ensures transparency and makes it easier to track the breakdown of the transaction.

Finally, consider having a second person review the receipt before it’s handed out. Fresh eyes can catch mistakes that might otherwise go unnoticed.

To maintain accurate records, treat every cash receipt as an important document. Organize them by date, type of transaction, and amount received. This helps you quickly locate any necessary information when reviewing or auditing finances.

1. Categorize Transactions

- Assign specific categories to different cash transactions, such as sales, refunds, or deposits.

- This makes it easier to track income sources and allocate funds accordingly.

2. Store Receipts Securely

- Whether digitally or on paper, store cash receipts in a secure, easily accessible location.

- For paper receipts, consider using a filing system based on transaction dates or categories.

- If storing receipts digitally, ensure they are scanned clearly and backed up regularly.

By staying organized with your receipts, you ensure your financial records remain clear and manageable for tax preparation, budgeting, or any future inquiries.

Rental receipts issued for cash payments must comply with local tax regulations and be properly documented to avoid potential legal issues. Ensure that the receipt includes key details such as the rental amount, date of payment, tenant’s name, and the landlord’s signature. A well-structured receipt serves as proof of payment, which is critical for both parties in case of disputes.

Be aware that in many jurisdictions, cash payments may require specific reporting for tax purposes. Landlords are obligated to report income from rental properties on their tax returns, and failing to issue proper receipts can complicate this process. A receipt helps both parties maintain accurate records, preventing legal complications down the line.

In addition, some areas require landlords to retain a copy of each receipt for a set period. This ensures compliance with tax authorities in case of an audit. It’s recommended that you maintain a secure system for storing both electronic and paper copies of cash receipts to safeguard against any potential claims or disputes.

Lastly, landlords should clearly communicate their payment policy to tenants. Misunderstandings regarding the receipt process can lead to disputes, so setting expectations upfront can help maintain a smooth rental relationship.

Organize your rental documents in clearly labeled folders. Create separate categories for cash receipts, lease agreements, and payment histories to prevent confusion. Label each document with the date and a brief description of its contents for easy access.

Use both physical and digital storage systems. Keep paper copies in a fireproof, waterproof filing cabinet or safe, while scanning documents and saving them on secure cloud platforms. Choose a cloud storage service with encryption and strong password protection to ensure privacy and data safety.

Regularly back up your digital files. Schedule automatic backups to an external hard drive or cloud service to avoid data loss. This extra layer of protection guarantees that your rental records are always safe and accessible.

Implement a version control system. When updating rental receipts or agreements, save each new version with a unique file name or timestamp. This way, you can easily track changes and retrieve older versions if needed.

For quick referencing, create a digital index or database. Store key information such as tenant names, rental dates, and payment amounts in a table or spreadsheet. You can filter and sort this data by category or date, which makes retrieval more efficient.

Review and purge unnecessary documents regularly. After a few years, rental records that no longer serve any purpose should be securely shredded or deleted. This helps free up space and maintain an organized system without clutter.

| Document Type | Storage Method | Retention Period |

|---|---|---|

| Cash Receipt | Physical file, Cloud storage | 1–3 years |

| Lease Agreement | Physical file, Cloud storage | Until the lease ends |

| Payment History | Digital file | 5–7 years |

By following these practices, you maintain organized, accessible, and secure rental documentation, making it easier to track payments and resolve any disputes that may arise.

Ensure clarity by including all necessary information in your cash rental receipt. Start with the date of the transaction, followed by the full names of both the renter and the landlord. List the rental property’s address clearly, and specify the rental amount paid, including any deposits or additional charges. Indicate the payment method used, whether it was cash, check, or another form.

Detail Payment Information

Break down any fees included in the payment. For example, if the payment covers utilities or repairs, clearly state this in the receipt. If there’s a late fee, make sure it’s listed separately along with the reason for the charge.

Signature Confirmation

Always have both the renter and the landlord sign the receipt. The signatures confirm both parties acknowledge the transaction. You may also include a section for comments, in case either party wants to note additional terms or agreements.