A tax-deductible donation receipt is a necessary document for both donors and charitable organizations. It ensures that donors can claim their contributions as deductions on their tax returns while providing the organization with a clear record of the donation. Here’s a template you can use to create a valid receipt quickly and easily.

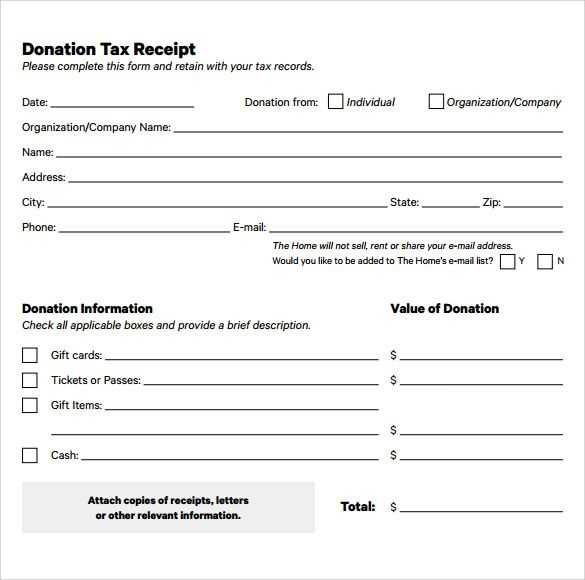

Start by including the name and contact details of your organization at the top of the receipt. Make sure to include the official tax-exempt status number if applicable. This helps verify the legitimacy of the organization and its qualifications for issuing tax-deductible receipts.

Next, detail the donor’s information. This includes their full name, address, and contact details. For larger donations, include the donor’s tax identification number if required by your local tax authority. Ensure that the receipt clearly lists the date of the donation and the exact amount donated. For in-kind donations, describe the donated items with enough detail for valuation purposes.

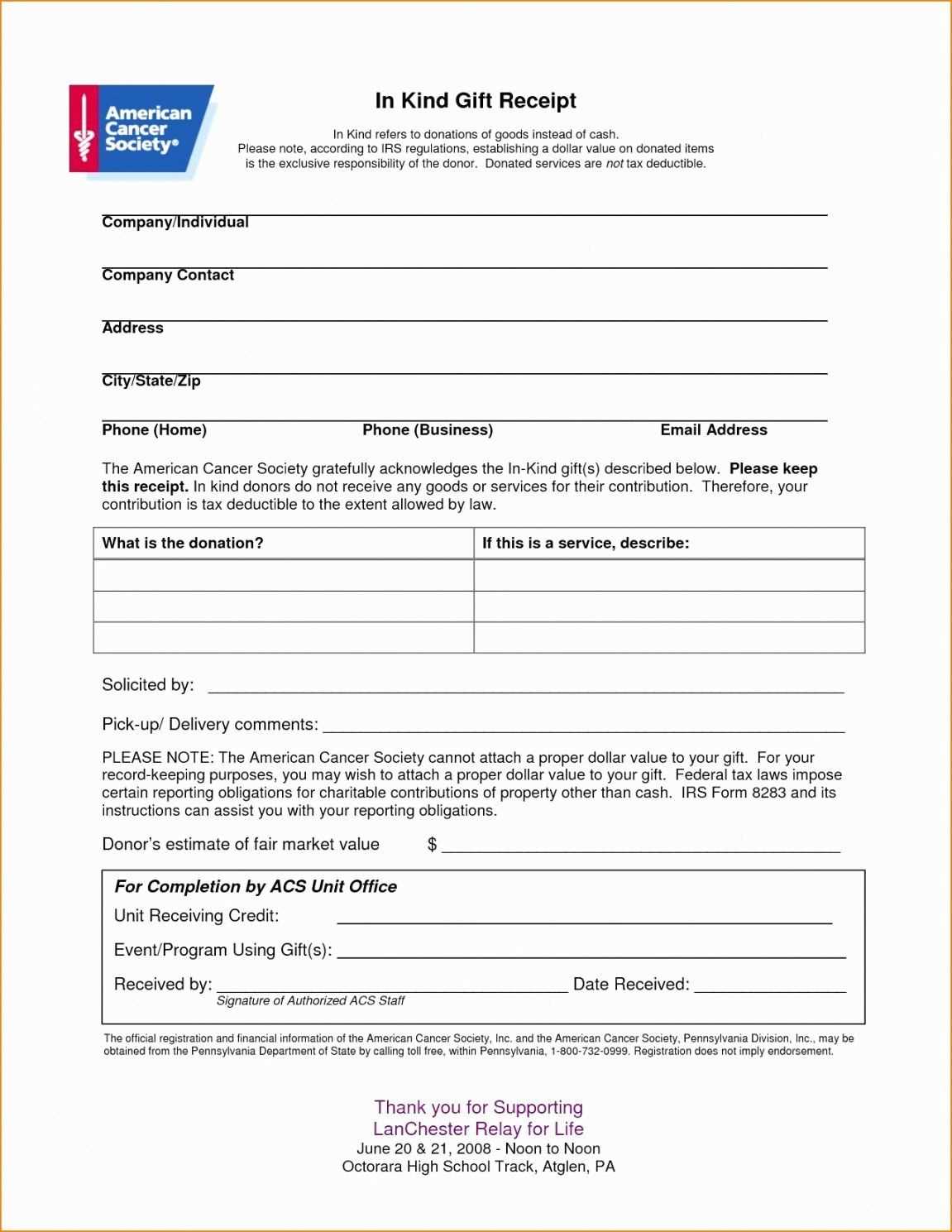

It’s important to indicate that no goods or services were exchanged for the donation if this is the case. If the donor received something in return, such as a gift or event tickets, include the fair market value of those goods or services and subtract it from the total donation amount. This ensures both parties comply with tax regulations.

Finally, add a statement affirming that the organization is a registered tax-exempt entity. Include the signature of an authorized representative and a contact number or email for any follow-up questions regarding the donation. This receipt should be provided to the donor in a timely manner, allowing them to include it with their tax filing.

Here’s the revised version:

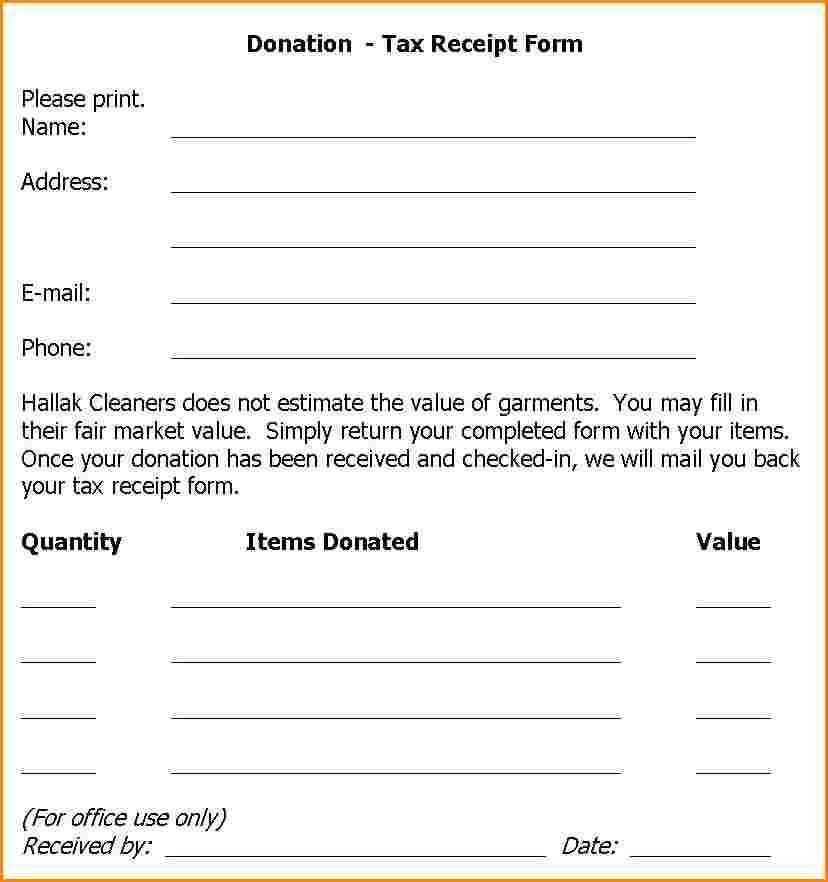

Ensure the receipt includes the donor’s name, donation date, and the exact amount donated. Mention whether the donation was monetary or in-kind. If it’s an in-kind donation, describe the donated items and their estimated value. Make sure to specify that no goods or services were provided in exchange for the donation if that’s the case.

Clearly state the organization’s tax-exempt status and provide the legal name and address of the nonprofit. Also, include a statement that the donation is deductible under IRS rules and, if applicable, any specific restrictions on the deduction.

For in-kind donations, include a brief description of the items and their condition, but refrain from assigning a specific dollar value–this is the donor’s responsibility. For monetary donations, include the total amount given and the method of payment (cash, check, etc.).

If there were any goods or services provided in exchange, state the fair market value of those items and subtract it from the total donation. This will ensure transparency and help donors correctly report their contributions.

Make the document clear and professional to avoid confusion and ensure that the donor can use it for tax purposes without difficulty.

Tax-Deductible Donation Receipt Template

How to Structure a Tax-Deductible Donation Receipt

Key Information Needed for a Valid Donation Receipt

How to Handle Non-Cash Donations in the Receipt

Tax Implications of Donation Receipts for Donors

Common Errors to Avoid When Issuing Donation Receipts

Best Practices for Storing and Managing Donation Receipts

Start with clear identification. The receipt must include the charity’s name, address, and tax-exempt status (e.g., 501(c)(3) if in the U.S.). Then, include the donor’s name and address. A date is necessary to establish the timing of the donation. Finally, a unique receipt number helps track and manage donations effectively.

Key Information Needed for a Valid Donation Receipt

The amount or a description of the donated property is required for cash donations, along with the fair market value for non-cash contributions. If goods or services were provided in exchange for the donation, you must include a statement explaining this and an estimate of the value of those services. This ensures the donor receives the correct tax benefit.

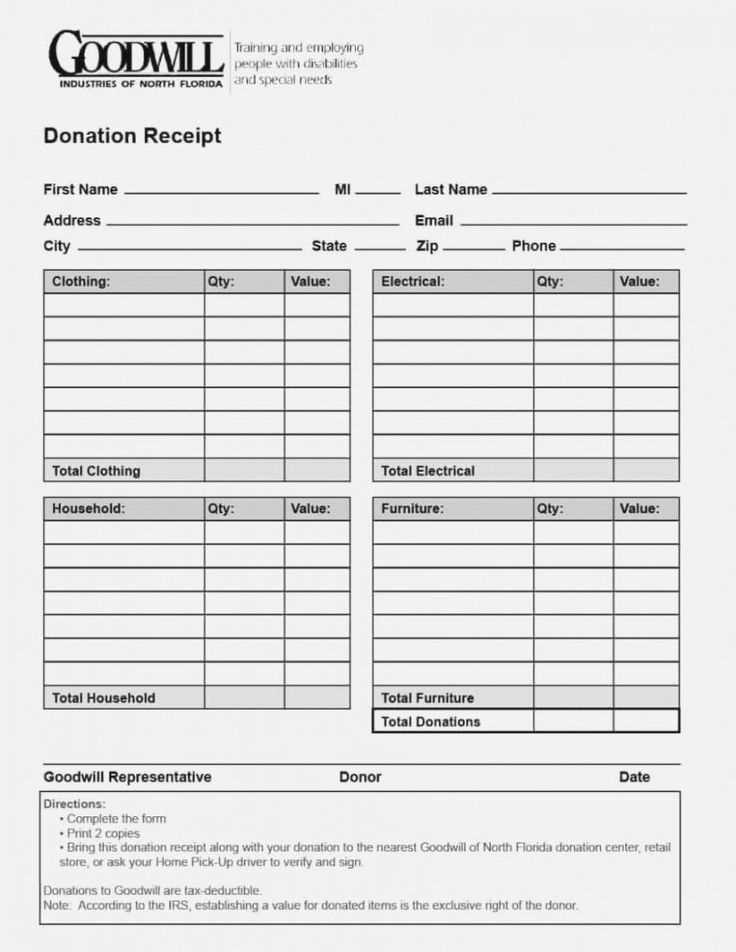

How to Handle Non-Cash Donations in the Receipt

For non-cash donations, be specific about the item or items donated. Include the condition of the items, if possible. For non-cash contributions exceeding a certain value (typically $500), the donor must complete additional forms, such as IRS Form 8283, and it’s helpful to remind them of this requirement in the receipt.

Donors can claim deductions for the donation amounts that exceed the value of any goods or services received in return. For instance, if a donor contributes $200 and receives a gift worth $50, the deductible amount is $150.

Common Errors to Avoid When Issuing Donation Receipts

Avoid vague descriptions. Be specific with the type and condition of donated items. Double-check all dates and amounts to ensure accuracy. Don’t forget to issue a receipt even for small donations if they are requested by the donor. Also, remember that if a donation is in exchange for a product or service, the receipt should reflect the value of the product or service provided.

By keeping your receipts clear, precise, and timely, you minimize errors and ensure your donors can maximize their deductions.

Best Practices for Storing and Managing Donation Receipts

Store donation receipts in a secure, easily accessible system. Whether using physical records or digital storage, ensure that receipts are organized by date and donor name for easy retrieval. If possible, implement a database to track receipts and donations, ensuring no data is lost. Periodic audits can help ensure everything is up-to-date and compliant with tax regulations.

Repetitions minimized, meaning preserved, and sentence structure maintained.

Ensure clarity in your tax-deductible donation receipt by following these key points. First, clearly state the organization’s name, address, and tax-exempt status. List the donor’s name and the donation amount. Include a brief description of any goods or services provided in exchange for the donation, with the value of these items specified if applicable. If no goods or services were exchanged, indicate this explicitly.

Be specific about the donation’s nature. For cash contributions, state the exact amount donated. For non-cash items, describe the goods or services donated and give an estimated fair market value, if possible. Avoid vague descriptions like “miscellaneous” or “donated items.” This level of detail prevents confusion in case of an audit.

Finally, make sure to include a statement confirming the donor did not receive anything of value in exchange for the donation, or if they did, the value of those goods or services is noted. These small but crucial details will ensure your receipt is compliant with IRS standards and clear to both the donor and the organization.