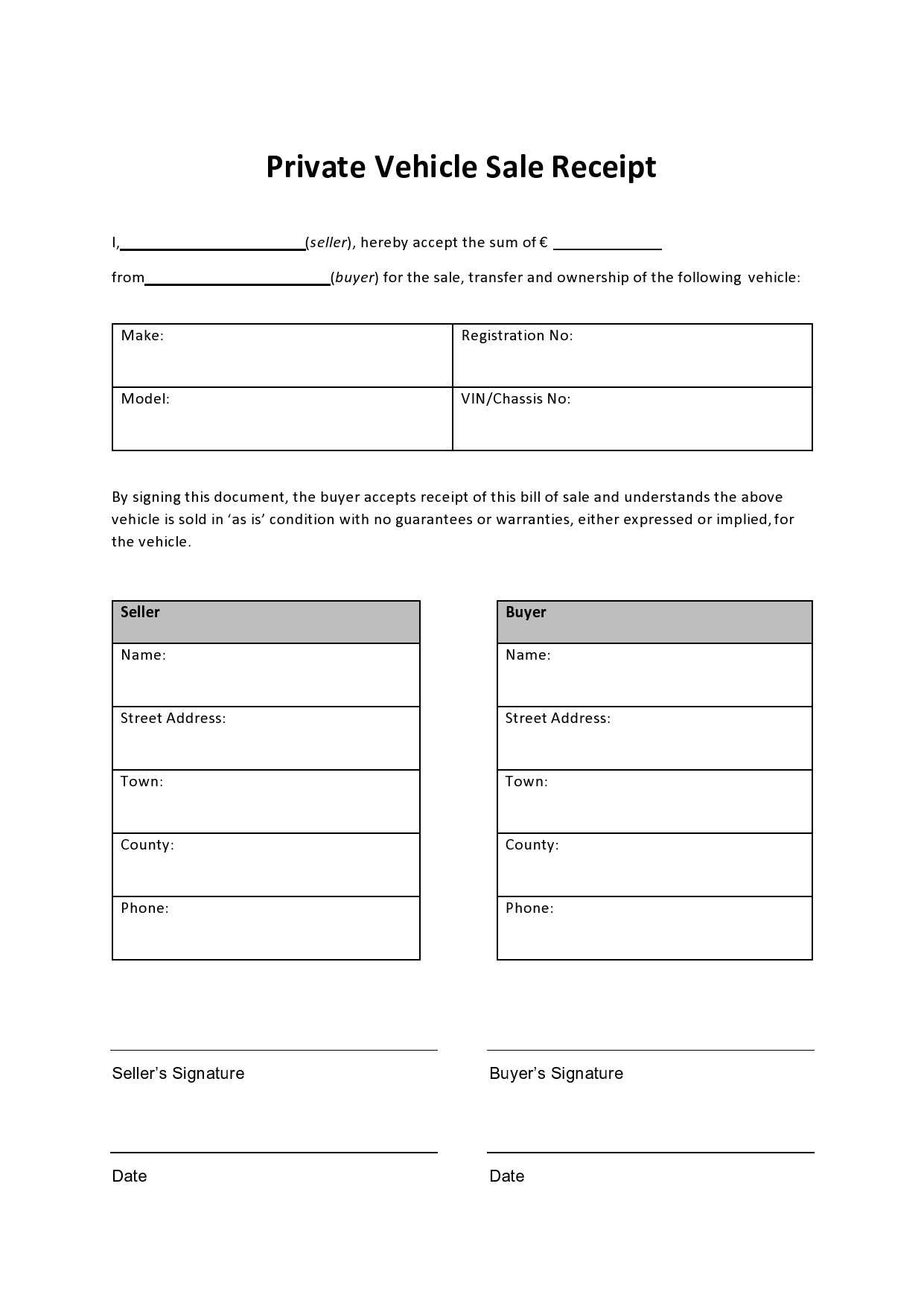

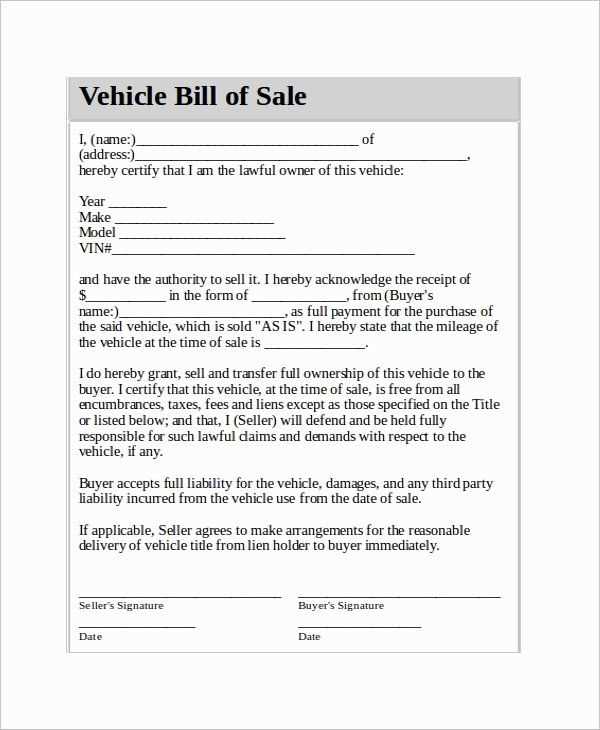

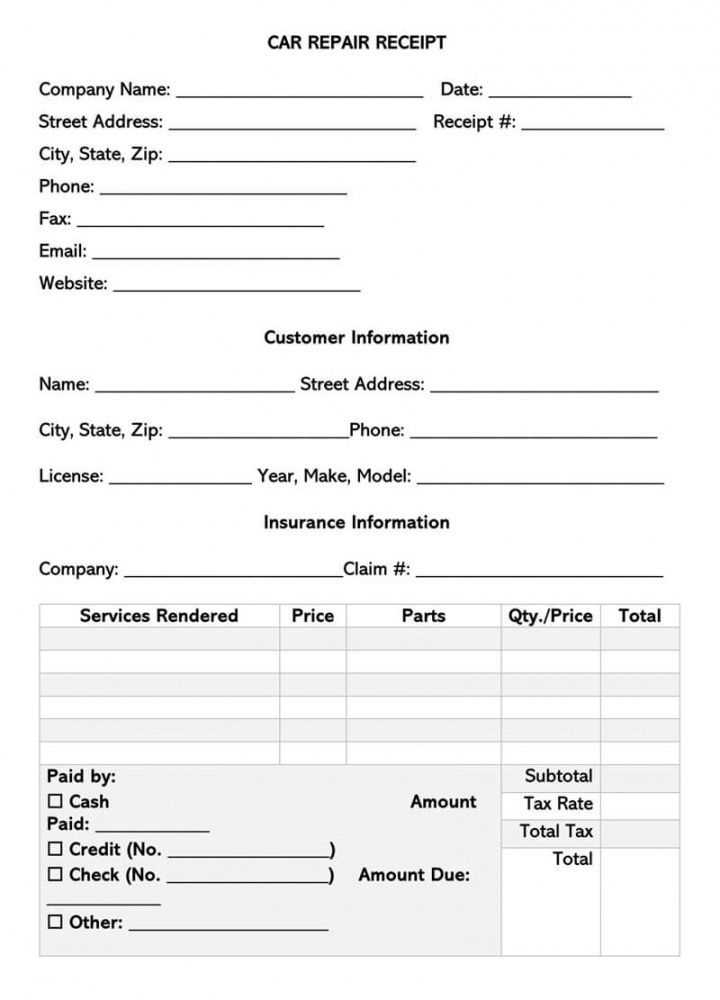

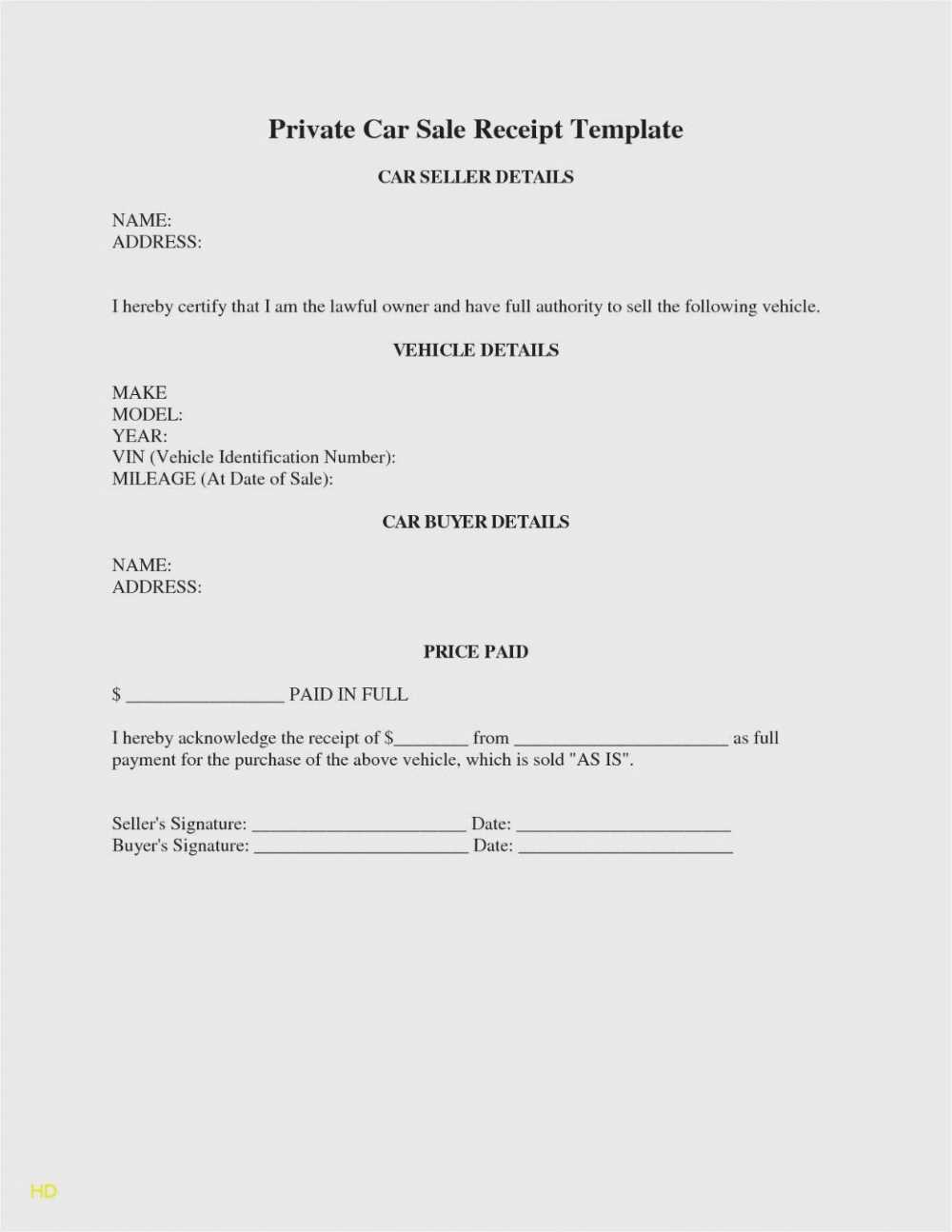

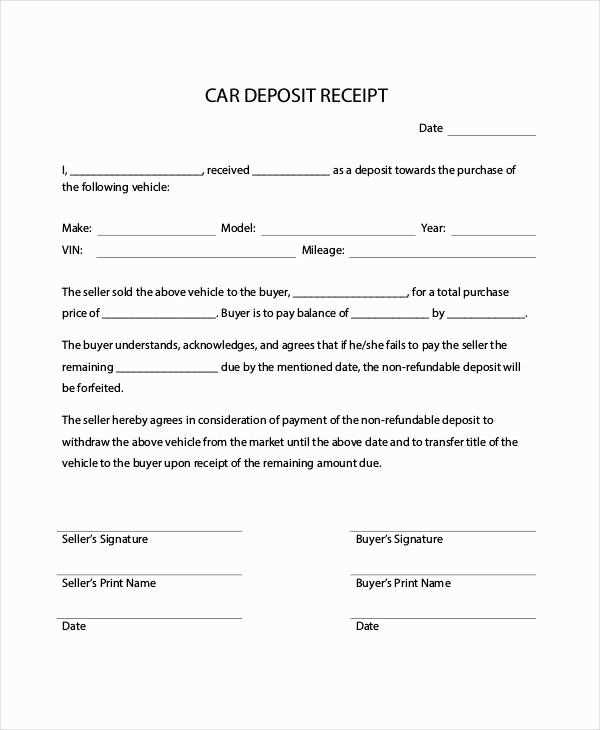

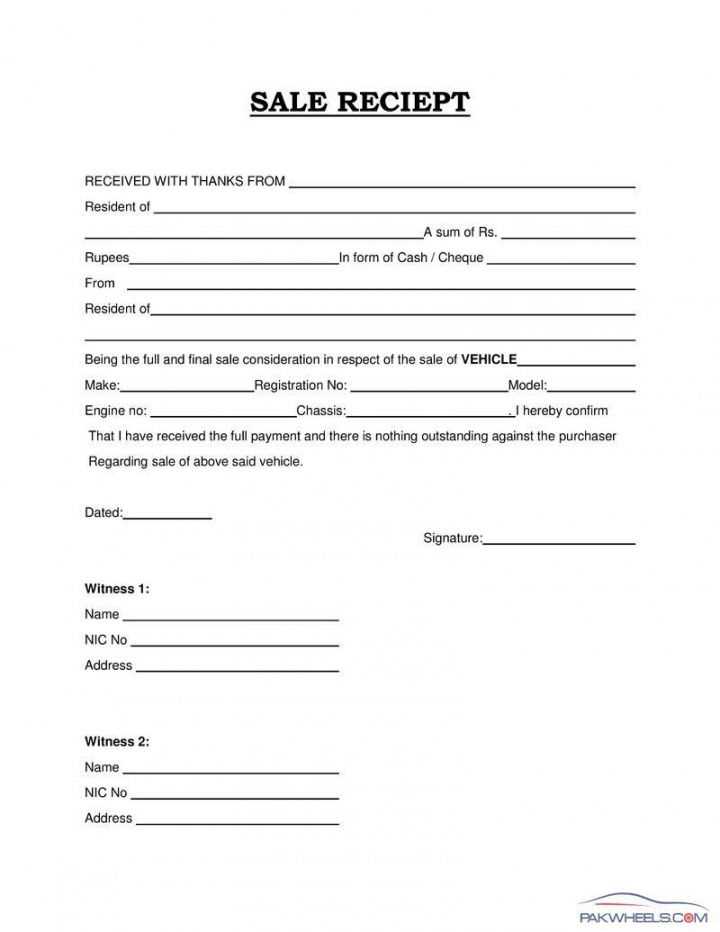

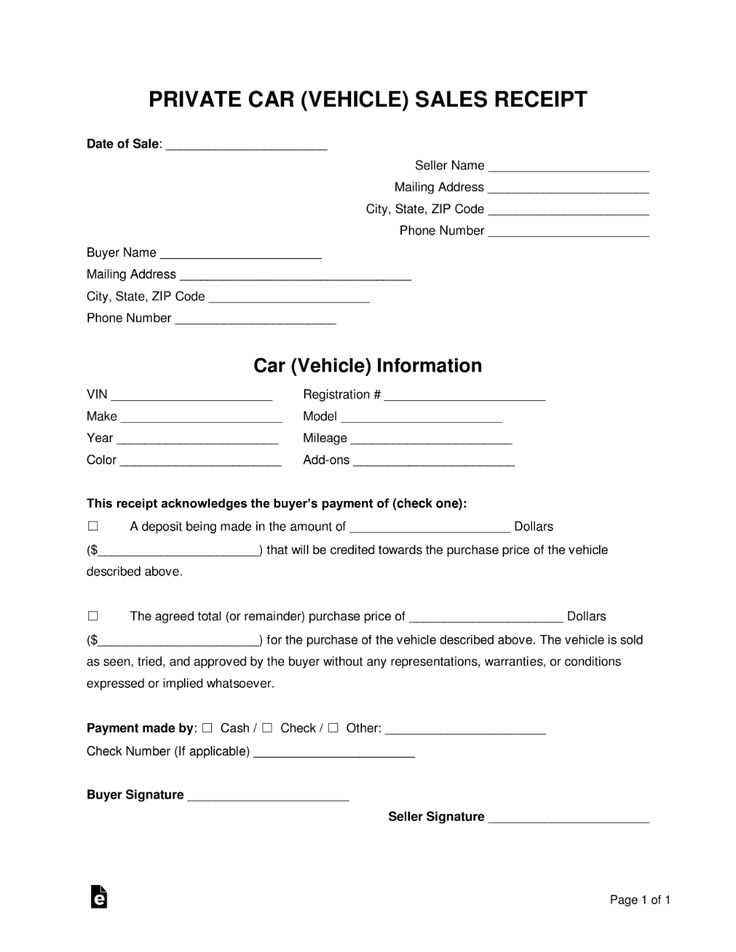

To create a valid unregistered vehicle receipt, include the full details of the transaction. List the vehicle’s make, model, year, and Vehicle Identification Number (VIN). Clearly indicate whether the vehicle is sold as-is or with any warranties.

Specify the date of the sale and the names and addresses of both the buyer and the seller. Include the agreed price and method of payment, along with any additional terms related to the transaction. Double-check that the buyer and seller both sign the document to confirm the sale.

For added clarity, consider adding a statement that clarifies the vehicle’s registration status and that the buyer acknowledges understanding that the vehicle is not registered. This can help prevent any future misunderstandings or disputes regarding ownership and title transfer.

Here is the revised version with reduced repetition:

Remove redundant phrases to improve clarity. Focus on the key points without reiterating them. If certain terms or ideas are repeated unnecessarily, streamline them for conciseness. Avoid using similar expressions that don’t add new meaning or value to the content.

For example, instead of saying “in order to achieve the goal, it is necessary to…,” simply state “achieve the goal by…”. This eliminates unnecessary words and makes the sentence more direct.

Minimize the use of filler phrases that don’t add substance. Direct language keeps readers engaged and ensures your message is clear. Use precise terms to describe actions or results without over-explaining.

Unregistered Vehicle Receipt Template

How to Create an Unregistered Vehicle Receipt

Key Information to Include in the Template

Legal Considerations When Using an Unregistered Receipt

Customizing the Template for Specific Transactions

Common Mistakes to Avoid in Unregistered Receipts

How to Distribute and Store Vehicle Receipts

Creating an unregistered vehicle receipt requires accuracy. Include the vehicle’s make, model, year, VIN (Vehicle Identification Number), and odometer reading. Record the buyer’s name, contact details, and the date of transaction. A clear indication of the transaction being unregistered is necessary for legal clarity. Provide both seller and buyer’s signatures to confirm the exchange.

Incorporating these details ensures clarity for future reference. The receipt should be in a straightforward format, with designated fields for each piece of information. Avoid vague terms and include specific vehicle identifiers. Include a brief note regarding the transaction’s unregistered status for both parties’ protection.

Legally, make sure the receipt meets local regulations. Some areas require particular wording for vehicle sales and transfers. Be mindful of required documentation such as proof of identity or insurance details. Ensure the document clearly outlines the transaction’s nature, as unregistered vehicles may involve additional legal steps.

For unique situations like private sales or donations, modify the template to reflect the specifics of the transaction. You may need to add clauses like ‘sold as-is’ or include details about prior inspections. Adjust the template as needed to align with the nature of the exchange, whether it’s a private sale or a transaction involving multiple parties.

Common mistakes include omitting key vehicle details like VIN or misspelling buyer and seller names. Ensure all fields are filled correctly to avoid future disputes. Misrepresenting the vehicle’s registration status can lead to complications. Double-check the receipt’s accuracy before finalizing the transaction.

Once the receipt is completed, provide a copy to both buyer and seller. Store the document in a secure place for future reference. Digital storage may be an option, but paper copies remain valuable for legal proof. Keep track of all vehicle-related documents in an organized system.