If you manage an automotive service business, using a clear, organized receipt template will make a significant difference. A well-structured receipt helps both you and your customers stay on the same page regarding services provided and payments made.

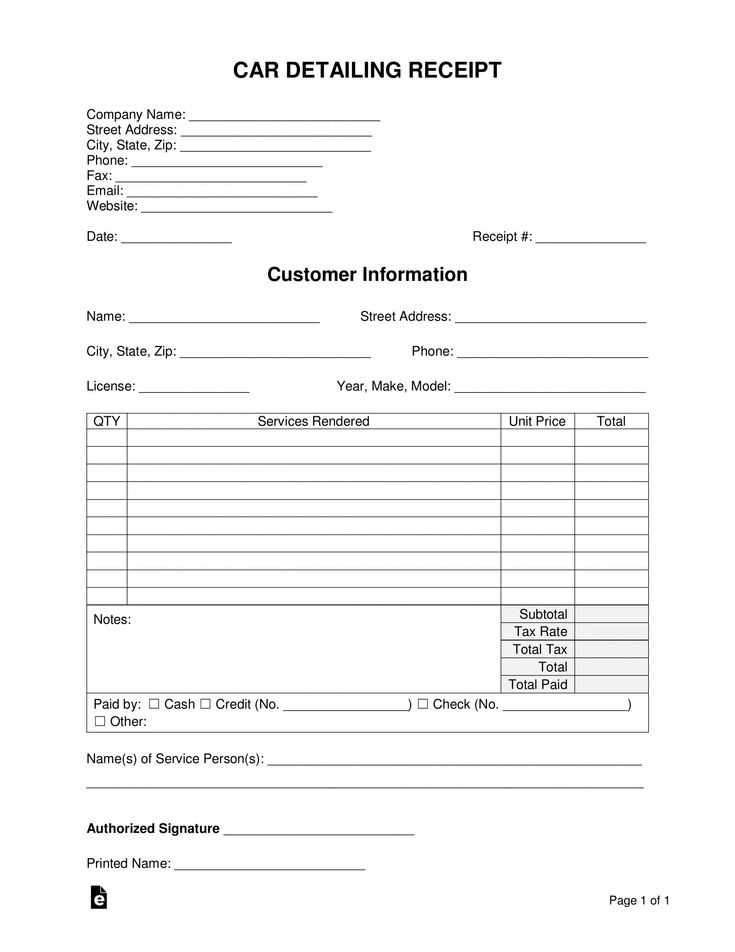

Start by including key details like the service date, vehicle information, and a breakdown of services rendered. Specify the costs for labor, parts, and any additional charges. Transparency here ensures that there are no misunderstandings.

Another useful element is the payment method, which helps track financial records. Don’t forget to add your business name, contact details, and a space for customer signatures, if needed. This reinforces professionalism and trust in the transaction.

For repeat customers, include a service history section. This can serve as a reference for future work, showing previous maintenance done on the vehicle and offering convenience to both you and your clients.

Here’s the revised version without repeating words excessively:

Start by clearly stating the service provided, such as “Oil Change” or “Brake Repair.” Include details like the type of oil used or the specific brake components replaced. This helps the customer understand exactly what was done.

Invoice Breakdown

Include a detailed list of parts and labor with corresponding prices. Ensure each item is separate for transparency.

- Labor: 2 hours @ $50/hr

- Parts: Brake pads ($100), Fluid ($30)

Payment Information

Clearly state the total amount due and any discounts applied. Make sure to mention accepted payment methods and due dates.

- Total Due: $250

- Discount Applied: $20 (10% off)

- Payment Methods: Cash, Credit Card, Bank Transfer

End with the contact information of the service provider for any questions or follow-up.

- Automotive Service Receipt Template

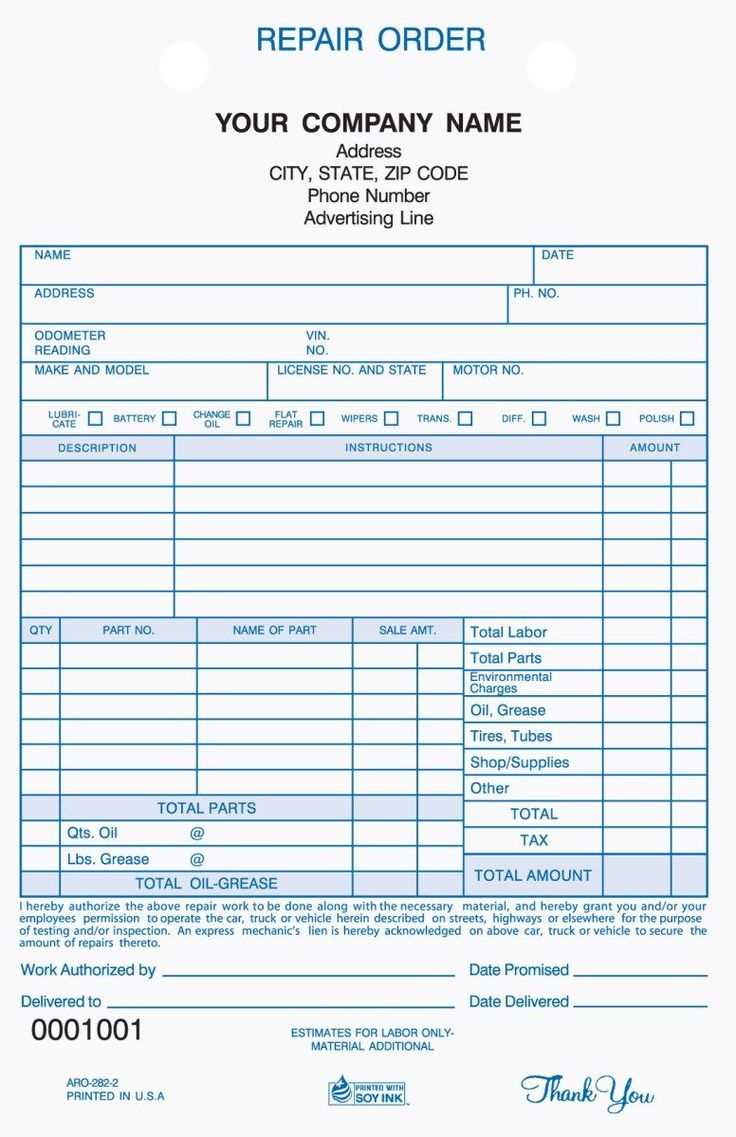

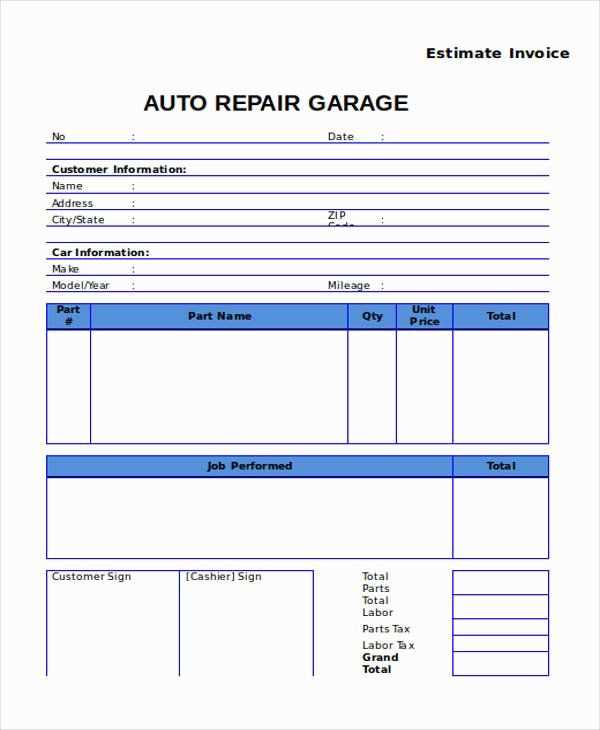

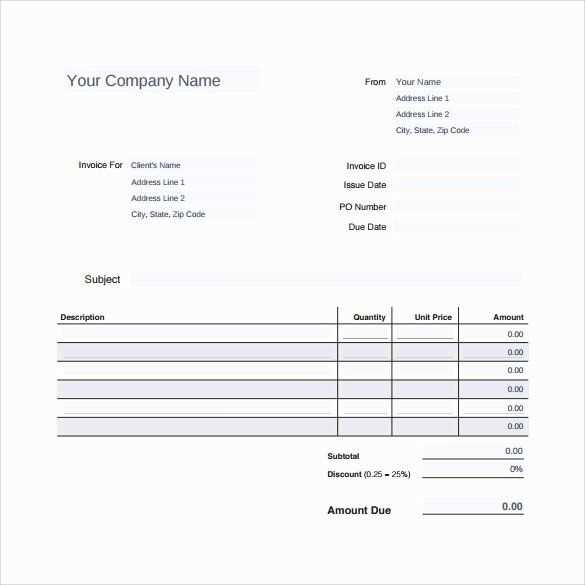

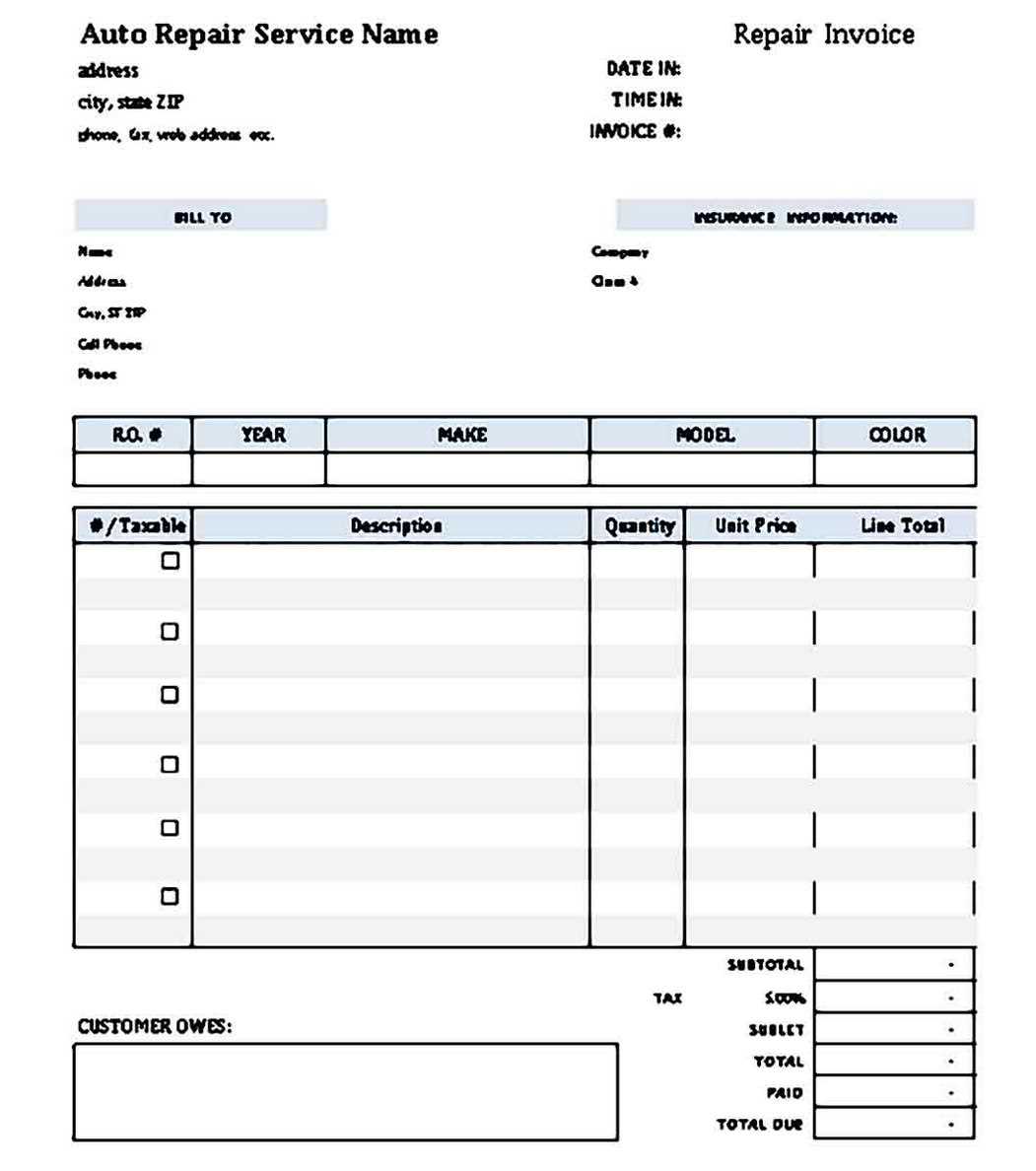

Creating an automotive service receipt requires clear structure and precise details. Make sure to include the following key sections:

Header Information

At the top of the receipt, list the service provider’s name, address, contact details, and logo (if applicable). This makes it easy for customers to identify where the service was performed. Also, include the receipt number for tracking purposes.

Service Details

Detail the services provided, specifying each task, part replaced, and time spent. Use a table to break down the pricing for parts, labor, taxes, and any additional charges. This helps the customer see exactly what they are being charged for.

Payment Information

Clearly state the total amount due, including any discounts or adjustments. Specify the payment method (e.g., cash, credit card) and any payment terms (e.g., due on receipt or within 30 days). This ensures transparency in the transaction.

Warranty and Terms

If applicable, outline any warranties on parts or labor. Mention the duration and coverage to avoid misunderstandings. This section is important for both the customer and the service provider to refer to if issues arise post-service.

Begin by adjusting the template to include your company’s logo, name, and contact details. This ensures customers recognize your business immediately. Make sure the receipt clearly shows the service provided, including a breakdown of labor, parts, and any additional fees. Each section should be labeled clearly for easy understanding.

Customize for Specific Services

Tailor the receipt to match the types of services your business offers. For example, if you offer car repairs, include space for part numbers, warranties, or specific vehicle details like model and VIN. Adjust fields for time spent on repairs or maintenance, and add any relevant industry-specific codes or certifications that may apply to the service.

Add Payment Details

Clearly state the payment method used, whether it’s cash, credit card, or other. Include any tax information if applicable, and offer a space for discounts or promotional codes. If customers can pay in installments, list that as well, along with payment due dates.

Consider adding a thank-you note or an invitation for feedback at the bottom of the receipt. This personal touch can enhance customer satisfaction and encourage repeat business. Customize the layout for readability and to reflect your brand’s style.

Key Information to Include in a Receipt for Auto Repairs

Clearly detail the services performed, the parts used, and the total cost. This transparency helps avoid disputes and gives the customer a clear record for future reference.

1. Service Description

Provide a detailed breakdown of the work done. Specify each repair or maintenance task, including labor charges. If any diagnostic work was done, list it separately.

2. Parts and Materials

List all parts replaced or repaired, including part numbers, descriptions, and quantities. Include the cost of each part along with the labor charges for installation.

3. Labor Charges

Include the hourly rate, the total time spent on the repairs, and the corresponding labor cost. This shows the customer exactly what they’re paying for in terms of labor.

4. Total Cost

Clearly state the total amount charged for parts and labor. Include any taxes or additional fees, such as shop supplies or disposal fees, if applicable.

5. Date of Service

Note the date when the service was completed. This helps with warranty claims and provides a reference for any future repairs.

6. Contact Information

Ensure the receipt includes the shop’s name, address, phone number, and email. This is useful if the customer needs to follow up on the work done.

7. Warranty or Guarantee

Clearly state if any parts or services are covered by a warranty, including the duration and specific terms. If the customer is entitled to a guarantee on repairs, mention it here as well.

8. Payment Method

Indicate how the payment was made (credit card, cash, check, etc.). If payment was made through financing or a service plan, include those details too.

List each part and service separately. Include the specific part name, part number, and quantity. Clearly display the price for each part and the total for all parts used. If any parts have a warranty, note that information to build trust with the customer.

Parts Section

Provide a detailed breakdown of all parts used in the service. For each part, include the exact name, part number, and unit price. If the part is sourced from a particular manufacturer or supplier, mention that as well. This transparency helps customers understand the cost structure and ensures they are aware of what they paid for.

Labor Section

Outline the labor charges, specifying the time spent on each task. List the number of hours worked and the hourly rate for the technician’s service. Break down complex tasks into smaller units if necessary, to reflect the effort involved. Avoid grouping labor charges under vague terms–be as specific as possible.

Ensure all details are easy to read and understand. A clear and concise breakdown builds customer confidence and helps avoid disputes over costs later on.

List all accepted payment methods directly on the receipt. This gives the customer clear information on how they can settle their bill. Include options like credit cards, cash, checks, and digital payments (e.g., PayPal, Venmo, or bank transfers). It’s important to specify any restrictions or preferred methods. For example, if you only accept certain types of credit cards or if there’s a fee for digital transactions, make it clear.

Payment Terms

Clearly state your payment terms, including the total amount due, due date, and any late fees. If a service is to be paid in installments, include the schedule and amount for each payment. For instance, “Due by the 15th of every month,” or “$50 due at the time of service, balance due in 30 days.” Mention any discounts for early payments if applicable.

Refund and Cancellation Policy

Including a refund and cancellation policy is important for transparency. If you offer refunds, specify the conditions under which they are granted. For example, “Refunds are available within 7 days of service, provided the issue is not related to user error.” Similarly, if cancellations are subject to fees, make that known in advance.

Keep the payment terms brief but specific. This reduces confusion and ensures both parties are on the same page regarding financial obligations.

Include the full name, address, and contact details of your business on every receipt. This ensures your service is traceable and provides customers with necessary contact information in case of disputes or warranty claims.

Clearly outline the services provided, including labor, parts, and any additional charges. Make sure the description is detailed enough for customers to understand exactly what they are paying for. This helps avoid confusion and supports transparency in business practices.

Specify the warranty terms on the receipt. If any part of the service or repair is covered under warranty, note this along with the expiration date or conditions that apply. This can prevent misunderstandings and protect both parties legally.

List the total price and tax breakdown. Accurate tax reporting is necessary for compliance with local regulations. Ensure you’re applying the correct rate for the region where the service is provided.

Have a clear policy on refunds and cancellations. Include this information on the receipt to avoid disputes. Your customers will appreciate the transparency and it protects your business from potential legal issues.

Ensure your receipt complies with local consumer protection laws, which may require certain disclosures or specific formats. Stay informed about any changes in the regulations that affect your business.

Using digital tools to generate auto repair receipts significantly reduces time and errors. Implementing specialized software designed for auto repair businesses enables quick creation and customization of receipts, making them more accurate and professional. Tools like repair management software and point-of-sale systems can automate most of the data entry process, ensuring consistency across all receipts.

For example, a typical auto repair receipt template includes customer details, service performed, labor costs, parts used, and total charges. With digital tools, this information can be pre-filled based on previous transactions or customer records. This removes the need for repetitive manual entries and prevents mistakes in data transcription.

Many software programs allow you to save and reuse templates, making it easy to generate receipts with just a few clicks. These tools also enable businesses to track receipts, providing an organized history of transactions for both customer and business reference. You can integrate these receipts directly into accounting systems for seamless financial recordkeeping.

Here’s an example of how a digital receipt might look:

| Item | Details |

|---|---|

| Customer Name | John Doe |

| Service Date | 02/07/2025 |

| Service Description | Brake Pad Replacement |

| Labor Charges | $150 |

| Parts Used | Brake Pads ($80) |

| Total Amount | $230 |

Digital tools also offer features like email receipts, allowing customers to receive their receipts instantly, which enhances the customer experience. Additionally, these tools often include tax and discount calculations, removing the need to perform these manually. This streamlines the entire process, making it quicker and more accurate for both the service provider and the customer.

This keeps the meaning intact and avoids redundancy.

Keep your automotive service receipt template clear and focused. Include only the necessary fields: service description, parts used, labor costs, and taxes. Avoid excessive details that can clutter the document or confuse the customer.

Use simple, direct language for item descriptions and pricing. For example, instead of saying “newly installed air conditioning unit,” write “installed air conditioner” for simplicity.

Ensure that all prices are clearly itemized to prevent ambiguity. Break down labor and parts separately, with clear indications of hours worked and parts prices.

Make sure the template includes a space for customer details, service date, and invoice number. This keeps everything organized and easily traceable for both parties.

Avoid redundant phrases like “total cost after tax,” since the final price already includes taxes. Let the calculations speak for themselves.