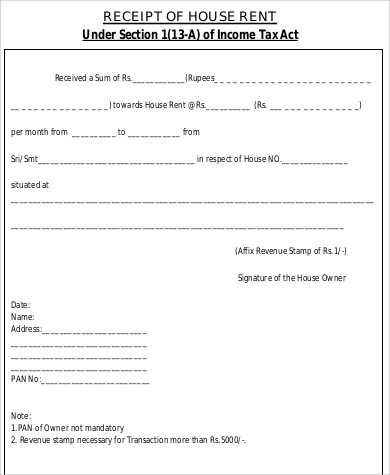

Use the following template to create a rent receipt for tax purposes in India. This receipt ensures compliance with the requirements set by the Income Tax Department, and it can be used to claim deductions under Section 80GG or HRA (House Rent Allowance).

Template Format

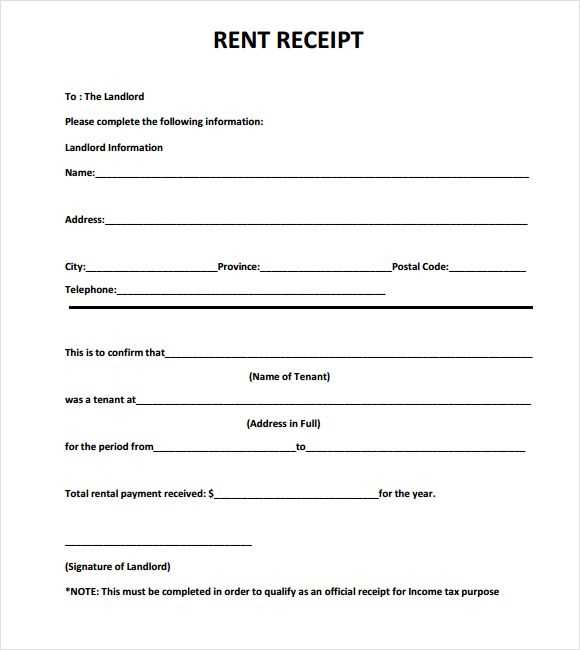

The rent receipt should include specific details to validate the payment. Here’s a basic structure you can follow:

------------------------------------------------------------- | RENT RECEIPT | ------------------------------------------------------------- | Date: [DD/MM/YYYY] | | Receipt No: [Unique ID] | | Received from: [Tenant's Name] | | Address of Rented Property: [Complete Address] | | Landlord's Name: [Landlord's Name] | | PAN Number of Landlord: [PAN Number] | | Tenant's Name: [Tenant's Name] | | Rent Amount: [Amount] | | Rent Payment Period: [From DD/MM/YYYY to DD/MM/YYYY] | | Mode of Payment: [Cash/Bank Transfer] | | Signature of Landlord: _______________________________ | -------------------------------------------------------------

Key Details to Include

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Date: The exact date when the rent payment is received.

- Landlord’s and Tenant’s Details: Full names, addresses, and PAN details should be included for both parties.

- Rent Amount: Clearly mention the total rent paid during the period.

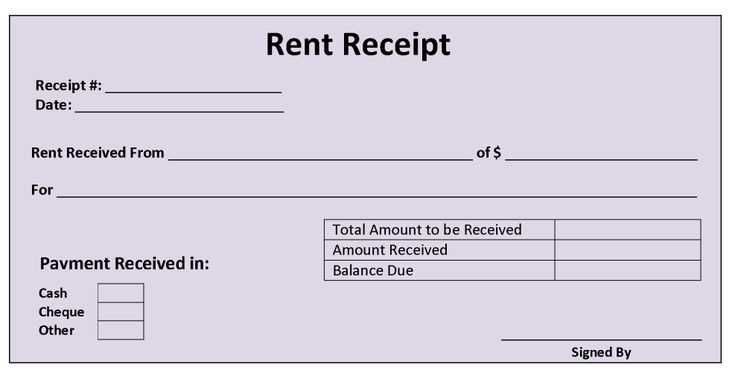

- Payment Mode: Specify whether the payment was made in cash or via bank transfer.

Important Considerations

- Tax Purpose: Rent receipts are important when you are claiming HRA deductions or applying for tax benefits. Make sure all details are accurate and up-to-date.

- Rent Agreements: Ideally, the rent receipt should align with the terms stated in the formal rent agreement.

Ensure that you keep a copy of every receipt for record-keeping and tax filing. Proper documentation helps avoid disputes and ensures smooth tax processing.

Rent Receipt Template for Income Tax in India

Understanding the Requirements for Rent Receipts in India

Key Elements to Include in a Rent Receipt Template

How to Properly Format a Rent Receipt for Tax Purposes

Legal Aspects of Rent Receipts in India

How to Personalize a Rent Receipt Template for Personal Use

Using Rent Receipts for Income Tax Deductions in India

To claim a tax deduction under Section 80GG of the Income Tax Act, a rent receipt must contain specific information. The key elements include the tenant’s name, landlord’s name, address of the rented property, monthly rent paid, and the duration of payment. Additionally, the landlord’s PAN number should be included for transparency. It’s critical that these details are accurate to avoid discrepancies during tax assessments.

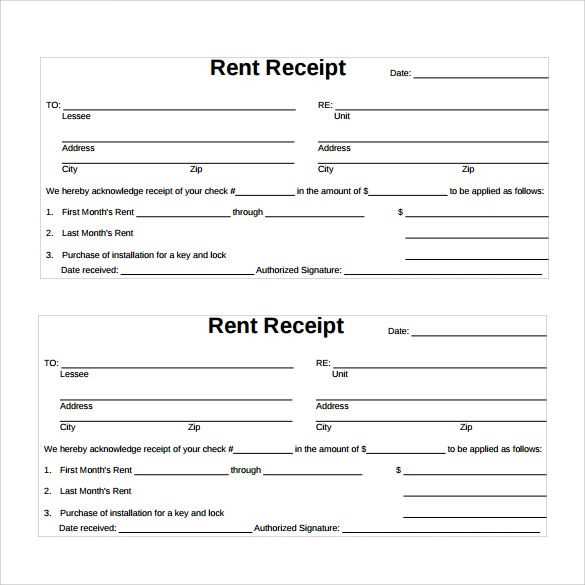

A rent receipt must clearly indicate the amount paid along with a mention of the date the payment was made. Formatting should be consistent and easy to read. Include the payment mode (cheque, bank transfer, or cash), as this can further authenticate the transaction. Ensure the receipt is signed by both the tenant and landlord, confirming the transaction.

When using a rent receipt for tax purposes, the format needs to reflect proper legal standards. The receipt should be clear and free of errors, with each section demarcated appropriately. The date and signature are required to validate the receipt. Keep the rent receipt records for at least 6 years, as the income tax department may request them during an audit.

The legal framework surrounding rent receipts in India is straightforward. The Rent Control Act ensures that tenants are provided with valid receipts for rent payments. Landlords are also obligated to maintain records of rent receipts for tax purposes. A valid rent receipt serves as proof of rent payment, which can be used to claim deductions under tax laws.

Customizing a rent receipt template for personal use is easy. You can modify an existing template by adding specific fields that fit your needs, such as including the security deposit or rent arrears. Online tools also provide templates that can be tailored to include these details. When personalizing, ensure that all essential elements are included to meet tax requirements.

Rent receipts are beneficial when claiming deductions under Section 80GG of the Income Tax Act. Tenants who do not receive House Rent Allowance (HRA) from their employers can claim a deduction for rent paid. The amount eligible for deduction is based on the rent paid, and must not exceed Rs. 5,000 per month in some cases. Ensure that the rent receipts match the amount shown in your tax returns to avoid issues with the income tax department.