Creating a clear and professional contractor receipt template helps ensure both parties in a transaction have a proper record of services rendered and payments made. A well-structured receipt can prevent confusion and provide a reference point in case of disputes.

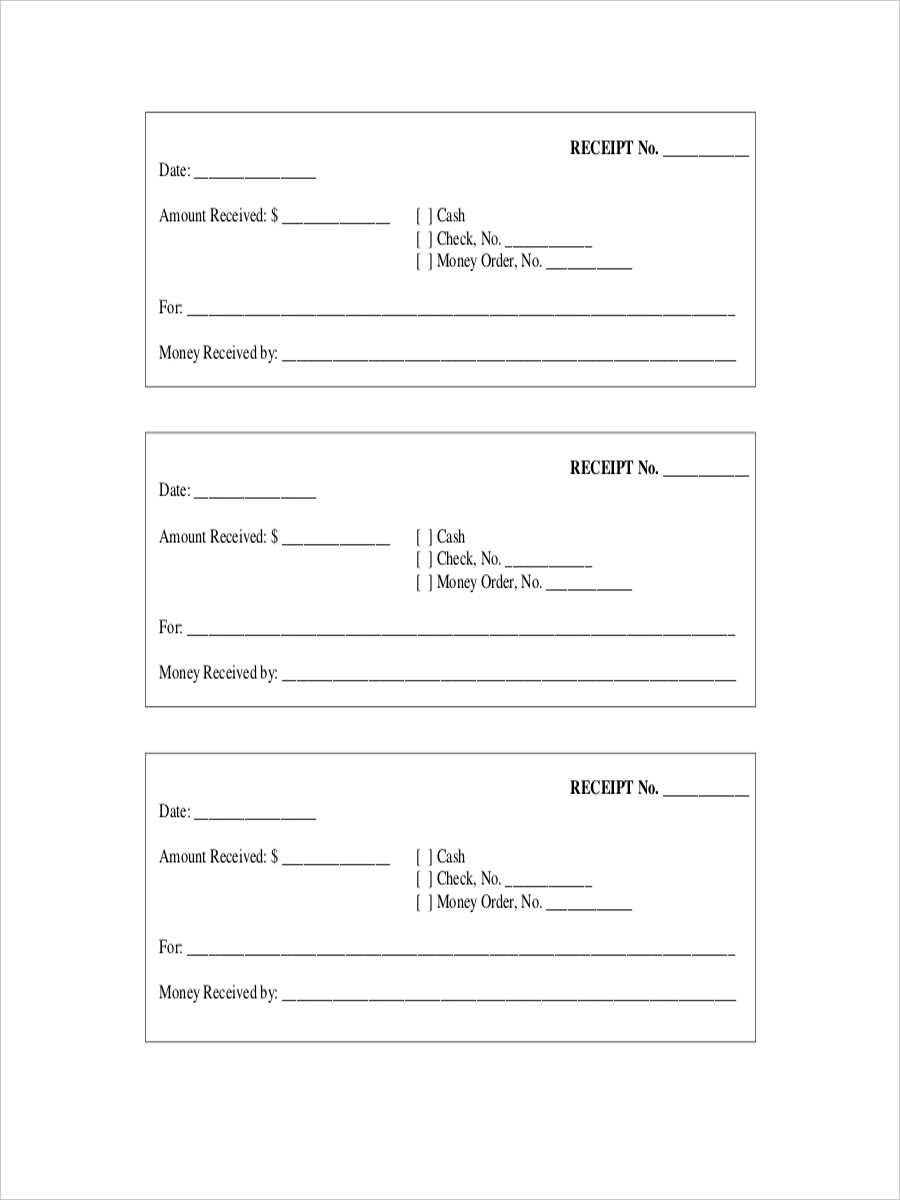

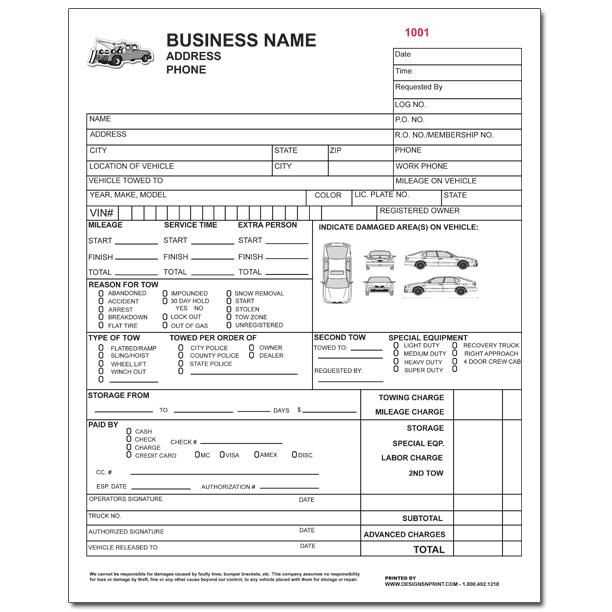

Start with key details like the contractor’s name, business address, and contact information. Make sure to include the client’s name, address, and project description. Include the date of payment and a breakdown of services or materials provided, along with their corresponding costs. This level of detail makes the receipt transparent and easy to follow.

Lastly, include the total amount paid and the method of payment. Whether the payment was made via check, bank transfer, or cash, specifying this will make the receipt more useful for both parties in case future questions arise. Keep the design simple and organized for clarity.

Here is the updated version without repetition:

Make sure to include all necessary details on the contractor receipt. A clear breakdown of the work completed, date, and payment amount should be specified. Avoid vague terms and focus on concrete facts like service descriptions, total sums, and applicable taxes. This ensures both clarity and legal validity for both parties involved.

For a neat format, list the contractor’s name, business information, and job description first. Then, proceed with the payment information such as amounts, method, and any adjustments made. Always include the date and receipt number for tracking purposes. Don’t forget to indicate any outstanding balances or future payments if applicable.

Double-check that all spelling, figures, and calculations are accurate. Details like this prevent misunderstandings and simplify any future references to the document.

Blank Contractor Receipt Template Guide

To create an effective contractor receipt, begin by identifying the key details to include. A blank receipt template should cover the contractor’s name, business name, address, and contact information, as well as the client’s details. It’s also necessary to specify the service provided, including a description of the work done and the total payment received. Clearly state the payment method, whether cash, cheque, or bank transfer, and mention the date of transaction.

How to Customize a Blank Receipt Template for Contractors

Customizing a blank template involves adding fields that cater to your specific business needs. Include an area for invoice numbers or job IDs to help track your records. Consider adding spaces for tax details, such as applicable tax rates or discounts, if relevant. You can also integrate your business logo for branding. Adjust font sizes and layout to ensure clarity and professional appearance. Ensure the format is user-friendly for quick data entry and printing.

Key Elements to Include in a Contractor’s Receipt

A contractor’s receipt should always have the contractor’s full name and contact information, the client’s details, a clear description of the services rendered, the total cost, and the payment method. It’s important to list any taxes separately and to include a note that the payment has been received. Adding a line for both parties to sign can also provide additional validation of the transaction.

For proper record-keeping, ensure that each receipt is numbered sequentially. This helps both the contractor and the client track payments and services over time. Consider adding a short statement noting that the payment is final, or indicating if any future payments are expected.

Legal Considerations When Issuing Receipts for Contractors

Ensure your receipts comply with local tax laws by including necessary information about sales tax, VAT, or other applicable taxes. Contractors should also provide clear documentation for any warranties or guarantees related to the work performed. In some jurisdictions, specific language may be required on receipts to ensure compliance with business regulations.

Common Mistakes to Avoid with Contractor Receipts

Omitting crucial details such as the payment method or the service description can create confusion or lead to disputes. Failing to number receipts sequentially can cause trouble when organizing records. Additionally, not keeping copies of receipts can result in losing track of transactions. Ensure your receipts are detailed and accurate to avoid misunderstandings.

How to Ensure the Validity of Contractor Receipts

To validate a contractor receipt, both the client and contractor should keep signed copies of the document. If the transaction was made online, having an electronic receipt with a timestamp and transaction ID can act as proof. Double-check all details on the receipt for accuracy before handing it over, ensuring there are no clerical errors.

Benefits of Using a Blank Receipt Template for Contractors in Your Business

Using a blank receipt template streamlines the payment process, improves organization, and ensures all necessary information is captured accurately. It can also save time by reducing the need to create receipts from scratch, allowing contractors to focus on their work instead of administrative tasks. Having a consistent and professional receipt format helps build trust with clients and maintains a smooth business operation.