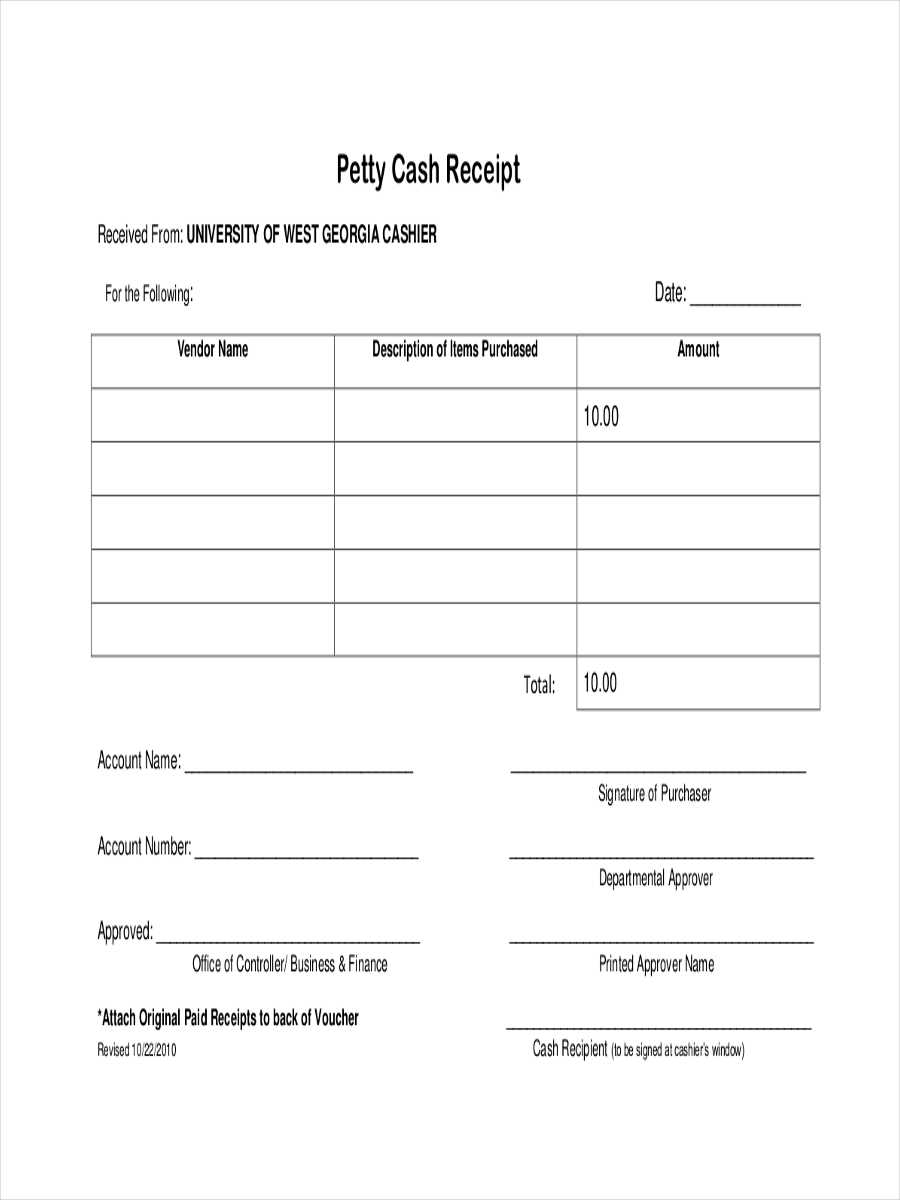

For businesses that manage petty cash, keeping clear and consistent records is key. A Word template for petty cash receipts ensures that every transaction is logged accurately and professionally. This template simplifies the process of tracking cash spent on small office expenses, helping you stay organized and avoid confusion when reconciling accounts.

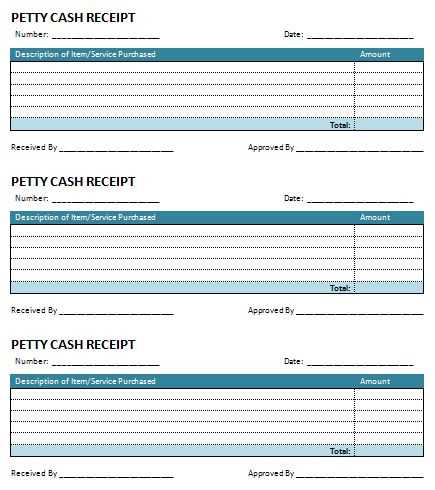

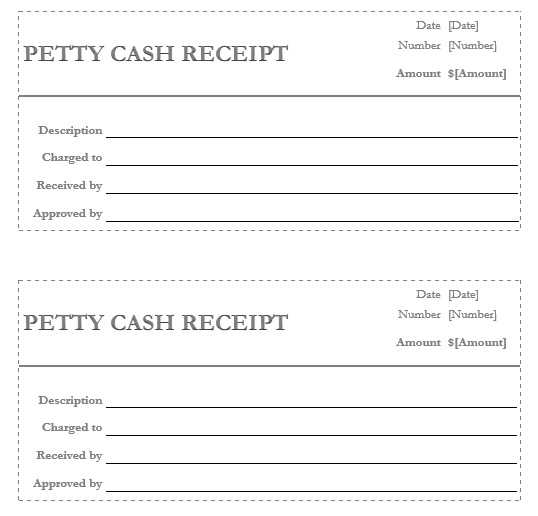

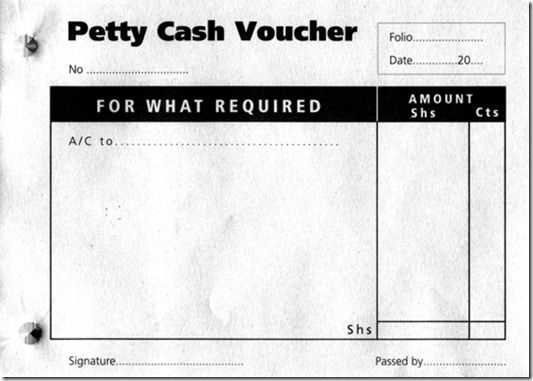

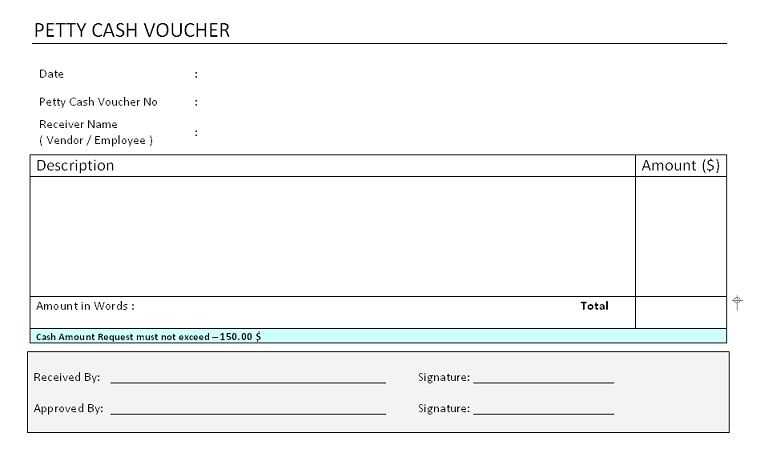

The template typically includes fields for the date, the purpose of the expense, the amount, and the signature of the person who received the cash. With a Word template, you can quickly fill in these details and print a receipt for both your records and the person making the withdrawal. This provides transparency and helps keep your business accounting in check.

By using a standard format for all petty cash transactions, you reduce the risk of errors and ensure uniformity in your financial reporting. It’s an easy-to-use tool that integrates seamlessly into your existing accounting practices without requiring specialized software or training.

Here are the corrected lines with minimal repetition of words:

When creating a petty cash receipt template in Word, focus on simplifying the structure while maintaining clarity. Start by clearly labeling the purpose of the document, such as “Petty Cash Receipt” at the top.

Effective Design for the Template

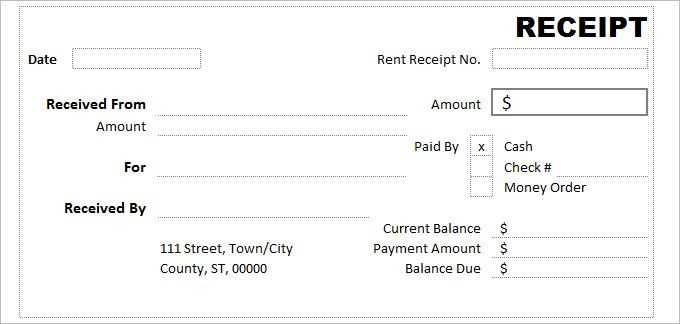

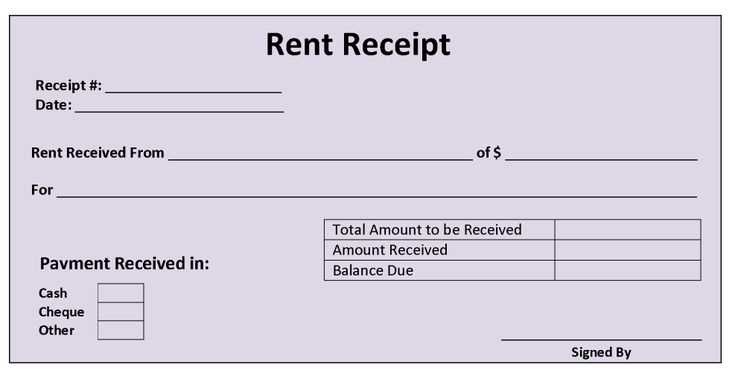

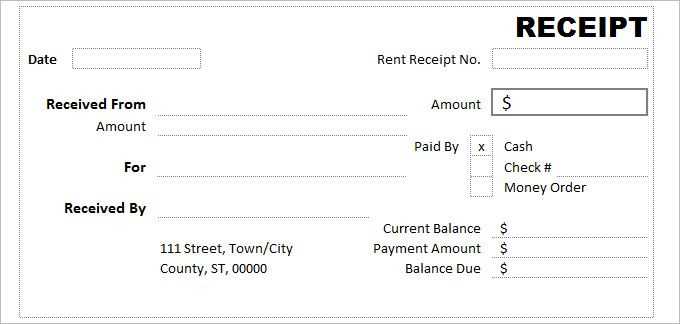

Use separate sections for the date, amount received, purpose, and recipient’s name. This layout will reduce redundancy and enhance readability. In the “Amount” field, list both the numeric and written format (e.g., “$50.00 – Fifty dollars”) to avoid any misunderstandings.

Ensure Proper Information Flow

For consistency, include a field for the cashier’s name, ensuring it stands out from the rest of the content. This distinction helps identify who processed the transaction without repeating the same wording elsewhere. Add a signature line at the bottom for both the recipient and the cashier to confirm the exchange.

- Word Template for Petty Cash Receipt

Creating a Word template for a petty cash receipt simplifies the process of tracking small cash transactions. Use the following structure to build a template that’s clear and easy to update.

- Header Section: Include the company name, address, phone number, and email at the top for clear identification.

- Receipt Title: Label the document as “Petty Cash Receipt” or a similar clear title.

- Date: Add a date field so each receipt can be timestamped for accuracy and future reference.

- Receipt Number: Assign a unique receipt number to maintain a record of each transaction.

- Payee Name: Provide a space for the person receiving the cash, including their full name and contact details.

- Amount: Clearly specify the amount given, formatted with currency symbols for easy readability.

- Purpose of Payment: Include a section to describe the reason for the petty cash disbursement, making it easy to track expenses.

- Signatures: Include spaces for both the person receiving the cash and the person authorizing the payment to sign the receipt.

- Notes: A section for additional comments or remarks can help clarify any special conditions tied to the transaction.

Once the template is created, it can be saved and used repeatedly. You can also customize it with your company’s logo and color scheme for a professional touch.

Open Microsoft Word and create a new blank document. Set up the page layout by adjusting the margins to fit your needs–typically, a 1-inch margin works well. You can do this by selecting ‘Layout’ and then ‘Margins.’

Next, insert a table with two columns and several rows. This table will structure your receipt with clear sections for the date, description, amount, and other relevant details. Use the first column for labels like “Date,” “Description,” “Amount,” and “Received By,” and the second column for the data input fields. Keep the table simple to maintain clarity.

In the header of the document, add the title “Petty Cash Receipt” in a bold font. You can center this title for a neat look. Below the title, insert your company name and address if applicable. This will provide the necessary context for the receipt.

Under the table, leave space for additional information such as approval signatures or comments. You can also add a line to record the petty cash balance after the transaction.

Once the layout is complete, save the template for future use. You can customize this template by adjusting the table or adding other elements, like a logo, depending on your specific needs.

A petty cash receipt should clearly outline specific details for accurate record-keeping. Focus on including the following elements in your template:

1. Date and Time

Always include the exact date and time when the transaction occurs. This ensures a clear chronological record of petty cash movements.

2. Description of the Expense

Provide a brief but precise explanation of the item or service purchased. This helps clarify the purpose of the expenditure.

3. Amount Spent

Clearly state the exact amount spent, including any applicable taxes or fees. This ensures transparency and simplifies financial tracking.

4. Payment Method

Indicate how the payment was made, whether it was via cash, check, or another form. This helps avoid confusion regarding the source of the funds.

5. Authorized Signatures

Include signatures from both the person requesting the petty cash and the one authorizing it. This adds an extra layer of accountability.

6. Receipt Number

Assign a unique receipt number for each transaction to easily reference and track receipts during audits or reviews.

Tailor your petty cash receipt template by adjusting the fields to fit your specific needs. For businesses requiring more detailed tracking, include additional sections such as project codes, department names, or specific expenditure categories. These fields help allocate expenses accurately for financial reporting or audits.

If your business needs to track tax or VAT, add a section for tax rates and amounts. This is especially useful for industries with variable tax rates or those operating in multiple regions. Clear documentation of tax amounts ensures compliance and simplifies reporting.

Incorporate fields for approval signatures or manager review. This feature is beneficial for companies that need internal verification before processing reimbursements. A space for signatures or a checkbox for approval will enhance accountability and streamline internal processes.

For businesses with frequent small transactions, consider adding a recurring expenses section. This can help you easily track repeat expenses and manage budgets without manually reviewing each receipt.

Finally, customize the template with your business logo and branding. A professional-looking receipt can enhance your company’s image while making it easier for employees or clients to identify your organization in the future.

Set clear fields for each transaction. Make sure your template includes distinct sections for the date, amount, purpose, and recipient of the cash. This structure ensures all necessary details are captured for each payment or reimbursement.

Include predefined categories for expense types. Using drop-down menus or checkboxes can help classify expenses (e.g., office supplies, travel, etc.), making it easier to review the financial records later.

To track payments accurately, implement a balance tracking system within the template. Include an automatic calculation for the running balance after each entry. This will help prevent discrepancies by providing real-time updates as new data is entered.

| Transaction Date | Amount | Expense Category | Purpose | Recipient | Running Balance |

|---|---|---|---|---|---|

| 2025-02-07 | $50 | Office Supplies | Purchase of printer paper | John Doe | $950 |

| 2025-02-08 | $30 | Travel | Taxi fare | Jane Smith | $920 |

Regularly update the template. Consistent data entry allows for more accurate tracking over time. Perform weekly or monthly checks to ensure all entries are complete and accurate. This will also make it easier to reconcile records with bank statements or receipts.

Double-check the amounts on petty cash receipts. Incorrect figures, such as miscalculations of expenses or adding extra zeros, can cause discrepancies during audits. Always verify the totals before finalizing the receipt.

Ensure that you fill out all required fields. Missing information, such as the date, name, or purpose of the expenditure, can delay processing and lead to confusion. Include as much detail as possible to keep accurate records.

Avoid using outdated templates. Over time, your organization’s petty cash procedures may evolve, and templates need to be updated to reflect any changes. Using an old version can lead to unnecessary mistakes in the paperwork.

Don’t neglect approval signatures. If the receipt requires managerial or supervisory approval, make sure it is signed before submission. Lack of authorization can delay reimbursement or cause issues during reconciliation.

Be mindful of improper formatting. Incorrect alignment or inconsistent font sizes can make the receipt difficult to read. Stick to a clean, uniform layout to avoid confusion and ensure the document looks professional.

| Error Type | Consequence | Prevention |

|---|---|---|

| Incorrect Amount | Discrepancies during audits | Double-check all figures |

| Missing Information | Delays in processing | Complete all required fields |

| Outdated Template | Inaccurate or irrelevant information | Update templates regularly |

| Lack of Signature | Delayed reimbursement or reconciliation issues | Obtain all necessary approvals |

| Poor Formatting | Confusion and difficulty reading | Use a consistent, readable layout |

To save your receipt template in Word, follow these steps:

- Click “File” in the top-left corner of Word.

- Select “Save As” from the menu.

- Choose a location on your computer or cloud storage where you’d like to store the file.

- Name your template, then select “Word Document” as the file type.

- Click “Save” to store your receipt template.

To share your receipt template, you can use a few different methods:

- Email: Attach the saved Word document to an email and send it to the recipient.

- Cloud Storage: Upload the document to a cloud storage service like Google Drive, OneDrive, or Dropbox, then share the link with others.

- Print: If needed, you can also print the template and distribute physical copies.

Consider converting the Word document to PDF if you want to ensure that the format stays consistent across different devices and operating systems. Simply click “Save As” again, and choose PDF as the file type before saving it.

Key Points to Include in a Petty Cash Receipt Template

A well-structured petty cash receipt template ensures accuracy and clarity in recording small cash transactions. Start with a clear header indicating “Petty Cash Receipt” for easy identification. Below the header, include the date of the transaction, the amount received, and a brief description of the purpose. Always specify the name of the person receiving the cash to maintain accountability.

Details to Include in the Receipt

Include the following sections in the template:

- Date: Clearly state the transaction date.

- Amount: Indicate the exact amount received.

- Purpose: Briefly describe the reason for the payment.

- Receiver’s Name: Add the name of the person receiving the cash.

- Signature: Leave space for the receiver’s signature to confirm receipt.

Why These Details Matter

Providing these details helps track petty cash disbursements and maintains a transparent record. It minimizes errors and ensures a smooth audit trail. Including a signature also prevents disputes regarding cash handling. Customizing your template with these essential sections streamlines petty cash management, making the process simple and straightforward for all parties involved.