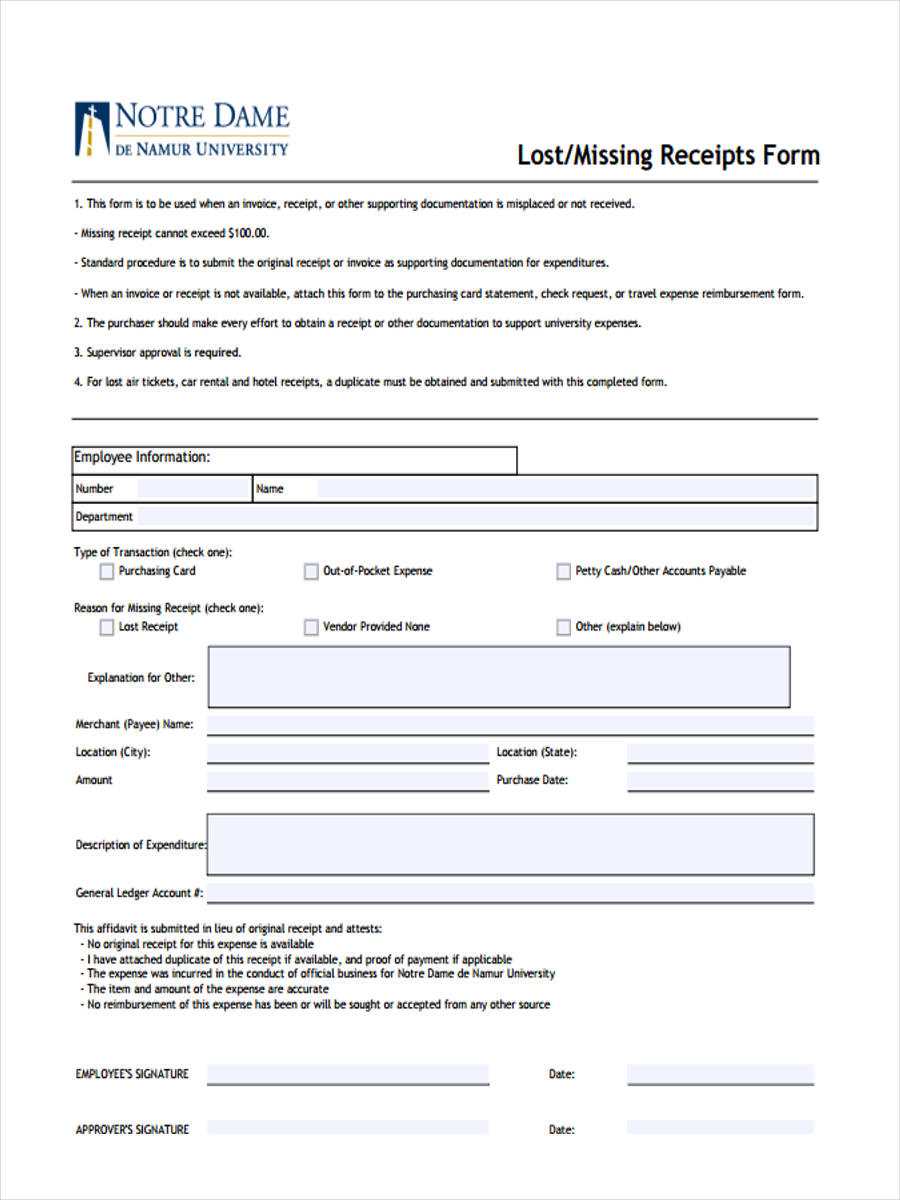

If you’ve lost a credit card receipt, it’s important to quickly fill out a missing receipt form. This document allows you to request a duplicate or provide details of the transaction for your records. Using the right template will streamline the process and ensure you provide all necessary information.

Start by including key transaction details, such as the date, amount, and merchant name. These are crucial for tracking the purchase and verifying the charge. Make sure to detail the reason for the missing receipt–whether it was misplaced, damaged, or not provided. This helps the issuer better understand your situation and expedite the request.

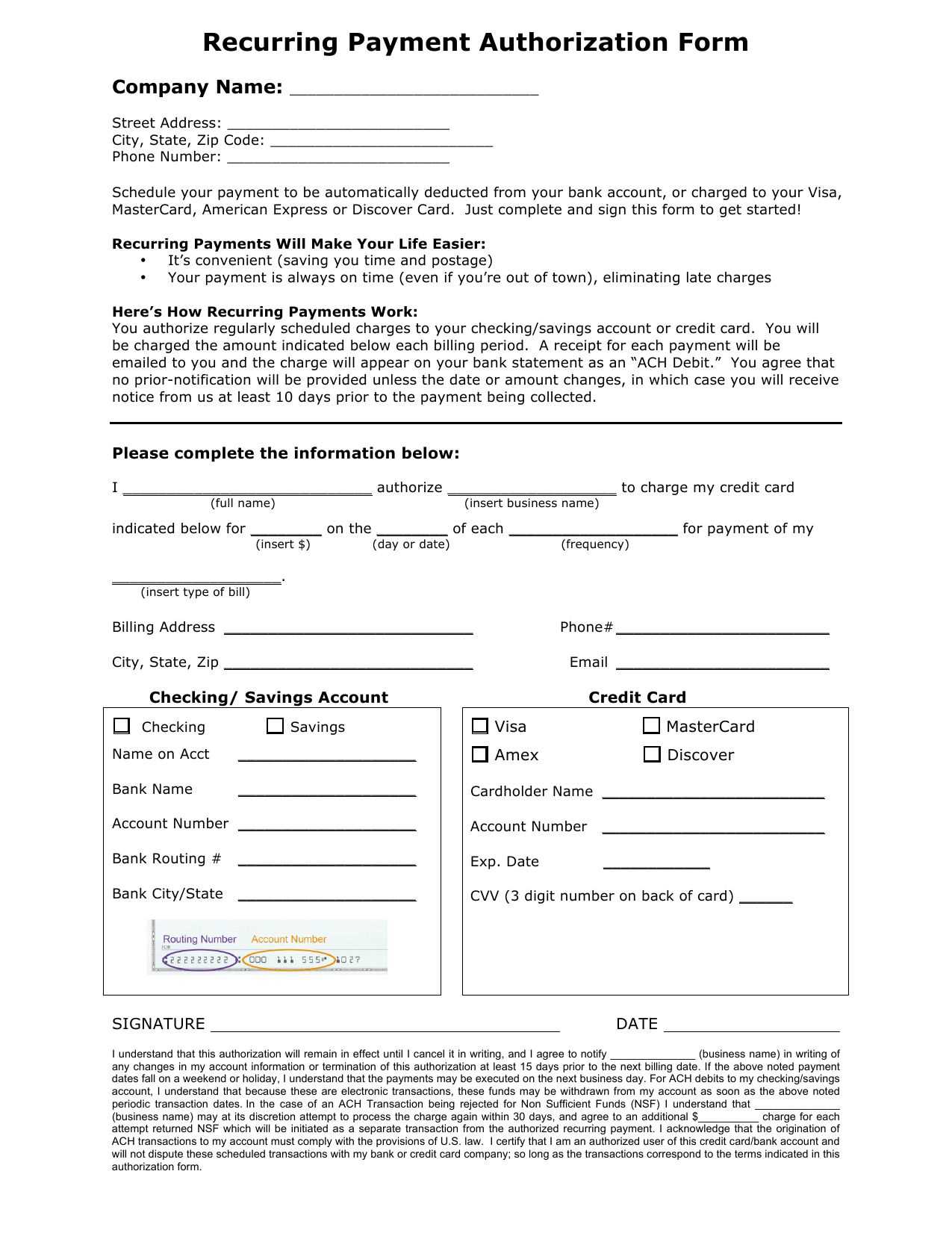

The form should also request your account information, including your credit card number (or the last four digits), to verify your identity and link the transaction to your account. Additionally, providing contact information ensures the issuer can reach you for follow-up or additional verification.

Once completed, submit the form through the issuer’s designated process, whether it’s online, via email, or by mail. Some institutions may ask for additional documentation, such as bank statements or proof of identity, so be ready to supply anything requested to speed up the resolution.

Here’s the corrected version:

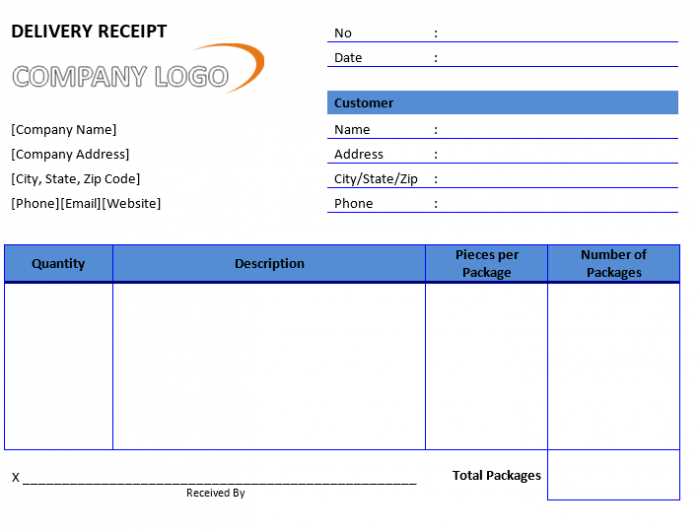

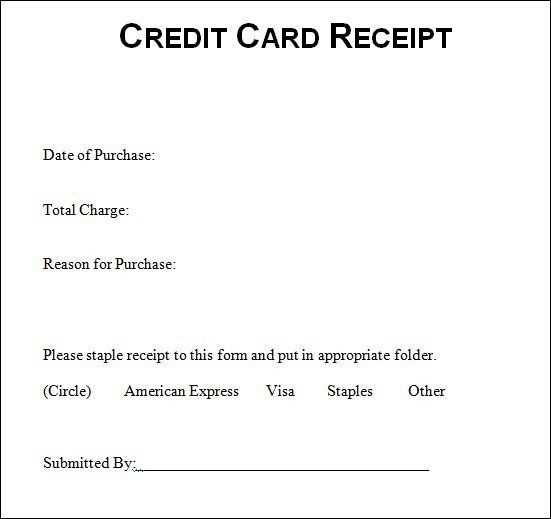

Make sure to include the full date, the total amount, and a clear breakdown of items or services in the receipt. Add your business name, contact information, and any relevant tax information for transparency. Ensure the payment method is clearly stated, specifying whether it was via credit card, cash, or another method. If using a digital template, check for customizable fields that allow you to adjust details for each transaction.

If your template includes a signature field, ensure it’s placed at the bottom for easy signing. This also helps in maintaining a professional look for your records. Lastly, double-check the alignment of all fields for readability and clarity. Consistent formatting reduces errors and enhances the experience for both parties.

- Missing Credit Card Receipt Form Template

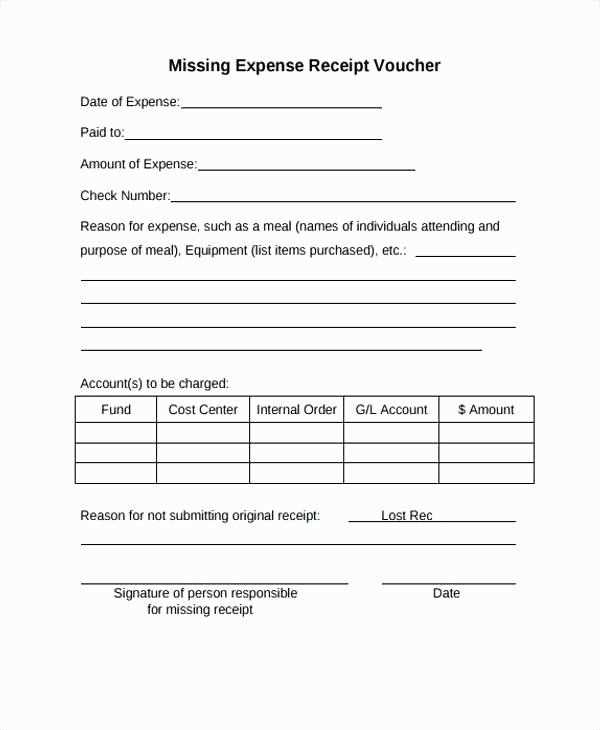

If a credit card receipt is missing, it’s important to act quickly and create a clear, professional form to document the situation. Use this template to request a duplicate receipt or to inform the relevant parties about the missing transaction.

Key Information to Include

- Transaction Date: Specify the date of the original purchase.

- Transaction Amount: List the exact amount charged to the card.

- Merchant Information: Include the name, address, and contact details of the merchant.

- Credit Card Details: Provide the last four digits of the card used for the purchase.

- Reason for Missing Receipt: Briefly describe why the receipt was not obtained.

Template Example

Here’s a basic structure for the form:

Name: [Your Name] Date of Transaction: [MM/DD/YYYY] Amount: [$Amount] Merchant: [Merchant Name] Merchant Address: [Merchant Address] Reason for Missing Receipt: [Brief explanation] Last Four Digits of Card: [XXXX]

This form should be submitted to the merchant or your credit card provider to resolve the issue quickly.

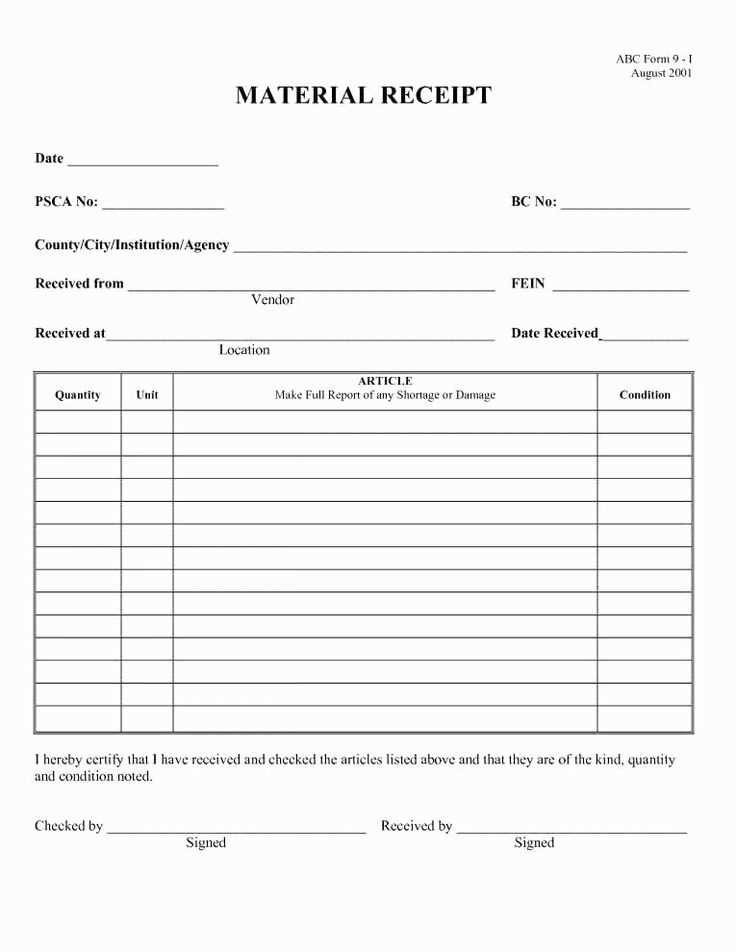

Design a simple form that includes key details like the date of the transaction, merchant name, amount, and reason for the missing receipt. Ensure there is a section for the individual to sign, confirming the information is accurate. This can help streamline the reporting process and serve as a reference for future claims.

Basic Information Fields

Include fields for the date, merchant, amount, and description of the purchase. Add a section where the person can briefly explain why the receipt is missing, which could be helpful for follow-up or verification. If necessary, provide a dropdown list or checkboxes for common reasons like “receipt lost” or “receipt not provided”.

Verification and Sign-off

Incorporate a space for the individual’s signature and date to confirm that all the provided information is accurate. This serves as an official record, ensuring that the claim can be processed quickly without confusion or delay. If the form is being submitted digitally, include a checkbox for electronic confirmation.

Ensure you include the following details in the documentation form:

Basic Personal Details

Provide your full name, contact number, and email address. These are necessary to identify the individual submitting the form.

Transaction Information

List the transaction date, the total amount, and the credit card used for the purchase. Include details such as the card type and the last four digits of the card number for verification purposes.

Make sure all information is accurate and up to date to avoid delays in processing the request.

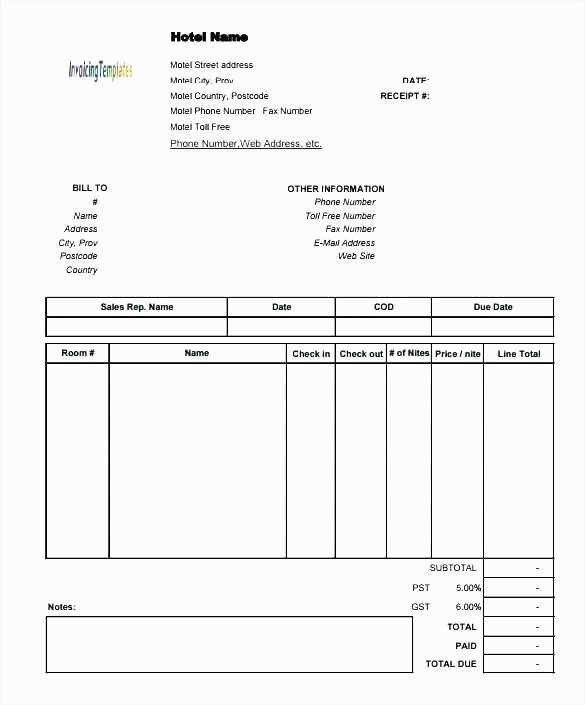

Ensure your receipt records comply with local tax laws and financial reporting standards. Accurate documentation plays a key role in auditing and verifying business transactions. Keeping receipts helps businesses demonstrate due diligence in financial management and protects them from legal disputes regarding payments.

Track receipts for warranty claims, refunds, and returns. Many countries require businesses to maintain detailed transaction records for a set number of years. Failure to comply can result in fines or penalties. Ensure each receipt includes essential details such as the merchant’s name, date, amount, and transaction type.

| Required Information | Legal Implications |

|---|---|

| Merchant’s Business Name | Verifies the legitimacy of the transaction for both buyer and seller. |

| Transaction Date | Ensures proper tax reporting and helps resolve disputes over timing. |

| Amount Paid | Essential for accurate financial statements and tax filings. |

| Payment Method | Confirms the authenticity of the transaction for audits or refunds. |

Consult a tax professional to ensure your receipts meet the required legal standards specific to your region or industry. Keeping organized and complete records helps avoid unnecessary complications during audits or when handling legal claims.

If you can’t find your credit card receipt, follow these steps to resolve the issue. First, check your email inbox or junk folder for any digital receipt that might have been sent. Many companies send receipts electronically, so it’s worth verifying.

Problem 1: Receipt Not Issued at All

Sometimes, a merchant forgets to provide a receipt. In this case, contact the store directly and request a copy. Many retailers can look up the transaction using your card number and provide you with an official record.

Problem 2: Receipt Lost or Misplaced

If you lose a receipt after receiving it, start by checking with your card issuer. Some banks allow you to view recent transactions, and you might be able to use the transaction details as a substitute for the receipt. Additionally, using a receipt tracker app can help you store and manage receipts digitally, preventing loss in the future.

Problem 3: Inaccurate Receipt Information

If the receipt shows incorrect information, reach out to the business for clarification. Provide them with details such as the date of the transaction, purchase amount, and your payment method. Merchants usually have records of all transactions, making corrections easier.

Problem 4: Non-Refundable Transactions

Without a receipt, some businesses may refuse refunds or exchanges. To avoid this, use your credit card statement as proof of purchase. Credit card transactions are traceable, and this document can help verify the details of the purchase.

Solution to Prevent Future Issues

Consider keeping digital copies of receipts. Some credit card apps allow you to snap a picture of the receipt directly and store it with your transaction details. This method keeps all receipts organized and accessible for future reference.

Fill out all required fields clearly. Incomplete forms can delay the processing and cause confusion. Double-check all information, including dates, amounts, and your personal details.

Double-Check for Accuracy

- Ensure the receipt matches the transaction details exactly.

- Verify the merchant’s name, purchase amount, and transaction date are correct.

Provide Clear Documentation

- Submit the form with a clear, legible copy of the receipt.

- Make sure the receipt is not cropped or blurry.

- If submitting digitally, avoid using low-quality scans or photos.

Submit the form promptly. Delays in submission can lead to complications in reimbursement or processing timelines. If the form requires additional documentation or clarification, address it immediately.

To quickly check the status of your submission, start by accessing the submission portal or the website where you submitted your form. Look for the “Submission Status” section or a similar option. Once you locate it, input your reference number or submission details as required. You will typically receive an immediate update on whether your submission is under review, approved, or requires additional information.

If the status is unclear or the portal doesn’t provide enough information, reach out to the customer support team. Include your submission details in the inquiry for quicker assistance. They can provide an accurate update and guide you on the next steps if needed.

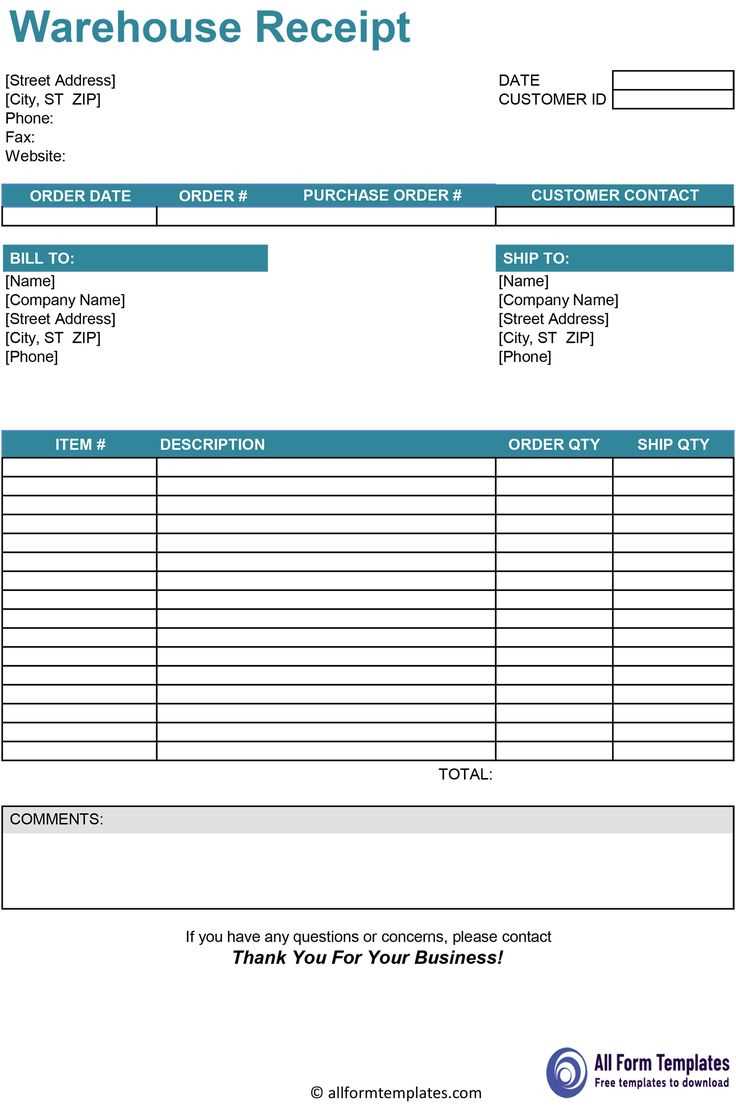

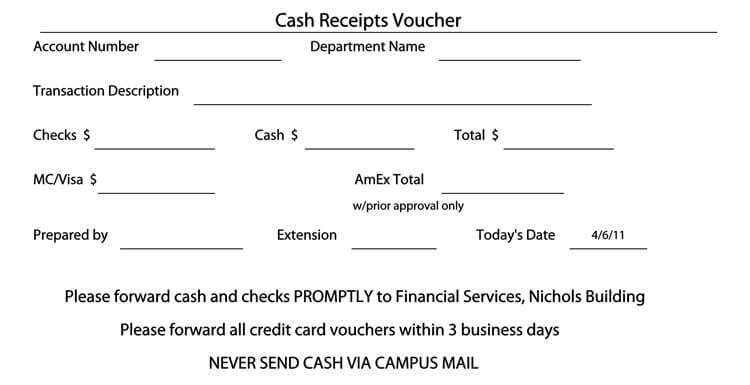

When creating a credit card receipt form, it’s crucial to structure it clearly and ensure all necessary details are captured for efficient processing. Ensure the template includes the following sections: cardholder’s name, card number (last four digits), transaction date, merchant name, and amount charged. These details allow both the merchant and the cardholder to easily verify the transaction.

Use a simple, clean design for readability. Include checkboxes for the payment method and space for signatures or additional comments. Keep font sizes consistent, and leave enough white space for users to fill in required fields. This design minimizes errors during manual entries and enhances clarity.

Finally, always include your contact details for customer inquiries. This fosters trust and ensures customers can easily reach you for assistance, should they need it. Keep the template accessible, adaptable, and easy to print or save digitally, so it remains useful across various platforms.