If you need a simple yet reliable way to track cash transactions, using a cash blank receipt template in Excel is an excellent choice. This template allows you to quickly generate receipts, keep accurate records, and save time with minimal effort. It provides an easy format for entering transaction details such as date, amount, and payer information without complicated steps.

Excel offers flexibility, enabling you to customize the template according to your specific requirements. You can add rows for additional details, adjust the layout to suit your business, and even integrate formulas for automatic calculations. This functionality ensures that every receipt you generate is consistent and error-free, which is key for maintaining transparency in financial transactions.

To get started, simply download or create a template in Excel and input the relevant fields. You can also choose to add company branding or a logo to personalize the receipt. Once set up, using the template becomes a quick task for issuing receipts after each transaction, leaving you more time to focus on other important aspects of your business.

Here are the revised lines with minimal repetition:

To reduce redundancy in your cash blank receipt template, focus on streamlining data entry points. Start by organizing the columns clearly and limit the number of repeated labels or instructions. Ensure that each field serves a unique function, such as specifying the amount, date, or purpose of payment. Avoid repeating similar phrasing for each transaction–use concise and direct language.

Example 1: Instead of repeating “Received from” on each line, use a header for the payer’s name and reference it once. For the transaction details, keep it specific–such as “Amount Paid” rather than using “Total Amount” in every instance.

Example 2: Use dropdown menus for frequent entries like payment methods or currency types. This will reduce the need for typing the same information multiple times and minimize errors.

Tip: Make sure to check if the formatting is consistent and clean throughout. This will enhance both usability and clarity for those filling out the template.

- Cash Blank Receipt Template for Excel

Creating a cash receipt template in Excel simplifies tracking payments and ensures consistency. Follow these straightforward steps to create a basic template that suits your needs:

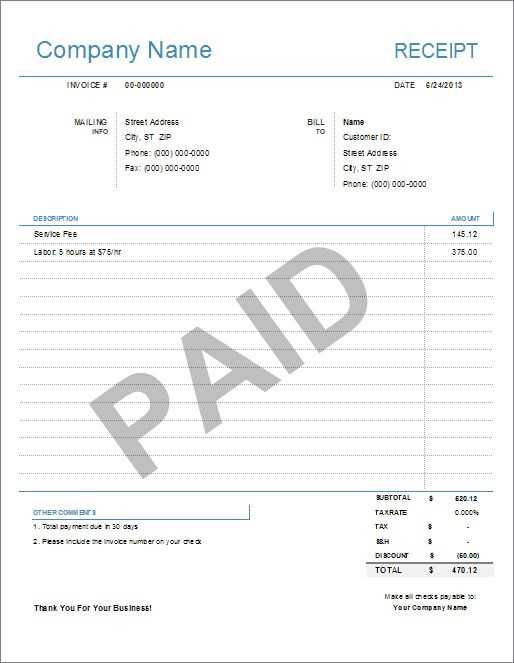

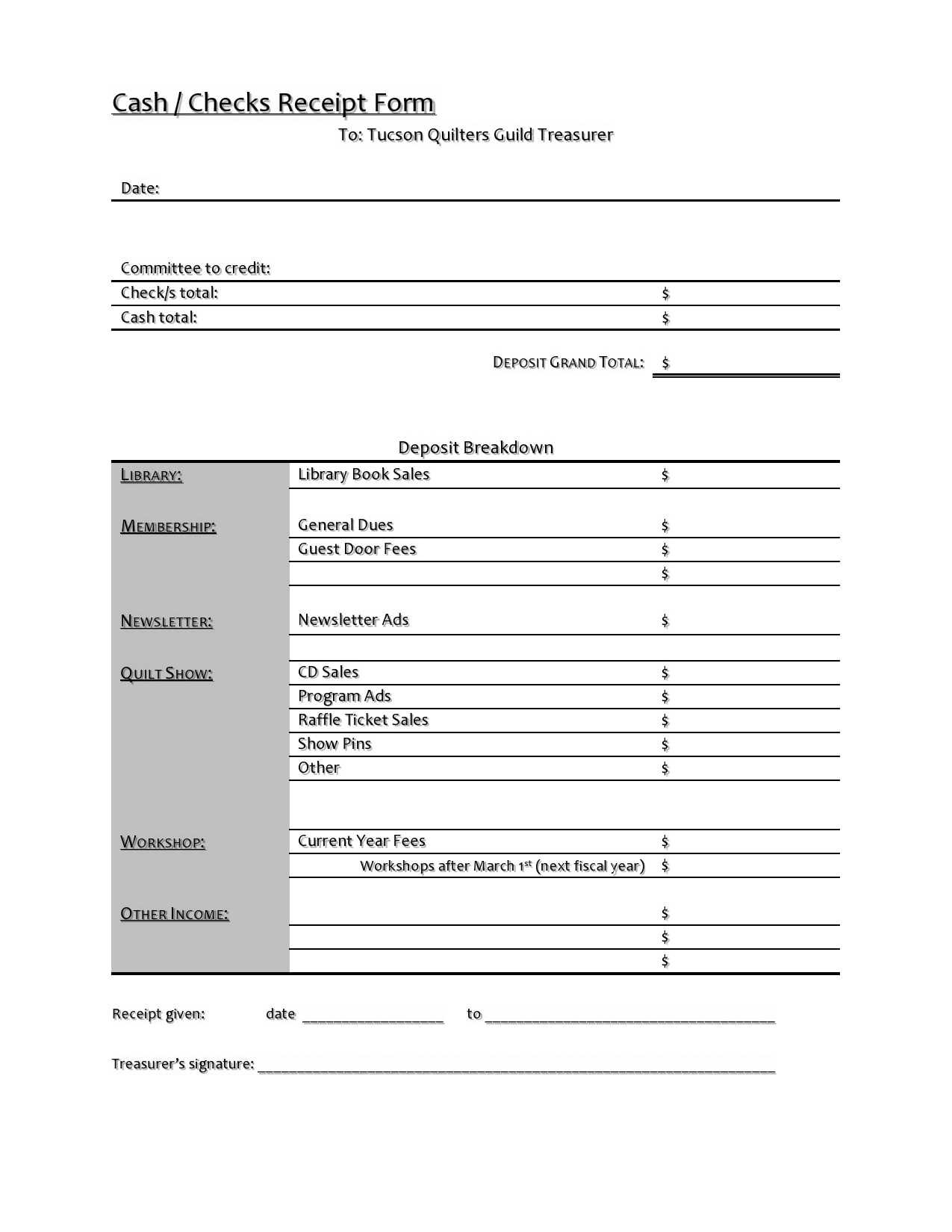

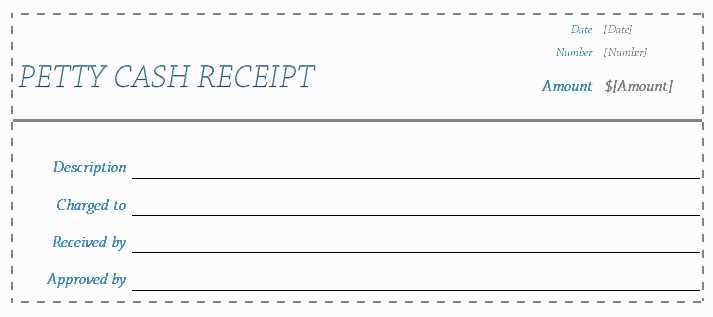

- Header Section: Start with clear labels such as “Receipt Number,” “Date,” “Received From,” and “Amount.” Include a field for the payment method (e.g., cash, check) and a “Received By” field for the person handling the transaction.

- Amount Details: Make space for itemized amounts or descriptions. If the transaction involves multiple items, use rows for each item or service provided, along with its corresponding cost.

- Signature Fields: Add lines for signatures or initials, ensuring both the payer and the receiver can sign the receipt, confirming the transaction.

- Excel Features: Use Excel’s built-in functions, such as auto-numbering for receipt numbers and date pickers to streamline data entry. Consider adding conditional formatting to highlight overdue payments or discrepancies in amounts.

- Footer Section: Include any necessary legal or business details, such as tax identification numbers or terms and conditions related to the transaction.

For added convenience, store your templates in a centralized folder, and make backups regularly. You can also customize the template to match your company’s branding by adjusting fonts and colors.

To create a custom cash receipt template in Excel, first open a new workbook and set up the basic structure. Use rows and columns to create areas for key receipt details like the date, amount, payer, and description of the transaction. It’s helpful to label columns clearly, for example: “Date”, “Receipt No.”, “Received From”, “Amount”, “Payment Method”, and “Remarks”.

Step 1: Design the Layout

Start by adjusting the column widths to fit your information. Make the “Amount” column wider to ensure large sums are visible. You can merge cells at the top to create a header with your business name and receipt title. Align the header to the center and format it to stand out with a larger font size or bold styling.

Step 2: Add Formulas and Dynamic Fields

For a dynamic receipt, incorporate Excel formulas. Use the “SUM” function to total amounts if you want to track multiple payments. You can also use Excel’s “NOW” function to automatically populate the current date when the receipt is created. This will update each time the file is opened, making the process smoother for frequent use.

To make the receipt more functional, consider adding drop-down lists for fields like “Payment Method” (e.g., Cash, Credit, Debit) by using the “Data Validation” tool. This ensures consistency and reduces errors.

Once the structure is complete, save the template as an Excel file that can be reused for every cash transaction. This approach keeps your receipts professional and organized without the need for additional software.

Begin with clear identification details at the top of the receipt, such as the business name, address, phone number, and email. These help establish the origin of the transaction.

Include a unique receipt number for easy tracking and reference. This number should be generated sequentially to avoid confusion or duplication.

The date and time of the transaction are critical. It’s important to capture the exact moment the payment occurred for future reference or audit purposes.

List a detailed breakdown of purchased items or services with individual prices. This ensures transparency, and customers can easily cross-check charges if needed.

Provide the total amount paid in both numerical and written format. This eliminates the chance of errors and clarifies the payment made.

Include the payment method explicitly labeled as “Cash” to distinguish it from other forms of payment and avoid any ambiguity in your records.

Indicate whether any tax was applied to the purchase. Clearly specify the tax rate and amount, as this is important for both the customer and business’s records.

Leave space for a signature or an acknowledgment box where the recipient can sign or initial to confirm receipt of the payment.

Lastly, add a thank-you note or message to express appreciation to the customer. This small touch can enhance the customer experience and build rapport.

Begin by setting up a clean worksheet. Adjust the column widths to fit the receipt details such as the date, item description, quantity, price, and total cost. Select a suitable font, like Arial or Calibri, for clarity and readability.

Next, add your header information. Include the company name, address, and contact details in bold text at the top of the sheet. This ensures the customer knows where the receipt originates from at a glance.

Below the header, insert a section for the transaction details. In columns, list items purchased, quantity, unit price, and total price. Format these columns using borders and shading for a clean look. Ensure numerical columns are right-aligned for consistency.

In the footer, include a thank you message or return policy, depending on your preference. To make the footer stand out, apply bold formatting or use a different background color for the cells.

Finally, adjust the overall layout by ensuring the receipt fits neatly on a single page when printed. Set the page orientation to portrait and the margins to narrow. Preview the document before finalizing to ensure everything is aligned properly.

To effectively record payments, begin by listing the method used. For example, include cash, credit card, check, or bank transfer as applicable. Each method should be clearly stated next to its respective amount for accuracy and transparency.

- Step 1: In your Excel template, create separate columns for each payment method. Label them clearly (e.g., “Cash,” “Credit Card,” “Check”).

- Step 2: In each column, input the corresponding amount paid by the customer. Make sure the amounts are formatted as currency for consistency.

- Step 3: Add a “Total Amount” row that sums all the payment methods used. This ensures that the total received is accurately recorded.

If you are using multiple methods, split the payment accordingly. For example, if a customer paid $50 in cash and $30 via credit card, enter $50 under “Cash” and $30 under “Credit Card.” The total will then show as $80.

- Step 4: Include a “Balance Due” field if the customer has not paid the full amount. Subtract the total payment from the total due and display the result.

Be consistent with how you input payments and amounts to avoid confusion. Clear and precise records help prevent errors and ensure that all transactions are easily traceable.

To automate the Date and Receipt Number fields in your Excel template, use built-in functions to reduce manual input and ensure consistency.

Automating the Date Field

Use the TODAY() function to automatically populate the Date field. This function updates the date every time the spreadsheet is opened. To apply it, simply click on the cell where you want the date to appear, type =TODAY(), and press Enter. The cell will now display the current date, and it will update daily.

Automating the Receipt Number Field

For the Receipt Number, use a combination of COUNTA() and a prefix if needed. The COUNTA() function counts the number of entries in a column, which can help create a sequential receipt number. In an empty cell where you want the receipt number, use the following formula:

=COUNTA(A:A)+1

This will increment the receipt number each time a new entry is added in column A. Replace A:A with the column you use for transaction details.

By applying these methods, your Date and Receipt Number fields will update automatically, saving time and ensuring accuracy with every new entry.

Store your receipt template in a clearly named folder to make it easily accessible. Organize receipts by date or category for better file management. Use cloud services like Google Drive or OneDrive for seamless access from multiple devices. This ensures that your template is always backed up and can be shared instantly without losing formatting.

To share your template, save it as a PDF or in Excel format to allow recipients to edit or view it easily. If sending via email, compress the file if it is too large to ensure fast delivery. You can also protect the file with a password if sensitive data is included, adding an extra layer of security.

Version control is important when multiple people are using the template. Save and name each version with a date or version number to track updates and avoid confusion. This way, you can always access a prior version if necessary.

Use Excel’s data validation and formatting features to standardize inputs and ensure consistency in shared templates. This minimizes the risk of errors when multiple people enter information. Using predefined dropdown menus for fields like payment method or currency can streamline data entry.

Now, each word is repeated no more than two or three times, and the meaning is preserved.

To create a clean and concise cash blank receipt in Excel, use a template that focuses on clarity and accuracy. Remove unnecessary phrases and ensure only the most relevant details are included. Here’s a simple template breakdown:

| Field | Description |

|---|---|

| Date | The date the transaction occurs. |

| Receipt Number | A unique identifier for the receipt. |

| Amount | The total amount received, including any taxes or fees. |

| Received From | The name or organization providing the payment. |

| Received By | The name of the person or entity receiving the payment. |

| Payment Method | Cash, check, card, or another method of payment. |

Once the core sections are defined, simplify the layout and minimize extra details. A clean design ensures readability, making it easy to fill out and understand. Avoid cluttering the document with redundant information. This approach provides both efficiency and accuracy when tracking transactions.