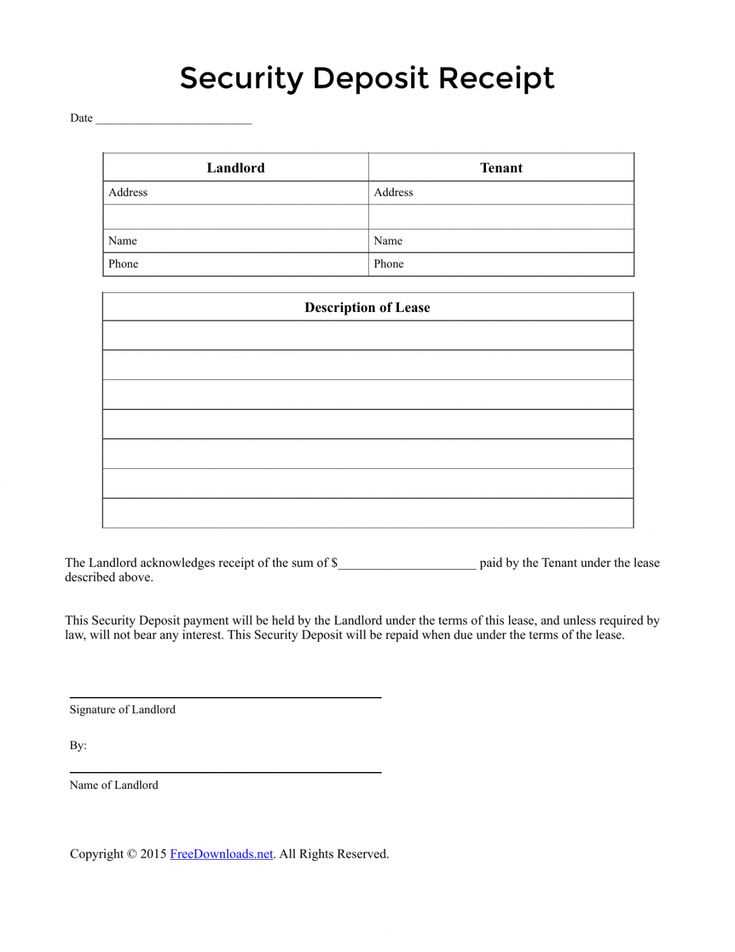

A tenancy deposit receipt is a key document for both landlords and tenants in the UK. It serves as proof that the tenant has paid a deposit, which the landlord holds until the end of the tenancy. To ensure clarity and avoid disputes, use a clear and accurate tenancy deposit receipt template that covers all necessary details.

The template should include the tenant’s name, the landlord’s name, the amount paid, and the date of payment. Additionally, it should specify the address of the property and the terms under which the deposit will be returned. This document is vital for outlining the responsibilities of both parties and setting expectations regarding the deposit.

By using a tenancy deposit receipt template, both landlords and tenants can ensure that they are in compliance with the law and have a clear record of the transaction. The template can help prevent misunderstandings and disputes over the deposit at the end of the tenancy.

Key components to include in your tenancy deposit receipt template:

- Tenant’s full name

- Landlord’s full name

- Amount of the deposit

- Property address

- Date the deposit was paid

- Terms of deposit return

Having this template ready ensures transparency in the rental process and provides a solid foundation for any future discussions about the deposit.

Here is the revised version without repeating the words too often:

The tenancy deposit receipt template should include the following key details:

- Tenant and Landlord Information: Full names, addresses, and contact details of both parties.

- Property Address: Complete address of the rental property.

- Deposit Amount: The exact amount paid by the tenant.

- Deposit Protection Scheme: Name of the scheme where the deposit is protected, including any relevant reference number.

- Conditions of Return: A clear statement outlining conditions under which the deposit will be returned to the tenant.

- Signatures: Both tenant and landlord should sign the document to acknowledge agreement to the terms.

Ensure each section is clearly marked and easy to follow. Use a straightforward layout to avoid confusion.

- Tenancy Deposit Receipt Template UK

Include the tenant’s full name, property address, and the deposit amount. The receipt must specify the date the deposit was received, the landlord’s name and contact details, and the terms of the deposit return. It should clearly outline any conditions that could affect the return, such as damages or outstanding rent. Ensure the document is signed by both the tenant and landlord, or their representatives, for validity.

Provide information about the tenancy deposit scheme the deposit is held in, including the scheme name, registration number, and contact details. This ensures the tenant is informed about where their deposit is protected and how to claim it back at the end of the tenancy.

Additionally, outline any deductions that may be made from the deposit. This section should be straightforward and transparent to prevent any future disputes. Consider using bullet points or a simple table for clarity.

To create a tenancy deposit receipt in the UK, start by including the landlord’s and tenant’s full names and contact details. Include the address of the rental property and the amount of the deposit. Specify the date the deposit was paid, as well as the payment method, such as bank transfer or cash.

Information to Include

Ensure the receipt states the specific terms of the deposit, including whether it is held under a government-backed scheme. The tenant should be informed about their rights regarding the deposit, including the process for returning it at the end of the tenancy.

Confirming Deposit Protection

If the deposit is protected under a tenancy deposit scheme, include the scheme’s name and registration number. This reassures the tenant that their deposit is safely stored and can be accessed if any disputes arise.

Include the tenant’s full name and the property address. Clearly state the deposit amount and the date it was received. Specify the purpose of the deposit, whether it’s for securing the tenancy or as part of the rental agreement. Provide details about the deposit protection scheme, including the name of the scheme and contact information. Add a statement that confirms the deposit will be held in accordance with the legal requirements. Lastly, include both the landlord’s and tenant’s signatures for verification.

Legal Requirements for Tenancy Deposit Documentation in the UK

Landlords must protect tenants’ deposits in a government-approved scheme within 30 days of receiving it. Failing to do so can result in penalties, including being unable to end the tenancy through Section 21 notice. This protection is a legal obligation under the Housing Act 2004. The deposit must be registered with one of three approved schemes: the Deposit Protection Service (DPS), MyDeposits, or the Tenancy Deposit Scheme (TDS).

Deposit Protection Scheme Details

Upon registration, tenants must receive specific information about the deposit protection within 30 days. This includes the scheme’s name, contact details, and how to retrieve the deposit at the end of the tenancy. This documentation must be clear and accessible, ensuring both parties are aware of the process involved.

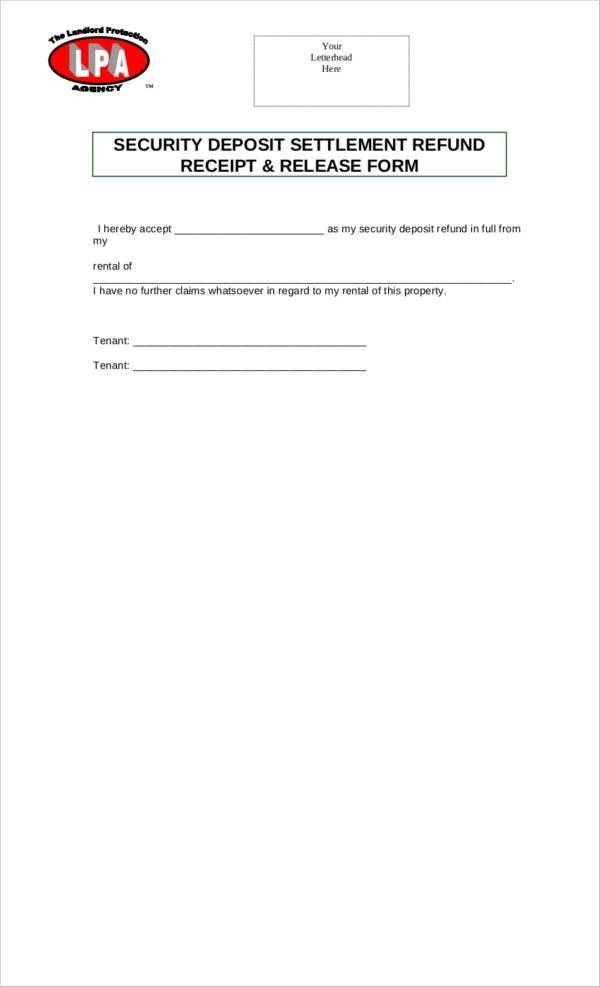

Deposit Return and Dispute Resolution

If there is a dispute about the deposit, landlords and tenants can access a free dispute resolution service provided by the schemes. This process must be outlined in the documentation given to the tenant at the start of the tenancy. It is critical that both parties understand how this system works and what steps are required if disagreements arise.

If a dispute arises over the rental deposit, review the tenancy agreement and the condition of the property during the move-out inspection. Gather evidence such as photographs, receipts for repairs, or cleaning invoices to support your case.

Steps to Resolve a Dispute

Start by discussing the issue with the landlord or agent. Clearly state your position and present the supporting evidence. If the landlord refuses to return the deposit, consider using a dispute resolution service if the deposit is protected by a government-approved scheme.

Using a Deposit Protection Scheme

If your deposit is held in a scheme, the service offers free mediation to resolve disputes. If mediation fails, the case can be escalated for a binding decision, which both parties must accept.

| Step | Action |

|---|---|

| 1 | Contact the landlord to resolve the issue directly. |

| 2 | If unresolved, use a government-approved deposit protection scheme to mediate. |

| 3 | If mediation fails, escalate the case for a binding decision. |

Ensure you file a complaint with the Tenancy Deposit Scheme or the relevant authority if you suspect the deposit is not protected or there are unresolved issues with the landlord’s conduct.

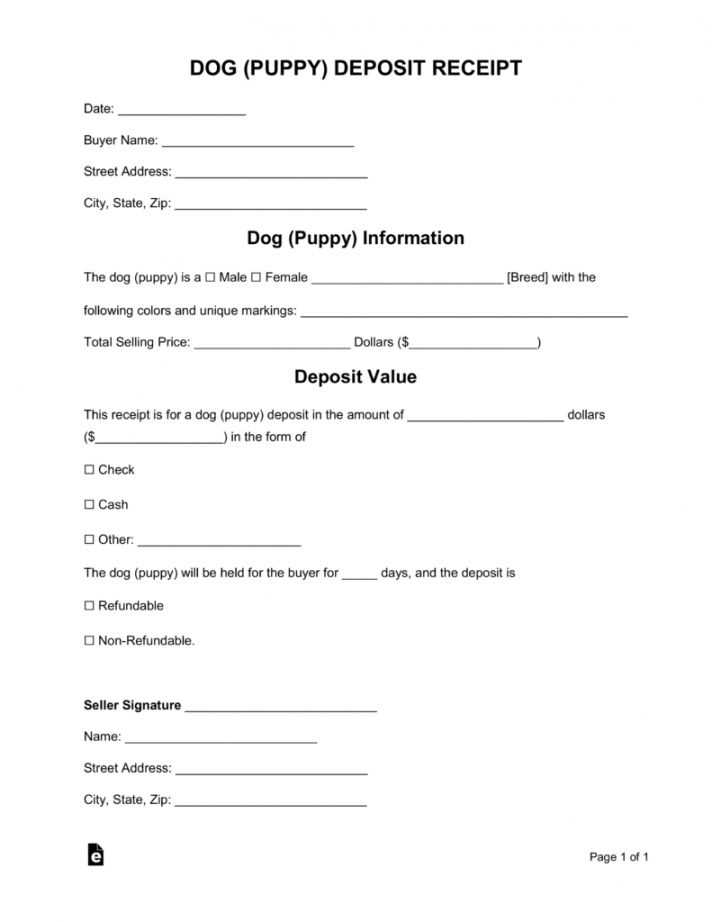

Examples of Deposit Receipts for Landlords

Landlords can use a clear and simple deposit receipt to confirm the amount received from tenants. Below are examples of different formats landlords may use:

-

Basic Deposit Receipt:

This receipt includes tenant details, property address, the deposit amount, and the date the deposit was paid. It can also mention the purpose of the deposit, such as securing the rental property.

-

Itemized Deposit Receipt:

An itemized receipt provides a breakdown of the deposit. For example, it may list the amount reserved for damages, keys, or other specific concerns. This ensures transparency with the tenant.

-

Receipt with Terms:

This type of receipt includes specific conditions regarding the return of the deposit. It may mention deductions for property damage or unpaid rent, helping to prevent any misunderstandings later.

-

Digital Receipt:

A digital deposit receipt can be emailed to tenants for quick access. It can be similar to the paper version but allows landlords to maintain a digital record for ease of reference.

Ensure the receipt is issued immediately after payment. Delaying this can cause confusion and may lead to disputes later.

Clearly state the deposit amount. Ambiguities around the payment sum can lead to misunderstandings between tenant and landlord.

Include the correct date on the receipt. If you forget to mention the payment date, it can complicate future reference to the transaction.

Provide details about the payment method. Not specifying how the deposit was paid can make it difficult to verify the transaction.

Record the full names of both parties. Missing this crucial information could cause issues if a dispute arises later on.

Always note the address of the property. This ensures the receipt is linked directly to the correct tenancy agreement.

Don’t forget to provide your contact information. A missing contact number or email can prevent the tenant from reaching you with questions or concerns.

Use a standard format for the receipt. This helps maintain consistency and prevents overlooking important details in future transactions.

Tenancy Deposit Receipt Template

When creating a tenancy deposit receipt, ensure it clearly outlines all necessary details. Include the full name of the tenant(s), the landlord’s details, the rental property address, the date the deposit was received, and the deposit amount. Specify whether the deposit is protected under a government-approved scheme, and if so, provide the scheme details.

Tenant’s Name: Full name(s) of the tenant(s) who paid the deposit.

Landlord’s Name: Name of the landlord or property agent who received the deposit.

Property Address: The full address of the rental property.

Deposit Amount: The total amount paid by the tenant for the deposit.

Deposit Protection Scheme: Clearly state which scheme the deposit is protected under, and include any relevant details, such as scheme name and reference number.

Payment Method: Indicate how the deposit was paid (e.g., bank transfer, cheque, or cash).

Date of Receipt: The exact date on which the deposit was received.

Signatures: Both tenant(s) and landlord should sign the receipt to acknowledge the transaction.