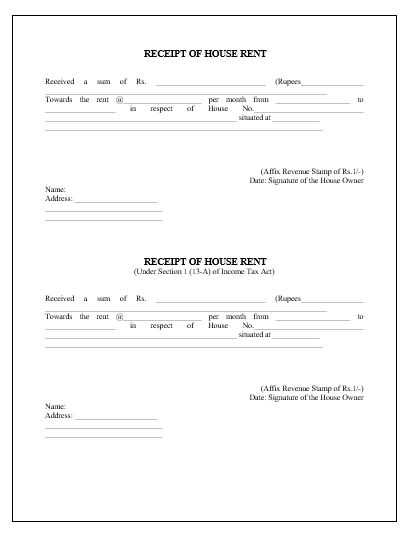

Providing a clear and professional rental receipt is one of the best ways to maintain good communication with tenants and ensure both parties are on the same page regarding payments. Use a house rental receipt template to simplify this process and keep track of payments with ease.

A reliable template will include key details like the rental period, amount paid, payment method, and any additional fees or discounts. Make sure to include both tenant and landlord names, property address, and the date of payment. This ensures transparency and helps prevent misunderstandings down the line.

Keep your receipt design straightforward yet professional. Using a consistent format each time helps build trust and avoids confusion. A well-organized document should also feature space for a signature, confirming both parties’ agreement to the transaction. Whether you’re a seasoned landlord or managing your first property, this simple tool can make your rental process smoother.

Here’s the updated text with reduced repetitions:

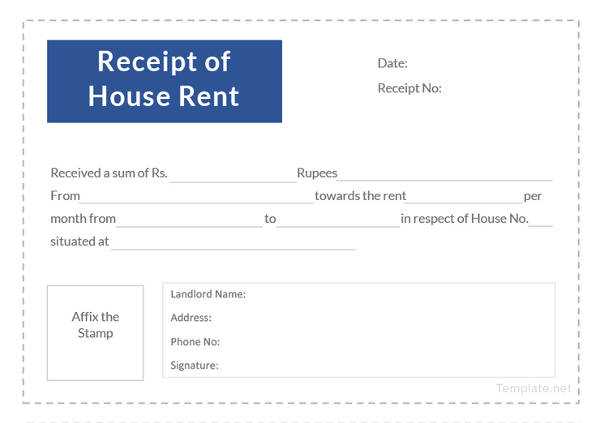

For a rental receipt, include the tenant’s name, the landlord’s details, and the address of the rental property. Clearly state the rental amount paid, the payment method, and the payment date. You can also mention the lease duration or specify the rental period if needed.

Ensure to add a unique receipt number for easy reference. The receipt should be signed by the landlord and, if necessary, witnessed for verification.

Finally, consider including any additional notes such as partial payments, late fees, or special agreements. This keeps the receipt clear and complete.

- Detailed Guide to House Rental Receipt Template

A rental receipt should contain specific details to ensure transparency and clarity between the landlord and tenant. These details help track payments, provide proof of rental transactions, and maintain accurate records for both parties.

Key Components of a Rental Receipt

A well-structured receipt should include the following:

- Landlord’s Information – Full name, address, and contact information.

- Tenant’s Information – Tenant’s name and contact details.

- Property Address – The full address of the rented property.

- Rental Period – The start and end date of the rental period covered by the payment.

- Amount Paid – The total payment received, including any taxes or fees.

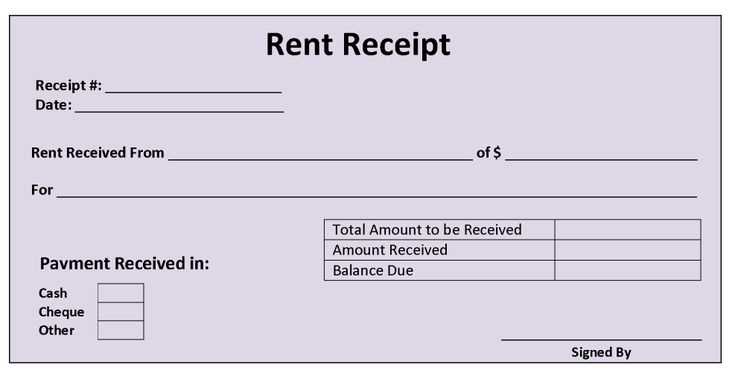

- Payment Method – Indicate whether the payment was made by cash, check, or digital transfer.

- Date of Payment – The exact date the payment was made.

- Receipt Number – A unique identifier for the transaction.

- Signature – Both the landlord and tenant should sign to confirm the transaction.

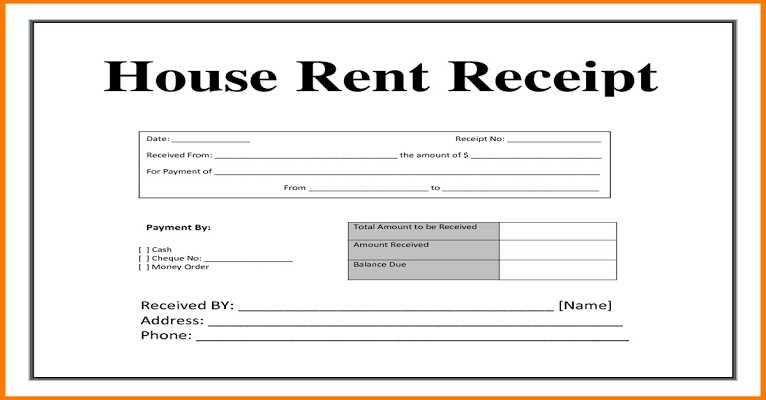

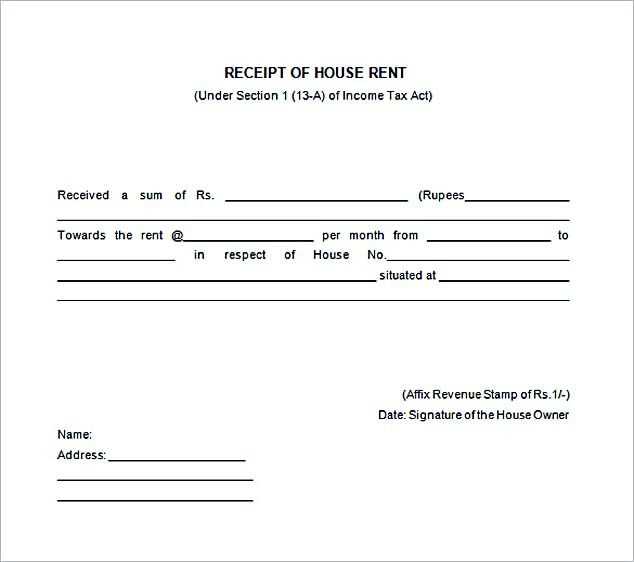

How to Create a House Rental Receipt Template

The structure of a rental receipt template ensures that you don’t miss any important details. Here’s an example of a simple layout for a rental receipt:

| Section | Details |

|---|---|

| Landlord’s Information | Name, address, and contact information |

| Tenant’s Information | Name and contact information |

| Property Address | Full address of the rental property |

| Rental Period | Start and end date of the rental period |

| Amount Paid | Total amount, including taxes or fees |

| Payment Method | Cash, check, or digital transfer |

| Date of Payment | Exact date of payment |

| Receipt Number | Unique identifier for the transaction |

| Signature | Landlord and tenant’s signature |

This template can be adjusted based on specific requirements, such as adding a breakdown of fees or additional clauses. Keeping the receipt clear and detailed prevents misunderstandings between the landlord and tenant.

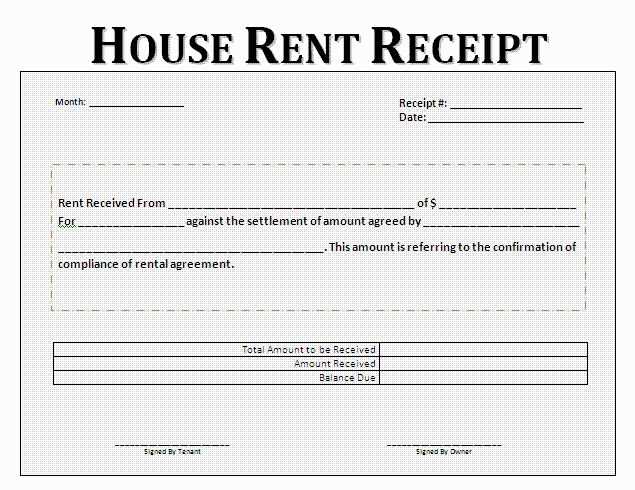

Use a simple, structured layout to enhance clarity. Start by including the renter’s and landlord’s full names at the top. Clearly state the property address and rental period, specifying the start and end dates. Next, list the rental amount due and the payment date. Include any late fees or other charges separately for transparency.

Make sure the receipt has a unique identifier, such as a receipt number, to avoid confusion. Provide a clear breakdown of payments, such as rent, utilities, and maintenance fees, if applicable. Use a readable font size and spacing to ensure all details are easy to follow. Finally, leave space for both parties to sign and date, confirming the transaction.

Ensure the rental receipt contains all the necessary details to avoid confusion and protect both parties involved. A well-documented receipt will help maintain transparency and support any future claims or questions. Below is a breakdown of the key elements that should be present:

- Landlord and Tenant Information: Include full names, contact details, and addresses of both the landlord and tenant. This ensures clarity about the parties involved in the rental transaction.

- Property Address: Clearly specify the rental property’s address to avoid any ambiguity about the location being rented.

- Payment Date: Mention the exact date the rent payment was received. This helps in confirming the timeliness of the payment.

- Amount Paid: State the total amount paid, ensuring there is no doubt about the payment’s value. If the rent is paid partially or for a specific period, clarify the details of the payment structure.

- Payment Method: Indicate the method used for payment (e.g., bank transfer, check, cash). This adds clarity on how the payment was made.

- Rental Period Covered: Specify the exact period the payment covers (e.g., from July 1 to July 31). This helps in tracking payments and avoiding disputes over rental periods.

- Late Fees (if applicable): If there are any late fees, list them separately with a clear explanation for why they were charged.

- Signature: Include space for both the landlord’s and tenant’s signatures to confirm the agreement on the rental payment.

Additional Tips

- Keep a copy for both parties. Both the landlord and tenant should retain a copy of the rental receipt for their records.

- Ensure legibility. A rental receipt should be clear and easy to read, avoiding any potential misunderstandings.

Focus on simplicity and clarity when selecting a rental receipt template. Choose one that clearly outlines payment amounts, tenant information, and payment dates. A clean, organized design ensures all important details are easily visible and accessible.

Look for customizable templates. This allows you to tailor the document to your specific business needs, whether it’s adding your company logo or adjusting the payment breakdown format. A good template should be flexible enough to meet varying tenant requirements.

Make sure the template you choose complies with local rental laws. It should include necessary legal clauses and meet tax documentation standards. This helps avoid legal issues while keeping your records up to date and accurate.

Consider a template that’s compatible with your business management tools. If you use software to track payments or manage accounts, select a template that can easily be integrated. This saves time and reduces the chance of errors.

Specify the payment method clearly to ensure the transaction is well-documented. For cash payments, include a section where the exact amount is noted, along with the time and date of the payment. For card transactions, list the card type (Visa, MasterCard, etc.) and last four digits of the card number for identification, ensuring the full number is not displayed for privacy reasons.

For bank transfers, include bank details such as the transaction reference number and the date the transfer was made. This provides both the tenant and landlord with clear proof of the payment process. If payment is made through a service like PayPal or Venmo, note the account used and transaction ID to track the payment easily.

Adapt your receipt template with placeholders for these specific details. This way, you can quickly generate receipts regardless of the payment method used, keeping a consistent record for both parties.

In different regions, house rental receipts must adhere to specific legal standards. Some countries or states require landlords to include certain information, such as the tenant’s name, address, rental period, and amount paid. Ensure your receipt is accurate and provides a clear transaction record to avoid legal complications.

United States

In the U.S., receipts for rent payments are often required by state law for tax purposes. They should include the property address, the rental amount, and the date of payment. Some states mandate that receipts are issued upon request, while others require them for all transactions.

United Kingdom

Landlords in the UK must issue receipts for rent payments when requested by tenants, especially if the rent is paid in cash. Receipts should contain the amount paid, the payment date, and the rental period covered. This helps prevent disputes and ensures proper record-keeping for both parties.

Australia

In Australia, landlords must provide a receipt for any cash payment. The receipt should list the tenant’s details, the rental amount, and the rental period. In some jurisdictions, electronic receipts may also be acceptable, as long as they meet legal requirements for accuracy.

Double-check the amounts on the receipt. Ensure both the rental fee and any additional charges are clearly stated, with no room for confusion. Miscalculating or omitting any amounts can cause issues with both the landlord and the tenant.

Don’t forget to include payment details. Make sure to specify how the payment was made, whether by cash, check, or bank transfer. Without this, it may be difficult to track payments and resolve disputes in the future.

Keep the date consistent. Ensure the date of the rental payment is listed correctly, matching the actual date of the transaction. Incorrect dates can lead to confusion, especially if payments are made on different dates than expected.

Avoid vague descriptions. Be specific about what the payment covers. Instead of just saying “payment,” mention the rent period, any deposits, or extra charges for utilities. This adds clarity and prevents misunderstandings later on.

Don’t leave out signatures. Ensure both parties sign the receipt. A signed receipt is a crucial proof of payment that can protect both the landlord and tenant in case of future disputes.

Start by listing the details clearly in a bulleted format for easy reference. This makes it simple for both parties to verify the information at a glance. Follow these steps:

- Start with the tenant’s name and the rental property’s address at the top of the receipt.

- Include the rental period, specifying the exact dates for the start and end of the rental agreement.

- List the amount paid, broken down if necessary, to cover rent, deposits, and additional fees.

- Include the method of payment (e.g., cash, bank transfer, etc.) for clear records.

- Provide a space for the signature of both the tenant and the landlord, confirming the receipt of payment.

Having these details helps both parties stay organized and ensures transparency in financial transactions.