If you’re creating receipts for your business, using a pre-made receipt template in Word can save a lot of time. Word templates allow you to quickly customize key details like company name, date, and payment method, ensuring consistency across your documents.

Start by choosing a template that suits your business style. Many UK-specific templates include sections for VAT, itemized lists, and terms of sale, making it easier to stay compliant with local regulations. Customize the fields with your company logo, contact details, and any other essential information.

After filling in the necessary details, save your template for future use. This way, you can generate receipts quickly for any transaction without having to redesign the document each time. For added professionalism, adjust fonts and layout to match your brand’s identity.

Here are the corrected lines with minimal repetition, keeping the meaning intact:

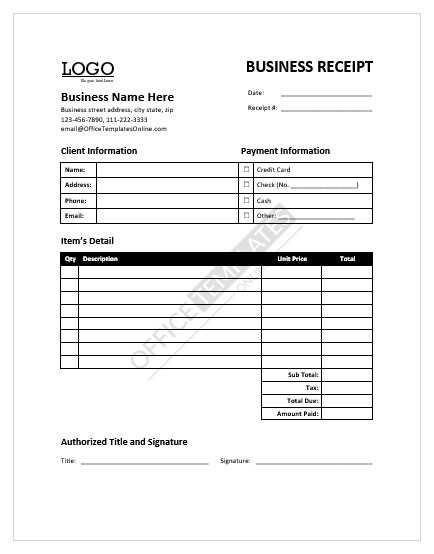

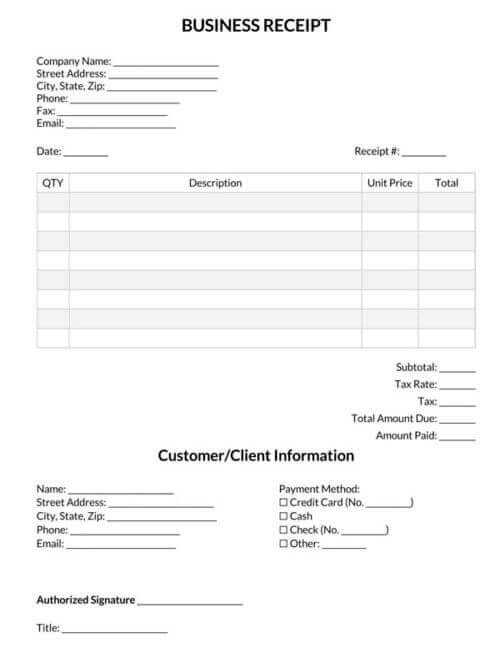

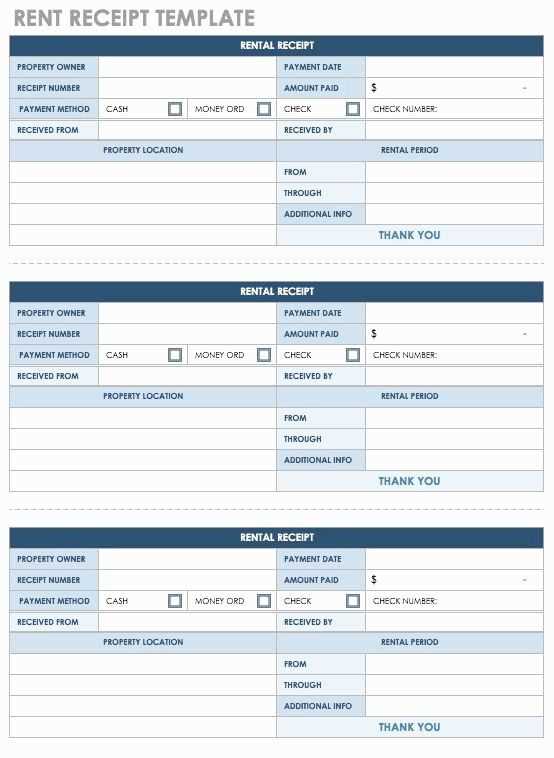

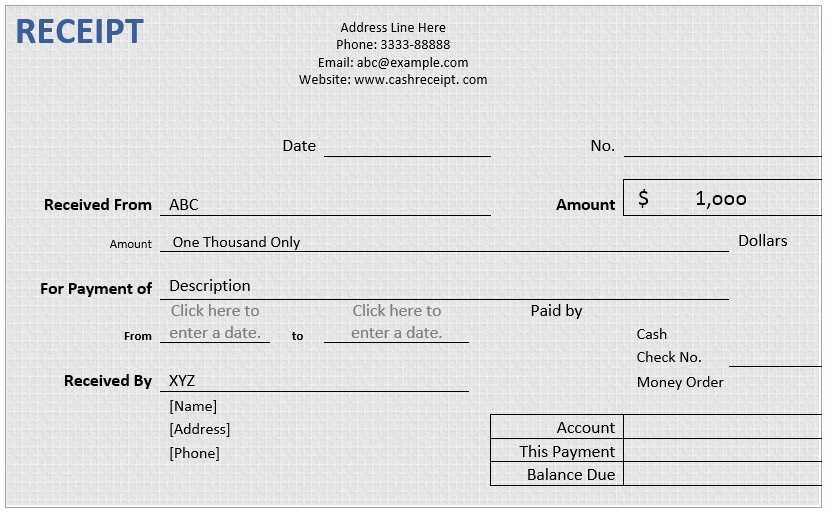

When creating a receipt in Word, ensure the following details are included: date, item description, quantity, price, and total amount. It’s important to format the document clearly with appropriate spacing for readability.

Receipt Title

The title should be bold and center-aligned at the top of the page. A simple phrase like “Receipt” works well to maintain clarity.

Itemization Section

List each item with its description, quantity, and unit price. Use a table format to make this information easy to follow. Be sure to calculate and display the total amount at the bottom of the list.

- Receipt Template Word UK

To create a receipt in Word for the UK, use a template that includes key information like the business name, contact details, transaction date, items purchased, quantity, price, and the total amount. Look for a template that allows you to customize these fields easily to match your needs.

Key Elements of a Receipt Template

A proper receipt template should cover the following areas:

- Business Information: Name, address, phone number, and email.

- Transaction Details: Date of purchase, receipt number, and payment method.

- Purchased Items: Clear description of items or services with quantity and price.

- Totals: Subtotal, taxes, and final amount after any discounts.

Once these details are in place, ensure the template includes a space for your company’s logo and any specific terms or conditions related to returns or warranties.

Customizing Your Template

After selecting a suitable template, you can edit it to suit your branding. Adjust fonts, colours, and layout to make the receipt fit your business’s style. For invoices or receipts that need to be printed or emailed, make sure the layout is optimized for both printing and digital formats.

Customizing a receipt template in Word for your business in the UK can be done in just a few steps. Adjust the template to reflect your specific business details and requirements.

1. Insert Your Business Information

- Open the receipt template in Word.

- Replace the generic business name with your company’s name, address, and contact details.

- Include your VAT number if applicable, as it’s required for businesses in the UK.

- Add your company logo if desired for branding purposes.

2. Adjust the Payment Details

- Modify the itemized list to reflect the products or services sold, including the quantity and price.

- Ensure that the receipt includes the correct tax rate (if VAT applies). For UK businesses, the standard VAT rate is 20%, but this can vary depending on the goods or services.

- Make sure the total amount, including VAT if applicable, is clearly stated at the bottom.

3. Customize the Receipt Layout

- Adjust the layout to fit your business needs. You can resize text boxes, tables, and other elements to ensure the receipt looks clean and professional.

- Consider including a payment method section, indicating whether the payment was made by cash, card, or another method.

- Add any other details relevant to your business, such as a return policy or warranty information.

4. Save and Print the Receipt

- Once you’ve customized the template, save the document for future use. You can create different versions for various products or services.

- Print a sample receipt to ensure all details appear correctly and the formatting is as expected.

Include the VAT registration number at the top of the receipt. This is crucial for businesses registered for VAT in the UK and informs customers that VAT is being charged.

Clearly state the VAT rate applied to each item. In the UK, the standard VAT rate is 20%, but some products may have a reduced rate (5%) or be zero-rated (0%). Make sure the correct rate is displayed for each item sold.

Show the total VAT amount separately. Break down the amount of VAT charged for each item and display the overall VAT for the entire purchase. This allows customers to see how much VAT is included in the total cost.

Indicate whether the receipt includes VAT in the price or if VAT is added separately. If VAT is included in the price, make it clear by stating “VAT included” next to the price. If VAT is added separately, show it on the receipt to ensure transparency.

Provide the total amount paid, including VAT, at the bottom of the receipt. This is necessary for clarity and allows customers to see the final cost of their purchase, including tax.

Clearly display accepted payment methods in a prominent area of the receipt. Include icons or abbreviations for common options such as cash, credit cards, and digital wallets. Make sure they are easy to identify to avoid confusion.

Next, include payment terms like “Payment Due Upon Receipt” or “Net 30 Days” if applicable. This sets clear expectations for the customer. Choose simple and direct language to avoid ambiguity.

Position payment method details near the total amount section or at the footer for easy reference. This helps to ensure customers know how they can pay and what the expectations are for payment timelines.

For added clarity, include any necessary taxes or fees that apply to the transaction. Providing a breakdown of these elements can help the customer feel more confident about the payment process.

Keep the layout clean and organized. Ensure all text is easily readable by using clear fonts like Arial or Helvetica. Avoid clutter by leaving enough white space between sections, which makes the receipt visually appealing and easy to navigate.

Use a simple color scheme. Stick to neutral or brand-specific colors. Avoid using too many different colors, as this can make the receipt look unprofessional. A professional look often involves a single accent color to highlight key information such as totals or tax rates.

Align the text properly. The text should be aligned to the left for item descriptions and right for numerical data, ensuring everything is neat and easy to follow. A well-aligned receipt gives it a polished, structured appearance.

Include your business logo and contact information at the top. This adds a personalized touch and makes the receipt recognizable. Ensure the logo is not too large, as it should not dominate the document.

Make item descriptions clear and concise. Provide enough detail for customers to understand the products or services they purchased without overwhelming them with unnecessary information.

Here’s a sample structure for a professional receipt layout:

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Item 1 | 1 | £10.00 | £10.00 |

| Item 2 | 2 | £5.00 | £10.00 |

| Total | £20.00 | ||

Ensure all key details, like the date, receipt number, and payment method, are included. This creates a comprehensive and traceable document that is useful for both customers and businesses.

Lastly, use borders or lines to separate sections and organize information. This improves the overall clarity and structure of the receipt. Keep everything neat and uniform for a professional touch.

UK businesses must ensure that receipts meet specific legal requirements. These are designed to provide transparency and protect both consumers and sellers. Below are the key elements to include in every receipt.

Key Information on Receipts

Receipts must display the following details to be compliant with UK regulations:

- Business Information: Name, address, and contact information of the business.

- Date and Time: Clear indication of when the transaction occurred.

- Description of Goods or Services: A brief but accurate description of the items purchased or services rendered.

- Price Details: Itemized prices, including any taxes such as VAT (Value Added Tax).

- VAT Registration Number: Required for VAT-registered businesses.

Keeping Records for Tax Compliance

Ensure that receipts are properly archived for tax reporting and auditing purposes. The UK tax authority, HMRC, mandates businesses to retain these records for at least 6 years. Maintaining clear and accurate receipts is key to avoiding penalties or issues with tax submissions.

To save time and maintain consistency, it’s best to save your receipt template after you’ve customized it. Here’s how you can do that:

Save as a Template in Word

- After creating your receipt, go to the “File” menu and select “Save As”.

- Choose a location on your computer where you can easily find it, such as the “Documents” folder.

- Under “Save as type”, select “Word Template (*.dotx)” from the drop-down list.

- Give the file a recognizable name, for example, “Receipt Template” and click “Save”.

Reusing the Template

- Open Microsoft Word and go to “File” > “New”.

- Click “Personal” to find your saved templates.

- Select your “Receipt Template” and start editing it for your new transaction details.

- After updating the information, you can save it as a regular Word document by choosing “Save As” and selecting “Word Document” (*.docx) under “Save as type”.

By saving the template, you can quickly access and customize it for any future transactions without starting from scratch.

When creating a receipt template in Word for the UK, consider focusing on clarity and simplicity. Include all necessary components like the company name, contact details, date of issue, description of the product or service, quantity, unit price, and total amount. Make sure the font size is readable, and ensure the layout is clean, making it easy for customers to understand their purchase.

Designing the Template

Use tables for a structured approach to listing the items, keeping alignment consistent for a professional look. Ensure that columns are evenly spaced, and the text is legible. Make the total amount stand out by using bold or a larger font size for clarity.

Key Details to Include

Always remember to add a section for payment details, whether it’s cash, card, or other methods. Also, including your VAT number and any applicable taxes is required for compliance in the UK. A thank you note at the bottom of the receipt adds a nice touch, leaving a positive impression on the customer.