Use a well-structured personal training receipt template to keep accurate records of your services and provide clients with clear documentation. This simple tool ensures transparency and professionalism while helping clients track payments for their sessions.

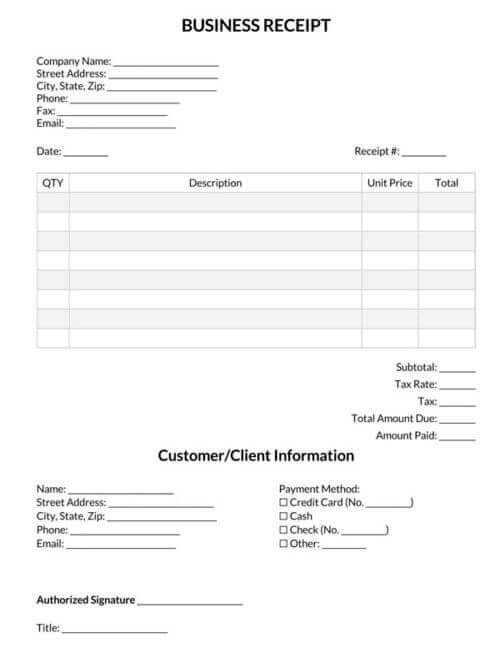

Include key details such as the trainer’s name, client’s information, the date and time of the session, and the total amount paid. Additionally, specify the type of service provided, whether it’s a single session or a package deal, and outline any discounts or promotional offers used.

It’s helpful to keep a section for notes or additional comments, where trainers can mention specific goals or progress made during the session. Having this information easily accessible makes it simple to review for both parties.

By using a clear, consistent template, you not only create a professional atmosphere but also streamline your billing process, allowing for quicker, hassle-free transactions.

Here’s a detailed HTML plan for an article on the topic “Personal Training Receipt Template,” with 6 specific and practical subheadings. Each heading addresses a distinct aspect or subtask related to the topic: htmlEdit Personal Training Receipt Template

1. Required Information for a Personal Training Receipt

To create a valid receipt, ensure you include the following key details:

- Client’s name and contact information.

- Trainer’s name and business information.

- Session date, time, and location.

- Breakdown of services rendered (e.g., personal training sessions, packages).

- Total cost and payment method (cash, card, etc.).

- Any taxes applied, if applicable.

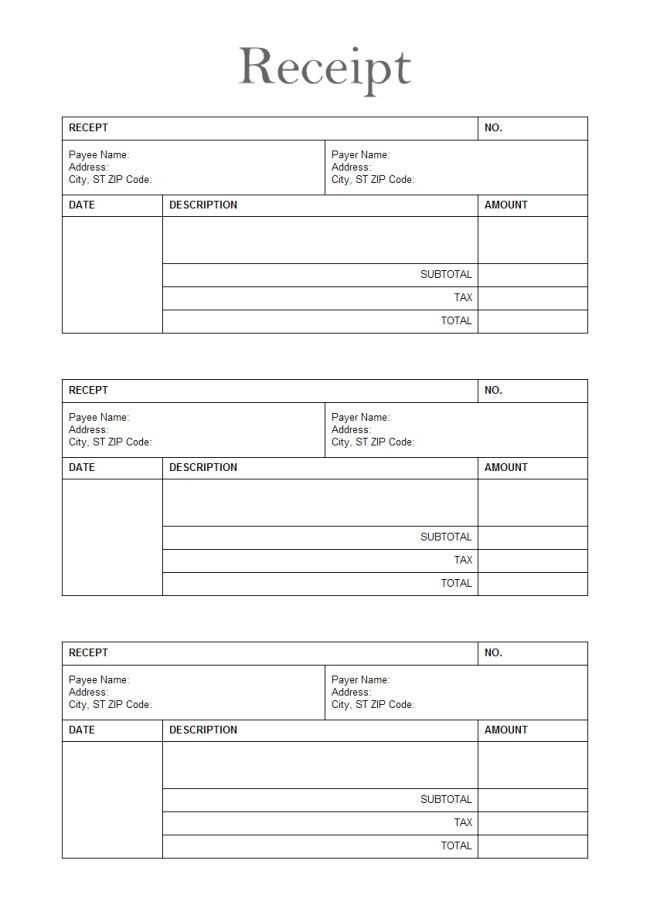

2. Structuring the Receipt Layout

The layout should be clear and organized to avoid confusion. Place the most important details (client name, service, cost) at the top. Include sections for:

- Trainer’s business information at the top left.

- Client’s information under it.

- Details of the service and pricing below.

- A footer with payment method and confirmation.

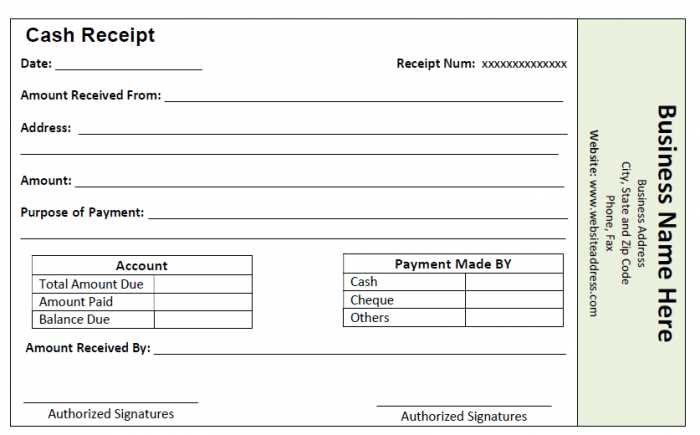

3. Including Payment Information

For a complete receipt, include a section that clearly details how the payment was made:

- Payment date and method (e.g., credit card, PayPal, bank transfer).

- If paid in installments, specify the amount paid and the outstanding balance.

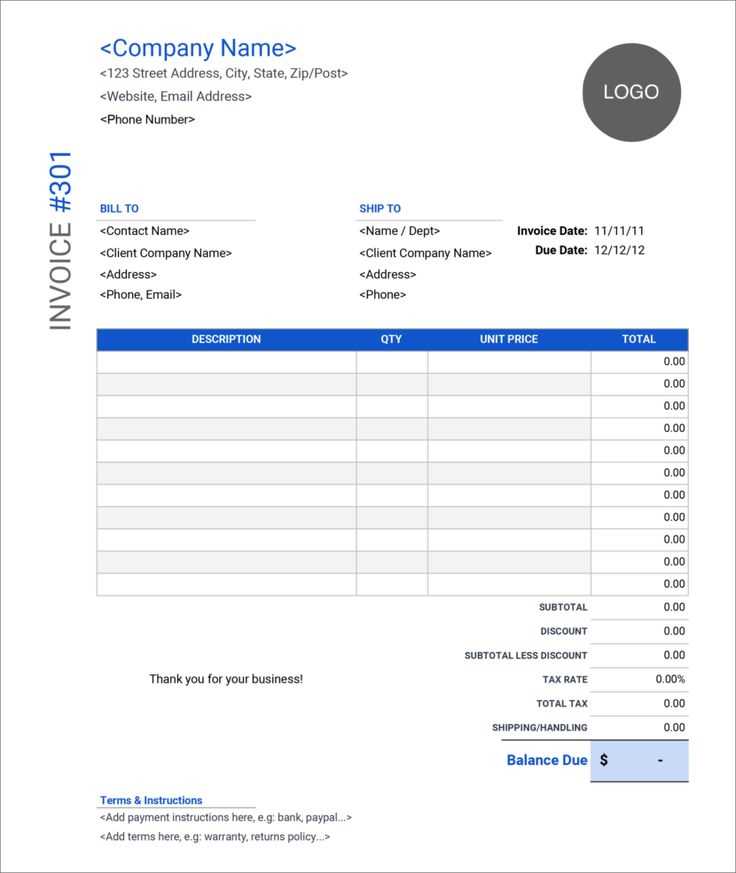

4. Formatting for Professionalism

Keep the design clean with simple fonts and aligned text. Avoid cluttered layouts. Use headings, bullet points, and borders to divide sections and make it easier to read. Include the company logo at the top for a professional touch.

5. Adding a Disclaimer or Notes Section

Include a section at the bottom for any necessary disclaimers, terms, or conditions related to the receipt, such as cancellation policies or future session bookings. This can help protect both the trainer and client.

6. Providing Digital and Printable Options

Offer clients the option to receive their receipt digitally via email or download from your website, as well as the ability to print the receipt if they prefer a physical copy. This can accommodate different preferences and improve client satisfaction.

Key Elements to Include in a Receipt

Include the business name and contact details at the top. This ensures the client knows exactly who issued the receipt and how to reach you if needed.

Clearly state the date of the transaction. This helps both you and the client keep track of services rendered or products purchased, and serves as a reference for record-keeping.

Provide a detailed description of the services or products. List what was provided, including quantities, duration, and any specific details like training type or equipment used. This eliminates any confusion later.

Clearly display the amount paid and the payment method. Specify if the payment was made by credit card, cash, bank transfer, or another method. Include the total, taxes if applicable, and any discounts applied.

Ensure the receipt has a unique reference number. This makes it easy to identify the transaction for both accounting purposes and client inquiries.

Finally, include a thank you note or a brief message that reinforces your appreciation for the client’s business. This small touch leaves a positive impression and encourages future engagement.

How to Customize the Template for Different Sessions

Tailor your receipt template by adjusting key fields to match the specific details of each session. Begin by modifying the date, time, and duration to reflect the exact session you are documenting. These fields are crucial for providing an accurate record.

Adjust Client Information

Ensure the client’s name, contact details, and membership status are correct for each session. If a session is a one-off or part of a package, note this explicitly.

Modify Session Details

Include specific exercises, goals, or progress made during the session. This could be as simple as adding a list of exercises performed or noting the intensity level for that day. For clients who require personalized feedback, make sure to add space for any notes or comments relevant to their progress.

- Update exercise details for each session.

- Include information on session intensity or focus area (strength, cardio, flexibility).

- Leave space for client feedback or trainer observations.

Lastly, adjust the payment information based on the session type (single session or part of a package). If discounts or promotions apply, be sure to specify these changes in the template for clarity.

Formatting Options for Easy Reading

Keep text concise by using clear sections. Break the content into manageable chunks with consistent headings. Use bullet points or numbered lists to highlight key information, making it easy to scan. For example:

- Bold text for important items or actions.

- Italics for emphasis on particular points.

- Short paragraphs with no more than three to four sentences.

Text Size and Contrast

Ensure your font size is readable. For most templates, use at least 12-14 pt for the body text and larger sizes for headings. High contrast between text and background increases readability–dark text on a light background works best.

Spacing and Alignment

Adjust line spacing to 1.5 or 1.75 to create breathing room. Left-aligned text is typically easier to follow than justified text, as it avoids uneven spacing. Add space before and after headings to separate sections clearly.

How to Include Taxes and Payment Details

List taxes clearly on the receipt, including the tax rate and the total amount charged. Specify if the tax is state, federal, or local, depending on your location. If there are multiple taxes, break them down separately. For example, “Sales Tax: 8%” or “VAT: 15%.”

Next, indicate the payment method used. Mention whether it was paid via credit card, bank transfer, check, or cash. If applicable, include the last four digits of the card number or any transaction reference number for future reference.

Be specific about the payment amount and make sure to include any discounts or adjustments before taxes. For example, “Total Before Tax: $50.00,” followed by “Sales Tax: $4.00,” and the final total as “Total Due: $54.00.” This transparency prevents confusion for both you and the client.

Best Practices for Sending and Storing Receipts

Send receipts as soon as possible after a session or transaction. Use a reliable platform that ensures quick delivery and clear formatting. This helps clients keep track of their payments without delay. Always send receipts via email or a secure messaging platform, avoiding text messages or social media to maintain professionalism.

Store receipts securely in both digital and physical formats. For digital storage, utilize cloud services with strong encryption to prevent unauthorized access. Create organized folders and back up receipts regularly. Avoid storing sensitive information like payment details directly in your device’s local storage.

Keep receipts for at least one year to comply with tax and legal requirements. Ensure that your storage system allows easy retrieval. Categorize receipts by date or client name for quick access in case of disputes or audits.

When sending receipts via email, use a clear subject line such as “Receipt for Personal Training Session on [Date]”. This allows clients to quickly locate their documents. Attach the receipt as a PDF file to preserve the format and prevent alteration.

Lastly, ensure all receipts include essential information: session details, client name, amount paid, date, and payment method. Provide clear, itemized breakdowns of the services offered to enhance transparency.

Legal Considerations When Issuing Receipts

Ensure your receipts comply with tax laws. The receipt should include the business name, address, and tax identification number. This will help clarify the identity of the service provider in case of a dispute or audit.

Include Key Information

List the date of payment, the amount, and the type of service provided. Clearly separate the service charge from taxes and any other fees. This allows transparency and ensures that the transaction is well-documented for both parties.

Understand Local Regulations

Familiarize yourself with your local jurisdiction’s receipt requirements. Some regions may have specific rules on the format, details, or electronic submission of receipts. Ensure compliance with these rules to avoid legal issues.

Keep records of all issued receipts for a set period, usually determined by local tax authorities. This practice helps in case of an audit and ensures that your business adheres to financial record-keeping laws.