Choosing the Right Template

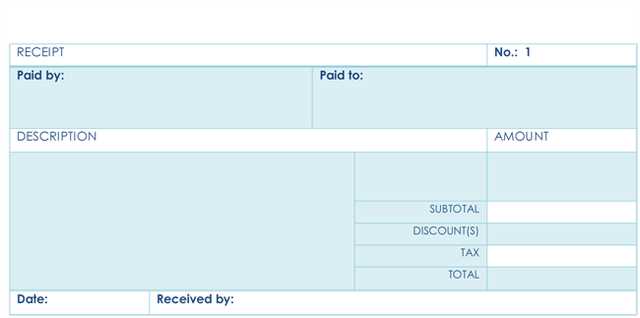

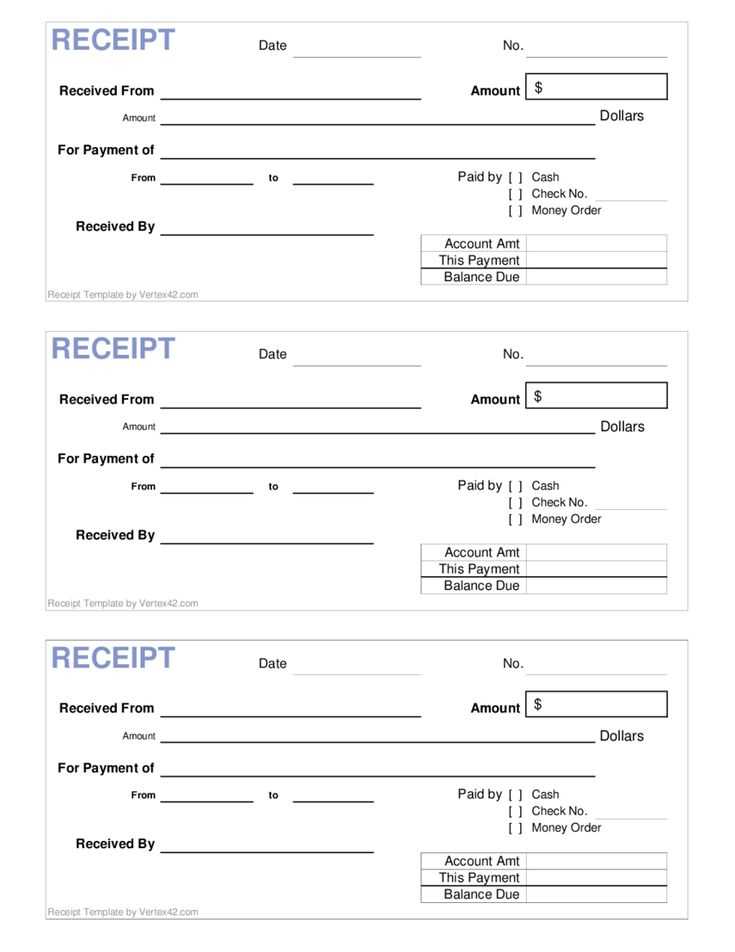

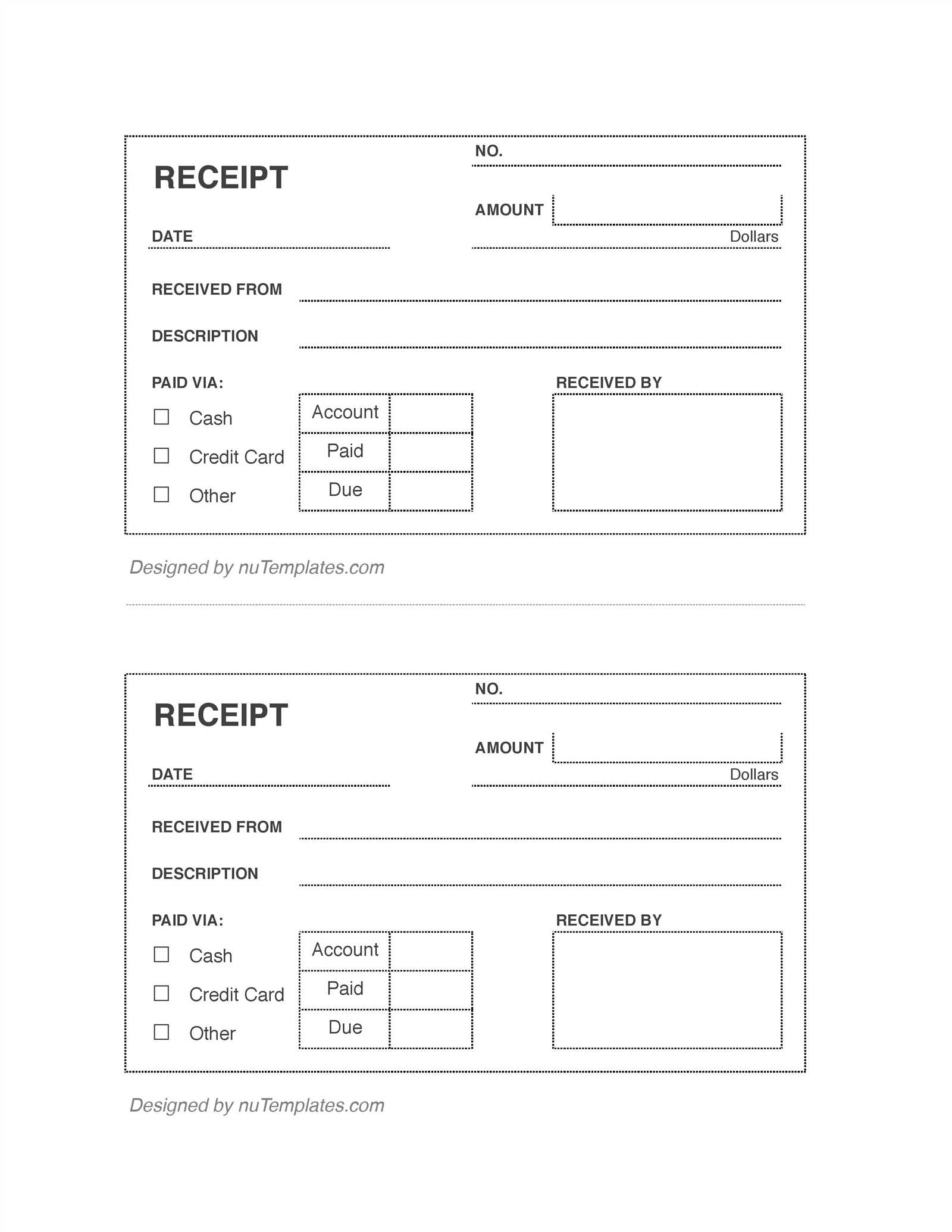

Opt for a template that aligns with your business needs. Focus on simplicity and clarity, ensuring that all critical details–like the amount, date, and method of payment–are visible. Whether you are a freelancer or run a business, a clear receipt helps build trust and provides transparency for both parties.

Key Elements in Paid Receipt Templates

- Company Information: Include the company name, address, contact details, and tax identification number, if applicable.

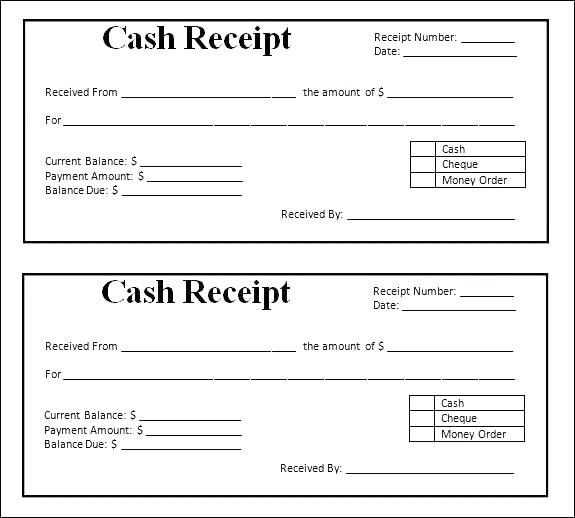

- Payment Information: Clearly state the amount paid, payment method (e.g., cash, card, bank transfer), and transaction ID, if available.

- Date: Include the exact date the payment was made to avoid confusion.

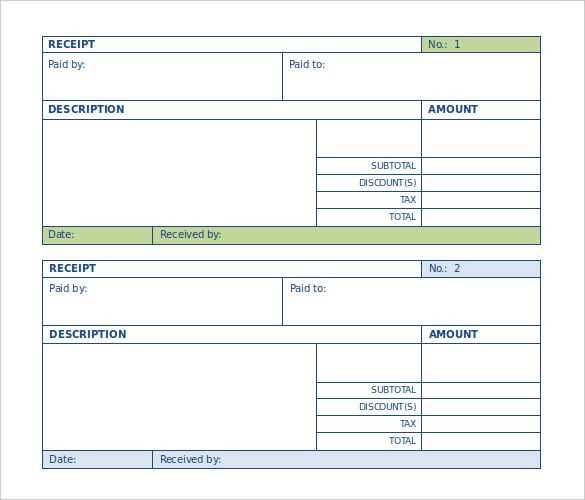

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference.

- Service/Products Provided: List the services or products for which payment was made, including any discounts or taxes applied.

Customizing Your Receipt Template

Customization options allow you to tailor the template to your specific business needs. For example, incorporate your logo for branding, or add additional sections if you’re offering multiple services. Ensure the design is clean and professional, avoiding unnecessary clutter that might distract from the important details.

Simple Customization Tips

- Fonts: Use easy-to-read fonts. Stick to classic options like Arial or Times New Roman for professionalism.

- Colors: Limit your color palette to avoid overwhelming the recipient. Stick with neutrals or your brand colors.

- Layout: Keep the layout straightforward. The receipt should flow logically with payment details at the top, followed by a list of services/products, and ending with the total amount.

Benefits of Digital Templates

Digital templates streamline the process of issuing receipts, especially when you’re dealing with large volumes of transactions. Online tools allow for easy edits and can automatically populate fields such as the date or transaction ID. Additionally, digital receipts are easy to send via email or integrate with invoicing software for faster record-keeping.

Template for Paid Receipts: Practical Insights

How to Create a Basic Receipt Template for Payments

Customizing Templates for Different Business Types

Key Elements to Include in a Paid Receipt Format

Design Tips: Making Your Receipt Look Professional

Legal Requirements for Payment Receipts in Different Regions

How to Automate Receipt Generation for Efficiency

Start with a simple layout that includes all critical details: payment amount, date, payer’s and payee’s information, method of payment, and transaction reference number. Ensure the receipt has a clear title such as “Paid Receipt” to avoid confusion. Organize the sections neatly for clarity. Customization for various businesses may involve adding specific fields, like service descriptions for a consultant or product details for a retailer. For example, if you’re running a service business, make sure to specify the service type and time spent. Keep the receipt free from clutter; only the most pertinent details should be included.

Every paid receipt must display specific elements. The transaction date is a must, along with the amount paid and currency type. Ensure the payment method is clearly stated, whether it was made via credit card, cash, or bank transfer. Including your business’s tax identification number or VAT number can help in regions where it’s required. A receipt number is beneficial for tracking purposes, especially if you process many payments.

Design your receipt for easy reading. Use legible fonts, keeping the text size consistent, and leave sufficient space between sections. A clean, organized look will enhance professionalism. Avoid overusing bold or italic fonts; they should be used sparingly to highlight important details such as the total amount. Incorporate your brand’s logo and color scheme subtly, but don’t let it overpower the information on the receipt.

Legal requirements can vary by region. In some countries, receipts must include certain tax-related information or adhere to specific formats. For example, in the EU, VAT numbers and tax rates should be included for businesses charging VAT. In the U.S., including a detailed description of products or services may not be mandatory but is often recommended for clear communication. Always check the local tax laws or consult a legal advisor to ensure your receipt complies with regulations in your area.

Automating receipt generation helps maintain accuracy and saves time. Software solutions can instantly generate receipts for online payments and services. Many accounting tools or point-of-sale systems can create receipts at the moment of payment. Additionally, consider integrating automatic email receipt delivery, providing your customers with instant confirmation. If you run a high-volume business, this can significantly streamline operations and reduce human error.