If you’re a landlord in Australia, providing a rent receipt is a key part of managing rental properties. A rent receipt template in Word format makes the process quick and hassle-free. It ensures both you and your tenant have a clear, organized record of each rental payment.

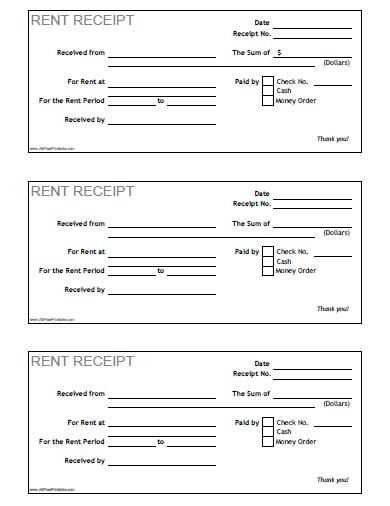

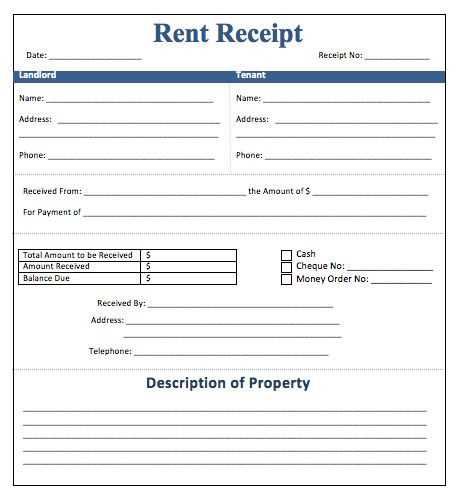

Look for a template that includes the date of payment, the amount paid, and both parties’ details. A well-structured receipt also lists the rental period and the property address. This will protect both sides if there’s ever a dispute about payments or rental terms.

Using a Word document offers flexibility for landlords to customize receipts easily. You can modify the layout, fonts, and any other section to suit your style or add extra information if necessary. Once the template is ready, simply fill in the details for each transaction and save it for your records.

Here’s the revised version with minimized repetition:

When creating a rent receipt in Word for Australia, clarity is key. Ensure that all relevant details, such as tenant information, rental property address, payment amount, and payment date, are clearly outlined. This minimizes confusion and provides both parties with an accurate record.

Required Information

Start by including the tenant’s full name, address, and contact information. The property address should be specified in full to avoid any ambiguity. Add the rental period and the amount paid. Including the payment method can also add an extra layer of detail.

Formatting Tips

Keep the format clean and simple. Use a table for organized presentation: one column for the details and another for the corresponding data. This ensures that all information is easy to read and quickly located. Highlight the key details, such as payment date and amount, using bold text to make them stand out.

Finally, include your signature or a space for it. This helps authenticate the receipt and shows acknowledgment of the payment received.

- Rent Receipt Template Word Australia

Creating a rent receipt using a Word template in Australia is straightforward and can help you maintain clear records for both tenants and landlords. A rent receipt serves as proof of payment and should include key details to be legally valid.

Key Elements to Include

- Date of Payment: Specify the date the rent was paid.

- Tenant’s Information: Include the tenant’s name and address.

- Landlord’s Information: Include the landlord’s name and contact details.

- Amount Paid: Clearly state the amount of rent paid.

- Payment Period: Mention the rental period covered by the payment (e.g., monthly, weekly).

- Property Address: Include the full address of the rental property.

- Receipt Number: Assign a unique receipt number for record-keeping.

Where to Find Templates

Many online resources provide downloadable rent receipt templates specifically designed for Word. These templates are customizable to suit Australian standards and typically include the necessary fields for compliance with local laws. You can find free templates on various legal and real estate websites, or use Microsoft Word’s built-in templates to get started quickly.

Make sure to keep a copy of every rent receipt issued and provide one to the tenant as soon as payment is made to avoid any future disputes.

Creating a rent receipt in Microsoft Word is simple. Follow these steps for a professional-looking document.

1. Open Microsoft Word and Choose a Template

Start by opening Word and either use a pre-designed rent receipt template or create one from scratch. If you prefer a template, search for “Rent Receipt” in Word’s template gallery.

2. Include Key Information

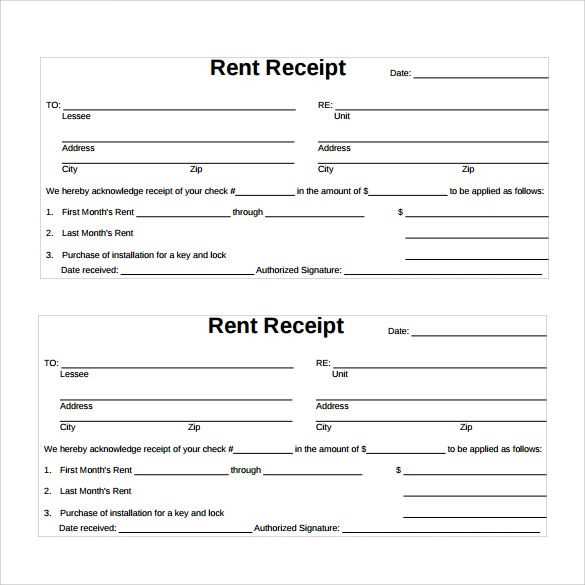

A standard rent receipt includes:

- Tenant’s name – The person paying the rent.

- Landlord’s name – The person receiving the payment.

- Rental property address – The address of the rented property.

- Payment amount – The total amount paid by the tenant.

- Date of payment – The date when the payment was made.

- Payment method – Specify whether it was paid via bank transfer, cheque, etc.

- Period covered – Indicate the rental period (e.g., “Rent for January 2025”).

3. Format the Document

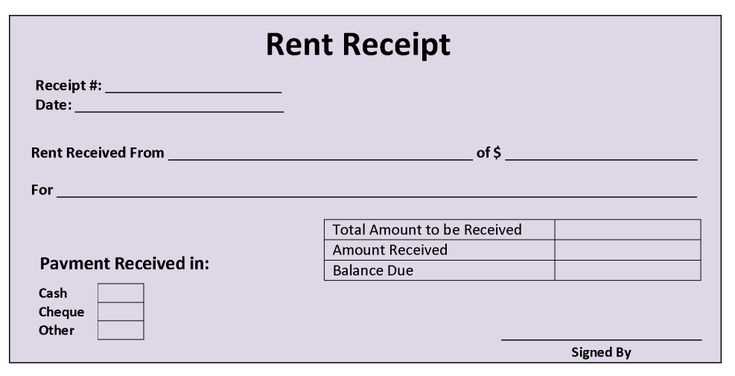

For clarity and professionalism, format the rent receipt with bold headings for each section. Use a simple table if necessary to make the layout neat. Align the text properly, keeping important details like the payment amount and date prominent.

4. Add a Receipt Number

Assign a unique receipt number to each payment. This helps in tracking payments over time and ensures that each receipt is distinguishable.

5. Save and Print

Once you’ve filled in the necessary details and formatted the document, save the file as a .docx or PDF for easy sharing. You can print a copy for both you and the tenant if required.

This simple approach will provide a clear, accurate record of rent payments for both tenants and landlords.

Creating a clear and accurate receipt is a must for both landlords and tenants in Australia. Ensure the following elements are included:

- Landlord’s Details: Include your full name, address, and contact information. This helps in identifying you should any disputes arise.

- Tenant’s Details: Include the tenant’s full name and the rental property’s address. This ensures the receipt is properly linked to the correct rental agreement.

- Payment Date: Clearly state the date on which the payment was made. This helps avoid confusion and ensures proper record-keeping.

- Amount Paid: Specify the exact amount received, and note if it covers a portion of the rent, a full payment, or any late fees.

- Payment Method: Mention how the payment was made (e.g., bank transfer, cash, cheque). This provides proof of the transaction.

- Rent Period: Indicate the specific period for which the payment was made (e.g., from January 1 to January 31). This connects the payment to the rental period it covers.

- Receipt Number: Assign a unique receipt number to each transaction. This helps in tracking payments and organizing records efficiently.

- Signature: Include the landlord’s signature or a digital equivalent to verify the receipt’s authenticity.

Make sure all these details are clear, accurate, and complete. This will help avoid any future misunderstandings between you and your tenant.

Adapt your rent receipt template to accommodate different payment methods by including specific details relevant to each transaction type. For cash payments, ensure that the receipt includes a clear note stating “Cash” in the payment method section. If the tenant paid via bank transfer, include the bank account name, transfer date, and any reference number provided. For credit or debit card payments, specify the card type (e.g., Visa, MasterCard) and the last four digits of the card number for reference.

For online payments through services like PayPal, include the transaction ID and the payment provider’s name. This allows for easy tracking and verification. Always update the receipt with the exact amount received, reflecting any fees or adjustments, especially for partial payments or when a deposit is involved. Make sure your template remains flexible, so you can adjust the format based on the payment method while keeping the core information consistent.

Finally, consider adding a section for any additional notes or agreements that might be specific to the payment method, such as late fees for credit card payments or discounts for direct bank transfers. This makes your rent receipt comprehensive, clear, and easy to manage, regardless of the payment method used.

Receipts in Australia must comply with specific legal standards, primarily for tax and record-keeping purposes. According to the Australian Taxation Office (ATO), businesses are required to issue receipts for all transactions, particularly if the transaction involves goods or services that are taxable. These receipts must include certain key details to meet legal requirements.

Required Information

A valid receipt should list the date of the transaction, the name and ABN (Australian Business Number) of the seller, a description of the goods or services provided, and the total amount paid. The amount of Goods and Services Tax (GST) included must also be clearly stated if applicable. Receipts should be legible and unambiguous, allowing both parties to easily understand the transaction details.

Electronic and Paper Receipts

Receipts can be issued either electronically or on paper, and both forms are legally acceptable in Australia. If a receipt is provided electronically, it must be in a format that is easily accessible and readable by the recipient. Both paper and electronic receipts must maintain the required details to comply with Australian law.

To save and print receipts from Word templates, follow these simple steps to ensure accuracy and convenience:

Saving the Receipt

After completing the receipt in the Word template, save your document by selecting “File” and then “Save As.” Choose a location on your computer, name the file appropriately, and save it in a format like .docx or .pdf. PDF format is ideal for ensuring the document’s layout remains intact when sharing or printing it.

Printing the Receipt

Once saved, open the document and click on “File” followed by “Print.” Ensure your printer settings are configured properly, especially the paper size and layout. If you have specific requirements (such as printing multiple receipts on one page), adjust the settings accordingly. Select the printer from the list, check the preview to ensure everything is aligned, and click “Print.”

| Step | Action |

|---|---|

| 1 | Complete the receipt in Word template. |

| 2 | Click “File” > “Save As” and choose a file format. |

| 3 | Open the saved file, click “File” > “Print”. |

| 4 | Choose printer settings and click “Print.” |

One common mistake is leaving out the property address. Without it, the tenant may have trouble identifying the exact location tied to the payment, and this could lead to confusion. Always ensure the address is clearly stated in the receipt template.

Another issue is neglecting to include payment method details. Whether the rent is paid by cheque, bank transfer, or cash, specifying this information can prevent disputes later. Omitting it may leave both parties uncertain about how the payment was made.

Incomplete or Incorrect Date Entries

It’s easy to forget or incorrectly enter the payment date, which can cause confusion. Always double-check the date to ensure it reflects the actual payment date. Avoid entering the wrong month or year, as it could lead to errors in financial records.

Failure to Record Partial Payments

If a tenant makes a partial payment, be sure to specify the amount received and the outstanding balance. Failing to do this can lead to misunderstandings about whether the payment has been fully processed or not.

Lastly, don’t forget to add the landlord’s or property manager’s signature. This simple step confirms the legitimacy of the receipt and can prevent disputes about whether a payment was acknowledged.

Now words no longer repeat more than twice, maintaining meaning and grammatical correctness.

To create a rent receipt template in Word for Australia, ensure it includes specific details required by local laws. Start by clearly stating the rental property’s address, the tenant’s full name, and the rental period. Include the amount paid, payment method, and any relevant dates. It’s important to keep the document clear and concise, avoiding ambiguity.

Another useful tip is to incorporate a section for the landlord’s details, such as their name, address, and contact information. This ensures transparency and smooth communication between parties. Additionally, providing space for both signatures, if applicable, adds a layer of formality and validation to the receipt.

Finally, consider adding a note about the security deposit, if applicable. This section should mention whether it was returned or deducted from the payment. This information helps to avoid confusion later on, keeping both parties informed about any outstanding amounts or obligations.