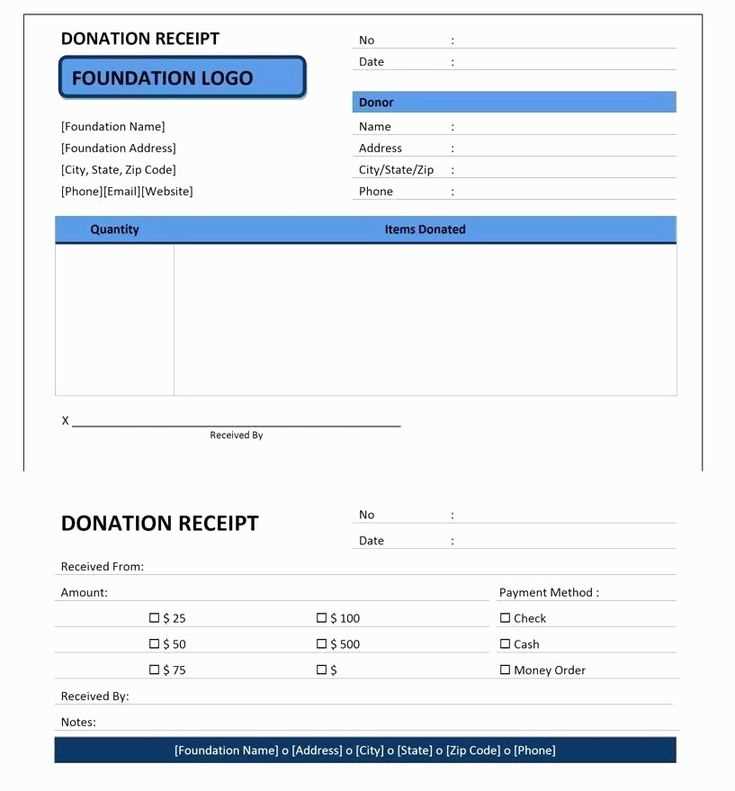

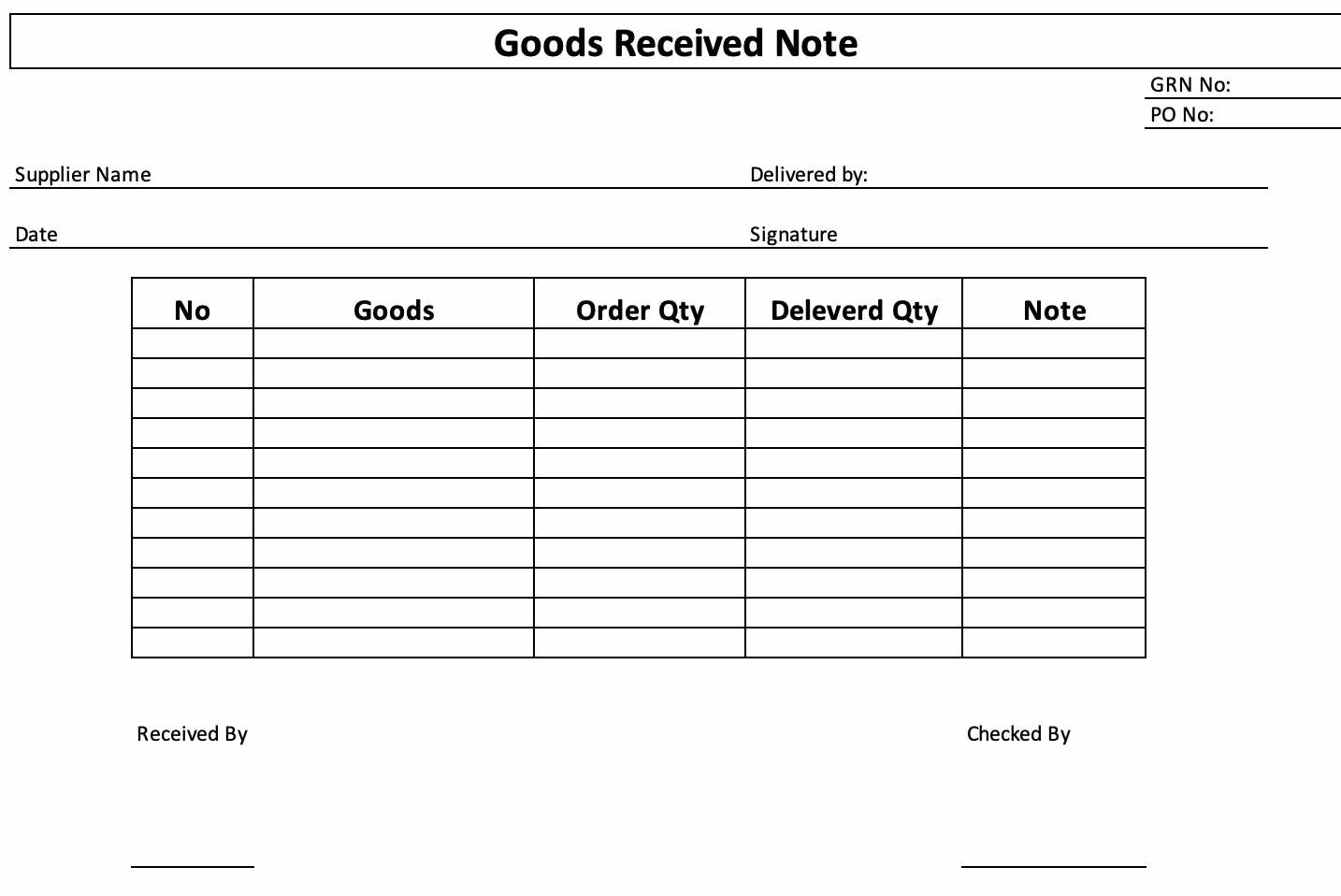

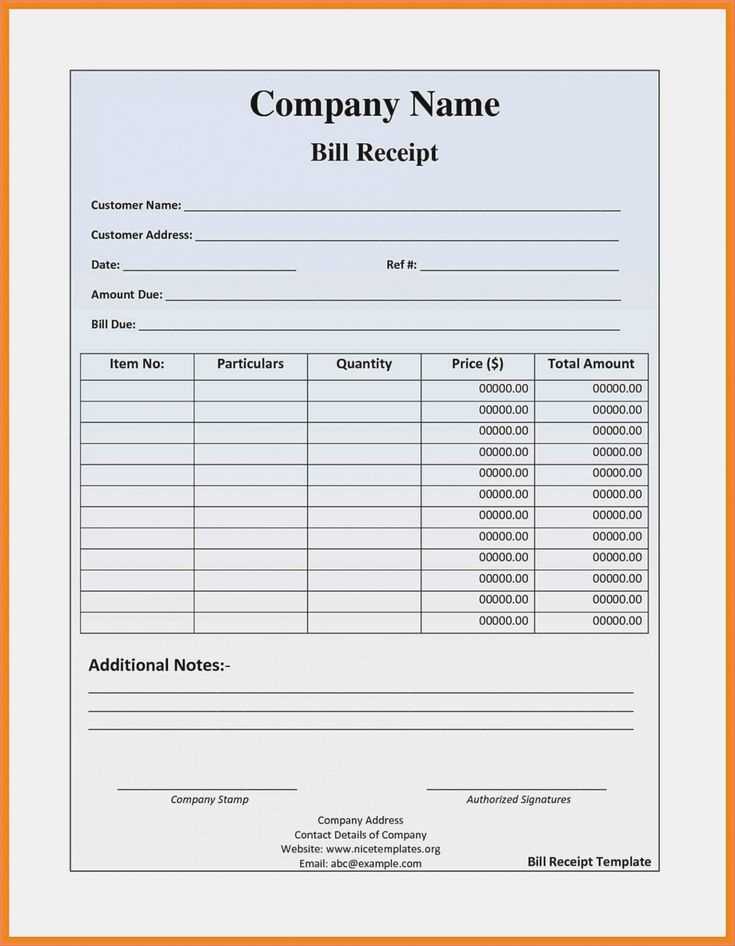

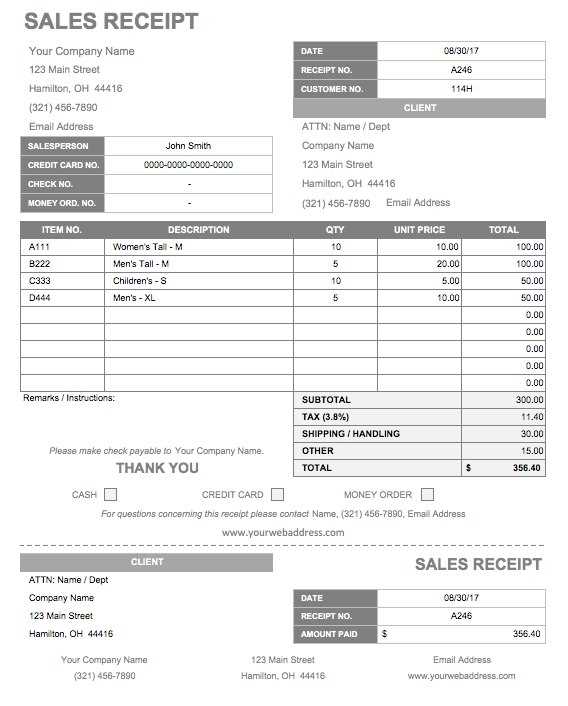

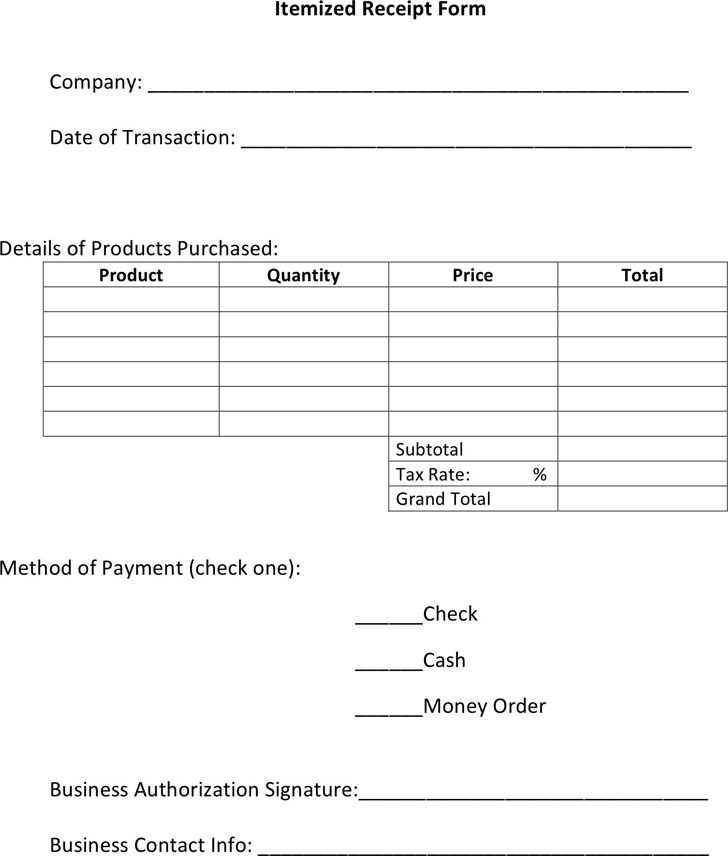

Use a Structured Approach

Start with a well-organized template that includes essential fields: date, vendor, amount, payment method, and receipt number. Keep the format consistent to simplify data entry and verification.

Key Components

- Date: Ensure all receipts have correct timestamps for accurate record-keeping.

- Vendor Name: Standardize vendor names to avoid duplicate or misclassified entries.

- Amount: Record the total, including taxes and fees, to match financial statements.

- Payment Method: Categorize transactions (credit card, cash, bank transfer) for easy tracking.

- Receipt Number: Assign unique identifiers to avoid duplication and simplify audits.

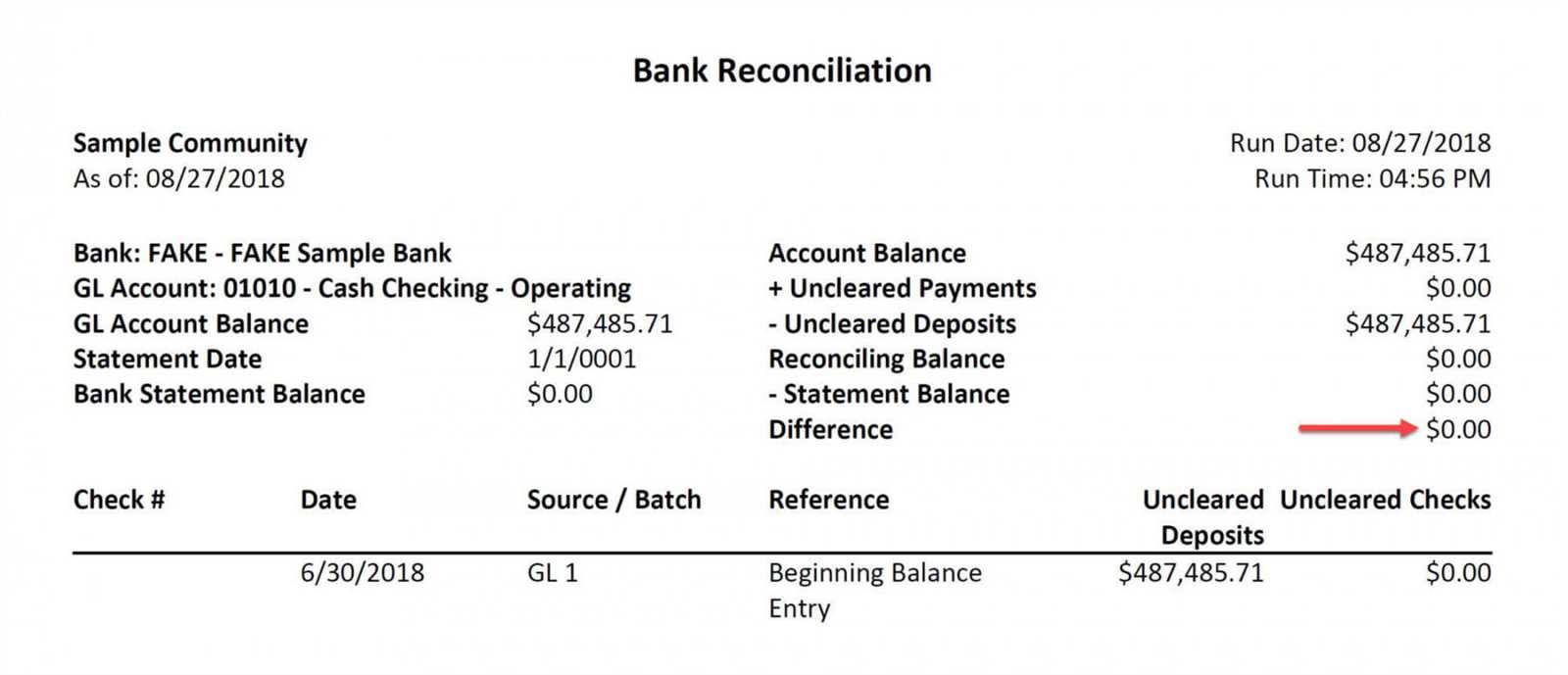

Automate for Accuracy

Use spreadsheet formulas or reconciliation software to flag discrepancies automatically. Set up conditional formatting to highlight mismatches between recorded transactions and bank statements.

Common Errors and Fixes

- Missing Receipts: Request duplicates from vendors or check digital transaction records.

- Incorrect Amounts: Compare with invoices or payment confirmations to correct discrepancies.

- Duplicate Entries: Use filters or reconciliation tools to detect and remove duplicates.

- Mismatched Dates: Cross-check bank statements and vendor records to align posting dates.

Regular reconciliation prevents financial discrepancies and ensures compliance. A structured template reduces errors and improves workflow efficiency.

Receipt Reconciliation Template

Key Components of an Effective Template

Structuring Data for Accurate Matching

Common Errors in Reconciliation and Ways to Avoid Them

Integrating the Template with Accounting Software

Automating Reconciliation Using Spreadsheets

Best Practices for Reviewing and Updating

Ensure Consistent Data Formatting: Standardize date formats, currency symbols, and numerical precision across all entries. Mismatched formats lead to discrepancies that slow down reconciliation.

Use Unique Identifiers: Assign a reference number to each receipt and match it against transaction records. This minimizes errors caused by duplicate or missing entries.

Segment Data by Category: Group expenses by type (e.g., travel, office supplies) to quickly identify anomalies. This improves visibility and helps detect incorrect classifications.

Apply Conditional Formatting: Highlight unmatched records in spreadsheets to speed up manual review. Use color-coded flags for missing receipts, duplicate entries, or tax discrepancies.

Leverage Bank Feed Integration: Connect the template with accounting software to auto-import transactions. Direct integration reduces manual entry errors and keeps records synchronized.

Automate Calculations: Use formulas to verify subtotal accuracy, tax amounts, and currency conversions. Automating calculations eliminates rounding issues and manual miscalculations.

Set Regular Review Intervals: Schedule periodic audits to validate data integrity. Frequent reviews prevent errors from accumulating and make month-end reconciliation smoother.