Key Elements of a Construction Receipt

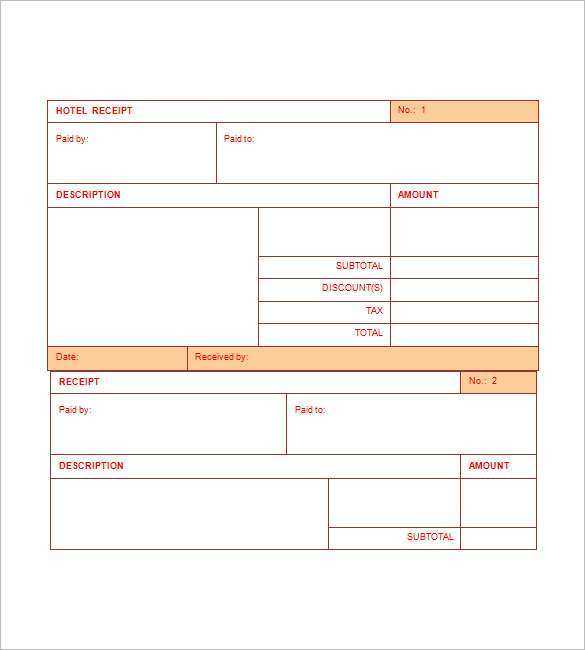

Ensure every receipt includes essential details to prevent disputes and maintain clear financial records. Key components:

- Company Information: Name, address, and contact details.

- Client Details: Full name and address of the customer.

- Date: Issuance date to track transactions accurately.

- Itemized List: Breakdown of materials, labor, and additional charges.

- Payment Details: Total amount, payment method, and any outstanding balance.

- Signature: Authorization from the contractor or business representative.

Choosing the Right Template

Select a template that suits the project type and business size. Common options include:

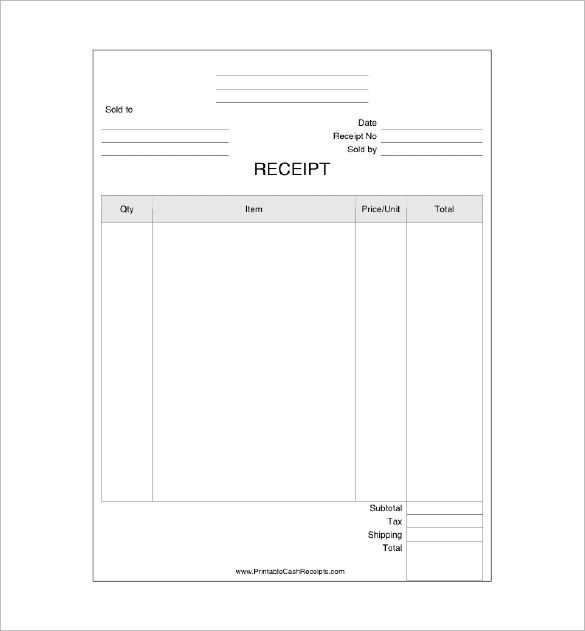

Basic Receipt

Ideal for small projects. Includes client and contractor details, total amount, and payment confirmation.

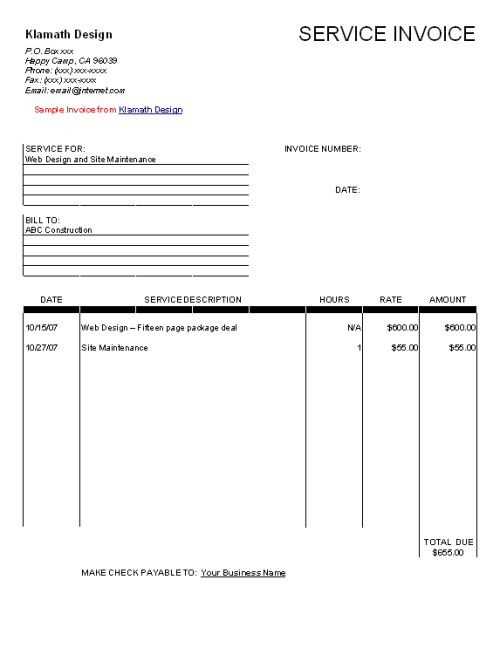

Itemized Receipt

Best for transparency. Lists labor, materials, and applicable taxes separately.

Tax-Compliant Receipt

Designed for businesses required to report taxes. Includes tax rates and registration numbers.

Digital Receipt

Suited for online transactions. Allows electronic signatures and automated record-keeping.

Use a format that aligns with local regulations and simplifies financial tracking.

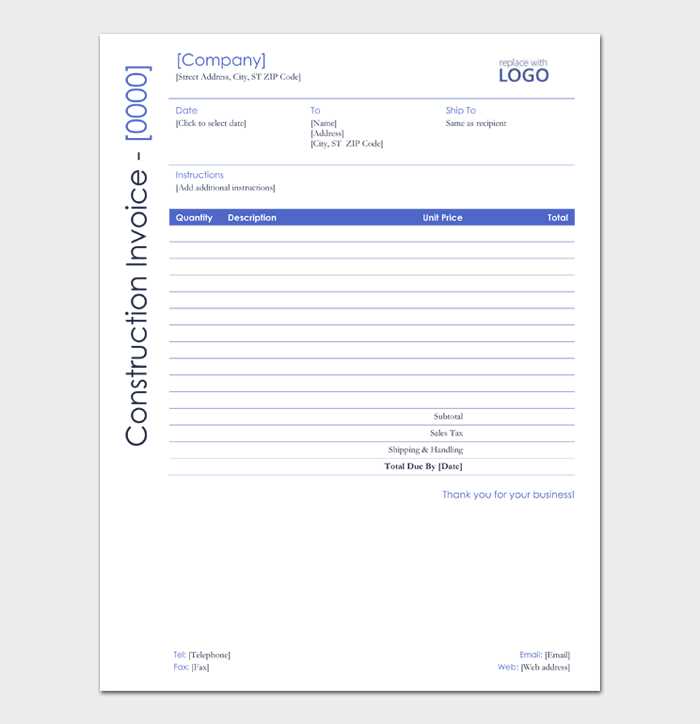

Templates for Construction Receipts

Key Elements to Include in a Receipt for Construction

Choosing the Right Format for a Builder’s Receipt

Legal and Tax Considerations for Construction Documents

Customizing Receipt Templates for Various Projects

Common Mistakes in Receipts and How to Avoid Them

Best Tools for Creating and Managing Building Receipts

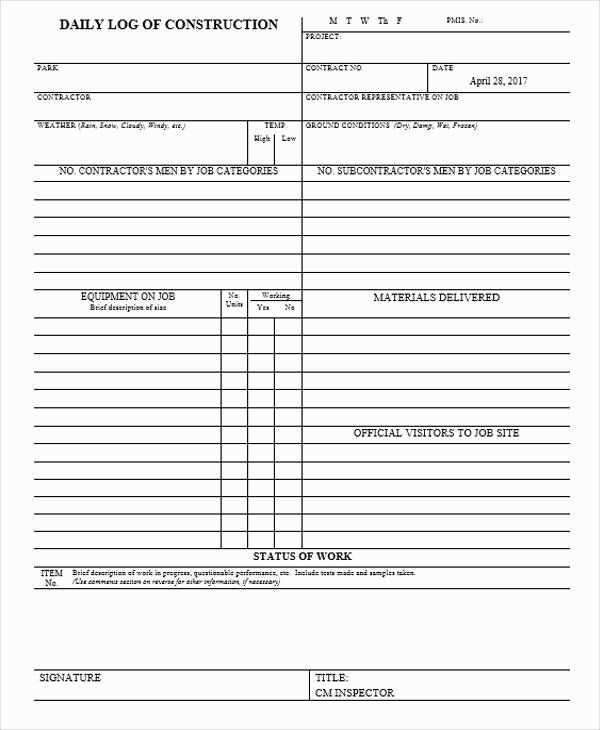

Include the project name, date, and a unique receipt number for clear record-keeping. List materials and labor separately, specifying quantities, rates, and totals. Always mention taxes, discounts, and additional charges to avoid disputes. State the payment method and transaction details to ensure accuracy. Add company details, including the business name, address, and contact information, for legal compliance.

Choose between digital and printed receipts based on the project’s scope. Digital formats, such as PDFs or Excel templates, offer easy customization and storage. Printed receipts work best for quick transactions on-site. Use clear fonts, structured layouts, and section dividers to improve readability.

Ensure compliance with local tax laws by including necessary tax breakdowns and registration numbers. Keep receipts for a legally required period to meet audit and warranty claims. Clearly state terms for refunds, adjustments, or outstanding balances to prevent future conflicts.

Customize templates to match project types. A small repair job may need a simple, itemized receipt, while large-scale projects require detailed documentation, including milestone payments and subcontractor costs. Adapt templates to reflect contract terms and project phases.

Avoid missing essential details such as labor hours, material specifications, or incomplete payment records. Errors in tax calculations or illegible handwriting can lead to financial complications. Standardize templates and verify entries before issuing receipts.

Use accounting software like QuickBooks or FreshBooks to automate receipt creation. Microsoft Excel and Google Sheets provide flexible, customizable templates. Mobile apps help generate receipts on-site, ensuring real-time documentation and professional presentation.