Donation ReceiptsAnswer in chat instead

Templates for Donation Receipts

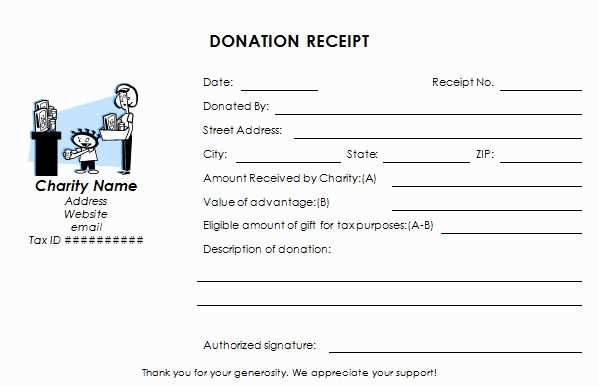

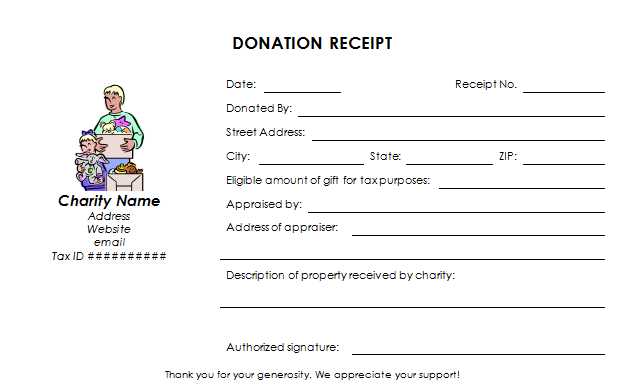

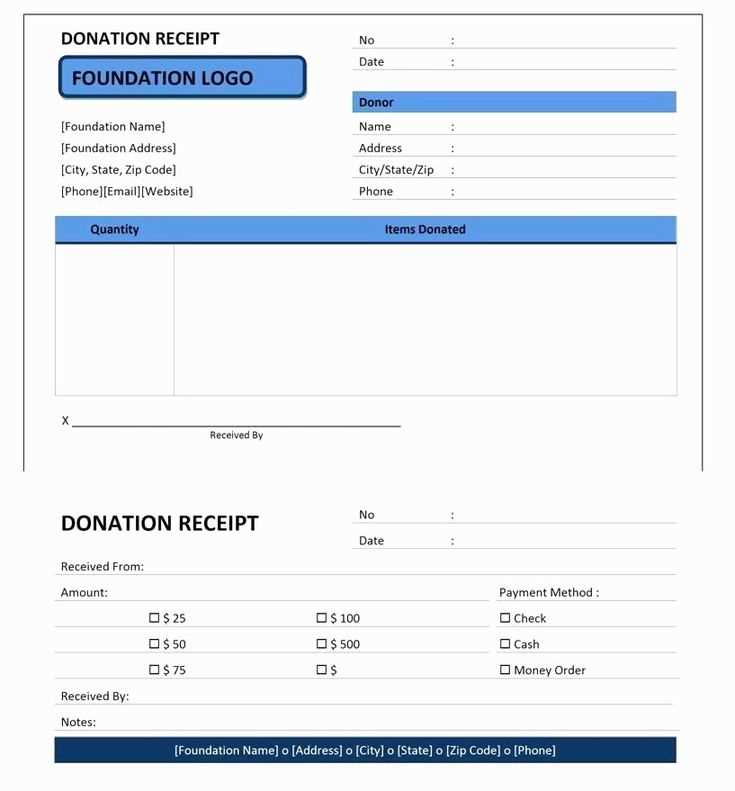

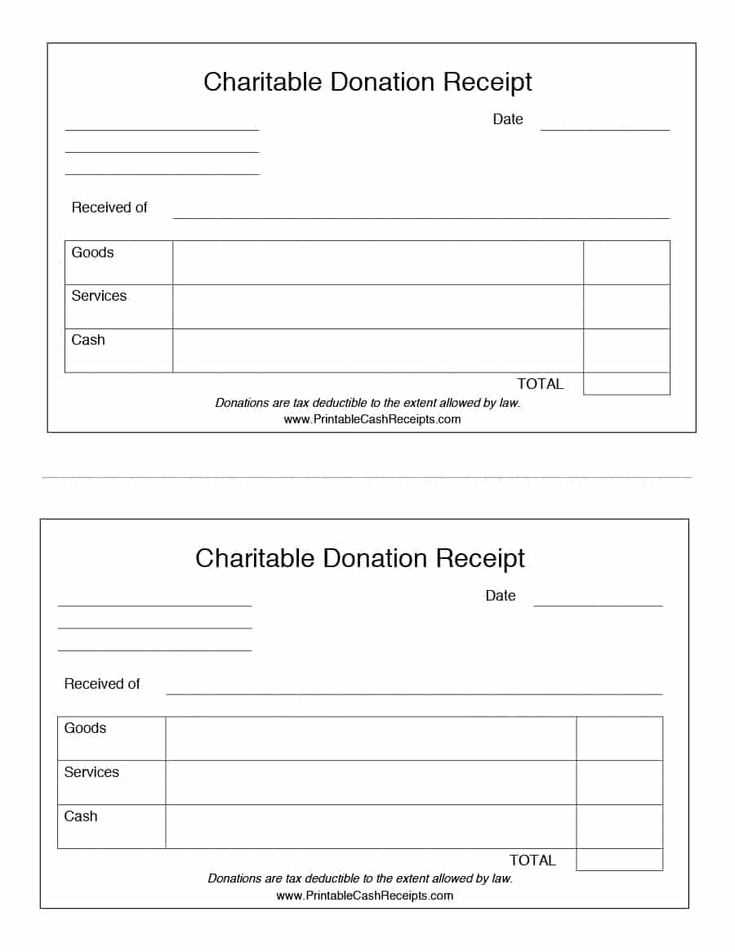

Required Details in a Receipt Template

Formatting for Clear and Professional Documents

Adapting Templates for Various Donations

Meeting Tax and Legal Standards

Digital vs. Paper Receipts: Main Differences

Frequent Errors to Avoid in Donation Receipts

Always include the donor’s full name, the donation date, and the exact amount given. If the donation is non-monetary, describe the item and its estimated value. Specify whether any goods or services were provided in exchange. A legally valid receipt must also include the organization’s full name, tax identification number, and a statement confirming its nonprofit status.

Use a clear layout with bold headers and aligned text for easy reading. Organize information into sections, keeping fonts legible and spacing consistent. A professional receipt should be structured, avoiding unnecessary design elements that might distract from the details.

Tailor templates to different types of donations. For monetary gifts, focus on amount and transaction details. For in-kind donations, add descriptions and estimated values. Sponsorship receipts should mention benefits received by the donor, if any.

Ensure compliance with tax and legal requirements by following local regulations. In the U.S., receipts for donations over $250 must contain a specific statement about goods or services received. Many countries require the inclusion of a registered charity number. Check regional tax laws to confirm necessary details.

Digital receipts allow for automation and easy record-keeping, while paper receipts provide a traditional option for donors who prefer printed documentation. Digital versions should be formatted as PDFs to maintain integrity. Regardless of the format, receipts must remain consistent in content and layout.

Avoid missing key details such as the date, donor name, or donation amount. Ensure all text is legible and free of errors. Double-check for compliance with tax regulations, and do not overcomplicate the format. Keeping receipts clear and accurate prevents misunderstandings and ensures they meet legal requirements.