Use a clear and well-structured receipt template to simplify transactions and enhance customer trust. A well-designed receipt provides essential details, including item descriptions, prices, payment method, and store information. Whether you run a small boutique or a large retail chain, a standardized format ensures consistency and professionalism.

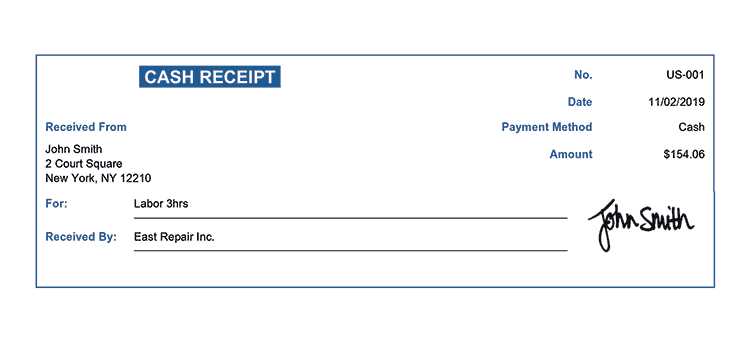

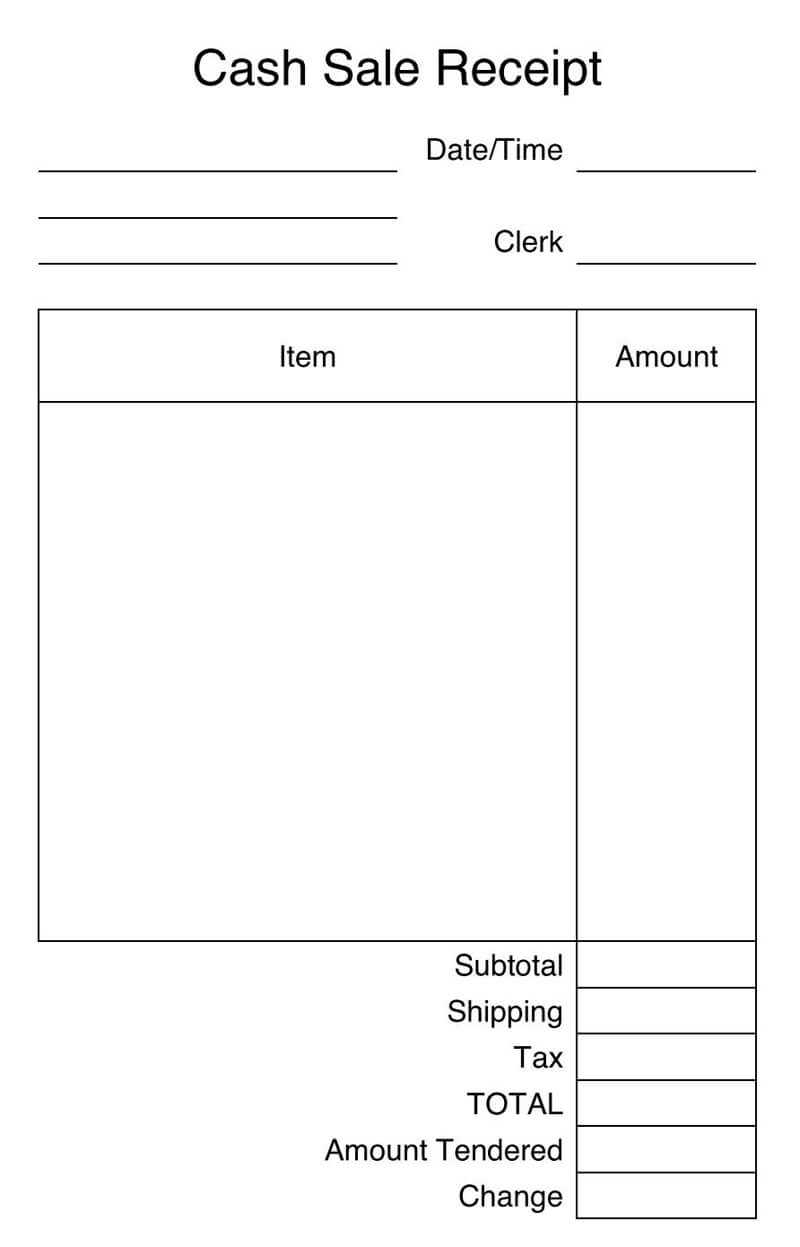

For cash payments, a simple receipt with date, itemized purchases, and a total amount may be sufficient. If your store handles returns or warranties, consider a more detailed template with policies and tax breakdowns. Digital receipts are also gaining popularity–many retailers offer email or SMS receipts to reduce paper waste and improve record-keeping.

Popular formats include PDF for fixed layouts, Excel for easy calculations, and Word for customization. If automation is a priority, integrate a POS system that generates receipts instantly. Choose a template that aligns with your branding and meets legal requirements in your region.

Here’s the corrected version with repetitions removed while keeping the meaning intact:

To create clear, concise receipts, eliminate redundant phrases. Ensure each piece of information is presented just once. For example, if you list the total amount twice, remove the second mention. Focus on presenting transaction details in a logical sequence, starting with the itemized list, followed by taxes, discounts, and then the final amount due.

Use simple, direct language for each line, without unnecessary modifiers. If there’s a need to clarify any terms (like “sales tax” or “shipping fee”), provide these explanations in brief and straightforward terms. Keep the receipt’s layout clean with enough white space, so each section stands out without overwhelming the customer.

By streamlining the wording, you not only reduce confusion but also enhance the customer’s experience, making the receipt both functional and easy to read.

- Receipt Templates for Retail Businesses

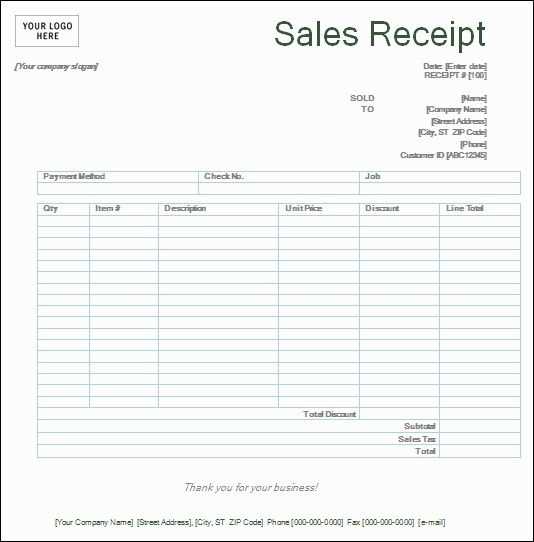

Retail businesses benefit from clear, professional receipt templates that keep transactions organized. Use simple, structured designs that include the key details customers expect. Include your store’s name, logo, contact information, transaction date, list of items, prices, taxes, and total cost. It’s vital that all this information is easy to find and understand. Make sure to format the receipt in a clean, readable font and logical order to enhance clarity.

Key Elements of a Retail Receipt Template

Every receipt should follow a clear pattern. Start with your store’s details: name, address, phone number, and website if applicable. Include a unique transaction ID and the date of purchase. List purchased items with clear item descriptions, quantities, and unit prices. Include taxes and any discounts applied. The total amount should be prominent to avoid confusion. Finally, provide a thank you note or return policy for a personal touch.

Customization Options

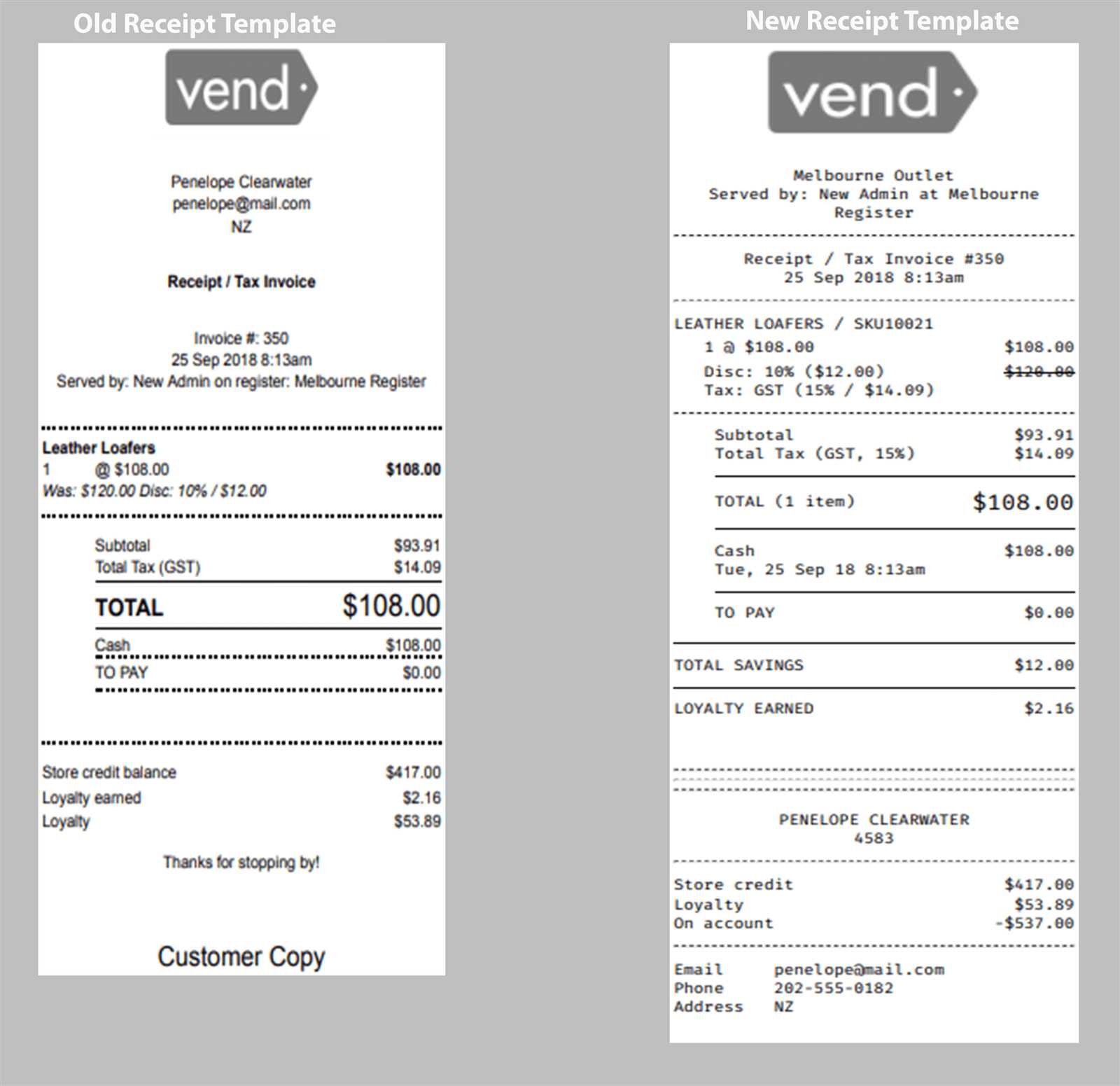

To make receipts fit your branding, customize templates by using your brand colors and fonts. This will create a cohesive look that enhances the customer experience. Some businesses add loyalty rewards, special offers, or a brief survey link at the bottom of receipts, which can encourage return visits. Make sure the template is adaptable for both printed and digital versions, depending on customer preference.

A store receipt includes specific details that help both customers and businesses keep track of purchases. The most crucial information is the store’s name, address, and contact details, which should be clearly visible at the top. This allows for easy communication or returns.

Each item purchased must be listed with a description, quantity, and price. This helps customers verify their purchases and serves as a record of the transaction. The subtotal is displayed right after the list of items, making it easy to see the total amount before taxes and discounts.

Taxes should be clearly broken down, showing the amount applied to the total, so customers understand how much they are paying in sales tax. Any discounts or promotions should also be listed, so the final price reflects these adjustments.

The final total is the most important element on a receipt. It should be displayed clearly at the bottom, after all calculations. Including the payment method (e.g., credit card, cash) ensures transparency in the transaction. The date and time of the purchase are essential for any return or warranty claims.

Finally, it’s useful to include a unique transaction or receipt number for easy reference in case there is a need to track or resolve any issues with the purchase later.

Select a format that aligns with your store’s needs and customer expectations. For basic retail operations, a traditional paper slip works well, offering space for item descriptions, prices, and taxes. For more complex transactions, consider adding a breakdown of discounts, promotions, or loyalty points.

Consider the size of the slip. The most common dimensions are 3×7 inches or 4×6 inches, but the right size depends on how much information you need to display. Keep the design clean and easy to read, with a clear hierarchy that highlights key details like totals and payment methods. Avoid overcrowding the slip with unnecessary information.

If you use a point-of-sale (POS) system, choose a format that integrates well with the software. Many POS systems offer customizable templates that can include your store logo, contact info, and specific sales details. Using these templates ensures consistency and professionalism in your receipts.

Think about durability. If you’re using thermal paper, it’s important to ensure that the print lasts. Some retailers opt for longer-lasting, high-quality thermal rolls to avoid fading over time. Make sure the font is legible, especially if it’s printed in small sizes.

Finally, consider environmental impact. Switching to digital receipts can reduce paper waste, but ensure your customers are comfortable with electronic formats. If you do offer digital receipts, ensure that the email or SMS messages are clear, easy to read, and include all necessary details.

Ensure your receipts align with your store’s brand by adding your logo, choosing brand-specific colors, and incorporating fonts that reflect your business identity. This small detail reinforces your branding every time a customer makes a purchase.

Logo and Business Name

Place your logo prominently at the top of the receipt. This visual cue makes it easier for customers to remember your store. Additionally, include your business name with the same font used on your website or marketing materials for consistency.

Colors and Fonts

Select colors that reflect your brand’s personality. Use your brand’s primary color for headings and accents. Choose fonts that are easy to read but unique to your business. Avoid using default or generic fonts–your receipt should stand out, not feel like a template anyone could use.

Adding Taglines or Slogans

Include a short tagline or slogan under your business name. This reinforces your brand message and can leave a lasting impression on the customer.

Custom Message Area

Designate a section where you can add personalized messages, whether for promotions, upcoming sales, or a thank-you note. This helps keep your receipts functional while adding a touch of your brand’s voice.

Digital vs. Printed: Design Considerations

For retail store receipts, the design of both digital and printed versions requires attention to readability, functionality, and user preferences. The format influences how information is presented and how easily customers can access it. Here’s what to keep in mind for each format:

Digital Receipts

When designing digital receipts, prioritize clarity and mobile-friendly layouts. Ensure the text is legible on various screen sizes and that important details, such as purchase items and totals, are easy to locate. Use a simple color scheme and avoid excessive imagery, as it can distract from the key information. Keep the layout minimalistic with clear separators between different sections, like itemized products, taxes, and total cost. Digital receipts should be easily shareable, with options for saving or printing if necessary.

Printed Receipts

Printed receipts must balance space with readability. Use a font size that is clear without overcrowding the space. Ensure the company logo and essential details such as date, time, and transaction number are prominent. Avoid cluttering the receipt with too much information that can overwhelm the customer. The design should be consistent across all receipts for easy recognition. Pay attention to margins and alignment to ensure everything fits within the standard paper size and looks professional.

| Factor | Digital Receipt | Printed Receipt |

|---|---|---|

| Readability | Mobile-optimized, clear text | Easy-to-read font, appropriate size |

| Space Usage | Flexible, can be compact | Limited by paper size |

| Design Complexity | Simplified layout, minimal distractions | More room for design elements, but avoid clutter |

| Accessibility | Can be saved or shared easily | Physical copy, no sharing options |

Ensure your receipt layout includes all legally required information. Clearly display the business name, address, and tax identification number. This is mandatory for tax compliance in many regions.

Include the transaction date and a detailed itemized list of purchased goods or services. This helps both customers and tax authorities to verify purchases. For tax reporting, make sure the price before tax, tax rate, and final total amount are visible.

Incorporate a tax breakdown when applicable. In some jurisdictions, receipts must show separate line items for different tax rates (e.g., state, local, or VAT). Clearly label these sections to avoid confusion.

Ensure the receipt includes any refund or exchange policies, if required by local law. A straightforward notice about the store’s return policy helps protect your business and meets regulatory standards.

Double-check the format and font size. Some laws dictate minimum font sizes for readability, especially for essential tax and legal information.

For seamless receipt creation, these tools and software can help streamline the process, offering user-friendly interfaces and customization options.

- Square – A leading point-of-sale (POS) system that provides free receipt generation. Square’s software allows retailers to create digital and printable receipts with branding options, including logos and custom text.

- QuickBooks POS – Known for its financial tools, QuickBooks offers receipt creation as part of its POS system. It integrates well with inventory and accounting features, generating professional receipts for every transaction.

- Zoho Invoice – Zoho offers customizable invoice and receipt templates that can be tailored to business needs. It also supports automatic receipt generation after sales, saving time on manual entry.

- Vend – This POS system helps generate detailed, customized receipts with the option to include product names, prices, and taxes. It’s ideal for businesses of all sizes with its cloud-based software.

- Receipt Printer Pro – A standalone software for businesses looking to print receipts directly from a computer or a connected printer. It features templates for different receipt styles, making it quick to use and easy to customize.

- Billdu – A simple invoicing tool that offers receipt templates. Its drag-and-drop interface makes it easy to personalize receipts, and it also includes features for automatic VAT calculations.

Choose the tool that best fits your business’s needs and budget to simplify receipt management.

Ensure the layout of your receipt template is clear and well-structured. Begin by including the store’s name and address at the top, followed by the transaction details such as date, time, and unique order number. This makes it easy for both the customer and store to reference the purchase later.

Next, list each item purchased with its name, quantity, and price. Align this information neatly to avoid confusion. Add a subtotal line that totals all the items before taxes and discounts.

Include tax and any discounts separately so they can be easily identified. A final total should be displayed at the bottom of the receipt, clearly indicating the amount the customer paid. This helps in case of returns or inquiries.

If applicable, offer a section for store policies, like returns or warranties, to keep the receipt informative. This can help resolve issues without additional contact.

Finally, add payment method information, including whether the transaction was made via cash, credit card, or another method. This ensures clarity in the transaction process for both the store and the customer.