For a legally valid and well-structured cash receipt in Spanish, use a format that includes key details such as transaction date, payer and payee names, amount, and payment method. Clear and precise wording ensures compliance with tax regulations and accounting requirements.

To create a professional receipt, include the heading “Recibo de Efectivo”, followed by transaction specifics. The total amount should be written both in numbers and words to prevent misunderstandings. If applicable, mention any taxes or additional fees.

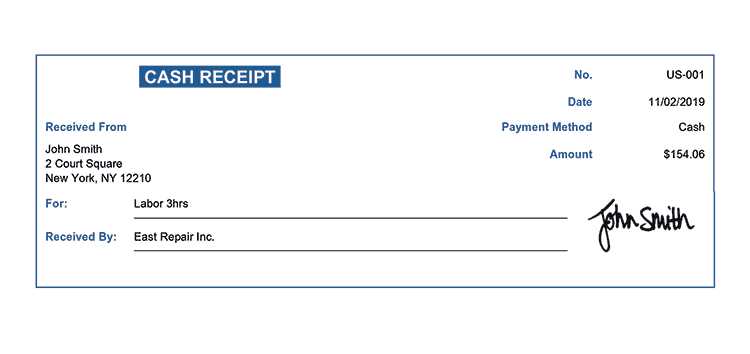

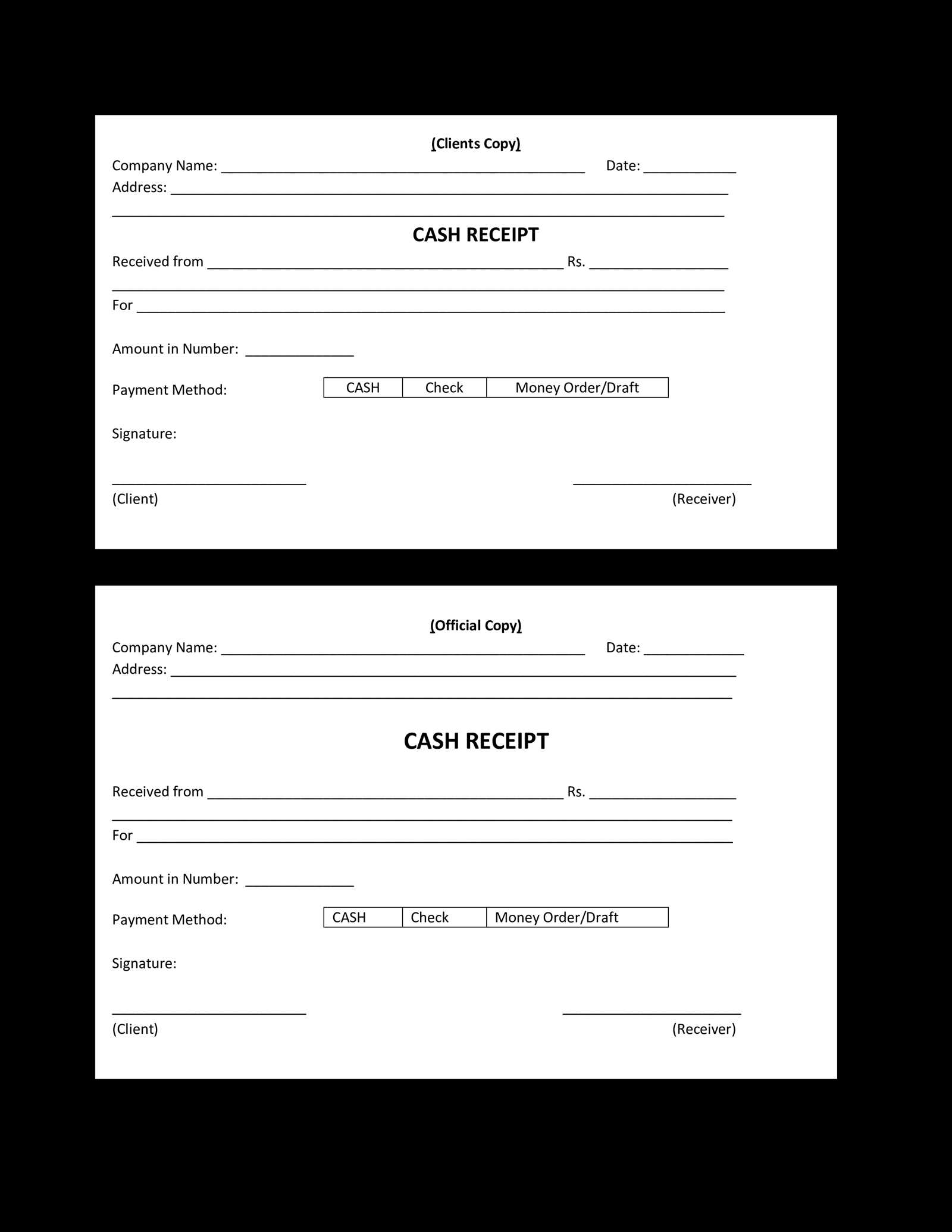

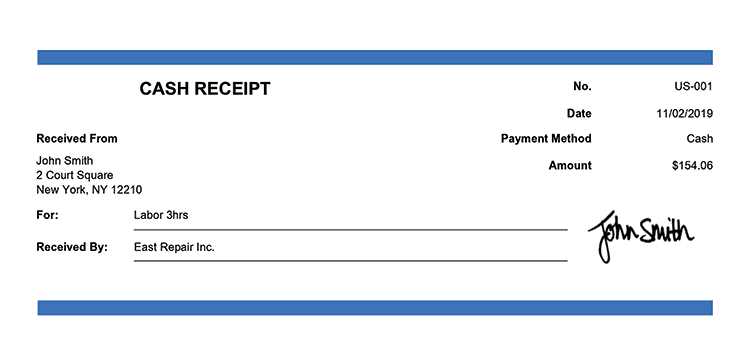

For added credibility, include the recipient’s signature and, if available, a company stamp. If issuing receipts frequently, consider using a template with predefined fields to maintain consistency and save time. A well-designed document improves transparency and simplifies financial record-keeping.

Here’s the corrected version without excessive repetition:

For a clean and concise Spanish language cash receipt template, focus on clear sections. Start with the header, which should include the business name, logo, and contact information. In the body, list the items sold, along with their prices and quantities. Avoid redundant phrases like ‘total amount’ and ‘total cost.’ Use simple language for payment details and transaction date. Keep the layout organized to enhance readability. Finally, include a footer with return or refund policies, ensuring the content is straightforward and free of unnecessary wording.

- Spanish Language Cash Receipt Template

A cash receipt in Spanish is a formal document used to acknowledge the receipt of money for goods or services. To create a Spanish-language cash receipt template, make sure to include key details such as the date, amount, and the name of the payer. Below is a sample template that can be easily adapted for various business scenarios.

Cash Receipt Template Example

| Detalles | Información |

|---|---|

| Fecha | [Insertar fecha] |

| Recibido de | [Nombre del pagador] |

| Cantidad | [Monto recibido] |

| Concepto | [Descripción del pago] |

| Firmado por | [Nombre del receptor] |

This template covers the essential fields. The payer’s information, amount, and reason for the transaction should be clearly stated to avoid any confusion. Adjust the template to your business’s specific requirements and legal standards in your region.

A Spanish payment slip typically includes several key components to ensure clarity and accuracy in transactions. Here are the main sections that should appear:

1. Payer’s and Recipient’s Information

The slip should list the names, addresses, and contact details of both the payer and the recipient. This helps confirm the identities of the parties involved. The payer’s information should be placed in the top section, followed by the recipient’s data beneath it.

2. Invoice or Reference Number

Each payment slip should feature a unique reference number or invoice number. This number is crucial for tracking the transaction and ensuring that payments are correctly matched to their corresponding invoices or contracts.

3. Payment Amount and Currency

The total amount due for payment should be clearly stated, along with the currency being used, typically in euros. This ensures that both parties are aware of the exact sum being transferred.

4. Payment Due Date

Clearly indicating the payment due date is important. It avoids misunderstandings and potential late fees. This date is often placed near the total amount due for easy reference.

5. Payment Method Details

The payment slip should specify the method of payment, whether it’s a bank transfer, credit card, or another method. For bank transfers, it is common to include bank account numbers or other relevant financial details to ensure smooth processing.

6. Description of Goods or Services

A brief description of the goods or services being paid for should be included. This section provides context to the payment and helps clarify the reason for the transaction.

7. Legal and Tax Information

The slip should include any applicable tax information, such as the VAT number of the business, and relevant legal disclaimers or notes. This is crucial for tax purposes and for complying with Spanish financial regulations.

Clear and organized layout is key in Hispanic receipt formats. Use a well-structured design that includes the following details: seller’s name, address, and contact information clearly displayed at the top. Followed by the date and time of the transaction. Always ensure that the total amount due is prominently visible, often at the bottom of the receipt.

Language choice is crucial for Hispanic receipts. The majority of transactions in Spanish-speaking regions are handled in Spanish, so the receipt text should be written in Spanish. Make sure to use accurate and commonly understood terms for the items, taxes, and payment methods.

Itemized listing is mandatory. Break down the products or services purchased, detailing their individual prices and any applicable taxes. It’s important that each entry is clearly labeled with a short description to avoid confusion.

Currency formatting is another key element. Always use the correct currency symbol for the country, such as “$” for most Latin American countries. For example, in Mexico, you might need to specify “MXN” if needed for clarity.

Tax details should be included in separate lines. Indicate the tax rate used, as well as the exact tax amount calculated on the subtotal. In many countries, it’s required by law to display taxes distinctly from the product prices.

Receipt number and reference are typically required for proper tracking. Include a unique number or code for every receipt issued to aid in auditing or returns. Always include a reference number if applicable, especially for services rendered.

In Spanish-speaking countries, cash receipts are governed by specific legal requirements. Businesses must ensure that receipts comply with both national and local regulations to avoid fines or legal issues.

- Invoice Numbering: Many countries mandate sequential numbering of receipts for tracking and auditing purposes. This ensures transparency and prevents manipulation.

- Tax Information: A valid receipt must include detailed tax information, such as the tax identification number of the business and the corresponding VAT or sales tax rate.

- Mandatory Information: All receipts should clearly state the date of transaction, name and address of the business, and a description of the goods or services provided.

- Digital Receipts: In some countries, businesses are required to provide electronic receipts for transactions above a certain amount, with encrypted digital signatures to verify authenticity.

- Consumer Rights: Spanish-speaking countries generally protect consumers with strict rules on receipt retention. Customers must be able to receive receipts and use them as proof of purchase in disputes.

These standards may vary slightly depending on the country, but all share the goal of ensuring accountability in business transactions. Adhering to these rules is crucial for maintaining compliance with local laws.

Customize your payment proof by adding key details that align with your business needs. Start with your company name and logo at the top to reinforce your brand identity. Include the customer’s full name and address to ensure proper documentation of the transaction.

Payment Breakdown

List the services or products provided, along with their corresponding prices. Break down taxes, discounts, or additional fees clearly so there are no misunderstandings. You can format this information in a table for easy readability.

Payment Method and Transaction Information

Specify the method of payment, such as credit card, bank transfer, or cash. Also, include the transaction number, payment date, and any reference codes for tracking purposes. This will make it easier for both parties to verify and reference the transaction later.

Finally, add a section for terms and conditions related to the payment, including any refund policies or warranties, if applicable. This helps in avoiding future disputes and ensures clarity for the customer.

Digital slips provide immediate delivery and easy access from any device. They eliminate the need for physical storage, saving space and reducing paper waste. They can be stored securely in cloud systems, allowing easy retrieval for future reference. However, digital receipts rely on technology, so if there is a system failure, access may be compromised. Some customers may also find it inconvenient to search for receipts on their phones or computers instead of having a physical copy at hand.

Paper slips, while tangible, can be easily lost or damaged over time. They are often required for returns or warranty claims, and not all businesses provide digital options. On the positive side, paper receipts don’t rely on technology, making them accessible even without an internet connection. However, they contribute to paper waste, and storing them physically can create clutter. The environmental impact and storage challenges of paper slips often outweigh their benefits in today’s world.

Ensure that the “IVA” (Value Added Tax) is accurately included. Incorrect or missing tax details lead to confusion and potential legal issues.

- Incorrect item descriptions: Avoid vague terms like “producto” or “servicio”. Specify the product or service clearly to avoid ambiguity.

- Missing date or time: Always include the date and time of the transaction. Without this, the receipt lacks vital information for returns or warranty claims.

- Wrong format for the “número de factura”: The invoice number should follow a consistent format, ideally numeric and sequential, to maintain proper documentation.

- Spelling mistakes in client or business names: Double-check names and addresses to avoid potential legal disputes or issues with refunds.

- Forgetting payment method details: Whether it’s cash, card, or another method, clearly indicate the payment type used for transparency.

Accurate and clear receipts avoid problems for both the business and the customer, providing a professional and reliable document for future reference.

For creating a Spanish language cash receipt template, ensure to include key elements like the date, receipt number, seller’s name, and buyer’s details. This template should clearly display the total amount paid, a description of goods or services, and any applicable taxes or discounts. Be concise and organized to avoid confusion. Choose a clean layout that enhances readability and usability.

Design Considerations

Keep the font size consistent for easy reading. Use bold for headings and totals to make them stand out. Incorporate sections that highlight the method of payment, such as cash, credit card, or bank transfer, to provide transparency. If necessary, include space for signatures to confirm the transaction.

Legal Compliance

Make sure the template adheres to local tax and accounting regulations. Include space for tax identification numbers (NIF) if required by law. Verify that the template format aligns with regional standards for issuing receipts.