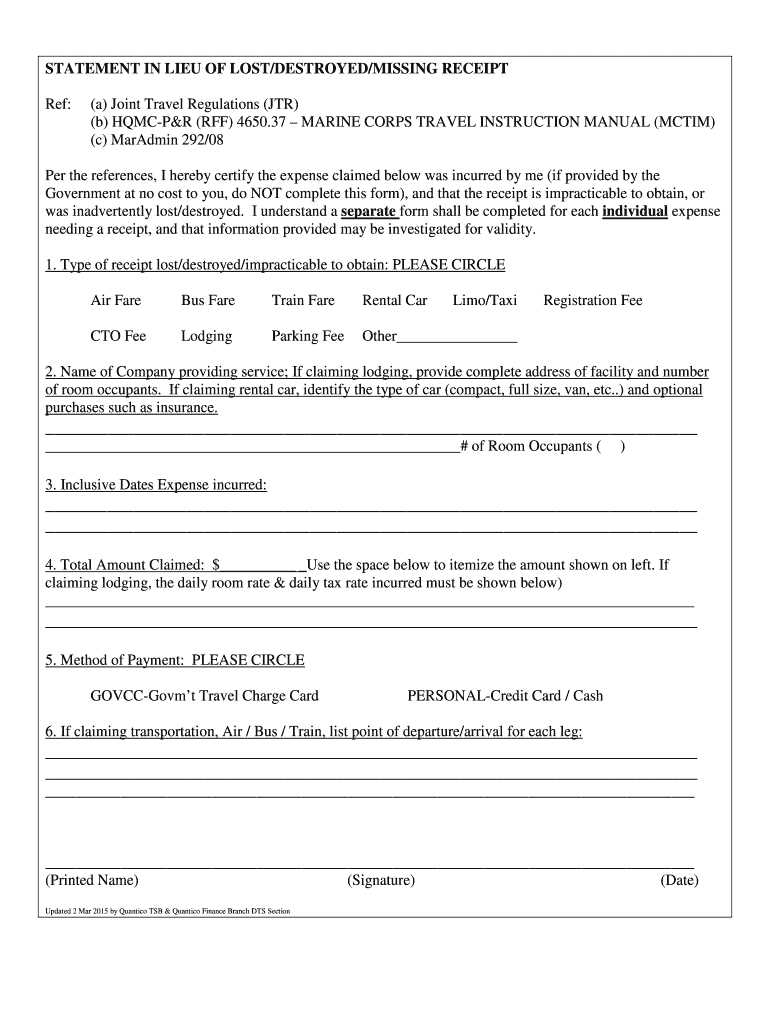

Need a replacement for a lost receipt? The best approach is to create a clear, professional document that includes all necessary details. Most businesses and organizations require specific information to process a reimbursement or verify a purchase.

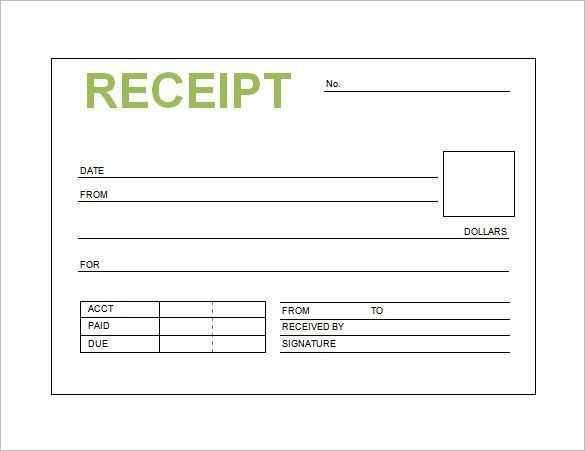

Start with the date of purchase, the name of the business, and a description of the items or services. Include the total amount paid, payment method, and any reference numbers that might help confirm the transaction.

Use a simple, structured format. A lost receipt template should resemble an original receipt as closely as possible while remaining truthful. Adding a note explaining why the original was lost can help establish credibility.

For added legitimacy, consider requesting a duplicate receipt from the original vendor. Many businesses keep digital records and can provide a copy upon request.

Here’s the revised version with repetitions removed, while retaining the meaning:

To obtain a replacement for a lost receipt, contact the store or service provider where the purchase was made. Provide details such as the transaction date, item purchased, and payment method. Many businesses offer digital copies of receipts, so it’s worth checking your email or account online. If you’re unable to reach the provider directly, try using any available customer support tools, such as live chat or a helpdesk ticket system.

Make sure to ask for confirmation that the replacement receipt has been sent or is available. If the provider charges a fee for issuing a duplicate, be prepared to cover it. Keep a copy of all correspondence related to the request, including the date of the original transaction, in case of any future inquiries.

- Template for Missing Receipt

In case you lose a receipt, it’s helpful to have a template ready to submit to the company or service provider. This template allows you to explain the situation clearly and request a replacement or reimbursement.

Basic Information

- Your full name

- Your contact information (email, phone number)

- Date and time of the purchase or service

- Item or service description

- Amount paid

- Method of payment (credit card, cash, etc.)

Explanation of the Situation

- Clearly state that the receipt is missing or lost.

- Explain the reason, if known (e.g., accidentally discarded, never received). Keep it brief.

- Indicate any steps already taken to locate the receipt (e.g., checking email or asking for a duplicate).

Make sure to include any necessary details that could help the company verify the transaction. Once you’ve completed the template, send it to the customer service team. Keep a copy for your records.

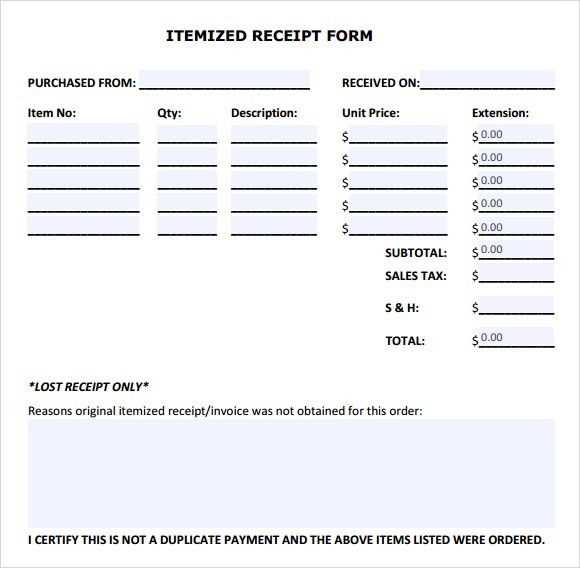

Make sure the replacement receipt includes the date of the transaction, which helps establish the timeframe of the original purchase. Next, specify the store name and address, ensuring the place of purchase is easily identified. Include the transaction number or order ID to track the purchase in the system.

Clearly list the items purchased, with quantities and individual prices, alongside any applicable taxes or discounts. The total amount paid should also be included, reflecting any additional charges. Don’t forget the payment method, whether it’s credit card, cash, or another form.

Finally, if applicable, provide the customer’s contact details or a reference number to link the receipt to the original transaction for verification purposes. A clear store representative signature or approval stamp can further confirm the receipt’s validity and authenticity.

To create a duplicate receipt for different purposes, follow these guidelines for accuracy and clarity.

For Personal Records

- Ensure all original transaction details are visible, such as item descriptions, quantities, prices, and taxes.

- Include the date of purchase, payment method, and transaction number.

- For clarity, add a note stating that this is a duplicate receipt, if applicable.

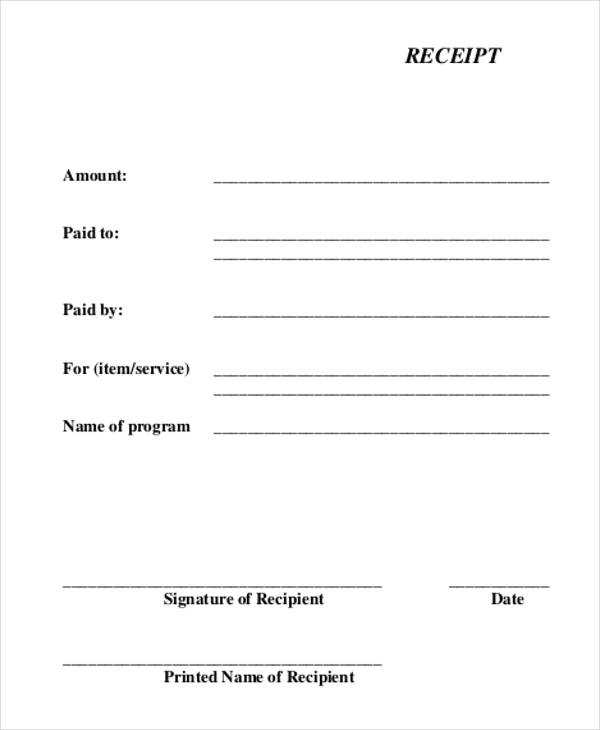

For Reimbursement or Tax Purposes

- Double-check that all required information is included, especially for tax deductions, like VAT amounts and business addresses.

- If the original receipt is unavailable, include a reason for the duplicate request and a clear reference to the original transaction.

Double-check the information provided in the replacement receipt to confirm it matches the original transaction details. Ensure the date, items, quantities, prices, and total cost align with your purchase records. Compare the receipt number, store name, and location to the original, and verify the payment method used. If possible, ask for an itemized breakdown of the charges to catch any discrepancies. It’s also helpful to confirm the return or exchange policy on the replacement receipt to ensure it’s consistent with the initial purchase terms.

Verify Transaction Details

Cross-reference the items listed on the replacement receipt with your bank statements or credit card history. This will help identify any missing or incorrect purchases. If the items are bundled in the original receipt, ensure they appear as a group or separate, depending on the retailer’s practice. If any confusion arises, don’t hesitate to contact the retailer for clarification.

Get Written Confirmation

If you’re unsure about the replacement receipt’s accuracy, request written confirmation from the store. This ensures that both parties are on the same page regarding the corrected information. Having documentation can prevent potential misunderstandings later, especially in the case of returns or exchanges.

Using a receipt template can be legally valid, but only if it adheres to specific regulations. When creating a receipt template, ensure that it includes the necessary information to meet tax and business requirements. This typically includes the name and address of the business, transaction details, date, and itemized costs.

Be mindful that fraudulent or misleading information on a receipt template can result in legal penalties. The template must accurately reflect the transaction made, without misrepresentation. If the receipt is used for tax deductions or expense reports, it must comply with the rules set by the local tax authority.

In some jurisdictions, receipts must follow specific formats or include certain elements, such as tax identification numbers or digital signatures for verification. Familiarize yourself with your local laws to ensure the receipt template complies with these requirements.

Finally, storing or using altered receipts can lead to disputes or potential legal action. Always ensure that the information is truthful and that the receipt serves as a proper record of the transaction.

Tailor the receipt template to your business type by including relevant fields. For businesses that sell products, ensure there is space for item descriptions, quantities, unit prices, and total amounts. If you provide services, make sure to capture service descriptions, hourly rates, and total hours worked. If applicable, add a section for discounts, taxes, and any additional charges, such as handling fees.

To improve clarity, provide a section for payment methods, allowing customers to clearly see how they paid. You might also need a place for customer details, especially for warranty or return purposes. Customizing the template in this way helps ensure it is specific to your business operations and improves the customer experience.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 1 | $25.00 | $25.00 |

| Service B | 2 | $15.00 | $30.00 |

| Tax | $5.00 | ||

| Total | $60.00 |

Adapt the template to reflect your unique needs, ensuring that it captures the necessary information while providing a clear and professional receipt for your customers.

Contact your employer or tax authorities as soon as you realize you’ve lost the receipt. Provide them with the details of the transaction, such as the date, amount, and nature of the purchase. If applicable, include the name of the vendor and the method of payment. Offer any available documentation that could support your claim, such as bank statements, credit card transactions, or email confirmations.

Prepare a written statement explaining the loss and request instructions on how to proceed with submitting a replacement receipt. Many employers and tax authorities accept digital records or a manually written replacement receipt, as long as it contains the necessary information. Keep copies of all communications for your records in case further verification is required.

If you’ve lost your receipt, don’t panic. Contact the store or service provider where you made the purchase and ask if they can provide a copy. Many companies can resend the receipt if you have proof of purchase, like a bank statement or order number.

Steps to Follow

1. Locate any transaction details: Check your email, bank statement, or online account for any records of the purchase.

2. Provide relevant information: When you contact the store, be prepared with details such as the date of purchase, item description, and payment method.

What You Can Expect

Stores typically have systems to retrieve purchase data. They may request information like your membership number, email address, or payment card details to verify the transaction. Once verified, they’ll usually email or print a duplicate receipt for you.