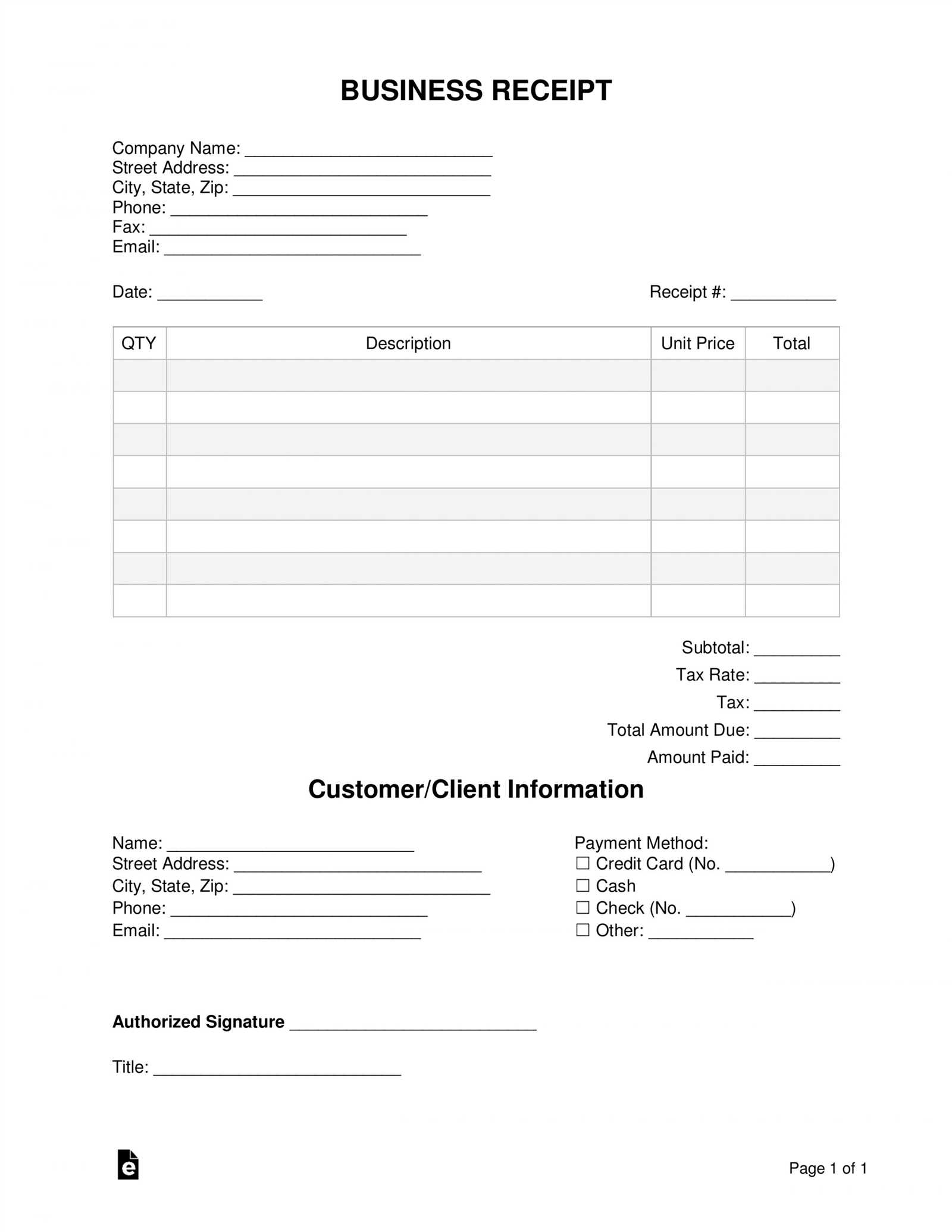

A well-structured receipt template ensures smooth financial tracking and simplifies tax reporting. Choose a format that includes essential details such as transaction date, seller and buyer information, itemized charges, and payment method. A clear layout prevents disputes and keeps records organized.

Opt for a template that aligns with your business needs. A digital format, such as a fillable PDF or spreadsheet, allows quick modifications and professional presentation. For handwritten receipts, a printable version with predefined fields ensures consistency.

Adding a logo and business details enhances credibility. Customization options, such as automatic calculations and integrated tax fields, save time and reduce errors. A well-designed template supports transparency and strengthens customer trust.

Here’s a refined version with reduced word repetition while keeping the meaning intact:

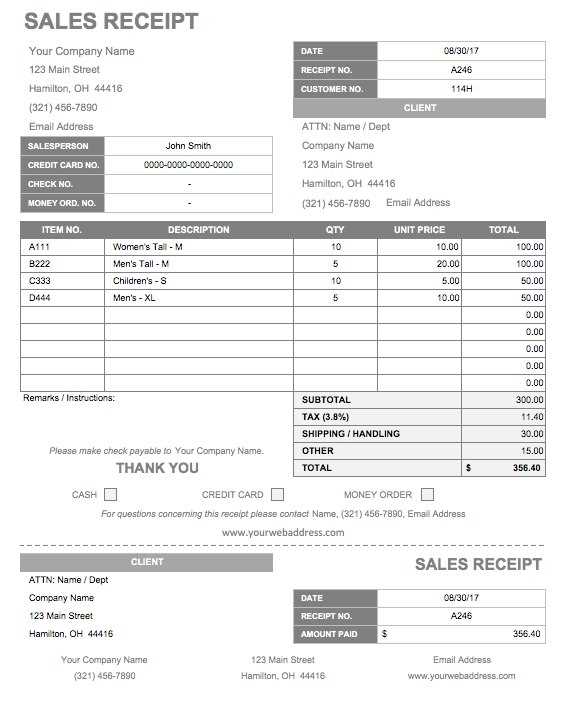

Use a structured table format to present receipt details clearly. Include essential columns such as date, description, quantity, unit price, and total amount. Below is a practical example:

| Date | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| 2025-02-08 | Office Supplies | 3 | $15.00 | $45.00 |

| 2025-02-08 | Printing Services | 1 | $30.00 | $30.00 |

| Subtotal | $75.00 | |||

| Tax (10%) | $7.50 | |||

| Total | $82.50 | |||

Adjust formatting based on specific business needs, ensuring clarity and compliance with accounting requirements. Digital or printed versions should maintain readability, with well-defined sections for easy reference.

- Free Business Invoice Template

Choose a structured format that clearly presents services, costs, and payment details. A well-organized invoice template includes a header with your company name, contact information, and a unique invoice number.

Key Sections to Include

List client details, including name, address, and contact information. Specify provided services with descriptions, quantities, and unit prices. Add a subtotal, taxes, and the final amount due.

Customization and Payment Terms

Incorporate branding elements like a logo and custom color scheme. Define payment methods, due dates, and late fee policies to ensure smooth transactions.

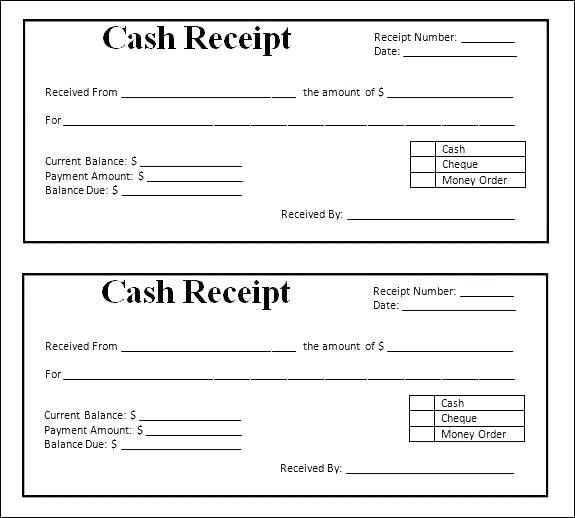

A payment receipt must clearly state the transaction details to ensure transparency. Include the date to record when the payment was made, along with a unique receipt number for easy tracking. Specify the payer’s and recipient’s names to establish accountability.

Outline the payment amount in both numerical and written formats to prevent misinterpretation. Mention the payment method, whether cash, credit card, or bank transfer, to clarify how the funds were received. If applicable, include tax details and any discounts applied.

A brief description of the goods or services provided helps confirm the purpose of the transaction. For added credibility, ensure that the receipt includes the business’s contact details and an authorized signature or stamp.

Adjust field labels for clarity. Rename default labels to match your business terminology. This ensures consistency across documents and simplifies data entry.

Add or remove sections. If your transactions require specific details, such as project codes or tax breakdowns, insert extra fields. Conversely, eliminate unnecessary sections to keep the form concise.

Enhance Formatting for Readability

Use alignment and spacing strategically. Group related fields together and adjust spacing to prevent overcrowding. A well-structured form reduces input errors.

Integrate dropdowns and checkboxes. Predefined options speed up form completion and maintain uniformity. This is particularly useful for payment methods or service categories.

Ensure Compatibility Across Devices

Test on multiple screens. Whether viewed on a phone or desktop, the form should remain legible and functional. Responsive design guarantees a smooth experience.

Save as a reusable template. Once customized, store the form for future use to maintain consistency and streamline record-keeping.

PDF ensures consistent formatting and prevents unauthorized edits, making it ideal for finalized documents like receipts and invoices.

CSV simplifies data manipulation in spreadsheets, allowing seamless import into accounting software for quick calculations and analysis.

XLSX supports complex formulas, multiple sheets, and data visualization, making it a strong choice for tracking financial trends.

TXT provides a lightweight option for plain-text records, reducing compatibility issues across different devices and systems.

Choosing the right format depends on whether security, analysis, or accessibility is the priority. Using multiple formats can optimize record-keeping efficiency.

Ensuring Legal Compliance in Transactions

Ensure your transactions are compliant with local regulations by including specific details on your receipts. First, check that your business’s registration number is visible, as well as any required tax identification numbers. This provides transparency and helps avoid potential audits.

Key Details to Include

- Business name and address

- Transaction date and time

- Itemized list of goods or services

- Total amount paid, including applicable taxes

- Payment method used

These elements not only ensure clarity for the customer but also help you remain compliant with tax reporting laws. Additionally, consider including refund policies and warranties if applicable. By doing so, you provide clear guidelines on how customers can engage with your business and protect their rights.

Maintain Record Keeping Standards

- Store transaction receipts for a set period as required by law.

- Ensure that digital receipts meet the same standards as paper receipts.

- Provide easy access to receipts for customers who need them for returns or tax purposes.

Adhering to these requirements will support your business’s legal standing, and prevent disputes with clients or tax authorities.

Integrate your business receipt template directly with accounting software to streamline financial tracking and reduce manual errors. Many accounting tools support CSV or Excel file imports, which makes it easy to transfer data from templates. By ensuring that receipt details, such as dates, amounts, and tax information, align with the software’s fields, you minimize discrepancies and improve your workflow.

Linking templates with invoicing features in accounting software can automate the recording of transactions. This integration not only saves time but also maintains accuracy in your financial reporting. Set up automatic syncing between your template and the accounting platform to ensure that every entry is logged immediately, providing real-time updates on cash flow.

For a more seamless experience, consider using pre-built integrations that some platforms offer. These integrations can help connect your receipt templates to tools like payment gateways or inventory management systems, allowing your data to flow smoothly from one tool to another without manual intervention.

One of the most common mistakes is neglecting to keep documentation clear and concise. Avoid lengthy descriptions or unnecessary jargon that can confuse the reader. Use simple and direct language to convey the necessary information without overcomplicating things.

Inaccurate Information

Ensure all details in your documentation are accurate. A small mistake can lead to confusion or costly errors down the line. Always double-check facts and update documentation as needed to reflect the most current data.

Lack of Consistency

Inconsistent formatting or terminology can make documentation difficult to follow. Stick to a set format for headings, bullet points, and dates. Use the same terms throughout to avoid confusion and keep your documentation professional.

To ensure a smooth experience when creating a business receipt, start by selecting a simple template with clear sections. Avoid overcrowding the document with unnecessary details. Only include the essentials: date, items sold, price, and payment method. The format should be straightforward, ensuring the recipient can quickly understand the transaction.

Use a Structured Layout

Organize the information in an easy-to-read format. Group related items such as buyer and seller details in one section, followed by transaction specifics like amounts and taxes. Ensure each section is clearly labeled, using headings like “Receipt No.” and “Total Amount.” Keep spacing consistent throughout the template for readability.

Include Payment Information

Make sure to list the method of payment, whether it’s cash, credit card, or online payment. This not only verifies the payment process but also keeps records accurate for accounting purposes. If applicable, provide a receipt number for reference.