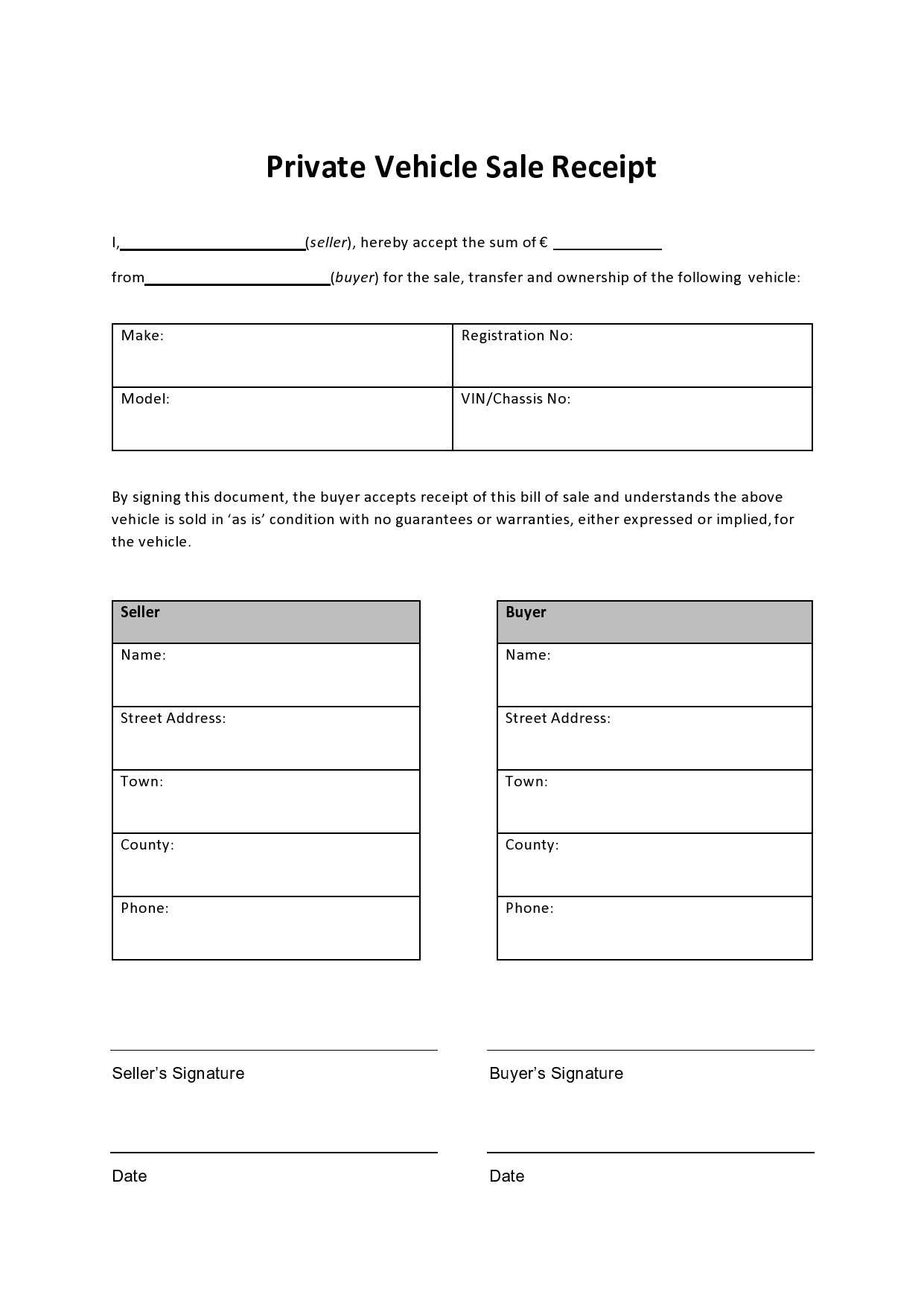

Clear and Concise Details

A proper vehicle loan receipt must include key information to confirm the transaction. List the lender’s and borrower’s full names, contact details, and addresses. Specify the vehicle’s make, model, year, VIN, and any other identifying details.

Include the loan amount, interest rate, repayment terms, and due dates. If collateral is involved, note its specifics. Both parties should sign and date the document for legal validity.

Structured Format for Easy Reference

Header Section

- Document title: Vehicle Loan Receipt

- Date of transaction

Loan Details

- Names and contact information of both parties

- Vehicle specifications (VIN, model, year, etc.)

- Loan amount and repayment schedule

Signatures and Acknowledgment

Both parties should sign and retain a copy. A witness or notary can add extra security.

Using this structured approach ensures clarity and prevents disputes. Customize the format based on your agreement’s specifics.

Vehicle Loan Receipt Template

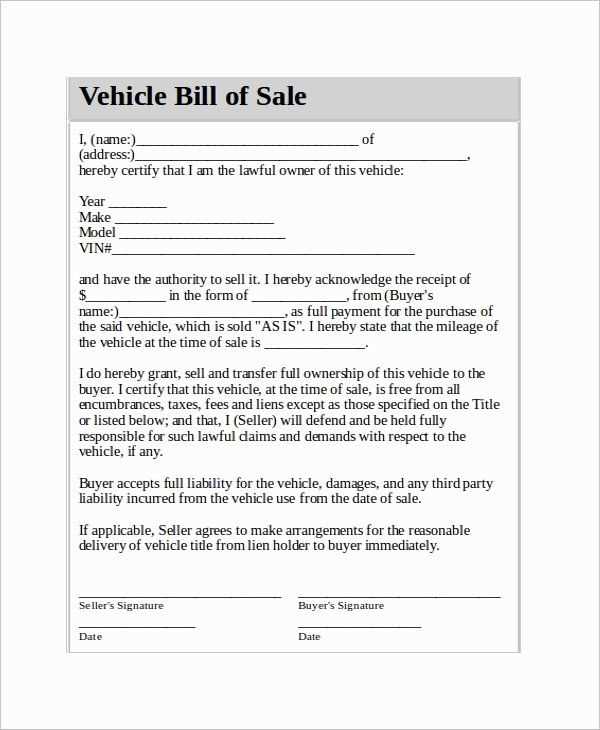

Key Elements to Include in a Vehicle Financing Receipt

Ensure the document includes the lender’s and borrower’s full legal names, contact details, and addresses. Clearly state the vehicle’s make, model, year, and VIN to eliminate any confusion. Specify the principal loan amount, interest rate (if applicable), and repayment terms, including the schedule and final due date. Adding a unique receipt number can improve record-keeping.

Legal Considerations for Drafting a Lending Document

Verify compliance with local regulations governing private and commercial lending. Clearly define late payment penalties and default consequences to prevent disputes. Both parties should sign the receipt, and signatures should be notarized if required by law. Including a statement confirming the borrower’s receipt of funds strengthens legal validity.

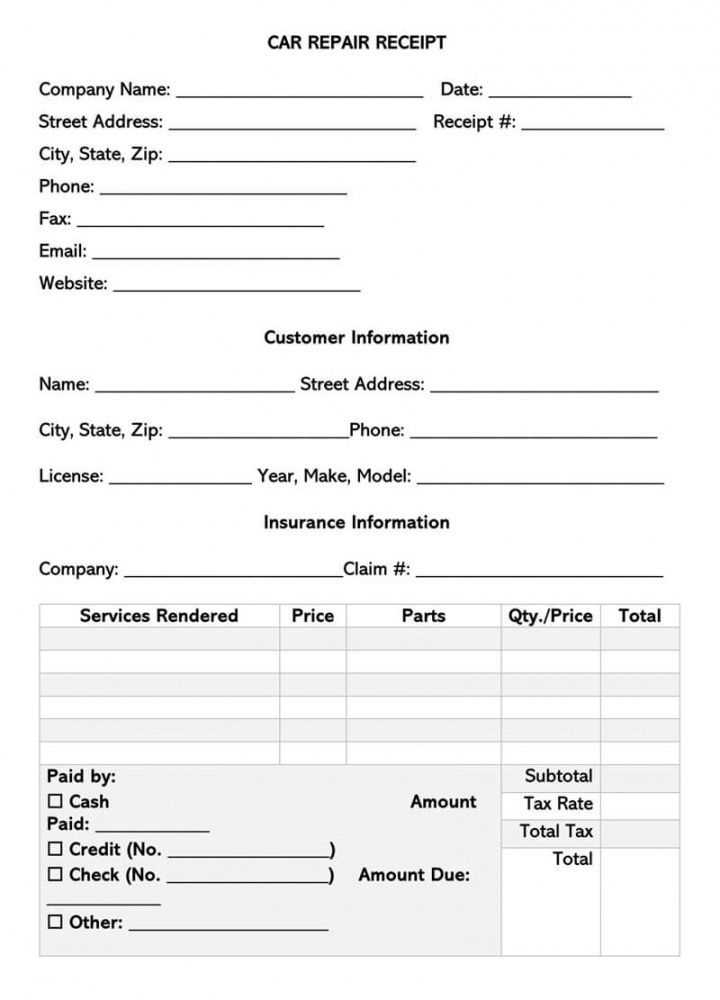

How to Structure Payment Details in the Agreement

Break down each payment installment with dates, amounts, and accepted payment methods. If collateral is involved, outline conditions for repossession in case of non-payment. Maintain a separate section for additional fees, such as processing charges or early repayment penalties, to avoid misunderstandings.

Customizing the Format for Personal or Business Needs

Personal loan receipts may prioritize simplicity, while business transactions require formal formatting with company branding and tax details. Digital versions benefit from dynamic fields for automated calculations, whereas printed forms should include signature lines for in-person verification.

Common Mistakes to Avoid When Preparing a Loan Record

Omitting critical details, such as due dates or payment breakdowns, can create disputes. Avoid vague language and ensure all terms are unambiguous. Failing to provide copies for both parties weakens documentation integrity. Neglecting to record partial payments can lead to discrepancies in outstanding balances.

Printable and Digital Format Options for Documentation

Use PDFs for printable versions to ensure a consistent layout across devices. Digital receipts can be created using fillable forms in document processors or accounting software. Cloud-based solutions enable real-time access and automatic backups, reducing risks of data loss.