Key Elements of a Gift Receipt

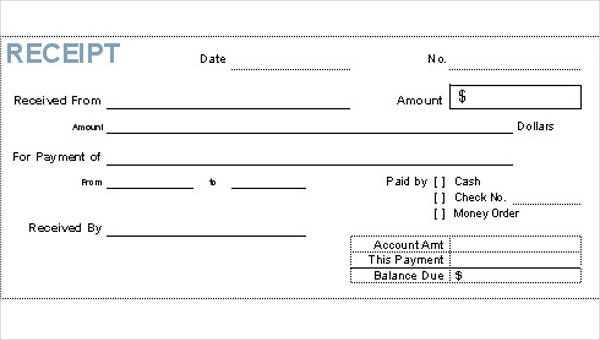

A well-structured gift receipt should include essential details while omitting sensitive buyer information. Ensure the following elements are present:

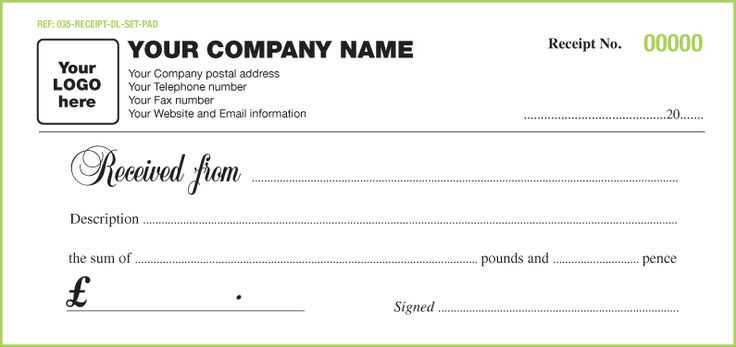

- Store Name and Contact Information – Include the retailer’s name, address, and customer service details.

- Transaction Date – The date of purchase helps determine the return or exchange window.

- Itemized List – List purchased items without displaying prices to maintain gift confidentiality.

- Unique Receipt Number – A reference number simplifies tracking and verification.

- Return and Exchange Policy – Clearly outline store policies regarding exchanges and refunds.

Customizing a Printable Gift Receipt

For a polished and professional appearance, structure the receipt in a clear format:

- Use Readable Fonts – Opt for standard fonts like Arial or Times New Roman to ensure clarity.

- Include a Simple Layout – Organize information in sections to enhance readability.

- Add a Store Logo – Branding adds authenticity and makes receipts easier to recognize.

- Provide a Digital Copy – Offering an electronic version allows customers to store receipts conveniently.

Best Practices for Gift Receipts

Retailers should implement a standardized template to streamline transactions. Consistency in design and information placement improves customer experience and minimizes errors. Always ensure the receipt is easy to reprint and includes return instructions to prevent confusion.

Tangible Gift Receipt Template

Key Elements to Include in a Receipt

Formatting Guidelines for Professional Presentation

Legal Considerations When Issuing One

Customization Options for Various Gift Types

Common Mistakes to Avoid in Creation

Best Practices for Storing and Managing Receipts

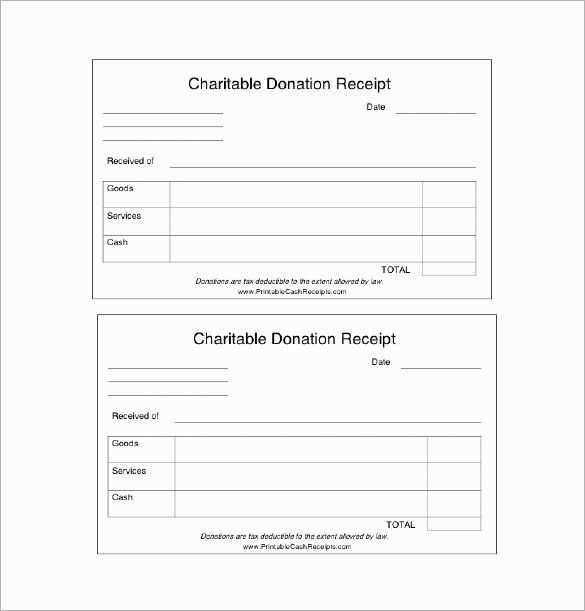

Key Elements to Include in a Receipt

Ensure the document contains the date of transaction, donor and recipient names, gift description, and monetary value (if applicable). If the item is non-monetary, specify its condition and estimated worth.

Formatting Guidelines for Professional Presentation

Use a clear layout with sections for details, a structured table for itemization, and a legible font. Avoid clutter by keeping essential information concise and well-spaced.

To maintain compliance, include a statement of acknowledgment confirming the gift transfer. For tax-deductible donations, reference applicable legal codes to validate the document’s credibility.

Tailor receipts for different occasions–personalized notes for sentimental gifts, corporate branding for business transactions, and legal disclaimers for high-value transfers.

Errors such as missing donor details, incorrect valuations, and unclear descriptions can invalidate a receipt. Double-check data accuracy before finalizing.

Store digital copies in secure cloud storage and maintain physical records in an organized filing system for easy retrieval. Implement a consistent naming format to simplify future reference.